Economic output is dwindling. Not in real numbers of course as global GDP, pre-pandemic, keeps growing. However, when we consider it from am investment perspective, essentially our return on each buck (or EURO, Yen, or whatever) is rather poor.

For about 4 decades, we saw the money printing machine of the United States Federal Reserve kick into high gear. Other central banks followed suit, with some even passing the United States. The ECB, for example, has been on an easing tear, starting in 2008 and never letting up.

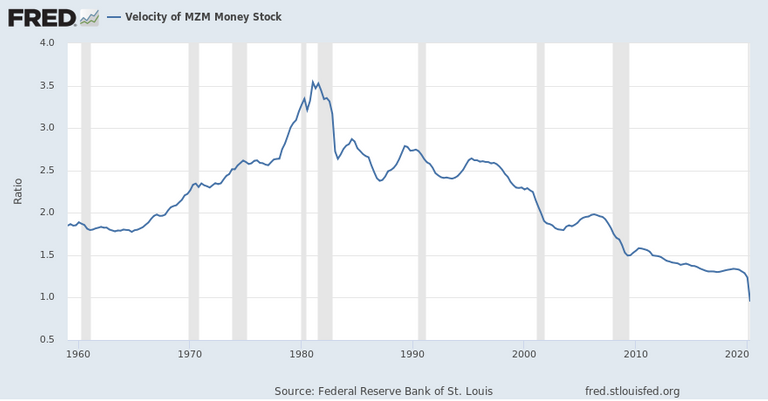

You would figure for all that money, the return would be outstanding. Unfortunately, this is not the case. Economic output, in light of that printing, steadily dropped. In the United States, we can see it clearly from the Fed's own charts.

This is a vital component in the economic picture. Velocity of money is basically the GDP divided by the money supply. When an economy is growing faster than its money supply, then you will see this number increasing. The reverse, which we witnessed over the last few decades, causes the number to drop.

The challenge with this is the law of diminishing returns. As more money is put out, it has less of an impact upon the output of a nation. Thus, the efforts to increase the growth rate requires more money.

What can be the cause of this?

Part of the problem is the way the central banks dole out money. The situation would likely be a lot different if money was put directly in the hands of individuals. Sadly, this is not the case.

The present approach, for the most part, is to put the money into the banking system. This is done by the Fed using base money. From there, the banking system can create bank money, which is allowed under the fractional reserve system.

Here is where things get very dicey. The banks, overall, do not have a ton of incentive to do this. Instead, they operate out of their own self interest, opting for the path of greatest profitability with the least amount of risk.

For them, it is often more sensible to play the spread on short term rate, as compared to the Fed's rate, than to enter into long-term lending. Thus, the financialization of the banking system versus a sound lending approach means less money is on the street than the Fed expects. Hence, a slowed velocity of money.

Cryptocurrency Adds An Entirely New Dimension

The new system that is being erected offers a direct payment mechanism that is unseen in the present one. With cryptocurrency, all currency is given to individuals (or mining farms) directly from the blockchain. There is no banking system in the middle who makes the decision of whether to put the money out or not.

It is a shift that could have massive impact upon the state of economic output around the world. Instead of flailing with economies that are growing at a couple percent a year, we could see growth rates entering double digits.

How could this be?

Quite simply, it all comes down to return. When individuals invest money, they seek out rates of return. As we are witnessing with the yield farming, sometimes those numbers can get rather crazy.

Of course, much of this is fluff and will not be sustained. There is, however, a component to it that will survive. The underlying premise of DeFi appears solid and like it will expand in time as the sector matures. When the shift is made from the Wild West to something more robust in its ability to offer solid service to those in need of money, growth could be the result.

For the moment, the industry is relegated to putting up tokens to earn more tokens. There are a lot of platforms that essentially are just applying financial principles to generate a rate of return. This is something that will expand as time passes.

Consider for a moment when token holders can put their money actual projects that focus upon research and development. Think about technologies that hold promise such as space development, longevity research, bio-tech, quantum computing, and AI. Each of these could have profound effect on society and the economic state going forward.

The Central Banks Cannot Overcome Technology

The central banks have a serious fight on their hands. Listen to most economists, they will tell you how things should be working. However, the wonderful world of ivory tower academia seems to have not translated into what is taking place in markets and economies around the world.

For all their huffing and puffing, central banks are going backwards. Whatever their efforts are intent on doing, they keep falling further behind. The old models that they used decades ago no longer apply yet they keep going to them.

Essentially, technology is eating their lunch and they don't know it. While they are aware it exists, they do not understand the exponential and advancing pace of what they are facing, not only in terms of technology, but their economies.

For a variety of reasons, mostly old beliefs, the central banks are going to fall even further behind the curve due to the unrelenting pace of technological advancement. Here is where cryptocurrency is going to have to step in.

Over the next decade, it is likely the world of crypto grows into an industry of many trillions of dollars. By 2030, we are apt to see crypto worth between $20T-$30T. This is going to be the case because those resources will be needed to fund all that is taking place.

It is a situation that will occur unless technological progress ceases to keep moving forward. Since the opposite is true and the pace of technological development is advancing, more is going to be required to "feed the bear". Where is this going to come from?

Certainly, the central banks are not going to figure it out. In fact, the Fed recently discussed their inflation targets, opting to raise their focus in that area. Are you kidding me? AI, robotics, and other technological innovations are about to eat the world and these clowns are discussing this.

The bankers got very wealthy off the present system. It is easy to see how the income and wealth inequality has shifted due to central bank policies. This is likely to continue, if for no other reason than general ignorance.

Once again, we see where cryptocurrency plays a vital role going forward. It is not all about lambos and mansions. Instead, we are requiring a new distribution system that opens up the floodgates of technological development and progress. Thus far, the banking system has slowed this process.

There is something much bigger taking place. If we step back, we can see it clearly in light of what is already occurring. Technology is affecting everything and, now, it has grown to the point it cannot be ignored.

This is the case, of course, if one understands its economic impact.

If you found this article informative, please give an upvote and rehive.

gif by @doze

Posted Using LeoFinance Beta

Currency itself is evolving into technology. Central banking has been holding back the world for so long they'll have no idea what to do going forward during this explosive reset.

Posted Using LeoFinance

The earlier we understand this, the better for us. However, there is still a lot of works to be done for this to be fully acknowledged; CRYPTO EDUCATION. A lot of people out there still don't know the potentials that this product holds. Many think it is just a get quick rich scheme that is not going to be around for long. It now falls on us to educate these people by making more posts like you have done and by having more crypto academies like Nowacademy that gives people a step by step guide into the world of crypto.

Great post

Indeed cryptocurrencies opened closed banking and financial instruments for the users and made them an active part of that. Not only that, but they have a saying in the systems they are being part of and through influence they can shape the direction in which a blockchain might move into. The first thing this shaped is getting rid of intermediaries and forcing traditional institutions to lower the commissions in order to survive.

Posted Using LeoFinance Beta

I could remember investing in bank stocks and the returns I got was totally poor. Unlike crypto where we have money in the hands of diverse individuals. Truth is, people need to the charge and change the narratives, the banking system is a no no.

Posted Using LeoFinance

At least in cryptocurrency everyone knows the money printing rate.

Oh, you’ll love this:

https://www.theguardian.com/us-news/2020/sep/20/leak-reveals-2tn-of-possibly-corrupt-us-financial-activity

None of it involving cryptocurrency.

The USD is still the undisputed champ when it comes to illegal activity.

Actually is it illegal if bankers do it? That might be grandfathered in as suddenly legal.

Posted Using LeoFinance Beta

@tipu curate

Upvoted 👌 (Mana: 9/27)

Your current Rank (31) in the battle Arena of Holybread has granted you an Upvote of 21%

View or trade

BEER.Hey @taskmaster4450, here is a little bit of

BEERfrom @pixresteemer for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.Congratulations @taskmaster4450! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @hivebuzz:

The blockchain technology will bring to this century huge changes in the way social life is organized.

Thank you for this informative article.

Peace

#leofinance

Cryptocurrencies are the future and there is no denying that. Whoever does this is just wasting time.