Today I made a closer look on WLEO-ETH trading pool, on UNISWAP. The figures are very nice, $366497 liquidity pool size as I'm writing this.

No doubt the highly motivating introduction post by @Khaleelkazi on Friday did it's job well.

Look at the title - "Earn a 50% APY on WLEO...".

Impressive, right?

Although Khal cautiously avoided to state in his post, that this reward levels are waiting for all participants, the "click byte" style title seems was a clever move.

But is it real?

Theoretically - YES.

Practically - most likely you can end at half way from it (in most cases)

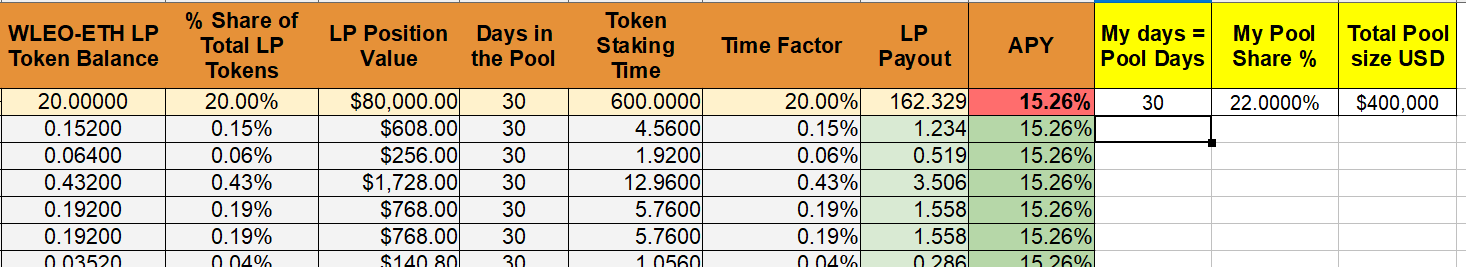

The very useful excel type LP incentive simulation tool was provided in advance, which allowed to simulate various scenarios.

In any case, we do not have any other formulas of the algorithm, so this is the only source of information to it, anyway.

As pool has already made such an overwhelming START, I think now it is safe to reveal some of my findings.

The original Excel simulation table was not very convenient to use, as you must enter variables on one sheet (SETTINGS), and see the results on the other (TOTAL POOL RESULTS). Which makes you switching between sheets back-and-forth all the time. But since all is done with simple formulas, not any fancy scripts or other programming - it does not took me long to make my alternative ENTRY cells on Sheet-2, and relink them accordingly into sheet-1 (SETTINGS). This allowed very quickly change all possible & imaginable values for the (SETTINGS), and instantly see the results on sheet-2

So is 50% APY possible?

YES. But in which scenarios?

Let's make some assumptions which will reduce variables, so we can see and describe the results

Scenario #1

All my participants are just super aggressive as I am, and will stay in the pool NON-STOP from day-1

In such case, No matter how long we stay in the pool, and what share % everyone keeps, APY depends totally from the pool size ( as total reward pack is fixed), Some examples:

Pool size ... APY %

$70K ... 87%

$122K... 50%

$150K... 40.7%

$200K... 30.5%

$250K... 24.4%

$300K... 20.3%

$400K... 15.3%

$500K... 12.2%

Again, here it does NOT matter how long you stay, and what % of the pool you share.

Competition from rivals is TOUGH (and expect as such), so once the pool size goes >$122K, you may forget about 50% APY

Scenario #2

Participants come and go (realistic distribution), pool assumed is fixed at certain levels ($350K, $400K, $500K), so I'll try to see my APY vs my piece size of the pie.

I don't know fancy formulas or programming in excel, so I went very simple way - hitting the F9 refresh button dozens of times, while watching what the MIN and MAX values of the resulting cell go :)

The trends are rather clear:

| pool/share size | 2% | 10% | 20% | 33% |

|---|---|---|---|---|

| $350000 | 22-53% | 21-50% | 20-32% | 18-28% |

| $400000 | 21-42% | 20-40% | 19-30% | 17-26% |

| $500000 | 18-38% | 17-37% | 16-26% | 15-22% |

I was specially interested to keep a minimum 33% of the pool, but after theses simulations I clearly see - the bigger I go, the smaller my APY drops.

Someone with 15 times smaller share (2%) in the pool gets 1.5-2 times better APY 😢

Probably I have to reconsider my initially planed ratio of my STAKED tokens vs Pool's LP tokens. 🤔

Conclusion :

the smaller you are, and the smaller the total pool size is - the bigger the chance to get that sweet 50% APY sometimes.

But only on certain days, as participants come and go, and recalculations will be done, as I assume, after every day's snapshot.

So far we see only one tiny removal from the pool. If everybody stays here NON-STOP, we get scenario #1, and will have to be satisfied with only 15% APY. Meet the reality, Lions 😃

Posted Using LeoFinance Beta

We need to wait a couple of months to get the real picture.

Posted Using LeoFinance Beta

There are also other ways having the LP will benefit Leofinance.

Nothing exists in a vacuum and this is a prime example.

Posted Using LeoFinance Beta

There is no doubt in this

Posted Using LeoFinance Beta

It certainly looks like you're better off putting in less than 33% and keeping more powered up and curating, isn't the return on that around a stable 25%? Or around there.

Then again as you've said before everything keeps shifting.

Having said that you have to remember that even the low end 15% return is outstanding compared to the wider economy.

If a shares fund had a consistent 15% growth, I'd certainly be happy with that!

And of course a 50% growth rate, that's only possible with rapidly increasing demand for the token, and that would never last forever!

Posted Using LeoFinance Beta

We can add in more token appreciation in price due to having a strong LP on Ethereum.

Lots of ways for this all to tie together for a much larger ROI.

Posted Using LeoFinance Beta

True, but people still have to actually buy it for that to happen!

Posted Using LeoFinance Beta

While this is all true, I was looking from a different prospective. Why satisfy with 15% , if leaving tokens for curations will bring me 25-30%?

The amount of work in curation process does not increase at all from a bigger stake.

Posted Using LeoFinance Beta

Well I can't argue with that logic,

Judging by your stats (from memory) it only makes sense for you to have a relatively small portion of your stake in the liquidity pool.

And keep the rest powered up.

It was more just a reminder of how lucky we are compared to the wider economy.

Posted Using LeoFinance Beta

that is also part of what Khal says... it will be interesting to see the dynamic between the LP and curation.

If you take out some of your stake the ROI of the others goes up but the curation pool has to be split differently

I think in a few months the ecosystem will balance itself out.

Posted Using LeoFinance Beta

But I think there is another interest you take from uniswap too. This reward is bigger as bigger are your liquidity pool aportation. Perhaps I'm wrong, but you should take it in the count...

Regards.

Posted Using LeoFinance Beta

The absolute numbers does not matter.

%% is all what matters

Good sage advice and a nice dose of reality for those chasing that APR. There are several inputs to take into account which will greatly impact one's ROI over the course of a year. The general theme is that the longer you are in the pool the greater your potential take of the rewards will be, all other things being equal of course. :)

Excellent post on wLEO liquidity providing on Uniswap! The breakdown of the potential APY you have done is really very useful to read!

Thank you for the great job!

Posted Using LeoFinance Beta

@taskmaster4450 said it well — there are a lot of other benefits to having a lot of tokens in the LP. One of the biggest is marketing to a broader user base.

Additionally, you’re earning fees and those can be quite a boost to APY (so far I believe they’re adding about 5-10% apy).

On top of all that, it is highly likely that a churning of liquidity providers will happen as some old ones drop out and new ones join. Giving a greater advantage to those who stuck around since the start.

I also see big stake like yours and it’s important to realize that the bigger you are, the lower your APY actually should be (in a real economic environment). This is why many investors can yield 200% return when trading with $100k but struggle to get 20% when dealing with 100 million

Yes, the trading fee (and other possible benefits) were completely ignored in this small research. They are not easy to evaluate numerically.

Maybe I should have this mention in the original post.

P.S.

I just played a bit more with simulation tool today.

At $400K pool and 33% of my piece - the daily 24h trading pool should never fall below %50-60K, just to reach at least the HALF of my incentive rewards.

With stake reduced to only 10% (and the same pool size), half of the incentive rewards to reach in trading fees - requires only 12-18K daily pool trade volume. A lot more realistic.

Posted Using LeoFinance Beta

Well this is a good dose of both reality and perspective. It’s great news that you put pencil to paper to hash out the math explaining how the top APR could be achieved, but also good to remind people that smaller APY may be more realistic. Khal did as you say stay away from over zealous predictions of APR, as do you. But as you both point out it is possible.

Additionally, we all are reminded that few things occur in a vacuum and most things are interconnected, so being tied to both Ethereum and being a successful Liquidity Pool on what may now be the largest exchange in crypto is great for publishing your community and increasing the size of the market for both WLEO and regular unwrapped Leo. We may one day look back at this listing, and subsequent listings as watershed moments which turned our chart price upwards in a steady assent, which in of itself brings more eyeballs.

So with so many interconnected events and effects...this is great!

Posted Using LeoFinance Beta

Plus don't forget LPs get a slice of the trading fees generated each day, though not large, it's something.

0,3% - in face of 15 vs. 50 quite neglectable. Also don´t forget the risk of impairment loss only the LP providers have.

When we think about the token price appreciation by being on the Uniswap pool, that APY will be much higher. And, it will also help increase the number of users coming into the platform. I decided not to join the pool for this relaunch with the small amount I had in the initial wleo pool. I think staking and pooling are both good for the overall health of the ecosystem on the long run.

Indeed 50% looks like you will hit the ceiling with your head, so less likely to happen.

The market size is a very important factor but for passive income I still think that it gives great returns.

Posted Using LeoFinance Beta

Surely seems like the smaller get bigger apr while the bigger get smaller apr if am right?

You've done what we all should do when providing liquidity... in my case I didn't provide liquidity yet, but playing with the idea. I have a question: in scenario 1 you state (under the conditions set out by you), the percentage is yearly return only depends on the pool size. But what about the amount of transactions. Each transaction give the pool 0,3% as swap fee which is (partially) distributed to the liquidity providers. When many trades are executed in a day, this gives more fee income as opposed to just a few trades a day. Therefore I would think this is another variable that can't taken out of the equation. Or am I missing or miss interpreting something?

Posted Using LeoFinance Beta

Yes, the trading fees (and other possible benefits) were completely ignored in this research.

There are many other benefits of LP trading, no doubt. As many do mention here in the comments too.

I was looking in to this from a very specific, fixed point of view - what is more beneficial do to with my fixed LEO token chunk - Leave more in the STAKED position and less in LP, or More in LP and smaller left for curations?

In other words - totally selfish valuation, what brings more direct, short term profit to myself.

Because it would be very difficult to anyone evaluate, what is more beneficial for community in general - bigger STAKE or bigger LP.

Large STAKE is great if many holders do manual curations. But we don't know how long this will continue

What if many largest, most active manual curators eventually get tired, and newcomers slowly tend back to autovoting bots?

We have no guaranty this will not happen.

Posted Using LeoFinance Beta

I get where you're coming from. I suppose (based on your own observations), it may not matter too much in direct return when either going for LP or LP... I always thought LP = Leo Power, you use it for Liquidity Pooling LOL

Regarding the manual curation: This could very well be more or less temporary. I do hope LEO get (more) manual curation teams when the community grows. Would be good when stakeholders (including the large ones) aiming for auto voting, use these services to provide them with more power and be sure their votes are used to distribute more dynamically then p2p auto voting does.

Interesting, I think I will just leave my 20K leo pooled forever and stay with that as opposed to adding. In the end, even the worst case scenario is a pretty sweet APY compared to any non cryto investment :-)

Posted Using LeoFinance Beta

Not a problem. All these numbers discount the appreciation in the price of the token. Sure some will make the case that would be realized by staking on Leofinance.

However, I look at it this way: having a successful LP on Ethereum will do more to add to the token price than we could ever imagine on H-E alone. It will help to bring in users, offers more alternatives to people, and will increase the overall perspective of Leofinance.

All of that will add to our ROI over the next couple decades because it will influence the appreciation in token price.

Of course, 15% in the traditional world would be a godsend to investors. You certainly dont get that from a bank.

Posted Using LeoFinance Beta

Traditional world.... ? :) Long ago since I'm trying to break away from banks as much as I can. I live in the crypto world. Where wild west and crazy roller-coasters are the NEW NORMAL 😃 My plan to split 50:50 between Stake and LP seem to be now broken. Both are good, and I have no intention to abandon any of these two. But at the same time - I'm a maximalist in most of my affairs

As you should be since nobody else is going to do it for you.

Plus, all in is a proven model to enormous wealth. This is proven over and over. Too many end up right yet only make a few dollars. Sad when the opportunity to make life changing money is presented.

Posted Using LeoFinance Beta

That is a big swing whether it is 50% or 15%. Maybe you can judge on a weekly basis to find the best scenario. I gather what you are saying is things change daily depending on staking and unstaking in your pool.

Posted Using LeoFinance Beta

...and then you have got this fucking gas prices. So for someone small like me it is a non-sense.

Posted Using LeoFinance Beta

Agree. Making large size swaps and transactions, we can often neglect the GAS fee. For small or tiny size transactions - GAS fee can, unfortunately, often be a killing factor

Posted Using LeoFinance Beta

View or trade

BEER.Hey @onealfa, here is a little bit of

BEERfrom @pixresteemer for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.Congratulations @onealfa! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz:

At least this is easy to understand! Remember the APY will be bigger if the LEO price keeps growing!

Posted Using LeoFinance Beta

NO, I totally disagree. This analysis has nothing to do with price grow.

IF LEO price goes UP +30%, it goes up +30 on all types of tokens, be it in POWERED UP state, or LIQUID, or in wLEO, or in LP.

It just does not matter.

My interest in this research was strictly limited to one SINGLE dilemma - where I get more gains, leaving tokens in STAKE position, or moving them to LP pool? ( provided all other conditions unchanged, or ignored)

NOTHING MORE MATTERS.

I disagree.

APY is measured per percentage. (%)

Can you explain please, how exactly these APY %%% can depend from LEO price ???

Posted Using LeoFinance Beta

I actually don't know. It's something that came up on my mind. I know that my vote will be worth more if the price rises.

Posted Using LeoFinance Beta

Awesome break down, you're seriously giving me FOMO now I think I need to jump into the pool too :)

Posted Using LeoFinance Beta

Awesome statistics that you reviewed there. Surpassing 50% APY is possible for WLEO especially as one can reinvent profit from other earning opportunities available with the token.

Posted Using LeoFinance Beta