I know people love their 'Magic of Compound Interest' posts here on Leo finance, they are the big vote winners and I feel like I'm the only person who hasn't written a post with that title.

There's a reason for that.

It's a pile of bullshit.

Almost as much as the bullshit talked about 'APRs' by a load of people who appear to be unable to grasp basic maths, anyway...compound interest.

Let's start with an example.

Let's imagine you have managed to scrape together $1000 from your salary after struggling to pay the bills in this period of ridiculous inflation. You excitedly pay it into a bank account or whatever investment vehicle you decide that you will reinvest the interest as you watch compound interest work its magic!

Let's imagine you're going to get 5% interest added annually...THIS is the APR!

How much will you have in 5, 10, 20, 40 years time, when you will really need that penison!

| Years | Value @ 5% |

|---|---|

| 5 | $1276.28 |

| 10 | $1628.89 |

| 20 | $2653.30 |

| 40 | $7039.99 |

THIS TABLE IS BASED UPON INTEREST BEING ADDED ONCE A YEAR.

Congratulations. After tying up $1000 for 40 years, you now have $7039.99.

but it's 'free' money'

Not really, if inflation averaged 3.8% as it did in the US from 1960 to 2022 your 'profit is now reduced to about $2800.

Let's have a look what happens if the interest is added to your principle sum each month...

| Years | Value @ 5% |

|---|---|

| 5 | $1283.66 |

| 10 | $1647.01 |

| 20 | $2712.64 |

| 40 | $7358.42 |

THIS TABLE IS BASED UPON INTEREST BEING ADDED ONCE A MONTH.

As you can see. Very little difference.

If you want to really make money, the only way you can do that is to add to the pot each month. So let's have a look at an example where you save $100 each month and add that to your principle sum.

| Years | Amount paid in | Value @ 5% |

|---|---|---|

| 5 | $7000 | $8083.97 |

| 10 | $13000 | $17175.24 |

| 20 | $25000 | $43816.01 |

| 40 | $49000 | $159960.43 |

THIS TABLE IS BASED UPON INTEREST BEING ADDED ONCE A MONTH.

Impressive? Not really.

$159,960 is a lot of money!!

It's fuck all. If you started this saving plan when you were 25, You'd be 65 when it finished. Hopefully with 15 years left to live which would give you an income of about $10k a year...Wow. Quality!

Let's not forget, average 3.8% Inflation would mean that the spending power of that dollar would now only be around a half of what it was back in the day.

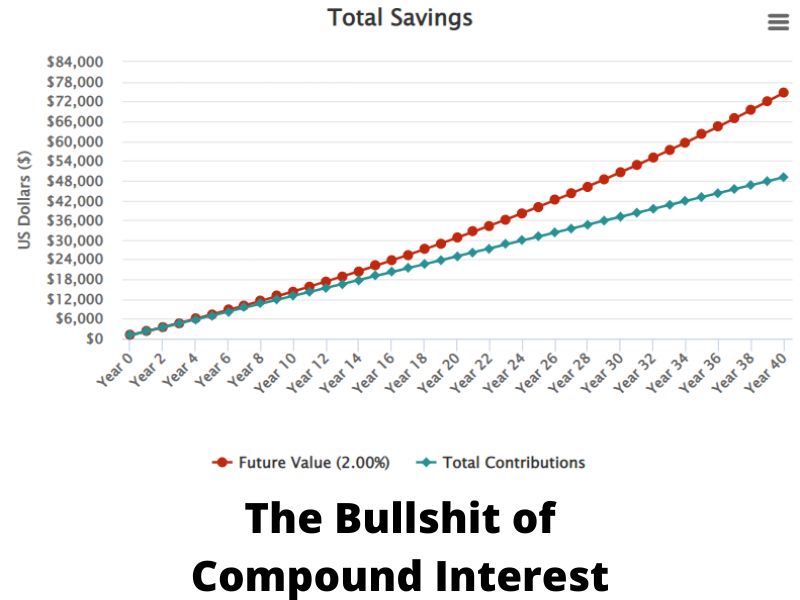

If you died sooner, you'd have more to spend each year, but would then be dead. So no fun there. Also don't forget that 5% interest from a bank or financial establishment has been unheard of for many years, if I changed that figure to 2%, after 40 years, your $49000 would have only changed into $74000 dollars. Worthless waste of time.

What does this mean?

It means that only if you have regular and large monthly income with some spare disposable income at the end of the month is compound interest of any..err...interest. That counts out the vast majority of the whole world who struggle to get by living from paycheck to paycheck or are desperately trying to eke out a dignified living.

With all sincerity, can I ask all my African and Asian mates here how many of you could follow this example. Invest a grand and then add $100 a month for the next 40 years? Seriously. How many?

So seriously. Unless you're rich.

FORGET COMPOUND INTEREST. IT'S BULLSHIT.

Now I hate people who just knock stuff down without giving a viable alternative and so in the next post, I will discuss an alternative to live and grow your money.

Until then. LIVE. How you choose, and not how others tell you to live.

This is not financial advice. Merely opinion. Don't be a follower. Make up your own minds. Form your own opinions.

If you want to work out your own figures. Go here

Posted Using LeoFinance Beta

Nicely done. An explanation even I understand.

And if what you said is not financial advice then what you're reading right now are not vowels and consonants.

Everything depends on point of view and context. Your vowels and consonants are nothing more than meaningless scribbles to a Chinaman who can't speak English ;-)

Interesting indeed and I wanna read more to understand about this matter.

@garrethgrey may I suggest you follow @eddieearner and @susiesaver. They are accounts run by @shanibeer who is expert at helping people start of microsavings schemes over the long term.

You are obviously good at budgeting and her tips and saving scheme starting from nothing could really help you build a nice best egg for the future :-)

But. Free money though

It's not free. Nothing is free. You're trading your spending power to lend your money to someone who will make more money than you can and being paid for doing so.

Hope you're well mate :-)

Well, what if I don't need that spending power? Isn't then better for it to generate yield?

Ye I am fine, just applied for a new job yesterday, so lets see what happens :p

You mate?

Absolutely it is! The point was kind of a reaction to the 'one cap fits all' nonsense that gets written here sometimes. Everyone needs a back-up but not everyone has the means. There is just so much disparity in the world.

Good luck with the application! How's my beloved Little Mermaid doing these days. Does she still have her head? lol.

I spent some amazing times in Denmark going back 10 years.

Ye true xD

Everybody writes the same in different ways though xD

Everybody should be paid more in generel, not the ceos though x)

As far as I know, yes she still have her head :p

Thanks for saying this in loud... There are numerous additional problems with "traditional" savings and one of them is that the inflation that you stated was average BEFORE, but I doubt that we will see that number in the future...

Also, we have a similar situation in crypto... With different tokens, De-fi pool, "juicy" APRs on screen, but when you calculate impermanent losses, your "earnings" vanish and you finish with millions of worthless tokens in the pool... If you didn't take any profits during the time, you will lose even more by compounding...

Nobody knows the future, but doing some calculations with numbers from the past (like you did) is enough to stay away from certain projects...

I have picked this post on behalf of the @OurPick project and it will be highlighted in the next post!

Posted Using LeoFinance Beta

Thank you mate. Don't get me started on 'investing' in worthless and useless tokens to simply get more worthless and useless tokens!

On the other hand, HBD savings interest is currently 20%. Who knows how long it will stay that way but for the moment that is pretty impressive. Plus it is compounded monthly, not yearly.

Looking forward to the next post ... 😍

Me too...lol

Does it involve magic beans? 😜

Seriously, though, I am interested to hear about alternatives. As you know, I'm big on saving as a route out of poverty. However, collective approaches whether that's supporting micro enterprises or clubbing together in things like mutual funds (credit unions, pardnas) are also good.

Beans work for me!

I just think it has to be a combination of local, community led schemes to lift people from poverty. Microfinance in respect to loans savings and most importantly , community trading partnerships can reduce cash payments which would then at least allow them to save...or use the savings to service small loans.

As always, it's difficult to seriously pitch as one size never fits all but generally, it's about reducing spending first without causing additional hardship or discomfort.

For some people who only putting in $100 per month will be low and others even $100 impossible. Like if you compare cost of living now in NY vs Tunis and where you currently live and intend to retire too.

The idea of deferring some pleasure now for the expected receipt of security in the future is a good concept.

I think a good long term strategy is investing into index funds but not at the expense of basic needs now.

Perfect. Deferring pleasure now for the future is sound advice and important but not if you create hardship now.

The point is, everyone's situation is different and there are no hard and fast rules. Every situation is as unique as the individual.

In an age of "high inflation", think of compound interest as a mean to reduce the speed of which your purchase power erodes.

Asian American here. $200 a week into assets. Not particularly interested in yields.

LOL now we get into the realms of discussing ethnicity depending on geographical location!

Absolutely true. But still an irony that you're lending money to establishments who are responsible for creating the high inflation in the first place!

I think assets are a great way forward for those without regular disposable income. The silver and gold stackers get something tangible and tactile that can possibly increase in value and can certainly be liquidated quickly if needs be!

Your content has been voted as a part of Encouragement program. Keep up the good work!

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more

Back in the I did save, then life hits and you spend it:) Yeah people need to stop with the hype and actually find out what all these percentages mean!

Posted Using LeoFinance Beta