MicroStrategy is the only enterprise analytics and mobility platform. The MicroStrategy platform supports interactive dashboards, scorecards, highly formatted reports, ad hoc query, thresholds and alerts, and automated report distribution.

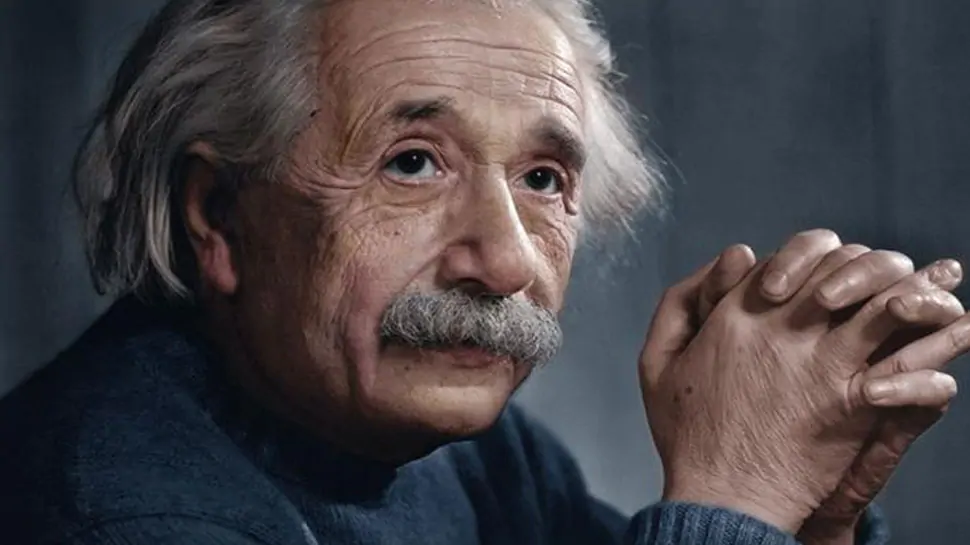

Albert Einstein famously said that compound interest is the most powerful force in the universe. He said, “Compound interest is the 8th wonder of the world. He who understands it, earns it; he who doesn't, pays it.

Dividends are very much like compound interest. The word “dividend” tends to have this calm, soothing effect on investors because you know the company offering dividend has a profitable and viable business model so in good times and bad times, you can sleep better at night and dividends act like compound interests if reinvested to grow ones portfolio exponentially. Dividends are a way for companies to create value for their shareholders.

MicroStrategy had over $500 million of cash and short-term investments at the end of June. The company previously announced plans to return about half of that to shareholders while investing roughly the same amount in alternative assets.

MicroStrategy decided recently to go down a different path in creating shareholder value for their investors. MicroStrategy decided to purchase 21,454 bitcoins at purchase price of $250 million as part of their capital allocation strategy.

"Our investment in Bitcoin is part of our new capital allocation strategy, which seeks to maximize long-term value for our shareholders," said Michael J. Saylor, CEO, MicroStrategy Incorporated. "This investment reflects our belief that Bitcoin, as the world’s most widely-adopted cryptocurrency, is a dependable store of value and an attractive investment asset with more long-term appreciation potential than holding cash.

Since its inception over a decade ago, Bitcoin has emerged as a significant addition to the global financial system, with characteristics that are useful to both individuals and institutions. MicroStrategy has recognized Bitcoin as a legitimate investment asset that can be superior to cash and accordingly has made Bitcoin the principal holding in its treasury reserve strategy."

Since the announcement, MicroStrategy stock price has gone up 10% and increased the company's market value by over $100 million. Now imagine if other companies start doing this, what do you think is going to happen to the price of Bitcoin?

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Posted Using LeoFinance