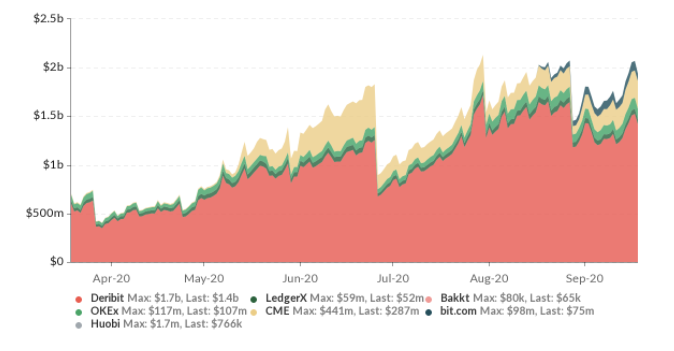

One of the big factors of BTC price factors is the options and various contracts that is a bit different normal spot trading that many traders do.

BTC options are very close to their all time highs, roughly only 8% from that high and a very shockingly high number of that will be terminated at the end of September!

With over 1.5 Billion of options on the line this is certainly going to impact the BTC price.

This chart above shows how open interest changes and it's price impacts can be rippling

The movement direction is always anyways guess, but we can look at previous changes and this does never look good for BTC.

Unfortunately this is not the most bullish direction we'd like, and this could have a fairly large sell off so this might be a great time to prepare for the big date next week!

@originate Hive Developer Evangelist & Market Analyst

@originate Hive Developer Evangelist & Market Analyst

Posted Using LeoFinance

Going back to the end of May when CME contracts expired, BTC went from 10.3 down to as low as 8.85 by the middle of June.

It went more or less sideways until it pumped more than halfway through July. It'll be interesting to see if something similar plays out again. 👍

Posted Using LeoFinance

Congratulations @originate! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz:

I just wonder if the current downtrend has any relations regarding the expiration date on BTC contracts... Looking forward to seeing why Friday will bring.

Will probably short btc in the short term until it reaches 9.5 lvls.