The past couple years saw a number of changes to the Hive ecosystem. One of the most promising developments is the advancement of the Hive Backed Dollar (HBD). Compared to where we were at the initial hard fork, we can see marked improvement in Hive's native stablecoin.

That said, there are some things that become evident when looking at the situation. It is, quite frankly, a common challenge among those in charge of monetary policy, hence there are no easy solutions. However, we have to keep walking down this path in an effort to improve the tokenomics on Hive. This is vital for the future growth of the system.

Being able to put HBD into savings and earn a return is a fabulous addition. It really incentivized people to pay attention to this coin and what it can offer. Of course, by doing this, one is helping to create more HBD. Since depth and liquidity is presently an issue, all that is produced helps.

The Downside To Savings

Have you ever wondered why politicians and those in charge of monetary policy consistently try to negate the effects of savings? Obviously, when a nation is made up of high savers, there is a great deal of stability to the system. The problem, however, arises in the fact that growth is difficult to achieve.

When money is being saved, it is not moving around. This is often referred as the velocity of money. When it slows, we can easily correlate a decline in growth rates. That is exactly what happened to the United States as the USD slowed down.

.png)

As we can see, after decades of stability, the VoM shot up during the economic boom of the 1990s only to peak in 1997. Since that time, we watched a steady decline. Even today, we are at a level much lower than before the COVID lockdowns.

If money is not flowing through the economy, it is not having much impact upon commerce. This is going to stifle economic output. Is it any wonder higher interest rates cannot be sustained?

Hive has the same problem. To illustrate, we will be using some of the charts from this article by @dalz.

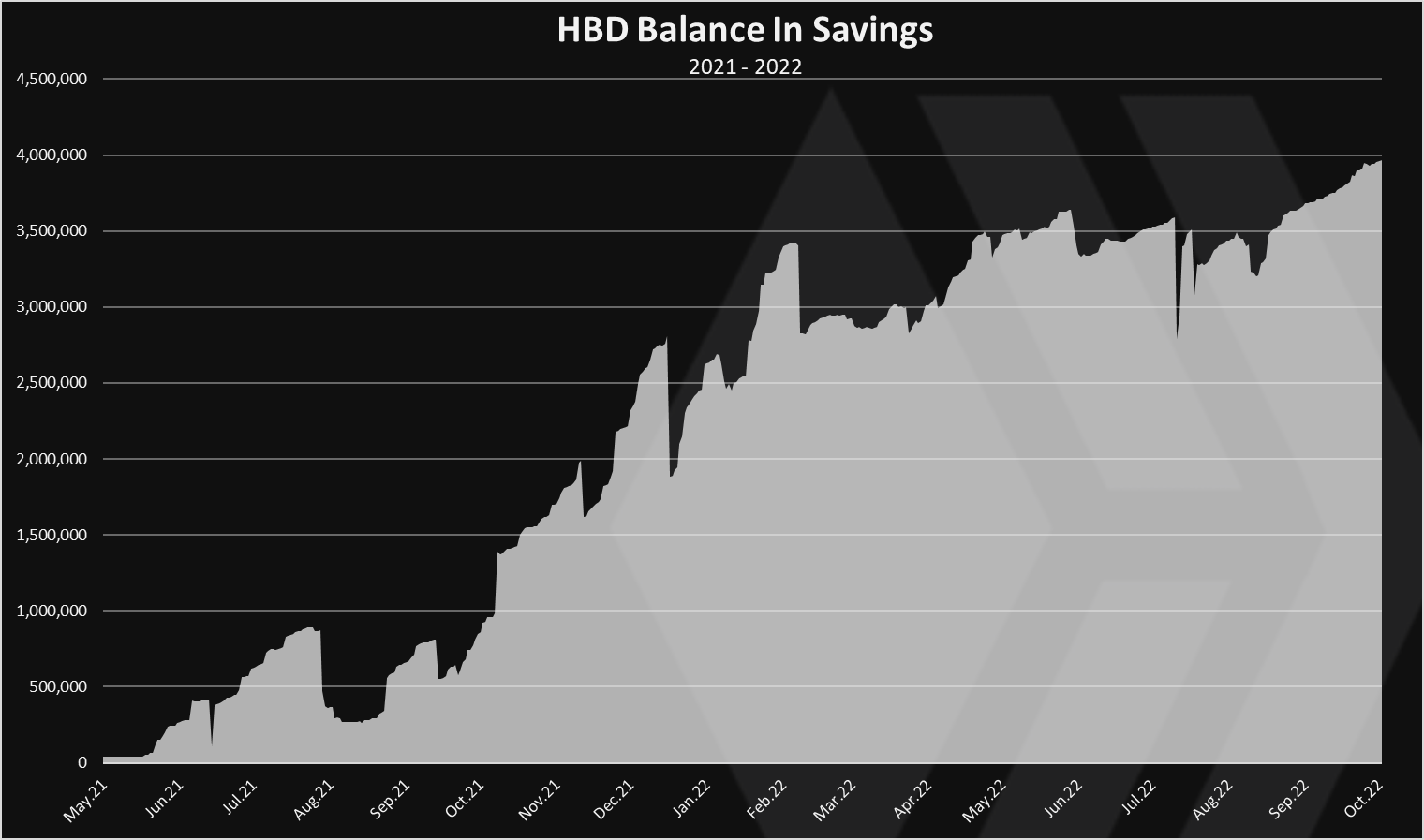

We covered a couple points regarding the expansion of HBD. Let us start with the savings:

We are now at roughly 4 million HBD. That is near 40% of the circulating HBD (excluding what is in the DHF). That is a strong savings rate based upon the percentages.

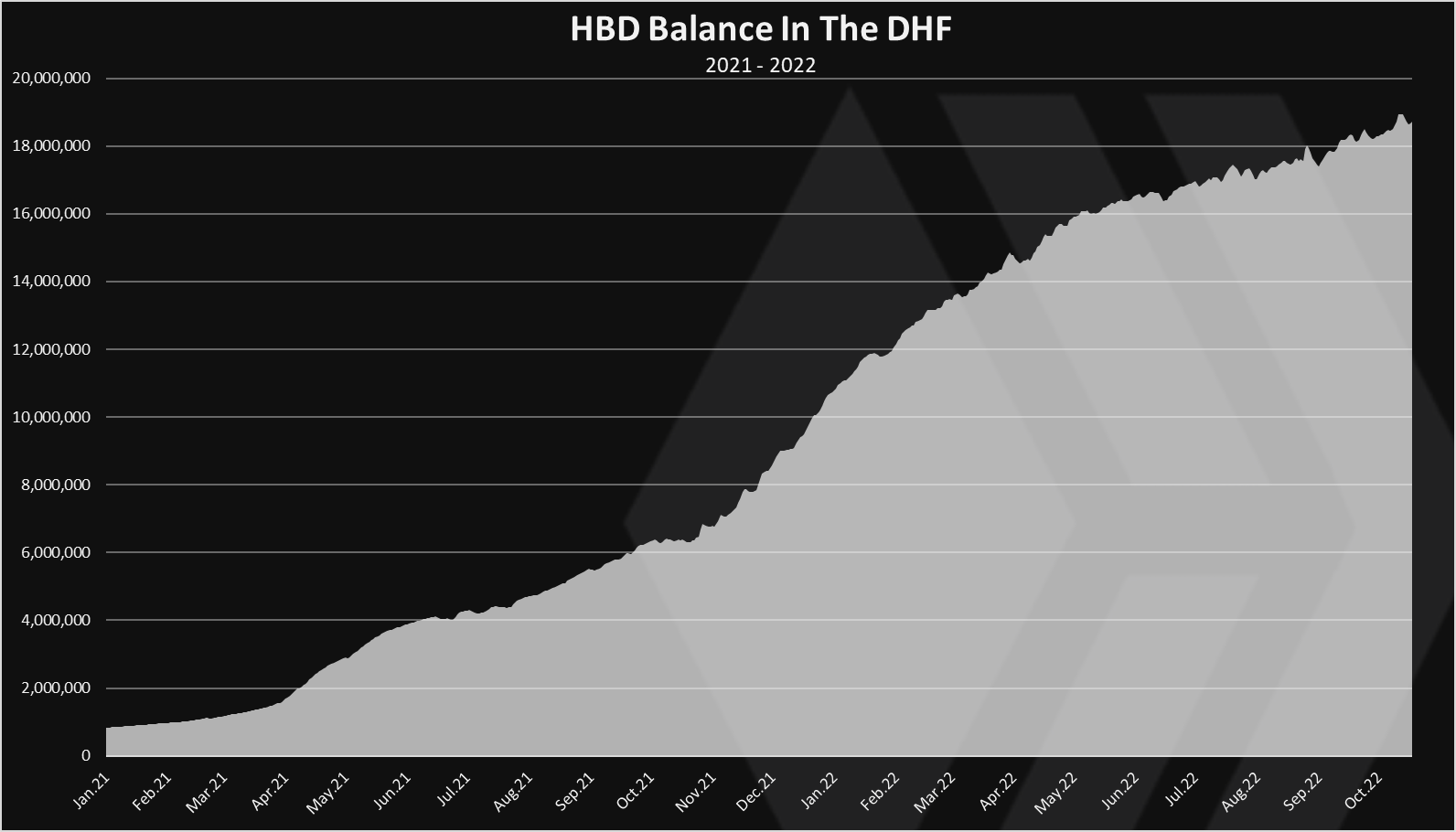

There is also the fact that the HBD Stabilizer is now eating up a lot of the HBD. Even though the total supply grew, the DAO is growing at a faster pace.

The total is now over 18 million HBD in the Decentralized Hive Fund. This is good from the perspective of stability yet is a drawback when it comes to economic growth. Actually, the Hive economy is stifled. Commerce cannot take place with 22M out of the 28M HBD locked up.

In short, it creates quite a quandry.

Therefore, how do we provide the ability to grow the Hive economy while also providing the stability to the ecosystem?

Hive Derivatives

The idea behind the Hive Financial Network was to alleviate this problem. Not only is this a defense mechanism by providing additional financial layers, we will see how it takes care of the problem we are now confronted with.

Let us use the concept of Hive Bonds to illustrate.

Under this idea, people are able to lock their HBD in a time vault for a certain period of time. For this example we will say it is 1 year at 25% APR. When the transaction is made, the blockchain knows the details.

A layer 2 token is instantly created that contains said data about the transaction. It knows the date, APR, amount, maturity, and how much is due. Each of these tokens is essentially a NFT.

Since there is a stated payoff over time, this asset has value. One of the main use cases is collateralization. Here we take the Hive Bond and take out a loan on the lending platform. Since it is modeled after Treasury bonds, the case for collateral is increased since volatility is reduced. After all, a lender can always hold the asset until maturity. There is no speculation as to what the payment from the bond will be.

Once the loan is granted, stablecoins are received. Now our borrower uses the money go buy a Ragnarok card that is believed to have appreciation value. Plus, since the individual is a player of the game, it is a worthwhile move.

Over a 6 month period, the loan is continually paid down, carrying a 5% interest rate. At that time, our borrower decides to sell the card for 100% profit. The balance of the loan is paid off and the bond removed as collateral.

This is a simple example but it does illustrate the difference.

When the money is in savings, it doesn't do anything other than create more HBD. This is important yet it doesn't have a lot of commercial applications. Sure, we might make the case that the newly minted HBD could then be used but most are likely feeding it right back into savings.

At the same time, we know the DAO locks HBD up for, potentially, years. So that is having a minimal impact economically.

However, we can clearly see by adding the derivatives, economic activity took place. The borrower was able to purchase a card (which is an economic transaction), utilize it in the game (presumed commercial activity in the Play2Earn realm), and then sell the card for a profit (another economic transaction).

We also see how the loan itself also fits into this category. There was an interest rate of 5% annualized. This means the entity behind the lending application was able to garner 2.5% during the 6 months.

Hive Power

We face the same situation with $HIVE, the other base layer coin. Here we also want to encourage the locking it up by staking it as Hive Power. This potentially puts us on the same path since we walk the fine line between circulating supply and growth.

There is a 13-week power down time which is a major security feature. However, it does go counter to some of what we discuss here although the fact powering up does give people the ability to engage with the chain does help.

Nevertheless, we can see how derivatives are important for growth of the Hive economy. Without money to transact we can easily see how there is nothing for commercial or financial activities. Money needs to flow through the economy for there to be an impact.

Unfortunately, this is not going to take place while Hive has to focus upon the security of the system. That is the overriding goal at the base layer. Thus, we have to take actions at the second layer to feed the growth aspect.

This is where Hive derivatives enter the picture.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

~~~ embed:1585792409392201728 twitter metadata:MTQxNTE1NTY2MzEzMTQwMjI0MHx8aHR0cHM6Ly90d2l0dGVyLmNvbS8xNDE1MTU1NjYzMTMxNDAyMjQwL3N0YXR1cy8xNTg1NzkyNDA5MzkyMjAxNzI4fA== ~~~

The rewards earned on this comment will go directly to the people( @michupa, @rzc24-nftbbg ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

I've actually seen this on a personal level with my account. I know my account has been growing a lot more slowly lately because I haven't been moving my HBD into HP. Instead I have been putting it in savings. I have some soft targets in mind that I want to reach with my savings and then maybe I will start moving HBD back into Hive to grow my HP.

Posted Using LeoFinance Beta

I think that is the norm. I am doing the same thing. None of the HBD I earned has gone anywhere but remain in savings.

Posted Using LeoFinance Beta

It's killing my growth, but how do you turn down 20% interest and the stability.

We can see how derivative is important is the growth of hive and hbd has done well but I believe this is just the beginning. We must encourage people to stake more hive because that is where value is

Posted Using LeoFinance Beta

Still need a lot of infrastructure to be built.

Posted Using LeoFinance Beta

Finding the equilibrium where the stakeholders can invest and at the same time can grow is the best thing possible. The current situation of HBD and Hive is promising, even if we compare it with other investment returns.

The growth aspect must continue.

!PGM

!PIZZA

!CTP

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

I gifted $PIZZA slices here:

@torran(2/10) tipped @taskmaster4450 (x1)

Send $PIZZA tips in Discord via tip.cc!

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

It's tough to find a good balance and I doubt we will really know the best solution. Each one comes with it's downsides and I agree that we need HBD to be used more economically if we want it to have more influence. So I think the derivatives makes a decent amount of sense but I am not sure if you intend to copy a similar structure to US bonds or apply some fixed percentage?

Posted Using LeoFinance Beta