I like to keep an eye on how much the 'basic' costs of living are in the UK, and how affordable basic human needs are.

Housing is the most fundamental of human needs, and also the most expensive in the UK.

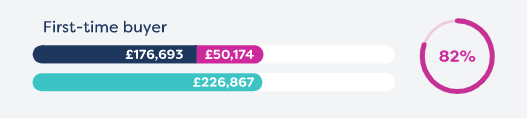

First time buyers in the UK pay on average £226, 867 for their first house (2019 figures), funded with an average deposit of £50 000 and a mortgage of £176 000.

Of course the £176K mortgage figure is bit misleading as they'll be paying back a bit more than that. If the mortgage is over the increasingly popular 30 year term, at 3% then they'll pay back £267, 127, plus their £50K deposit = a grand total of £317, 127.

That's assuming they stay living in the same house for 30 years and incur no additional costs associated with selling and buying another house, or two.

It also assumes that they don't benefit from any windfalls which would help them pay the mortgage off earlier.

Given that we're talking about the median here let's assume these two possibilities cancel each other out - Mr and Ms median probably aren't going to be lucky or unlucky!

The median household income in the UK 2020 was £30 800 in 2020, which means that it would currently take the average household a grand total of 10.5 years to pay for the privilege of owning a house.

That would mean monthly mortgage payments of around £750.

NB the above is excluding the necessary insurance costs you would pay on top which are going to be required by mortgage companies.

Surely something's got to give here!?

When I look at statistics like the above (and these are the median, so presumably half the population of homeowners have it worse!) I do wonder why there aren't droves of people looking for alternatives!

Just the sheer fact that it takes up 25% of one's working life merely to pay for one's dwelling is staggering!

Staggering because it is staggeringly unnecessary for it to cost so much and take so long for a household to own their own house.

I'm minded of the !Kung Bushmen who only work 4 hours a day on average to meet all of their basic subsistence needs - and here we've got people in the UK, in a supposedly more developed country working that long just to pay for their house, and other essentials like utilities, dominos pizza, netflix and the weekly trip to the nail bar on top.

And there are many viable alternative options not that far from the UK - I've managed to pick myself up 2 HA of land in Portugal for < £20K, that's around 8% of the cost of the average house in the UK, and the land is perfectly good for living on, albeit with a bit of discomfort while I build something to live in.

I do understand that millions of people are tied to their jobs, attached to their families, and maybe even 'like' living in the UK (there are plenty worse places to live), but honestly, 10 years of solid work just to own a piece of the country, that's a big chunk of yer life!

Posted Using LeoFinance Beta

Yep, absolute joke. 50k deposit, who's one of those?!

That's the bank of mum and dad I think for the most part!

Posted Using LeoFinance Beta

I heard stories about how the UK is expensive but damn, that's a lot of money for just a house. I like to think there are ways people use to cut cost right?

It's a damn struggle to get on the property ladder in the UK - that's just a fact of life, millions of working professionals stuck paying rent!

Posted Using LeoFinance Beta

Man that's rough. That amount would buy a fancy ass house in virtually anywhere in the world, yet it is average in the UK lol.

Posted Using LeoFinance Beta

scary expensive if I may add

It's a bit crazy isn't it!

Jeez, that property ladder is one tough set of rungs! Henning Wehn does a hilarious (but true) skit in his stand up about the property ladder and owning a house in the UK - think you'd like it!

Holding out on BTC allowing me to get enough capital to get my own place here. Have heard some horror stories with shared ownership so probably going to leave that one well alone.

I'll check that out!

I did shared ownership myself - it was fine! Really helped me out! But I did buy the whole place outright before then selling the whole thing on.

and the culture in the UK is to Trade UP the house... so they get one and then want a bigger one so... the story never ends

It really is! I went the other way and traded down!

It REALLY divides people too - it's probably around 50% of the class system - I remember one new teacher coming the college I worked at in Surrey (Stockbroker belt, so some of the most expensive houses in the country) - she moved from London, having inherited a flat in Russel Square (that's a proper nice area).

She just bought a massive house right in the middle of the town where the college was, the nice bit, near the nice schools, BOOM! No worries about cash or anything.

I don't think a lot of the older women who'd gone down the mortgage route with their husbands liked that very much, but even they were lucky - bought in the 90s, in that area.

In the same college you had many younger or poorer people doing 90 minute commutes because they'd had to buy houses so far out.

It's sick.

More expensive over here in Munich I can tell and much higher monthly shit to pay for more years - but it gives the kid a good substantial asset later.

Posted Using LeoFinance Beta