This is a type of addendum or extension to my post today on the positioning of Bitcoin in the following quote from an article, talking about retail investors:

“They don’t have enough money to buy property, they don’t have enough money to buy high-end art, they don’t have enough money to buy Bitcoin but they have enough money to buy little stocks and that’s why we’re seeing these frothy conditions.”

As I said in the other post, this annoyed me a bit as Bitcoin is definitely not out of reach for average people, or perhaps, most people. Yet, there are a few positive points from this same paragraph that I overlooked at first reading.

Firstly, I find it interesting from the examples given of "real estate" and "high-end art" as these are actually pretty good examples for Bitcoin, or crypto at large. As I have said many times now, what needs to happen is that ownership of valuable and appreciating assets needs to be spread wider in order for the economy to have health. This is a challenge as pretty much anything of value, is already owned by those who have enough resources to never need give it up. This means that the spread either has to come through redistribution of existing assets, something that will get a lot of understandable pushback against, or the creation of new assets that can hold and appreciate in value, but can be accessed by the majority of people around the world.

Real estate. High-end art. Bitcoin.

While the article likely didn't intend to do so, there is a common thread here and it isn't inaccessibility for the average person. There are overlapping attributes between these three investments that for a curious person, could get them to dig deeper. The starting point question would be, what makes these things valuable?

Location, location, location - that is what they say about real estate. The most valuable real estate has to be accessible for example in the middle of a city or, hold something very valuable, for example, in demand natural resources. What also makes it valuable is the "real" part of it, as well as the "estate" part, the real you likely understand, but the estate actually comes from state, condition or status and is about property. This makes it something solid, but also something that can be owned and handed down to others.

Bitcoin and crypto is all about location and while not physical, the space it resides on the blockchain is protected and only those with the key may access it. This allows for ownership and transferability with the same kinds of conditions as a house, except with the superpower to be highly mobile and accessible from pretty much anywhere on earth.

So then there is the high-end art, which is valuable for a couple reasons, with some being similar to real estate - like scarcity. There is only a limited number of a particular piece, with most being one-off works, originals. Being original in itself doesn't make it valuable, it is that for whatever reason, the art or the painter has become revered and often, after death, the value of the art will increase as there is no chance to ever add more originals to the supply. In the case of art, it is the exclusivity of ownership that makes it attractive with much of the worlds investors not necessarily caring about the art itself, but the status they feel and receive for having ownership.

Now, the connection here to Bitcoin is obvious if looking at it from a supply perspective, as there will only ever be 21 million in the supply, with many of them already locked and lost. But there is more to it than that, as while Bitcoin might not be itself "original" each transaction is and the ability to build non-fungible tokens (NFTs) on blockchain is growing in the industry, and we are already seeing some large purchases of digital art. This will expand out to all kinds of other things too of course.

The ownership of Bitcoin does actually fit quite nicely in those examples given in the quote, but it is bullshit that it is inaccessible to ordinary people. However, what about the not so ordinary one-percenters?

If we look at those asset classes from their perspective, real estate gives them something tangible and the art gives them exclusivity on top. Lumping Bitcoin in with that lot will probably make it seem unreachable to many, but it makes it also appear more exclusive to those who consider real estate and high-end art as investment vehicles.

The other day, I was asked "How much Bitcoin do you have" and when I didn't give an answer more than "some" - the comment was that "I bet you don't even have one - which is sad" This was said in some jest, so I don't take it too seriously, especially considering what this particular person knows about Bitcoin or crypto in general. Technically, there can only be a maximum of 21 million people with one Bitcoin in the world.

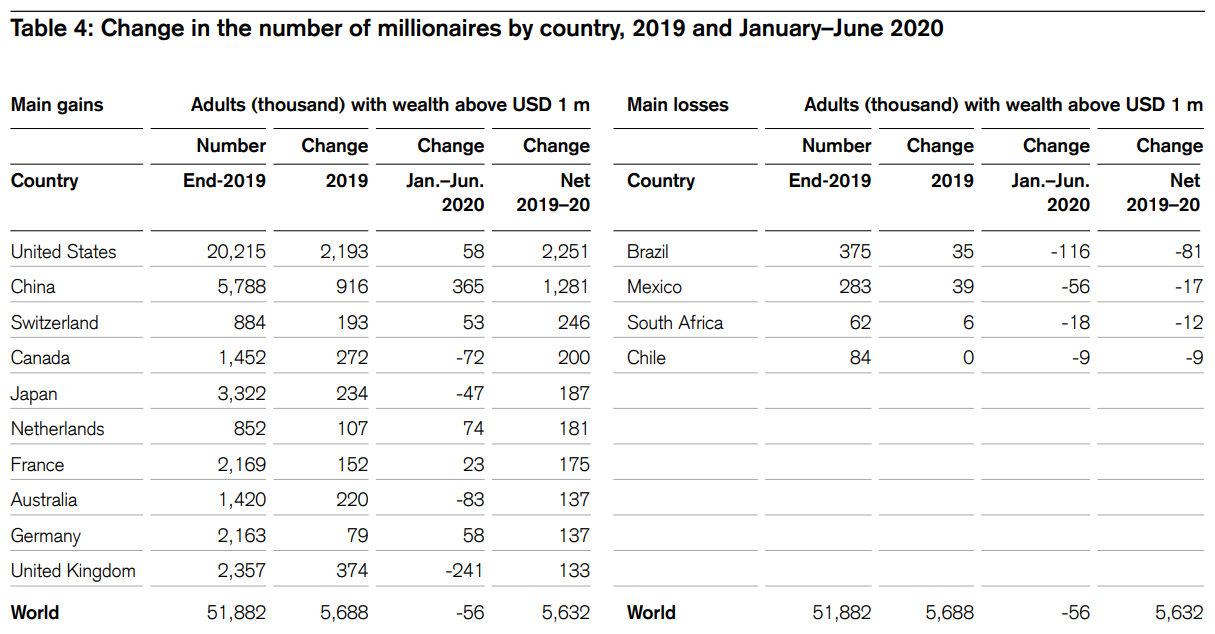

But, you want to know something interesting? According to credit Suisse and the 2020 global wealth report, there are over 51 million millionaires in the world and that was to June of 2020, so that has shifted upward again.

What this interestingly means is, if each of them said "I want a full bitcoin", less than half of them can have one. That is, if they had access to the full 21 million supply, which they don't, as there are already holders out there who covet their tokens. What this means is that you reading this, probably have more Bitcoin today than the vast majority of those millionaires will ever be able to own - because you probably have some.

This makes the scarcity of Bitcoin quite interesting if it does suddenly trend among the one percenters, as they could end up in Bitcoin FOMO trying to reach that coveted "One Bitcoin" status - which would push the price to... what exactly?

Sure, it might not be a Da Vinci on the wall, nor an apartment in the center of New York, London or Tokyo - but there will be bragging rights involved and, it will come with all of the capabilities that a house or work of art does not - including that coveted ability of always being accessible, from anywhere in the world, without anyone else on earth having access.

The end of that quote above talking about the retail investors not having enough money is,

"but they have enough money to buy little stocks and that’s why we’re seeing these frothy conditions."

Little stocks.

Perhaps instead of buying those little stocks, they should consider buying a few satoshis of Bitcoin instead, before the one percenters want to build their digital reputations.

Yes, this doesn't cover the expanding crypto industry as a whole, but that is for another day. As said above though, what needs to happen is better wealth distribution and what all of these digital assets and the way they can be bound to locations does, is open up more real estate and the potential of high-end art for everyone. It has a long way to evolve still, but the signs are looking good that it will continue on its trajectory of expansion to capture the attention of the rest of the world.

While there are 51 million millionaires today - how many will there be if and when Bitcoin ever hit a million dollars? You could look at the amounts in wallets and make an estimate, but that wouldn't factor in all of the other tokens and holders that are going to be dragged along for the ride. And it should be an interesting ride at that.

Taraz

[ Gen1: Hive ]

Posted Using LeoFinance Beta

I was a millionaire once!

I mean...A few times during 2020. But fret not, cause I intend to be a millionaire again, perhaps before the middle of next month. I'm close to 1 000 000 Satoshi...Seriously, it's stimulating when you think in those terms. A 0.01 BTC feels less intimidating to others. Which is not ideal. Although it's the same amount. Maybe my problem in 2020 was... I was thinking in 0.01 terms.

And I do have my staked Hive which is still worth more than that. I guess I am not that hellbent on becoming a millionaire as soon as possible.

I remember a character of a certain YouTube-popular film critic. He made the series Bum Reviews and his Chester A. Bum would often say:

With full and even distribution, it is possible for every person to have about 0.003 of a Bitcoin. That is not factoring in the 20% loss and all the current holders. I reckon that at some point in the future, having that 0.01 is going to be a pretty big deal.

I wonder what a million dollar Bitcoin would do to the price of your Hive stack.

Ah, given my position now, 0.01 would be a fail. Should be able to secure quite a bit more than that...but we shall see the big deal that I am...

!ENGAGE 20

Posted Using LeoFinance Beta

ENGAGEtokens.I don't even have fractions of bitcoins, but I prefer other things :)

we'll just ignore the fact I spend money on other things and am allergic to kyc XD

Neither do most people in the world. It might be worth getting a little though - just to say - "once upon a time kids..." ;D

LoL! XD

That would require me not being allergic to kyc and is probably out of my price range now.

And also if I was buying anything it's more likely to be hive x_x

because I don't care about bitcoin as anything more than a cool idea

Does blocktrades require kyc?

Just an account. Might need kyc to trade above their daily limit, but I'm not going to get anywhere near their daily limit anyway so that doesn't matter, and I don't know if they deal with fiat as last I checked they only had crypto pairs.

Congratulations @tarazkp! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz: