While it may seem counter-intuitive at first, focusing on actions that are guaranteed to leave you broke and penniless playing the crypto game, instead of concentrating on how to acquire profits, I've found that dealing with these wealth-evaporating, destructive, thought processes leading to terrible trading decisions, was the most profitable thing I've ever done. A lot of what I'm about to share has been observed anecdotally and through losing a shit ton of money myself trading these last couple of years.

I don't know about you but just I learn and absorb a lot more information in an event where my actions produce an undesired outcome, especially considering money.

Even though you'd probably learn best by making these mistakes yourself and feeling the resulting pain, I don't want to have to go there, nor do I want you to have to go through what I did to acquire this knowledge. In hindsight, for all the smarty-pants out there, what I'm about to share might seem obvious but those who can be honest with themselves will acknowledge how difficult it can be to apply these principles in order to act calmly and rationally when the market dictates rapid, irrational, decision-making with its crazy-fast, manipulative and extremely volatile price swings.

The normie point of view

Your normie friends that haven't yet experienced cryptos mind-boggling volatility by actively participating in the market won't understand this and will sometimes even respond with non-sensical questions such as:

"How can you lose money in a market that goes up so often and by that much?"

or even better

"How can you lose money when the only thing you need to do is buy low and sell higher?"

Bitch if it was that easy I'd be a multibillionaire by now!

Although it might seem to be very easy to WIN as an outside observer or a novice trader who has only been through the recent green day streak. I can guarantee from personal experience (which I've seen many others repeat) that this is not the case. It's definitely not as easy as it seems because if it was, then everyone would always win, which is theoretically impossible in an activity such as trading which can more often than not amount to a zero-sum game.

Simply put, in order for you to win, someone on the other side must lose.

Imagine how many people we made profits for with our shitty trades over the years, * yikes.*

In reality

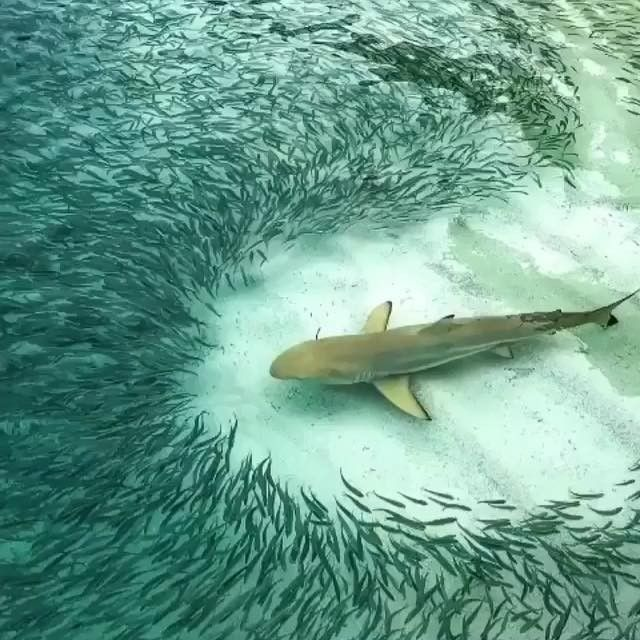

If you've dabbled your feet into the uncharted, murky, waters of crypto you've surely been through days, weeks and sometimes even months and years when the market kept sucking your net worth away, handing it over to more skilled players. Unintentionally making one irrational decision after another, oftentimes ending trading sessions with less $ value than you started with, is a reality check every trader will get to experience.

How you react to these emotionally charged situations is going to play a major role in determining the level of success you are going to accomplish as a trader.

Realize who you are playing against

Understand that the market is against you and that you are competing in a highly competitive environment, surrounded by players that are years ahead of you. Some take advantage of insane amounts of capital to move the markets in their favor while others use high-frequency trading bots, advanced trading strategies, TA and other ways of predicting market movements, etc. Not to mention exchanges and whales colluding to fuck over the little guys, literally painting the charts to make the most people possible jump in at a high price before dunking on them.

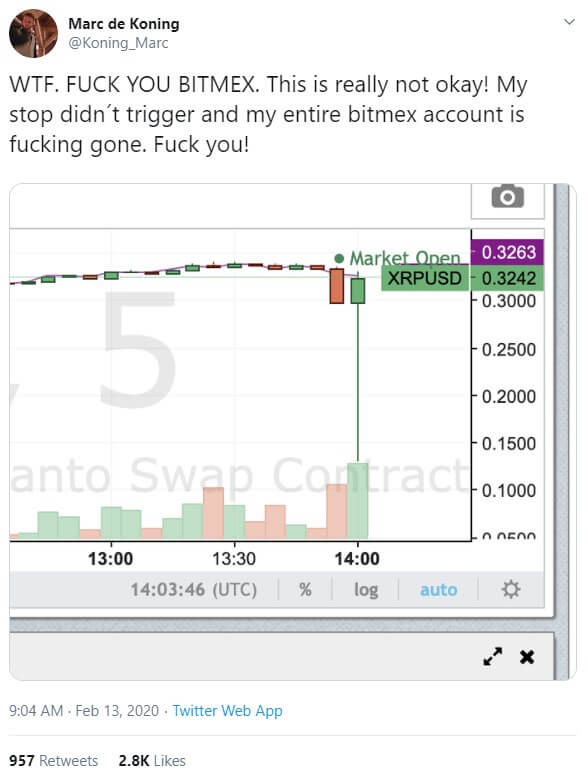

This is especially true on some leveraged exchanges like Shitmex but I've seen these crazy liquidation whicks which steal wealth from insane amounts of people, enriching exchange owners and their cronies at the expense of every other participant that wasn't lucky enough to be on the winning side of the manipulated trade.

Pure fucking insanity if you ask me but hey, that's what we get for investing in an unregulated market, or at least that's what they say....

Can only imagine the amount of frustration this dude was going through.

Then there is also the fact that markets tend to move in such a way that is almost guaranteed to make the maximum amount of participants make the most amount of mistakes which in 9 out of 10 cases teleports them to rekt city.

It's funny because it's true.

This is how you'll feel after a few months in the crypto market.

Now do yourself a favor and go watch this hilarious, educational video to get a feel of how the market is going to treat you as a newbie investor.

In a perfect world, playing the crypto markets could be as simple as avoiding risk and maximizing/realizing the potential opportunity.

Clearly the best place to buy is when the price is low and sell when the price is high but actually materializing this play is far from easy, especially for newcomers coming into the market with the skewed perspective that "it's easy" and "everyone can do it".

That couldn't be further from the truth.

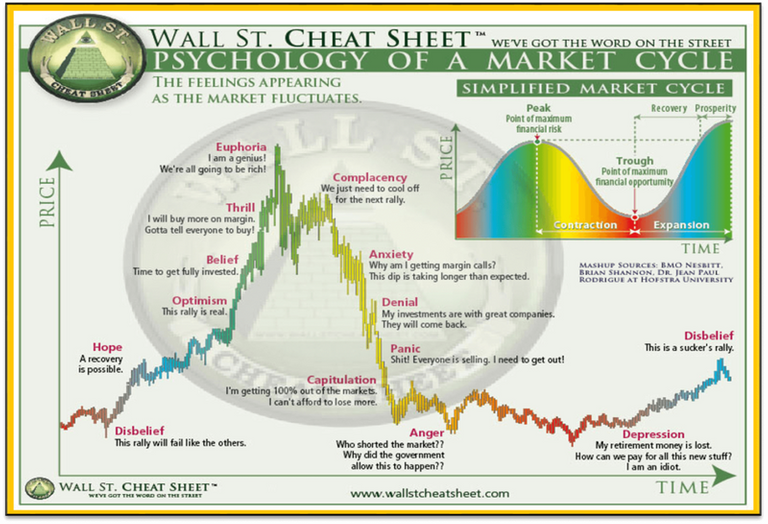

The market moves in such a way that is designed to entrap the most participants by getting them to act from a highly-emotional and irrational mental state in order to make the worst possible decisions.

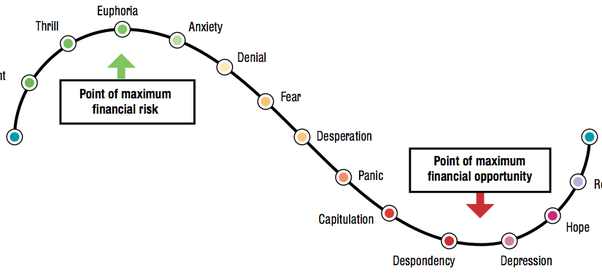

This frequently results in the majority of people entering the market at, or close to the point of maximum financial risk only to exit at the point of maximum financial opportunity, enabling seasoned players to get in at the point of max financial opportunity and cash out their profits at the point of their personal maximum financial gain at your individual maximum financial expense creating a perpetuum mobile machine that hands out rewards to skilled players at the expense of the uninitiated.

Consequently, if traders have remaining capital, a fabricated response often occurs making them desperately attempt to recoup losses by investing more, usually in a much riskier manner. Emotionally driven and fueled by irrationality, they keep losing one trade after another, leaving them with even less capital. At this point, they either exit for good or keep investing more and more capital until they eventually lose everything, call the entire crypto space a scam and never return.

I've observed the same degeneric cognitive bias of trying to recoup losses by betting more in gambling addicts and crypto traders, both experienced and novice players.

I've also been through my fair share of degen trading and decision-making.

How it works is that any kind of personally significant loss activates a thought pattern that tricks you into continually attempting to recoup losses. Usually, by betting more and taking up riskier bets to (in the degen mind) increase the odds of succeeding while in reality, you just keep perpetually stacking losses until you run dry.

This is the inflection point.

Now that you come to the realization that you ran out of money to play around with and that your chances of recovering that first 100$ that you were chasing which is now 2000$ are non-existent, you've hit a brick wall. At this point, I've seen people either resort to borrowing even more capital to "get it all back" in that last, riskiest bet, or coming to the obvious conclusion that they are fucked and finally calling it a day.

Understanding the problem

Letting emotions get in the way of clear judgment, sometimes even overriding sanity is a historically proven way to lose money. Operating from a highly emotional state of mind causes traders to be much more susceptible to making rash decisions, FOMO-ing into green candles, buying the top, selling the bottom, risking more than they can afford to lose and losing it all.

Sometimes these emotions the market makes you feel can be predetermined and fabricated by large players in order to make smaller participants act on an emotional basis which causes them to make mistakes. Chemically charged, negatively vibrating, in a state of absolute insanity, this frequently leads traders to overreact and make bad calls costing them not only money but also inflicting both mental and physical pain.

People strange beings.

They naturally feel more inclined to buy something when it's expensive rather than when it's cheap.

For some odd reason we tend to equate current monetary valuation with intrinsic value and quality. That's why you will see many "investors" enter the market at the point of maximum financial risk, i.e. belief, thrill and euphoria on the chart above and exit the market at a loss during denial, panic, capitulation, anger and depression.

And that's exactly what the manipulative bastards want you to do. Hand over your hard-earned money to line their dirty pockets.

Struck by heavy losses (degen thought pattern activated) some traders will try to quickly win it all back making even more bad decisions, eventually losing everything from financial to social status, relationships and occasionally even resulting in tragedy when traders decide to take their own life because they are unable to deal with the consequences of losing so much money.

Now that you've got an idea about how important it is not to get tangled up in this mess, let's pinpoint these costly emotional states, figure out why they occur and what can we do to circumvent them.

I won't go into all of them as this post is already getting quite lengthy but I'll talk about what I consider to be the three main pillars causing trading impotence.

Fear

Most common enemy of every wannabe trader.Fear is the natural reaction to danger.

The danger of losing money for traders can often be life-threatening, particularly for those who overextend and bet too big. A completely justified, natural response to feel but rather impractical mindset to operate from when trading. If your feet shake from risking a couple of percentage points of the portfolio, you seriously need to stop trading right now and consider doing something less stimulating, like knitting.

Getting so negatively emotionally triggered by slight alterations to the price will shake out your baby hands sooner than it takes you to say Satoshi Nakamoto.

If you can't take the risk of losing you don't deserve and probably won't win.

Fearful trading will eventually cause you to make big mistakes.

The more fearful you get, the more risk-averse your trading decisions become.

That feeling that you have to protect your capital starts creeping in. You feel that if you don't sell now, the boat will keep sinking even though the price only fell by 10%. Fear will make you sell at a relatively small loss, possibly because you went in with improper size, only to have to watch the coin go up 10x in the next few months.

Similarly, in winning trades, the fear manifests in form of paranoia about losing all the gains.

You'll get a 50-100% gain and panic sell because "it might come crashing down any second now" regularly closing trades way too early and again, having to watch the raging bull take it to Mars and beyond, while you hold exactly 0 after selling for a 2x, it does a 100x.

Such events can be mentally devastating.

I've endured a couple of these during the past few months.

$AAVE (ex $LEND) sold at 1k sat, went to more than 755k sat (755x opportunity cost)

$CHZ - not sure where I sold, don't even want to check, it did a 100x

$RVN - sold at around 0,02 after holding it for a year and going through a -60% - finally realizing the loss only to watch it pull a 25x a few weeks later

$MATIC forgot where I sold, don't want to know - it rebranded, went on polkadot and ran like a fucking Usain Bolt

The only way I've found to be able to deal with these events after they already happened is to simply let it go.

Don't even think about it.

Zen it out.

If you want to never have to go through such an event though, there is a simple solution.

ALWAYS carry a moonbag.

My way to go about it is to leave around 30% of the position out of orders, preferably in cold storage for that extra step to keep you from selling when it starts moving, and only sell in fractions at 10X, 50x, 100x, 1000x or more.

Moonbags for life!

I've literally got some moonbags that I won't sell for the next 10 years no matter the price they reach.

You can adopt a similar tactic in order to never have to watch a coin pull a 1000x after you've already sold all of it for a measly 10x.

Greed

Fear's polar opposite, greed is another common emotion that keeps traders from banking profits, ironically enough, even during bull markets. Greed, one of the 7 deadly sins, is one of the most financially depressing emotions that can quickly cause you to spiral out of control and throw you straight into the bottomless pit of liquidated plebs.Greed will cloud judgment in a big way.

What was once your sell target, can quickly become unsatisfactory as you see other coins go up by 10x in a week while you've been waiting for a 3x for months. Influential market participants flexing their 100X's on Twitter are the fuel to your greed's fire. Jealous and greedy, you forget about your initial take profit targets, put risk management principles aside, exit trades too early and jump from one coin to another, trying to find that next 100x gem.

If you were "lucky" enough to have invested in a coin that pulled 30x, the chance for it doing another 10x from there are:

a) slim

b) lower than the chance of a huge retraction

c) not worth risking losing the profits

Don't let your greedy inner demon tell you otherwise.

Be smart about it.

Take a moment or two to calm down and think about if what you are expecting is even realistic or not?

If the answer is no, realize some profits and reduce your position size by however much you feel comfortable with. Seeing unrealized gains evaporate overnight can be very traumatic so strategic profit taking should be applied routinely to prevent such tragic events from taking place.

Take some money off the table regularly!

B-bbut ser, what about opportunity cost?

Sell incrementally, a few percent of the original position at a time and always carry that lambo moonbag!

Euphoria

Simmilar to greed, euphoria will significantly cloud your judgment, making you think that your 5x isn't good enough and that you should be able to squeezee another few X's out of it. While in reality, you should have taken some profits to reduce the risk of being unprepared for a sudden reduction in price.When in a euphoric state of mind, traders will feel the urge to get into coins that already went up by a couple hundred percent because they think the price will keep mooning forever and they don't want to be left out of making profits. After acquiring a position, in most cases the price will quickly revert to the mean, burning all FOMO entries with a fierce - 40-80% retraction.

From personal experience, I can tell you that most of my bad trades came from FOMO-ing into coins.

There wasn't yet a time that I FOMO-ed in and won.

10/10 times so far after FOMO-ing in, I've been left with less than I started with, or at least had to go through a 50% correction and wait for few months for it to pump back up.

Avoid trading when you feel FOMO at all costs.

Also, avoid trading when you feel overly confident and overly euphoric about a specific market outcome.

Not having your emotions in check will in most cases get you rekt

You'll find yourself buying into massive green candles and selling deep red candles, doing exactly the opposite of what your initial plan was. While it seems like a stupid thing to do you can't help but do it.

Why?

Because you let your emotions get the best of you.

Mastering your emotions while trading, firmly grounding yourself in reality and trading in a calm, positive, rational and disciplined state of mind is going to erect your trading journey to new heights. By denying negative behavioral impulses to dictate your trading decisions you are positioning yourself way ahead of most other market participants.

Learning to take control of your emotions and distance yourself from them to acquire monk-like focus will be a pivotal moment of your trading career.

When you learn to be zen about extreme price swings is when you will start making some real progress. Clear-minded, with crystal clear focus and laser-sharp execution, you'll be able to make much better decisions and maybe, just maybe, even make a career out of trading.

On the other hand, letting your emotions get the best of you, will quickly leave you broke and homeless.

Start working on controlling your emotions today!

This is something I can't exactly help you with as it's a personal thing. What helps one person won't help the other so you have to do what's best for you.

Here are some tips and tricks which greatly helped me overcome this struggle

- don't start trading before you properly educate yourself about risks involved

- learn basic skills like TA and fundamental analysis

- meditate

- work out

- be prepared to grind for years before you finally make it

- be patient

- don't FOMO in

- don't FUD out

- reduce the size you trade with

- realize, confront and deny the negative effects of the emotions you feel while trading

- don't trade with more than you are willing to lose

- accept losses

- prepare to lose a big chunk and in some cases even your entire initial investment

- don't stress out over your profits being small compared to others

- don't chase profits

- don't over-trade

- don't allow your psyche to overpower rational thinking

- stop trying to win it all back in one trade

- have rock-solid conviction

- take as much time as you need to do research before investing

- make a trading plan and stick to it

- create personal rules and boundaries - stick to them

- it's ok not to trade for a few days/weeks/months if you feel like it

- dollar - cost average and diversify

- acquire diamond-hands mentality

- make decisions slowly after doing proper research first and change them quickly if proven to be wrong

Learn these principles and apply them religiously.

It will be hard at first as it's much easier to make rash decisions that alleviate your anxiety caused by a specific trade, rather than dealing with the emotions you are experiencing to reason yourself into not making a mistake.

That's all there is to it.

Learn from my mistakes.

Don't repeat them.

It's all on you now to make it happen anon.

I sincerely hope you can adopt some of what you've learned here to improve your trading outcomes because I know how bad it feels to lose your hard-earned money.

Best of luck and happy trading fellas!

Finally a nice fresh normal Financial blog to which I can fully relate....although my baby trading has been going quite well

Posted Using LeoFinance Beta

Just don't get too confident as that can get pretty dangerous, very fast.

Trading man, phew, I'm now 5 years in, still learning not to get a heart attack. Good to see you back btw.

Simply saying goodby to the money before aping in can have miraculous, stress-releiving benefits once you do actually lose it :D

Thanks bud, good to be back!

You have loads of experience as a trader now already, for your relatively young age lol. So you will go far with all the wisdom you have acquired regarding the nature of the mind under the influence of emotions like fear, greed and euphoria, etc. This material world is ultimately a place where we learn to transcend its allures in the end, and trading is a fine path to that insight.

It was a quite expensive knowledge to acquire. Especially the part where I married STEEM and continually lost money religiously investing in it for years. Also the Rona crash... oof, that was a tough pill to swallow. But now that I've been through all of this, I feel that I can place my orders much more rationally than before.

I've been trading crypto for about a month now, and from what I've read of your article I don't think I'm as invested as some people are.

For me, I watched and learned for a long time before I actually jumped into the game, and I'm trading with entirely disposable income.

It was actually a government Covid stimulus check that was my initial investment.

I'm mostly in BTC and ETH so they're relatively reliable assets as far as crypto goes.

When BTC tanks I don't sell anything at all, and instead try to buy more at the bottom.

It's a long read so I've bookmarked it to come back and finish but it's been an interesting read so far!

I've only been trading on Coinbase Pro, and seeing your mention of Bitmex's cheating makes me feel good about sticking with Coinbase. The only thing that might draw me away from CB would be some alt-coins that they don't offer.

Probably not. I've went in balls deep.

Way to go! Buying the dip during a bull market is a proven technique to boost your net worth. Only cowards sell dips, champions buy.

I've seen Coinbase go down a lot when volatility is high to prevent its users from winning.

Would suggest Binance but I guess you are from the US so that's not really an option.

I meant to say "emotionally invested", but I'm in a position where the money I have in crypto isn't going to break me. But I can imagine for others seeing the dips/crashes can be really stressful.

My best friend jumped into the US stock market over a year ago, and is trying to become a "day-trader". Which basically means aggressively buying/selling stocks on a daily basis. In the US you are only allowed 3 day-trades(buying/selling a stock in a single market day) a week unless you qualify as an actual day trader. To qualify you have to have 25,000 USD in your portfolio.

He's earned and lost lots of money. Not sure where he is in total right now, but then the Gamestonks thing happened and now I'm in a group with him and 5 of his friends who are all trading stocks. I told him about crypto back when he started, and he scoffed at it. He ended up getting into it before I even did though lol. He earned 30k on Gamestop, and "held the line" & lost most of it. His younger brother had over 200k in Gamestop, and lost most of it too.

I've wanted to try stocks, but I feel safer in crypto.

The worst thing is I wanted to invest $1k into AMD many years ago when their shares were worth $3.24. They've since had a major comeback as a company, which I also expected, and the shares are now worth around $80. Would have been a great investment...

Yes I am from the US.

Why is Binance a prolbem if you're in the US?

I know I've gotten a message about legality in the US on some exchanges, but Binance didn't show a popup warning.

I haven't had any issues with Coinbase-Pro so far, and have been through some wild markets in BTC but it's only been about a month.

One thing I noticed about Coinbase: Their app prevents Android from taking screen-captures, and it's the only app I've had do that. Which immediately led me to believe they're showing differing prices/stats. Kind of made me a little suspicious.

Besides BTC/ETH I have earned Steem/SteemBucks/Hive/HiveBucks, BAT:basic attention tokens, Minds tokens, and LBRY's LBC. I actually have quite a bit of LBC because I participated in an official video challenge and the organization paid me a few thousand of them, but they aren't worth much in fiat.

Do you have any alt-coins that you like for a specific reason? I really want to buy something that's going to pop, but I can't seen to find the reason/rhyme for what makes a coin take off. There is a boost coins tend to get when they get listed on Coinbase though.

It goes hand in hand. The more you invest the more emotionally invested you get.

Christ. Seems like suits won after all...

Binance.com doesn't allow US citizens and Binance.us has very few altcoins to trade when compared to the original.

Quite right. Method and discipline.

Posted Using LeoFinance Beta

As you were going through this I was starting to think it sounds a lot like a gambler and how they think if they can have just one more hand or one more pull on the slot machines it has to be ready to pay them out. Then you went and mentioned that very thing about half way though. Very insightful. Nice post!

Posted Using LeoFinance Beta

Great post. All the advice is on the money. Trouble is its easy to say but hard to implement when it comes to emotions.