Like every other individual who is into crypto-space, I watched the r/Wallstreetbets saga with keen interest. I don’t want to judge who is right and who is wrong. I think we do not have to make that judgment call in a free market where everyone is free to use their head and make a decision. The decision could be right or wrong but I don’t think it matters much if it was made in full awareness of the risks associated with it.

However, the trading that happened in the last few days made me realize how much has changed in terms of fundamentals. We were always told that we need to stick with the basics and research the fundamentals of the business before investing in it. The price to earnings ratio, market cap, revenues, earnings, quarterly reports and many other indicators were supposed to help us decide which stock in the market holds value. The basic principle of value investing was the structured way of investing. Yes, there were short sellers, margin trading and many other trading mechanisms in place to incentivize risk takers but the basic idea was to explore value in products that we are investing.

And, there is a crypto market which is highly volatile and speculative. Yes, the product matters in crypto space as well. The value of the coin with a good project to back up will eventually see the love they deserve. However, there are instances where a good project with a good use case does not even get recognized in the wild wild west of coin trading. And, that is due to the pumping and dumping of the coins as recently seen with $xrp.

I was hoping that the volatility of the crypto market will be mature when we have the stability of the stock market. But, things went opposite and the stock market actually acquired the volatility of the crypto market. Right now, there is no fundamental whatsoever. It’s all speculation and individuals are jumping in the market to make quick money by figuring out the short term market structure.

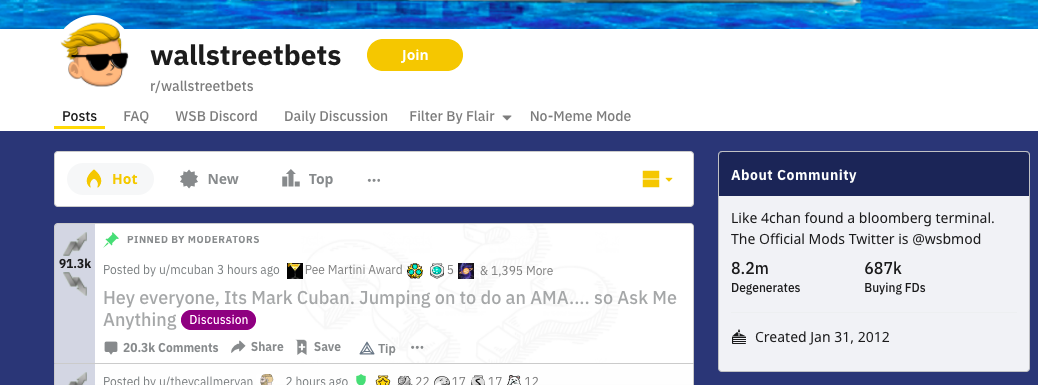

The Wall Street Hedge Funds were always infamous for market manipulation. The rise of the internet and the amount of information available online have changed the equation. Now, a group of people on platforms can act as a hedge fund and they have the capacity to steer the market direction.A recent piece on CBS news report how the subreddit saw 90% increase in bot activities.

Moderators of the WallStreetBets online discussion forum, which has been credited with creating a frenzy in the shares of GameStop and others, said bots are responsible for a "large amount" of the stock-recommendation content being posted in its popular Reddit group.

Bots are computer-generated accounts that post automatic messages on Reddit, Twitter and other social media platforms.

In a statement to CBS MoneyWatch, a spokesperson for the popular Reddit group described the bot activity as "recent" and said the group has done its best to remove the posts.

cbsnews.com

I am not sure if this is the financial freedom we were looking for. From one angle, it is justified that the real people are finally in the game. But, from another point of view it is highly risky as hedge fund managers can manipulate the retails investors’ forums to sway the market in their benefits. We can see how the WSB reddit group was used to pump silver. It has become a wild wild west out there. I am not sure if we need to invest into projects based on business fundamentals or by tracking the market based on supply and demand.

Posted Using LeoFinance Beta