We have heard it all before. The price of Bitcoin is going to crash. It will head back to zero. Yadda. Yadda. Yadda.

The mistake people seem to make when looking at cryptocurrency is they believe everything is in a bubble. This is derived by looking at other markets, ones that are vastly different from digital assets.

What makes Bitcoin and the like so different? The fact that they are digital is very revealing. This puts them under laws that produce results that are widely varied compared to "normal" markets.

The key here is the exponential nature of growth. In the digital realm, growth can take place at a much more rapid rate and to a far greater degree than in the physical world. Expansions is much faster when dealing with bits as opposed to atoms.

This creates an entirely new environment when it comes to crypto pricing. Markets can move in large chunks and not revert back to the norm. The reason for this? A new norm is established due to the exponential growth.

Does this apply to every cryptocurrency? In theory, yes. However, the reality of the situation is that very few cryptocurrencies are experiencing this at the moment. It does bode well for the long term growth of the industry. For the time being, we can probably narrow this down to Bitcoin and Ethereum.

One of the best barometers we have is the number of wallet addresses. Basically, the more wallets, the greater the number of users. Certainly, as we know with social media, an individual can have more than one account (wallet). Nevertheless, when taken as a whole, we can at least see the trend.

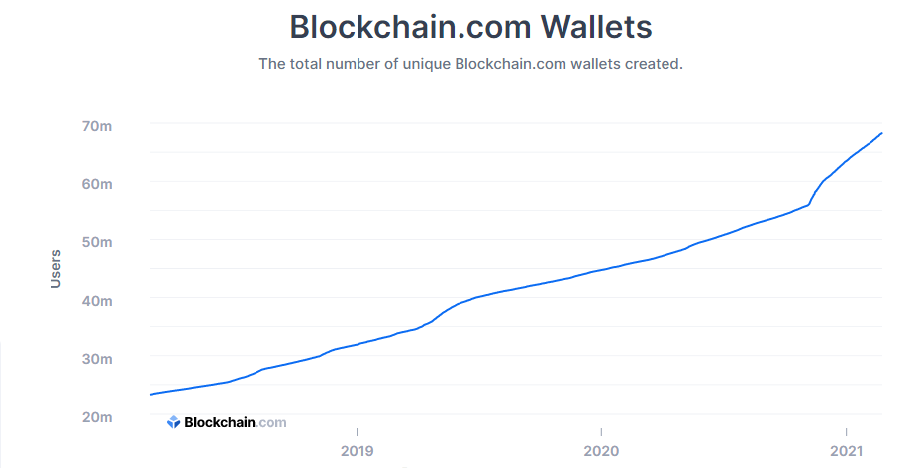

Here is a chart of Bitcoin wallets according to Blockchain.com.

Source

Over the last 3 years, we saw a tripling of the number of wallet addresses. This metric mirrors what we see happening in other areas pertaining to Bitcoin such as total hash rates and volume of money transacted.

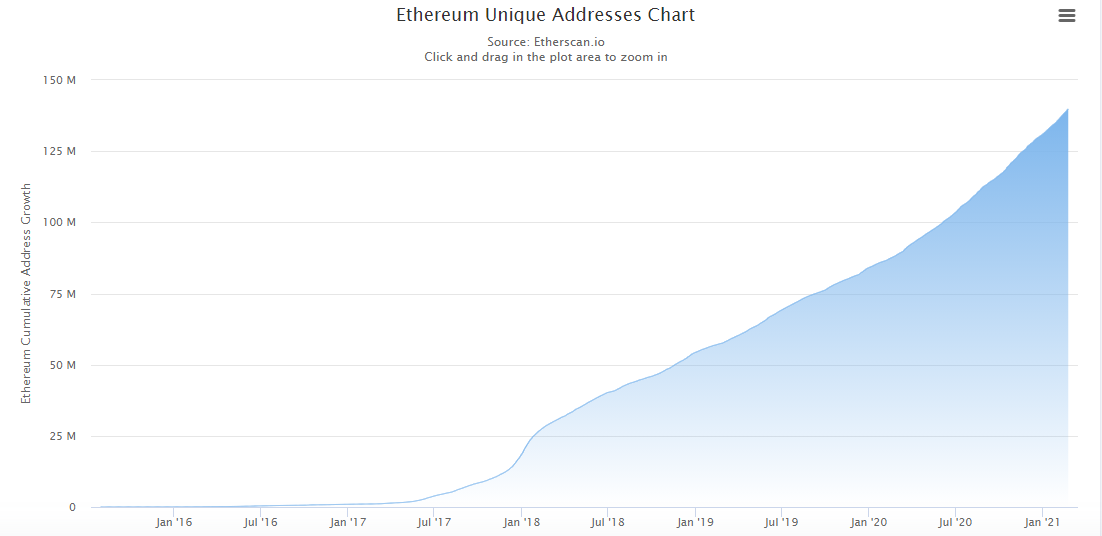

At the same time, we see similar results with Ethereum.

Here is the wallet chart from Etherscan.

We can see similar results with Ethereum. The wallet addresses reflect what other metrics are telling us such as developers on chain and number of applications. We also can look at the amount of money locked up in DeFi on Ethereum as another barometer.

In short, both these blockchains qualify as seeing exponential growth. The number of wallets along with other metrics are showing this clearly. Hence, we can conclude the Network Effect is in full force.

Which brings up the question why is the Network Effect so important?

What makes this so powerful is the fact that the users and the owners tend to be one. As more activity occurs, this has a direct impact upon the price action. Since many of the token holders are also users, this starts to compound over time.

Also, since it is in the digital world, the expansion rate can be triple digits, for years. We witnessed this in the social media realm where the likes of Facebook and Twitter spent close to a decade in the high growth category. Adding a user is a lot less costly and easier to maintain than in the physical world.

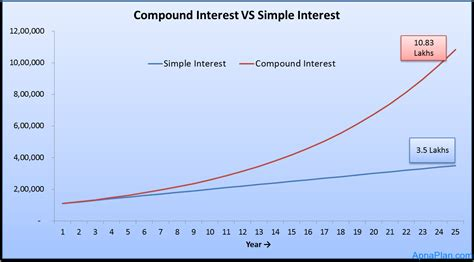

It is difficult for most people to envision exponential growth. We are conditioned, perhaps biologically, to think in linear terms. This is where we underestimate what is taking place. The impact on an exponential scale, over time, is very profound. It is what makes compound interest so incredibly powerful. Anyone who looked at a simple interest versus compounding chart will know what this looks like.

Source

Ultimately what happens is we see multiple Network Effects taking place. This ends up leading to a Mega-Network Effect. Essentially, a supersized organism begins to form as all the different pieces experience individual exponential growth.

This is also why pricing action will resist reverting back to its linear trend. Instead, it will chart in an upward pattern, creating a new mean with each leg.

The fact that, in most cases, the users are also owners creates a powerful multiplier. It is why Bitcoin HODLers are legendary. They are the ones who hold the coins while also keeping the network running. The early adopters participated in many different ways, including mining and promotion.

Of course, there was incentive since they can be considered to be the "owners" of the network.

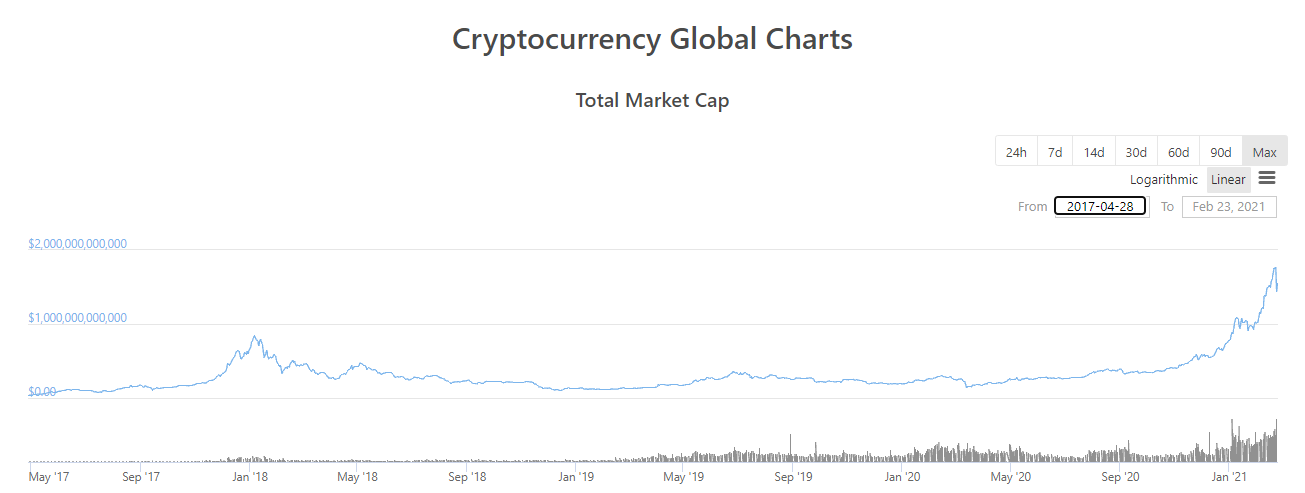

We can do the same thing with the entire market cap of cryptocurrency. This chart, from Coingecko.com, shows what it looks like over the past few years.

The tendency is to look at this and expect the pricing to move back to the historic norm. However, as was just explained, two of the tokens, which account for roughly 3/4 of the total market cap are engulfed in the exponential experience. This is not likely to end anytime soon.

Thus, it is safe to say a new norm is being established. For each of these tokens, we are better off looking at the moving average as compared to historic price levels. That will give us a better idea of where things are going.

Does that mean we cannot see serious pullbacks? Of course not. It is always possible that Bitcoin gives back 80% of its market cap. This is normal for this asset class. However, the level that it will pull back to keeps increasing with each passing year.

Overall, the growth rate of cryptocurrency can be foreseen by this concept. If we consider the price action with just two coins going exponential, what will things look like when there are a dozen or more?

Here is where the super organism idea enters. If we look at each token as an individual unit, piece of the entity if you will, and then mirror what happened with BTC and ETH, we can see how larger growth is still ahead. Thus, the latest move on the total market cap chart could end up being small in comparison to where things are going over the next couple of years.

In short, how many cars can you drive? Television can you watch? Homes can you reside in?

With digital, those numbers shoot up a great deal. The same user can participate with multiple chains throughout the day. Different applications can be used and tokens earned. While a family will have, perhaps, two cars, a single individual can have dozens of cryptocurrencies.

This sums up Network Effects and the digital world. We can use multiple applications, benefitting many different areas at the same time.

Ultimately, this shows up in the pricing action. Keep the idea of "fractals" at the forefront of your mind. If we look at each of these in pieces, we can really see how the Network Effect will influence things.

This is a far more powerful concept than people are conditioned to look for. Yet it is happening within the cryptocurrency and blockchain world. For this reason, we can be optimistic where things are going. The next couple years will see explosive growth, most likely in many more chains than just Ethereum and Bitcoin.

It is also a reason why many are betting that a blockchain such as Hive sees much greater levels.

The Network Effect within social media has been profound. It is also evident that there are similar results in the digital financial arena.

Now combine the two and see what can happen.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

Bitcoin is in no danger because it has huge network effects.

Someone somewhere selling their house to buy Bitcoin

Posted Using LeoFinance Beta

Bitcoin has a lot going for it.

Posted Using LeoFinance Beta

Like this one a lot and, of course, it's true.

In fact, very true, a rapid change so an instant new norm, reason is very simple, unlike physical objects/commodities, digital ones are in the reach of a lot more users (or as you said, Network Effect), so the variations can happen overnight.

Posted Using LeoFinance Beta

Something that Amazon has used to perfection. They simply need to add another page to their website and instant product added. Compare that to what a physical store needs to do.

On Hive we can see the various projects all having assorted network effects, adding to the totality of the whole.

We need to get a couple breakthroughs and it will be evident.

Posted Using LeoFinance Beta

Yes, the network effect is extremely powerful. When you couple the fact that the "network" being built is also expanding exponentially in utility, the numbers get pretty insane. Basically, the only real limiting factor in these markets right now is time. Onboarding users and building up infrastructure takes time. But you can already clearly see what the last three years of investment and time has wrought on the markets: as you say, an exponential growth in the overall crypto universe. If you extrapolate some of these numbers out to the next cycle, they truly become astronomical. Just happy to be involved at the beginning.

Posted Using LeoFinance Beta

Ethereum is adding roughly 150K new wallets per day. I am not sure how many people that translates into but each of them is an ideal candidate for other options within the crypto sphere. You are right, it is going to take more development but once a few more DApps are out, we can really start to target those who are "around" crypto but not really utilizing it.

Posted Using LeoFinance Beta

Very hindsight full data that put us into perspective about where we are now. With every swing, independently of the price. The user base does nothing but growing. We are on the right track.

Posted Using LeoFinance Beta

In the total cryto world it does. The key is just to keep adding more people and more development. If we can do that, we then can target all those who are in crypto, a bigger number with each passing week.

Posted Using LeoFinance Beta

good thing there are a lot of projects on being developed on hive that can absorb all the exponential growth :)

Posted Using LeoFinance Beta

It isnt so much absorb it as generate it. With so many different projects, it will only take a few breaking through before we see exponential growth on the overall network.

Posted Using LeoFinance Beta

I believe that we are on the right path towards success.

wow when seeing the cold graphs the number of wallets never decreases, on the contrary, year after year it is seen that it grows and I do not see that it is going to stop as you say.

and if this continues, well things will come and change our lives for all of us, I read that we are in the part of the abyss then soon we will overcome the abyss to move on to mass adoption and then all this will explode towards its maximum expression, and we are already with an advantage ahead first because we can provide our accounting and auditing services for something that is not considered much for now, the tax services to make the declarations will be in high demand when advancing in it so there we have an advantage we can have the occasional opportunity He does not believe in trading here, well that among many others that will be happening.

Posted Using LeoFinance Beta

It seems the number of wallets being produced each day only increases as time goes by.

This is vital. We are seeing more activity on both Bitcoin and Ethereum. We just need to convert some of those numbers over to Hive.

A couple of DApps and we will be golden.

Posted Using LeoFinance Beta

Those who go and do not have money will arrive slowly, I know that some idea will come to them as well as we also carry people will begin to arrive,

It is only a matter of time, and in the end many I know that they will like being here just as we have found the flavor of being here learning day by day.

Posted Using LeoFinance Beta

The benefit to what Hive is constructing is that people do not need to have money to get started. With Bitcoin and Ethereum, people need to buy them. However, with this, just get active and start getting rewarded in some crypto.

Posted Using LeoFinance Beta

Wow, triple the growth in the number of wallets. I probably wouldn't have guessed it was that high. I mean obviously people are creating accounts, but would have imagined it was less than that. I am sure it will only continue to rise in just a short time here.

Posted Using LeoFinance Beta

Hard to determine how many people that equates to but there is some kind of ratio which means there are more people involved with both Ethereum and Bitcoin.

Hive is getting more wallets (accounts) too. Each day we see new accounts created. It is a drop in the bucket at this point though. Not a lot of activity and we dont know how many are actually staying.

ProjectBlank should shift these numbers greatly.

Posted Using LeoFinance Beta

Yes, hopefully Project Blank is going to be an absolute game changer! I know I own about four or five Hive accounts but only two of them are really active.

Posted Using LeoFinance Beta

Money has changed forever. This evolution will continue while the network effect will only cause more disruption and development. The Peter Schiff’s of the world will never understand that the game itself has changed. 1970-80’s logic no longer apply.

Posted Using LeoFinance Beta

Oh boy you nailed it @automation.

There are so many ideas/concepts from the 1970s still floating around and being espoused as gospel. You are right, those like Schiff are dinosaurs and their viewpoints are worthless.

All aspects of economics and finance are rapidly changing. Too many believe that what was viable in the 1970s is applicable today.

Money and all associated with it changed.

Posted Using LeoFinance Beta

Could you imagine Bitcoin having a 50-80% pull back when it has a $500 000 price tag. People will panic lol as multiple coin owners would be down millions. I think it will be harder to trade as it would be easy to get it wrong and lose out entirely.

The network effect shows maturity as well which many of the other coins don't have as yet.

Posted Using LeoFinance Beta

This is highly possible. The price goes higher which means that pullbacks will be even more painful, in USD terms.

Of course, that already happened compared to where the prices were in the early days.

Posted Using LeoFinance Beta

The network effect sure is amazing. Just word of mouth is amazing as it generates so many more people to create wallets. I think the more known something is the more it moves around in the network. So I definitely agree that work that the early adopters did was vital to it's success. I would not be surprised to see more wallets opened every time BTC makes a new high because nobody would shy away from a potential money making opportunity.

Posted Using LeoFinance Beta

We all have a part in the future growth that is taking place. I believe everything we do lays down the foundation for what will come after. This will mean significant growth over the next few years.

It is just a matter of picking the right project, and Hive is one of them in my opinion.

Posted Using LeoFinance Beta

This is so true and that is why Bitcoin has been able to maintain his leadership in the world of cryptocurrencies..

@taskmaster4450