My Crypto Holdings have declined slightly in value since I last did a full review in April 2020, but in the context of a global economic crisis I will certainly settle for that.

But within my top holdings there has been a considerable range of relative performances over the last four months...

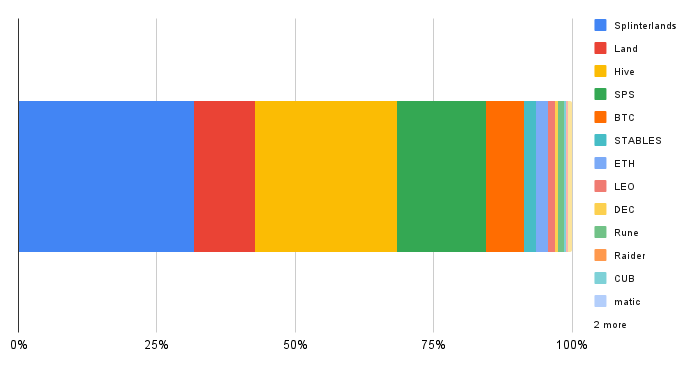

Top Crypto Holdings August 2022

Splinterlands assets still make up the majority of the portfolio - coming in at around 55% if we include the value of cards, SPS and LAND (I haven't included packs and VOUCHER in this).

My cards are down in value overall by around 20% but still yielding nicely.

SPS is up in overall value but the price is down since April - i just have more of it!

DEC is a big loser both in terms of overall value (I've sold most of it now) and in terms of the price, which is currently way below peg.

The thing with Splinterlands is to not panic and just hold and wait for LAND of course!

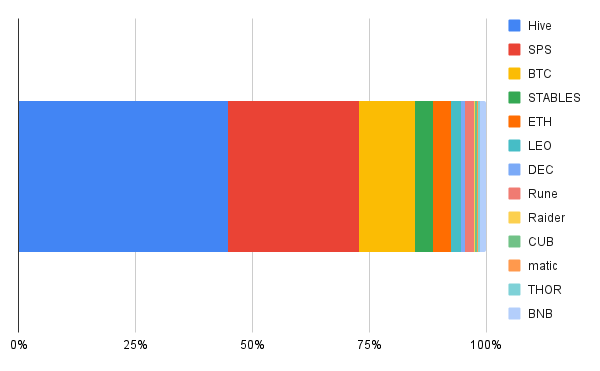

Holdings excluding Splinterlands

I'm happy to say Hive has been going through a positive patch - it's been increasing steadily in value for around a month now currently at $0.60 and I've managed to hold the amount of Hive I have level at just over the 70K mark since April.

There's still plenty opportunities to earn SPS on Hive-Engine so some of that is there rather than Powered Up.

Bitcoin and ETH come in next making up around 15% - I'm nearly at the point now where I'd like to start stacking more of both of these.

Stables have reduced as a percentage of my portfolio - mainly because I cashed out 80% to buy a house - RIGHT MOVE - stables have had a turgid time over the last months.

Raider has been the worst performing asset - down MASSIVELY - like 90% since its peak, I think I just have to write that off, but I think I've done OK out of it, skimming along the way.

Cub is the second biggest loser, that category also includes PolyCub - so poor in fact they only make up 1% of my holdings.

RUNE/ THOR and BNB make up around 5% together - I haven't added or sold just kept these level and the prices have remained pretty stable of late.

Holdings final thoughts....

Pretty much as I expected - a gradual decline in asset values over the last four months.

I'm still in a position where I can hold on for the most part, but I have been and will continue to skim around 10-20% of my earnings off every month - and keep ploughing 80% back in.

I think skimming even in a downturn is sensible - just as a hedge against everything going tits up.

Posted Using LeoFinance Beta

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

Declining times are building times! I am seeing the same trends as you even after diversifying a bit out of some the same ones. Decided to open all my old packs and rent the cards to build for my future land workers! Does not make economic sense (and it hurt seeing the values) but long term it will pay off!

The declining value hasn't been too bad in the context of the wider crypto downturn.

I have a few old packs I'm holding onto, I'm planning on using mainly Chaos cards for land staking!

No eth?

I have some, about half of the amount of BTC.

Congratulations @revisesociology! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 410000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPThat's an impressive portfolio if I do say so myself. I am somwehat surprised Hive isn't your clearcut No1 seen as you hold so much of it. I definitely hope to hold a large, diversified portfolio as this one in the next few years or so

Posted Using LeoFinance Beta

Hive was until Splinterlands came along, it's an easy second, Hive.

Very Splinterlands heavy.

Is there an eventual plan to ever rotate that back into HIVE itself at a profit?

Posted Using LeoFinance Beta

Hive is one of the few things I buy regularly, but mainly swap-hive and it's pooled.

When I cash out some SL assets Hive is defo on the list - 100K Hive Power would be nice eventually!

Isn't it so wild how much value Splinterlands held compared to everything else? Freakin lovin it and it's one of the first assets I see increasing the most rolling into the new year.

Posted Using LeoFinance Beta

It's been a wild ride and en enjoyable one for sure!