Introduction:

I was going to announce the winners of all my recent giveaway posts today but while I was browsing the vast web I randomly came across an article that I thought would be interesting to share with those who read my blog. That article is titled, One-Third of Americans Making $250,000 Live Paycheck-to-Paycheck, Survey Finds. As the titled indicates the topic at hand is the income of Americans who earn $250,000 or more. It also compares saving power of the different generations.

Personal Thoughts:

I often wonder how much annual income is enough. Of course what is or isn't enough will be subjective. Many things such as were we live, cost of living, TAXES and many other factors determine how much fiat we need. This specific article refers to Americans and notes generational differences in regards to earnings spent/saved. The article claims that One-Third of Americans Making $250,000 Live Paycheck-to-Paycheck. Taking the information at face value, to me that is insane but not surprising. Humans in general are very bad with money. Many don't look past the weekend and take for granted their paycheck will always come. Its the mindsets of people that need to change. We are taught bad money habits from those around us and fall into the same pitfalls the generations before us fell into. Its not an easy cycle to break but doing so will lead you to financial freedom or at least give you the best chance at having financial freedom.

I find that most will spend what they earn. This means if your paycheck is $500 a week by the end of the week you will be broke. If you suddenly get a raise and your paycheck becomes $550 by the end of the week you are still broke. Many simply up their standard of living each time they start to earn more money and they do so without saving. If you find it hard to save fiat my go to suggestion is to open a second bank account and have the bank remove a percentage from each of your paychecks to place in your newly created Savings Account. Then forget that savings account exists until you are in dire need of money or until you retire. If you can fight the urge to dip into that account you would have made your first step in having a nest egg built for yourself. After all $50 from $550 is less than 10% of your weekly paycheck (You can apply this to any amount), you can even drop that to 5% if you want and once you get comfortable start to increase that percentage. Once you take this baby step you might even find yourself enjoying the feeling of saving money. Congrats you broke the cycle, look at other ways to earn and start having your money work for you instead of you working for money.

Quotes From The Article:

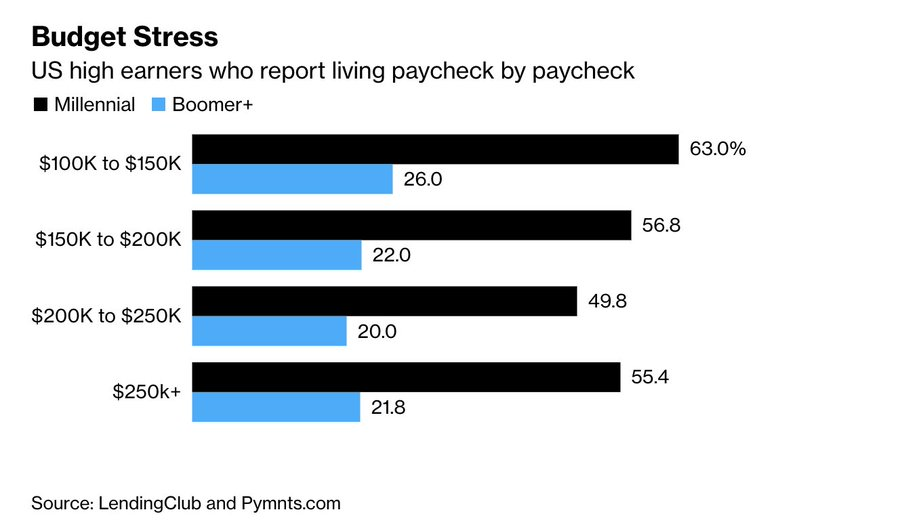

Some 36% of households taking in nearly four times the median US salary devote nearly all of their income to household expenses, according to a survey by industry publication Pymnts.com and LendingClub Corp. It’s particularly true among millennials, who are now in their mid-20s to early 40s: More than half of top earners in that generation report having little left at the end of the month.

Housing expenses, which typically take up large chunks of the budgets of wealthier people, have skyrocketed during the pandemic. For example in Orange County, California, a top-tier home cost $1.7 million in April, up from $1.2 million in February 2020, based on Zillow Group Inc. data. A mortgage on that house, assuming a 20% down payment, would cost about $100,000 per year. That’s 40% of a $250,000 annual pre-tax income.

**The LendingClub survey was conducted from April 6-13, based on about 4,000 US consumers.

Link To Full Article: https://www.bloomberg.com/news/articles/2022-06-01/a-third-of-americans-making-250-000-say-costs-eat-entire-salary

Final Thoughts

Looking at the provided graph we can see Millennials out earn Boomers by over 50% in all four categories running from $100,000- $250,000 USD + of earned income. Which is interesting since the article notes that this spending/saving "issue" is particularly true among Millennials. The conclusion I take from this is Millennials on average are likely to earn more than boomers but also spend more/have the same bad spending habits as boomers. Chances are if you are on the HIVE network (the network this blog you are reading is located) and reading this you have already broke the cycle and likely already have or about to put your money to work for you. Welcome to the club of free thinking individuals who managed to think outside of societies standard of "living".

Posted Using LeoFinance Beta

So much here to comment on... First, my go to advice is to start saving when you get a raise. Save the whole raise so you never see it in your check. Keep doing that as much as you can. Its an easy way to build up your savings rate. Second, there are two components to financial independence 1) earnings 2) spending. Cut your spending. You would be amazed how much you can lower your monthly costs. That helps two ways - it frees up some money to save and it also lowers how much you have to save to retire. If you spend less, you don't need as big of a nest egg to retire. I can go on and on but I'll stop here. I can feel my kids rolling their eyes even though they are far away and can't hear me lol

!LUV

love your post rentmoney

!gif unclescrooge

Great advice, I was going to touch on plugging leaks but decided against it. I'm happy that you mentioned it here in the comments. Plugging ones leaks (needless spending) is just as important as earning more.

!LUV

!gif make it rain

Posted Using LeoFinance Beta

Via Tenor

@steven-patrick, @rentmoney(1/5) sent you LUV. wallet | market | tools | discord | community | daily

wallet | market | tools | discord | community | daily

Via Tenor

@rentmoney, @steven-patrick(1/1) sent you LUV. wallet | market | tools | discord | community | daily

wallet | market | tools | discord | community | daily

Move along, these are not the GIFs you are looking for. 😉

Wise words 😎

Got to build that nest egg.

#retirement #thegoodlife

When @retirementmoney? 😅

oh, it's already in your name REtiremeNTmoney

!gif noice

Via Tenor

I like that handle.

Winners have been announced for the CryptoShots giveaway.

https://hive.blog/hive-167922/@rentmoney/recent-giveaway-winners-psyberx-and-cryptoshots

!gif cryptoshots

Via Tenor

Great article @rentmoney,

I find it very unsurprising as well because money management is not a hot topic in the education system, or investing, saving, how money works, where it comes from, etc, all seem to be very unimportant to teach youth.

I remember as an eighteen year old listening to a gunnery sergeant in the Marines giving us this Friday afternoon pep talk before we embarked on our regular weekend drunk fest and how I wished he would hurry up and get it over with so I could go party and have fun. He explained intricately how he became a millionaire by never partying on the weekends for his entire enlistment of 20+ years and that 95% of us or more would never achieve what he did because we will never listen, etc... I found it to be a very strange weekend pep talk and it stayed in my long term memory forever. Now it makes perfect sense and I wish I would have listened!

The best we can do is learn from our mistakes and pass insight onto our children and grandchildren when it comes to this topic, in my opinion.

Making 250k a year and paycheck to paycheck? Success or failure?

There certainly isn't much freedom associated to a lifestyle like this, that's for sure.

Have a great day, thanks for the thought provoking article.

!LUV

You hit the nail on the head. I preached and been preaching financial advice to those around me for sometime and for the most part it goes in one ear and out the other. I'm by no means a pro at finance but I do find most those who are cryptocurrency and blockchain wise are much better financial planners than those who are not. Thanks for sharing your Marines story. The experienced trying to help the less experience or young while mostly being brushed off for their efforts is a common theme in our society. To be a teenager again, the things we all would do differently.

!LUV

!BEER

!PIZZA

For me, I wouldn't go as far as saying its a failure but it certainly could and likely would lead to financial failure if one didn't adjust their spending habits.

Posted Using LeoFinance Beta

@futuremind, @rentmoney(2/5) sent you LUV. wallet | market | tools | discord | community | daily

wallet | market | tools | discord | community | daily

@rentmoney, @futuremind(1/1) sent you LUV. wallet | market | tools | discord | community | daily

wallet | market | tools | discord | community | daily

Putting money away when there are just so many things to spend it on is hard for people.

I always say that one thing that being a crypto fanatic does for people is teaches them to save. If you are collecting crypto, that's better than collecting bling!

Posted Using LeoFinance Beta

I agree, impulse buying is enough to keep most peoples funds flowing outwards. Cryptocurrency is a great learner for saving currency/wealth.

Posted Using LeoFinance Beta

I had to come back and post again LOL... Because really, if this is the only single thing that crypto ever does, increase a given group of peoples 'time preference', that alone will fundamentally alter the course of the world.

It really is that big a deal! I mean maybe I'm being dramatic, !LOLZ again, but time preference is a pretty big deal!

lolztoken.com

A receding hare line.

Credit: marshmellowman

@whatsup, I sent you an $LOLZ on behalf of @cryptokungfu

Use the !LOL or !LOLZ command to share a joke and an $LOLZ.

Delegate Hive Tokens to Farm $LOLZ and earn 110% Rewards. Learn more.

(2/2)

100%!!

!LOLZ

lolztoken.com

To prove he wasn’t a chicken.

Credit: marshmellowman

@whatsup, I sent you an $LOLZ on behalf of @cryptokungfu

Use the !LOL or !LOLZ command to share a joke and an $LOLZ.

Delegate Hive Tokens to Farm $LOLZ and earn 110% Rewards. Learn more.

(1/2)

This is really unbelievable but it doesn't surprise me either. On one occasion I did a training course on the type of client companies are looking for. Innocent of me, I was very young, I thought I would look for clients with high purchasing power or savings for nothing. The ultimate goal was the so-called aspirations, those who do not have but want to have and that's it. Willing to spend whatever it is without the slightest reflection of their actions. As it was very innocent ask the trainer. But they will run out of money and then what? They won't be able to buy and we will have to close?

His reply was "It doesn't matter for three reasons"

The first is that there are many people either by birth, immigration or export.

The second is that this type of customer is not sensitive to prices, we can sell less more expensive product.

The third and most important, for that we invented the debt. And the debt, believe it or not, can be infinite.

Us humans do love paying for things using debt. I try to keep to the rule of, if I can't pay for it with cash; I don't purchase it.

Posted Using LeoFinance Beta

As they say, there is no limit to perfection). It is difficult to imagine that with such salaries you can go broke, but the fact remains.

Indeed it is hard to imagine but lotto winners going broke come to mind.

Posted Using LeoFinance Beta

Apparently this happens when the guys lose their sense of control and lose their brakes)

Wow this is awesome and surprising

!LOL

!MEME

!hivebits

Posted Using LeoFinance Beta

Credit: arthursiq5

Earn Crypto for your Memes @ hiveme.me!

!LOL

!MEME

!hivebits

Posted Using LeoFinance Beta

Success! You mined .9 HBIT & the user you replied to received .1 HBIT on your behalf. mine | wallet | market | tools | discord | community | <>< daily

lolztoken.com

It was a knick knack paddywhack!

Credit: reddit

@emeka4, I sent you an $LOLZ on behalf of @rentmoney

Use the !LOL or !LOLZ command to share a joke and an $LOLZ.

Delegate Hive Tokens to Farm $LOLZ and earn 110% Rewards. Learn more.

(1/1)

Credit: yekindar

Earn Crypto for your Memes @ hiveme.me!

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

Thanks for the manual curation @india-leo and @bhattg.

Posted Using LeoFinance Beta

Living in Argentina, I find those numbers ridiculously high for me to even imagine the actual worth of such spending. Here you can consider yourself lucky if you manage to earn USD 12,000 a year!!

How a dollar is stretched in different parts of the world is something to behold. What some spend in a month someone in another part of the world earns yearly.

!BEER

!LUV

!PIZZA

@rentmoney(2/5) gave you LUV. tools | wallet | discord | community | <>< daily

tools | wallet | discord | community | <>< daily

HiveBuzz.me NFT for Peace

That's is surprising. I suppose when you earn that anounnt of money, you buy things on impulse. And bad management with the money. If they try passive income, maybe realize the value of money better !

Impulse buying will eat away at funds fast.

When I get a raise, I try to increase the savings rate and then I can avoid lifestyle creep. But prices are going crazy in the US, so the salaries may look high but don't go as far as before.

Smart move, prices are going crazy just about everywhere.

The problem with millennials is that they want to live lavishly without thinking about tomorrow. And that is bad for the whole economy too.

Posted using LeoFinance Mobile

I think that is a trait of just about everyone regardless of generation. Some escape that thought process but others seem to stay stuck in it.

Posted Using LeoFinance Beta

For me it doesn't make sense, it's good to live in a present but cannot deny the fact that you have to live your future too

Posted using LeoFinance Mobile

PIZZA Holders sent $PIZZA tips in this post's comments:

@rentmoney(2/5) tipped @jonimarqu (x1)

rentmoney tipped futuremind (x1)

Join us in Discord!