Welcome to the weekly update post for @spinvest-leo, where I (@jk6276) record on chain for transparency our transactions for the week, and update @spinvest investors with our progress.

Last week, I didn't have time for a full update, just a quick "Thread" of the basics. Back to a normal report this week.

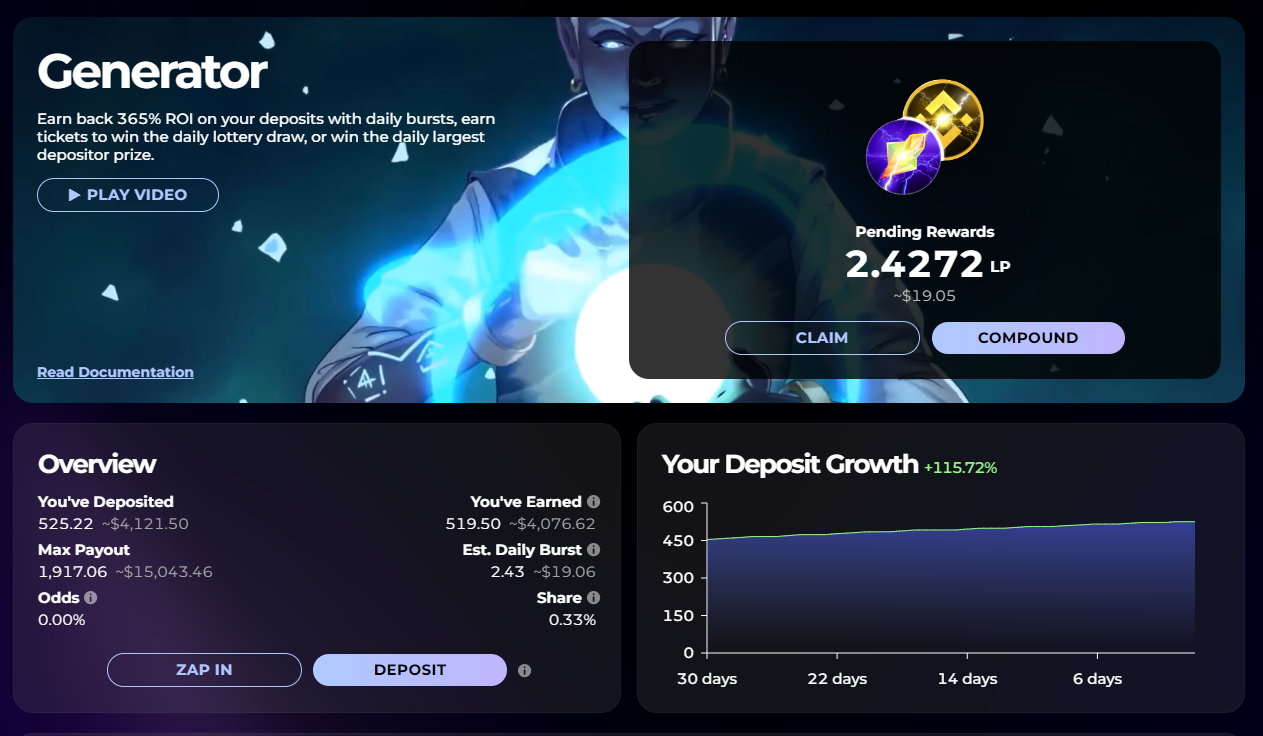

First, an update on the SPS/BNB Generator.

Here is what our position looks like in the Generator contract currently. I have decided today to alter the strategy a bit. It is now just over a month since we won the lottery here, and I've been consistently running the 5/2 strategy since. For those that are not familiar, the daily burst is the rewards from the contract, and it resets to zero at a certain time each day. Daily claims are a must here. I have been claiming rewards to add to the liquid SPS/BNB position (to farm SPS on Splinterlands) 2 days per week, and compounding back into the contract 5 days.

In order to give a boost to Spinvest's weekly dividends, I have decided to change this to a 4/2/1 approach. 4 days a week, I will compound. 2 days a week, I will claim as above. Once a week, I will claim, and break those LP units down to trade to HIVE to boost the funds for dividends. We are basically back to the amount of SPS/BNB LP tokens we had liquid before I started in the generator contract. So in effect, everything here now is freerolling.4 compounds will still keep the position growing, and keep us in the draw to win another lottery. 2 claims will keep the SPS/BNB LP position growing. 1 claim and swap to HIVE will boost dividends.

So, today I claimed the above 2.4 LP units. Removed those funds, swapped most through to HIVE (not quite all as I was running low on BNB to cover GAS) and ended up with 41 bHIVE to add to dividends.

Now, on with the regular report.

BSC

EMP

Peg is in a poorly condition again, so things are quiet overall for the EMP position. Still claimed around $10 worth of ESHARE from the EMP/ETH farm.

Swapped half to bHIVE, this added 14 HIVE for dividends.

CUB

Farmed around $8 of CUB this week. Swapped half through to bHIVE, adding 12 HIVE for dividends.

Asset values this week:

- ETH/EMP - $909 (down $65 on last week)

- CUB/bHIVE - $831 (down $27)

- CUB/bHBD - $823 (down $10)

BSC subtotal: $2563 (down $102 from last week)

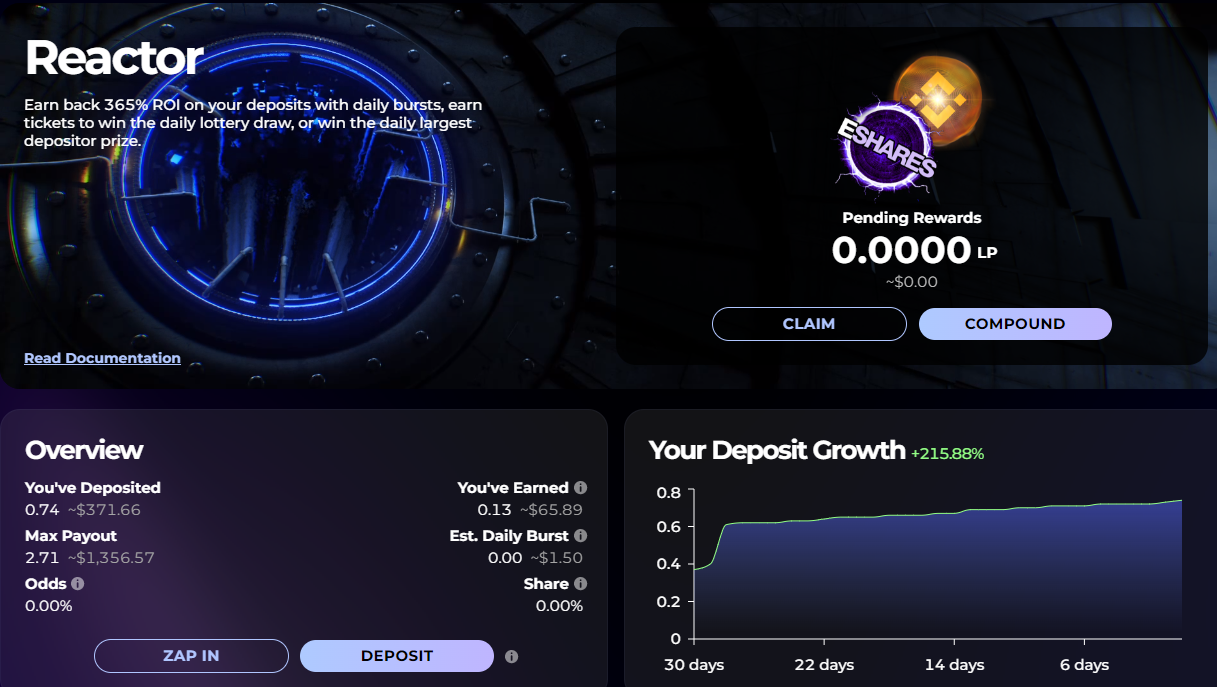

Lastly, I figured an update on the Reactor position is also in order. These funds are in the contract, so not reflected in our asset position. However the position is still an asset, and I have simply been compounding each day. Need to add funds to it to make it worthwhile, but don't really have anything spare at the moment to do so.

Not sure on the best path here. I don't have spare funds to add, and at this level it is basically a gas drain. Daily rewards are no where near enough to get a lottery ticket. Maybe the best course is to just claim each day till the position is payed out, and put the funds into something else.

Gaming.

- SPS/BNB pool - $689 (up $5)

- SPS stake - $358 (down $37)

- GLX stake - $11 (flat)

Gaming subtotal: $1058 (down $32)

The LP gained, despite the token prices dropping, thanks to the two claims for the week from the above mentioned generator contract. SPS dropped a bit, but we have more tokens staked (staking around 15 SPS each day). Similar with GLX, growing our number of tokens, but offset by price decline.

Half the income has been traded to HIVE each day. This has resulted in nearly 20 HIVE for dividends this week.

No changes to strategy here.

Other assets.

- vexPOLYCUB - $74 (down $6)

- HIVE power - $176 (down $6)

Other subtotal: $250 (down $12)

Gathered around 9 HIVE from post payouts and some Hive Engine dust to add to the dividends funds.

So, the total amount of HIVE collected to go for dividends is 96.517. This is well up on previous weeks as a result of the change in strategy for the Generator position outlined above.

That's it for this weeks report, thanks for reading,

JK.

Posted Using LeoFinance Beta

Thank you so much for your support of my @v4vapp proposals in the past, my previous one expired this week.

I'd be really happy if you would continue supporting my work by voting on this proposal for the next 6 months:

Additionally you can also help this work with a vote for Brianoflondon's Witness using KeyChain or HiveSigner

If you have used v4v.app I'd really like to hear your feedback, and if you haven't I'd be happy to hear why or whether there are other things you want it to do.

My previous @v4vapp proposal has expired. I have a new one which is running but unfunded right now. I'm still running @v4vapp and all my other services but I may have to increase the 0.8% fee to 2.0% if I continue to be unfunded.

Please consider asking your friends to vote for prop #244 or consider unvoting the HBD stabilizer explained below.

For understandable reasons in the current crypto climate it is harder to get funded by the DHF, I accept this so I'm asking a wider audience for help again. I will also redraft this proposal with more details (coming soon). I'm also looking for other funding sources.

Additionally you can also help with a vote for Brianoflondon's Witness using KeyChain or HiveSigner

If you have used v4v.app I'd really like to hear your feedback, and if you haven't I'd be happy to hear why or whether there are other things you want it to do.