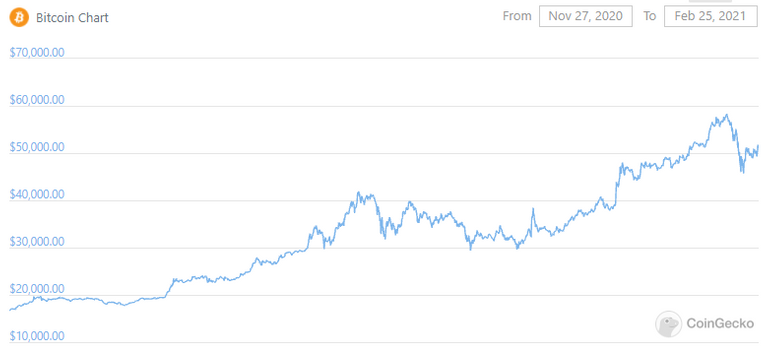

The last 3 months have been a hell of a ride if you are invested into cryptos... To be honest that price action reminds me certainly of the 98/99/2000 Internet boom... (and BUBLE!)

it is exactly the same feeling.. in disbelieve you stare at your monitor showing the coingecko price feed not daily but hourly.

Every single day the quote is up by 5% at bad days or 10% at good days.

And you begin to ask yourself: "OK, what if this doubles again.." or "What if this does 10x again"..

Having missed the 2016/2017/2018 crypto boom I just can imagine I must have been the same feeling.

And of course this is very joyful.. but at the same time this happened to me before and so the fear increases by the same rate the price increases.. Is this all sustainable? When will it crash? Should I not sell?

And then suddenly everything drops by 25% or more within 24h. Outch.. "I should have sold... I knew it..."

Sounds similar?

Yes, but um.. actually I did not know it at all and I did not sell! And that's a good thing, because I got the same feeling @20k already and I am for sure happy I did not sell.

So the current correction is a pretty good thing actually.. this steep price increases needed to pause for a few days... cryptos need to take some breath... recover.. for the next upmove.

And atm it looks like we are building a new support level around 50k ish in BTC and 1600 ish in ETH.

Even if we dip below those levels it seems as if big money standing by at the sidelines is moving in.

(@cryptohumster also wrote about this https://leofinance.io/@cryptohumster/institutional-investors-used-recent-deep-to-increase-crypto-holdings)

My gut feeling tells me we are in for another move up as "traditional money" is still moving into the market - but when to sell? (I am not answering the hypothetical question if one should still invest @ such high price levels because that for sure could be mistaken as investment advise)

You have to find a kind of your own rule / rhythm for your money management and timing.

Buying into BTC / ETH and EOS in Q1 and Q2 of 2020 was for me emotionally actually pretty easy.. prices had already crashed so much.. it just looked like the bottom.. at the same time - due to corona - reserve banks started to print money like crazy... so for me this was a quite obvious buying opportunity.. but not to such a degree that I invested more than little money.. I mean it is still crypto.. just ones and zeros...

What is IMHO much harder to achieve is the right timing for selling. How long to hold on if your investment tanks? Or does not perform as expected? When to sell if it moons? Sell at all or hodl?

Problem is in markets like this it is all greed and fear.. all craziness. A friend of mine just texted me when equity markets began to tank a few days ago asking for advice what to do with all his stock positions. For sure I would never give any investment advice but I can tell you what really shocked me is that every single position he held was not only very speculative (not a single blue chip, only hyped stuff) but he had also leveraged every single investment.

So who ever is leveraged atm in theses markets: Please don't do that, this is a certain recipe for disaster!

This seems to be the new normal "investment" behavior of retail investors. - and no, that is not investment but gambling. So whatever you do investment wise you have to know what kind of boys and girls are playing the same game. Those overleveraged gamblers will enlarge the market swings (volatility) to a massive degree as they will sell into the dive and buy into the rise.

What does this whole chatter mean?

I for myself consider no investment as "safe" and I am not ready to hodl forever. And I know that I do not know where the tops and bottoms are. So due to respect for markets and knowing my own psychological problems trading / investing in being not a rational computer but an emotional human being (at last I think so) I developed for successful and mooning investments / trades an exit strategy, too.

Whenever an investment doubles I consider taking some chips of the table and let the profit run.. if it goes up to be a tenbagger its time to take some more chips of the table, too.

Mathematically and trading wise many professionals will disagree with this strategy. But in essence this is actually a hodl strategy, because without loosing my cool, I am able to let a certain part of the investment more or less run forever... and this helps me to stay in for the big moves.. as I already took my initial investment of the table. For me this works perfectly and there is no other way I could hold onto shares or crypto once they are up 1,000%.

Of course there are also tax considerations as many states / countries might apply different tax rates to different hoding periods.

Maybe you will remember my words again if BTC and ETH go back to all-time-highs in their next move.

The sky is the limit, but once you are above 25,000 feet the air gets very very thin. At the end the anger about being only 50% in if BTC goes to 500k should be to a lesser extend than having lost it all when BTC tanks below 5k again.

These are not normal markets! Volatility, chances and risks are much greater compared to "normal" times.

The average long term stock market equity return is around 8%.. (higher if inflation kicks in) If your investment doubles every few month you have to understand that this will only keep on going for a very limited time. It might be wise to put not all eggs in one basket but to diversify and pay back any debt you might have (and for sure any leverage!!!).

DISCLAIMER

! NOT AN INVESTMENT ADVICE ! JUST PERSONAL OPINION ! DO YOUR OWN RESEARCH ! ASK YOUR ADVISORS ! BE AWARE OF RISKS AND YOUR RISKTOLLERANCE ! INVEST ONLY WHAT YOU CAN AFFORD TO LOOSE !

The author is long several above mentioned crypto currencies / financial instruments.

Posted Using LeoFinance Beta

Well said!

Posted Using LeoFinance Beta

Thanks, what I want to add:

At the end it seems to me that there is no universal system or rule that works for all but one has to find some mechanic that fits to his or her investment style.. so this article is more a suggestion that one thinks about his own investment style and tries to create some set of own rules he can rely on once the emotions kick in.

Posted Using LeoFinance Beta

Congratulations @solarwarrior! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 15000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz: