Is this any surprise?

Things are growing enormously in the crypto field. We are seeing the price of many tokens run, especially Bitcoin and Ethereum. These two are amassing big trading volume.

We are also seeing more attention paid to the centralization-decentralization discussion. The moves of the social media companies brought this to the forefront.

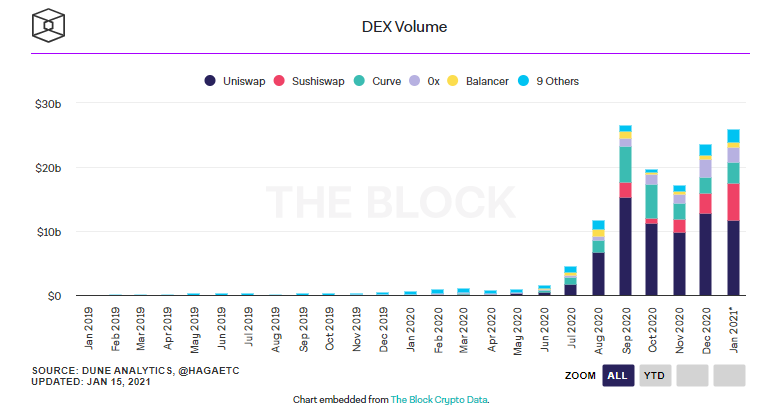

For this reason, few will be surprised that the DEX volume in the month of January is set to shatter the previous all time record.

According to data compiled by The Block, current DEX volumes for January 2021 are $26.01 billion with 15 days remaining for the month. In September, DEX volumes reached $26.6 billion fueled by DeFi Summer.

As Mel Allen, the long time New York Yankee broadcaster, use to say, "Well how about that?".

Basically January's volume is going to surpass the all time high in a little more than half a month. This means, if the present pace is maintained, it will be close to double the volume.

As interest in the crypto world grows, we are seeing a great deal more activity. This is common during bull runs. One advantage though, is that long time holders and active participants have more crypto than they did a few years ago. This is helping to push these numbers to such great heights.

Uniswap currently makes up 44.85% of January’s trading volume, with SushiSwap (22.19%) and Curve (12.98%) in second and third place, respectively.

These exchanges tend to cater to the long time crypto enthusiasts. Newer players tend to drift to the centralized exchanges since they are dealing with fiat. DEX is ideal for those who are already holding crypto and looking to get involved with DeFi in some manner.

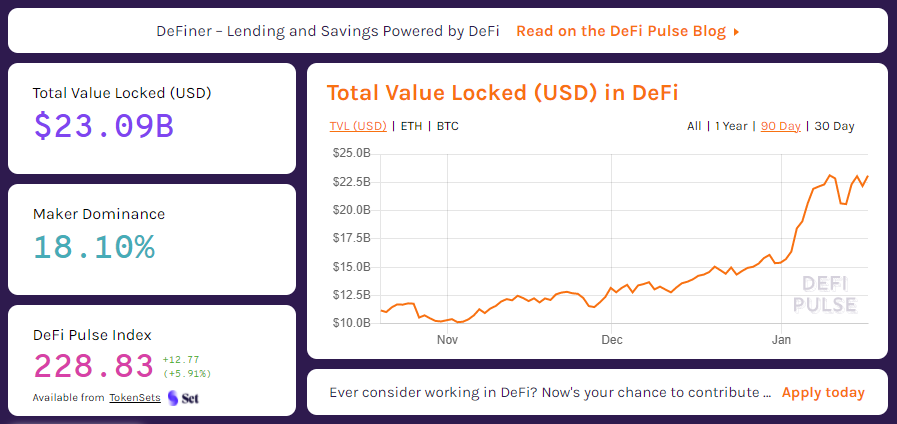

The latest numbers from DeFipulse.com tell us how much things have grown.

We are obviously still dealing with numbers that are much below the centralized counterparts. However, the fact that we are seeing records being set is very telling. Each day, the crypto world gets bigger.

When we think about it, there are many projects issuing out new tokens each day. Bitcoin, for example, doles out 900 new coins each day to miners. This makes the existing value grow if the price remains the same or goes up. Those who are receiving the tokens are seeing their bags grow.

This often leads people to do something with them. It is a sector filled with people seeking a return. Take all the tokens issued and then put a 15% annual return on them. That expands the total holdings even more.

It is something that will continue as long as innovation takes place. This is not even accounting for things such as airdrops and new projects where other tokens are created.

Over time, this all makes those involved in crypto more powerful and the entire pie growing at an insane rate.

The key for the world of DEX is to keep increasing the user friendliness of them. They are still a bit technical for most people. Again, with time, we can see enormous differences taking place.

Ultimately, it becomes a circular process. The more friendly the DEX become, the greater the amount that is drawn in. This is going to stimulate development and innovation, which will drive more opportunity to use these products. Again, that drives more money, increasing the activity.

As we see interoperability increase, this will provide the opportunity for one to leave where he or she is even less. Why move things around if you can swap from one token to another from a wallet where it is resident. Why even deal with the exchange process?

My expectation is that we will see the above chart, although with ebb and flows, see another move higher in the volume throughout the year.

It is not likely that the DeFi boom slows down any time soon.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

The alt season is really happening.

Posted Using LeoFinance Beta

The large cap alts are already having a field day.

We have to wait and see if it reaches further down.

Posted Using LeoFinance Beta

If they could reduce the gas fees, I think they could get more new smaller people to join. If LeoFi comes out with it's changes on smart contracts, I think we can see this go up. The only thing left to do is to promote it and more people will be willing to enter these exchanges with lower fees.

Posted Using LeoFinance Beta

I think that is the plan. To be able to replicate what is on Ethereum but without the Gas.

That will help to attract more money, smaller in size perhaps, into the DeFi world. And all of that trading will take place on a DEX.

Posted Using LeoFinance Beta

I'm still a novice when it comes to cryptocurency and its terms. In fact, this is my second comment on LeoFinance website after a year of being out of this platform. I never witnessed the breakout from steem as I'm told and it surprised me that LEO, the former steem-engine token I knew and actually bought a few. Had it been it reached some amount for upvoting, I would have become rich by now. However, my SPORTS stake was growing since I joined a voting trail then.

With what is happening here, I think I can comfortably restart my journey. I am a linguist by training and it seems cryptocurrency can help pay my bills.

here is my reintroduction on LeoFinance in case you may want to know more about me. https://leofinance.io/@apostlevincent/reintroduction-on-hive-after-one-year-off-steem-leofinance-should-be-a-home

I may not be engaging here daily but would surely improve. I have been educated that to grow, I'll learn to talk to people via comment.

Good morning Sir.

Posted Using LeoFinance Beta

Which are the most interesting defi coins in your opinion ?

Posted Using LeoFinance Beta

This is clearly just the beginning, and by December of this year we will see numbers four times greater than this report has.

Posted Using LeoFinance Beta

I wonder if Uni would still hold such a big market share if they had not done the big airdrop that drew so much attention to them. Still pretty impressive. More money moving around than I will probably ever see in my entire life!

Posted Using LeoFinance Beta