This is the weekly report to investors of EasyDeFi for Week 26 on Sunday 01/23/2022.

.

.

Pool Investors Earnings this Week.

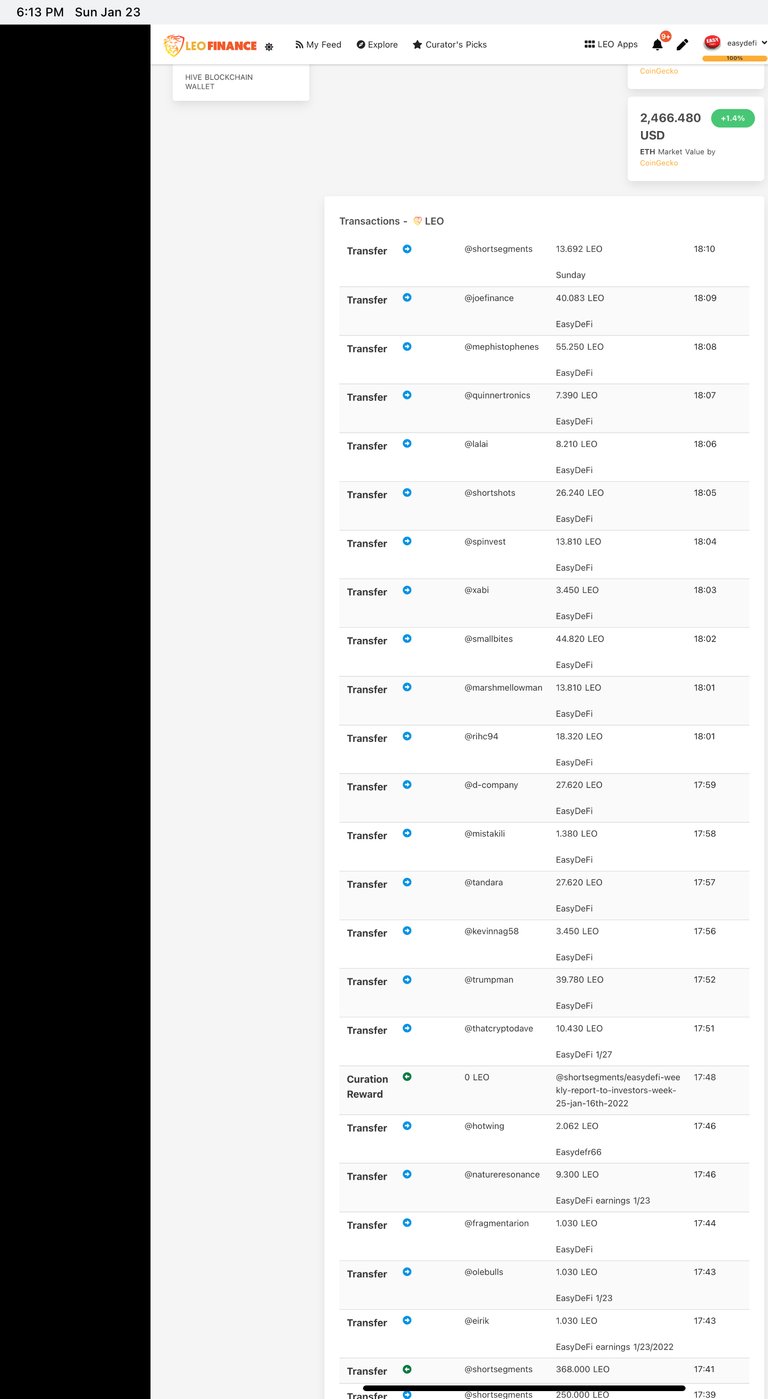

- The pooled Leo is converted to Cub-BUSD, and the earnings for this past week were 270 Cub, so it traded for 408 bLeo and 40 went to @shortsegments as an Admin Fee. This left 368 for the stake based investors.

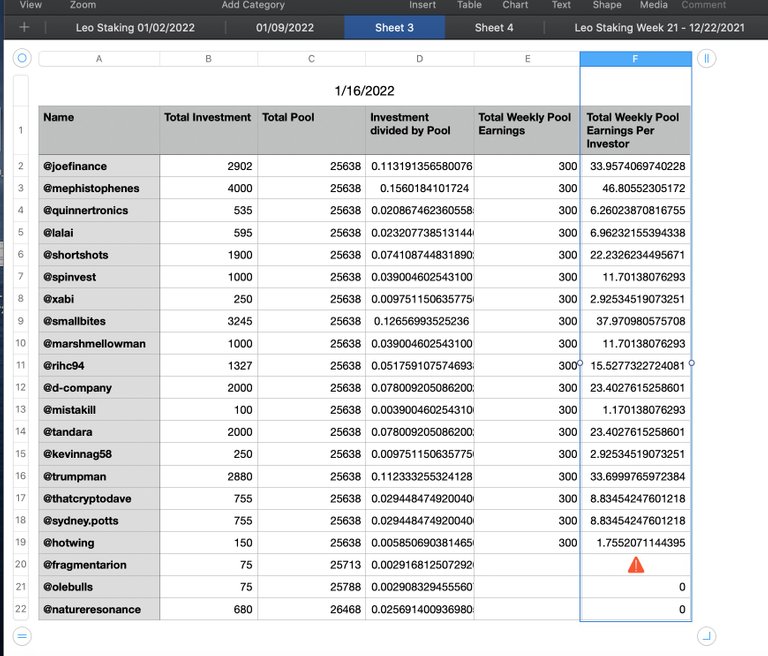

This weeks Stake based earnings

This weeks Stake based earnings using Excel Spreadsheet:

.

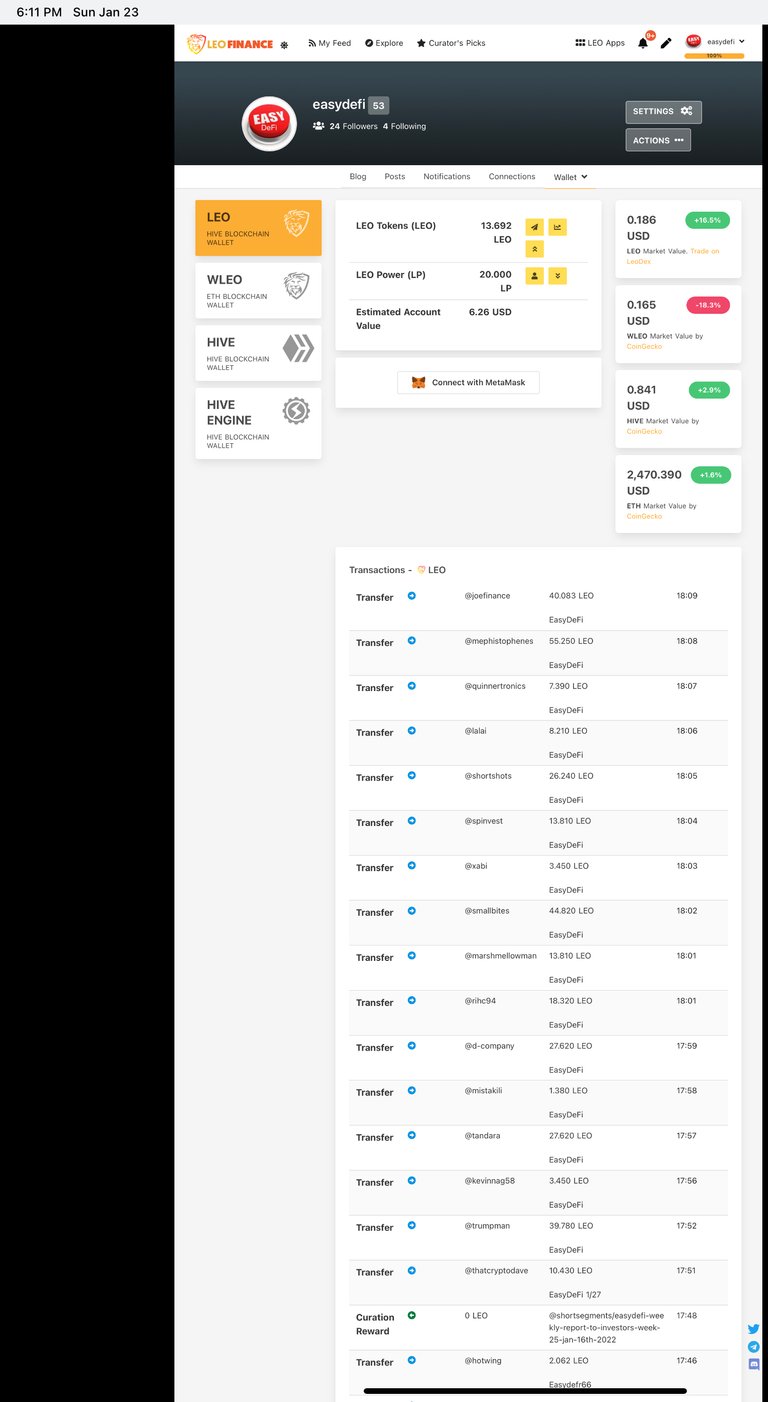

Wallet Transfers below documents that investors earnings were sent to their wallets.

.

.

Last Sunday’s New Investors who got earnings

@hotwing

@olebulls

@fragmentarion

@eirik

@natureresonance

New Investors

This week we welcome new investors that invested Hive at a time very favorable as Leo price is down compared to Hive, and Cub price is down too, so it’s a great time to invest@

Welcome New Investor to @easydefi

Monday Cutoff

The Monday cutoff protects the earnings of all investors, especially the smaller investors who would see their earnings reduced by deposits made after Monday and insufficient time to earn Cub because it is a shared earnings pool.

This week we thank our old investors who invested more Leo in the pool.

Thank you @trumpman

We have officially surpassed 25,000 Leo invested in the pool!!

Thank you investors for your trust!

We are in a dip, so weekly earnings are down, but it’s a great time to accumulate Cub!

New Promotions

This week I am giving away Free Legendary and Gold Foil Splinterlands Cards Delegations!

The investors get to keep the cards for as long as they are invested in the Pool!

Read more here

New Pool Group B is a SPS Staking Pool

Read more here

How does the EasyDeFi Investors Pool work?

Investors send liquid Leo or Hive to @easydefi. I bridge the tokens to Binance smart chain, then swap bLeo for Cub and BUSD, then I deposit them in a liquidity pair, obtain LP tokens, and deposit the LP tokens in a LP staking farm. I harvest the earnings daily and deposit them in another staking pool. I collect farm and staking pool earnings every Sunday and distribute them to pool members minus a 10% fee

The Average pool investor is earning an estimated 105% ROI (return on investment) per year. I also pay all the fees and do all the transactions. Pool members get their weekly earnings sent to their Leo wallets each Sunday automatically. It’s pretty easy for pool members to earn a high yield.

How to Join the Pool.

Send 100 Leo or 25 Hive or 125 SPS to @easydefi with the wallet memo Group A and you can get your earnings in your Leo wallet every Sunday.

After the first investment you can send additional investments of 50 Leo to add to your share of the pool and steadily increase your earnings.

Monday Cutoff

The Monday cutoff protects the earnings of all investors, especially the smaller investors who would see their earnings reduced by deposits made after Monday and insufficient time to earn Cub because it is a shared earnings pool.

Posted Using LeoFinance Beta

Request for clarification: Monday at midnight? Which time zone?

Hi @zolajade

Hawaii Standard Time

Still time then!

yes.

Posted Using LeoFinance Beta