HIVE is an equity used by the witnesses to secure a $4 million dollar loan at 20% interest. The financial report from @arcange is the best source of information on HBD.

I've been following the HBD page on Ausbit Bank which shows real time information on HBD. This page shows the market value of HBD was $8.49 million when I wrote this paragraph.

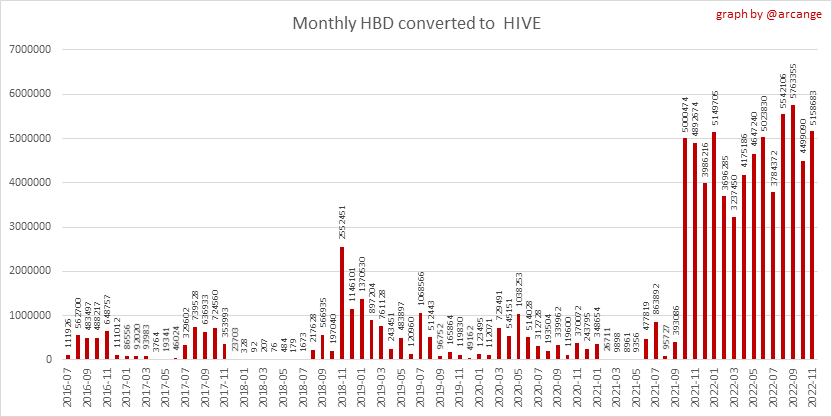

The market value of HBD was over $9.8 million before the market dip. The market dip caused people to dump over a million in HBD. This drop was confirmed by the financial report by @archange . Look at all the HBD holders abandonning HIVE.

The incentive is for users to convert HBD to HIVE when HIVE is low. It appears that the HBD holders converted their HBD to HIVE when the price was in the low $0.30s. Converting 1.3 million HBD to HIVE created about 4 million HIVE.

It is likely that the HBD holders dumped the majority of this converted HIVE onto the open market.

The mass dumping of converted HBD put an enormous downward pressure on HIVE in a weak market.

The $4 million in HBD savings is currently generating $720,000 HBD. Most of this HBD will be converted to HIVE and dumped on the market.

The high interest on HBD creates a tremendous downward pressure on HIVE.

The high interest on HBD has created such strong downward pressure on HIVE that HIVE has fallen at a rate faster than BTC.

Because of the high interest on HBD, I no longer feel comfortable suggesting that people invest in HIVE. For that matter, I no longer feel comfortable suggesting that people blog on HIVE as I believe that the users of HIVE should invest in HIVE.

Lending HBD at Junk Bond Rates Makes HIVE Look Like Junk

Apparently the reason that the witnesses are putting HIVE though the pains of junk bond interest rates is that the witnesses believe that a high interest rate makes HIVE look strong.

Leading crypto platforms like LUNA and FTX were centered on derivatives that return outrageous interest rates.

Yes, I understand that this is the same model that led to the explosive growth of Enron.

But the equities built around this model fail.

When sophisticated investors see a platform borrowing at junk bond rates, they know that the platform is junk.

Lending HBD at junk bond rates makes the platform look like junk.

** HIVE Has Been Hemorrhaging Users

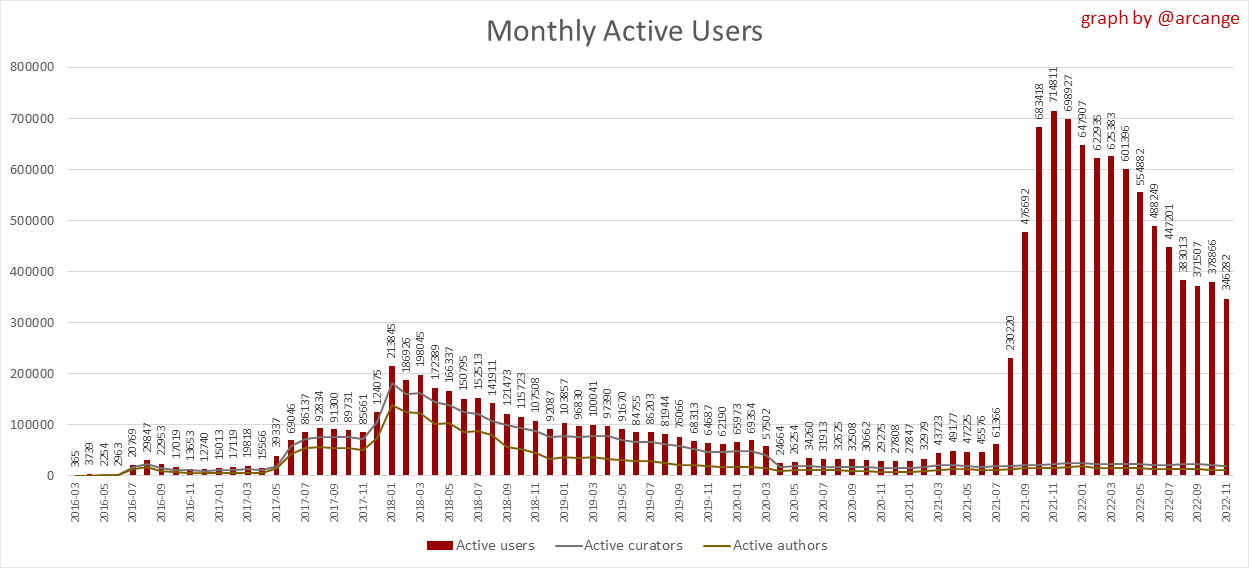

The Usages Report by arcange shows that HIVE has been hemorrhaging users since the decision to raise HBD interest to 20%.

Smart investors who see that the witnesses are using HIVE to secure a $4 million loan at 20% are likely to flee.

BTW, the forum shows a strange aspect of social media. People who like the high interest praise the decision as praising the 20% interest results in upvotes.

People who disagree with the decision leave.

If I am reading the graph; HIVE has lost almost half of its active monthly users since the rise in HBD interest rates.

Things Are Bleak on Hive-Engine

Things are looking bleak on HIVE-Engine. Many of the coins I've invested in appear to have failed.

I bought 50,000 CCC so that I could curate the inktober. The price of CCC has fallen so low that the curation was not worth the effort.

Not surprisingly, CCC coin stopped distributing rewards. The price of the coin has tanked. It is currently trading at $0.0001888 . The CCC richlist shows that several hundred accounts have triggered 100% unstake. So, my guess is that the price of the coin will fall to zero in the upcoming weeks.

It is so sad. The coin was supposed to provide an extra reward to artists. It appears that the artists are now left holding an empty bag.

The Witnesses Could Lower the Interest Rate

The witnesses could improve the long term aspects of HIVE by lowering the interest on HBD.

The high interest failed to bring in new customers and it put a downward pressure on HIVE.

Since the interest rate is set by consensus, the witnesses could gradually lower the rate.

This might help HIVE retain users and might encourage people to join the platform.

We Can Be Thankful

Many investors are foolish. These investors jumped at the high interest rates used to pump up FTX, LUNA, Bernie Madoff and Enron.

Fortunately, investors who have not lost their money on other high interest schemes have learned to flee platforms offering junk bond rates on poorly secured equities.

HIVE was lucky. Most investors saw through the high HBD interest. This limited the amount of damage done by HBD. There is only $4 million invested in HBD savings. It could be worse. Imagine if the equity popular and HIVE loaned out tens of millions in HBD.

HIVE would have seen a much deeper dip if more HBD existed. I am thankful that HBD was not all that popular. It did not attract in new users. It is possible to recognize that the high interest was a mistake and reverse it.

Of course it is unlikely that the witnesses would ever see reason.

My CCC coins followed PAY, BLOG, TIX, BHT, and other coins and is now essentially an empty bag. But I am thankful for my growing collection of empty bags. Although HIVE will end up being a losing proposition for me. I am thankful for the chance to help others pursue their online dreams as I continue to fill empty bags on this platform.

Conclusion

The fact that HBD holders converted $1.2 million HBD to HIVE in the current dip proves that using HIVE to guarantee the HBD puts a downward pressure on HIVE.

This downward pressure will continue. If the price of HIVE drops into $0.20s we are likely to see the HBD holders convert and dump HIVE.

People who are considering investing in HIVE know that this will happen. The downward pressure is ongoing. Since most HBD will be converted to HIVE at some point, the downward pressure is ongoing.

I have $200 in HBD. I admit, I will panic and dump the coins if the price of HIVE fell to 0.20.

The Picture

The picture at the top of the page shows a table set out for a Thanksgiving meal. The picture below shows thanksgiving pies.

Posted Using LeoFinance Beta

Well I appreciate the perspective if I’m not as doom and gloom on it as you are but there has been killing across the board, coins have been getting hammered. Venture capital money is exiting and getting wrecked left and right. Those that invested in hive in large quantities like the people in the Korean markets are trying to recoup some money and likely will enter in lower if it goes lower. I know that I’ve been converting all of my HBD to hive so that I can power it all up!

It is unfortunate how many coins on hive engine are toast. I wanted to make one myself but the cost to do so was astronomical to then have it fail like the others it wasn’t worth it.

I had been putting all of my earnings into HBD. Although I started sending some of my earnings into Hive Engine thinking that the alt coins might outperform HIVE this holiday season.

Of course the sudden collapse of CCC made me worried. What other coins will stop paying rewards?

I'm not sure I follow your argument.

Isn't this instead an internal demand for liquid HIVE, which sustains prices? And then there's the whole HBD stabilizer project which has in incentive to buy and sell at a loss just to maintain that market HBD price.

I'm in HIVE HODL mode, and I sold HBD for HIVE because I want to hold more HIVE. This is demand, not downward pressure.

This chart from arcange indicates that several million HBD get converted every month.

I suspect that most of this is from speculators and automated processes like the stabilizer.

As I understand, the conversion replaces a given amount of HBD with an amount of HIVE based on the average of the HIVE price reported by the witnesses over a 3.5 day period.

So, when the price of HBD is below $1.00, speculators can make a little bit of money by converting HBD to HIVE. They then buy HBD with the HIVE and repeat the process.

Personally, I like using the market to trade HBD for HIVE. I only use the conversion if the price of HBD is well below $1.00.

My claim that most HBD gets converted to HIVE is based on the observation that 25% of post rewards comes as HBD. The market value of HBD to HIVE is currently 6.766% .

6.766 < 25/2 .

Historically, the ratio of HBD to HIVE had been lower.

Posted Using LeoFinance Beta

The downward pressure is seen in the graph of HIVE compared to BTC. This 1 year chart is from CoinGecko.

BTC is pretty much the base currency of HIVE. The price of HIVE pretty much follows BTC, but there has been a downward pressure on HIVE for the past year which makes HIVE lag behind BTC.

Note, there has not been a major scandal at HIVE or anything else to explain this difference.

Posted Using LeoFinance Beta

Based on your chart, now would be the time to swap from BTC to HIVE while the FOMO gang goes nuts. How are other altcoins charting against BTC? Is this trend exclusive to HIVE or more general among others?

The chart shows a steady decline. If the is the result of a downward pressure from the high interest on HBD; there is no reason to believe that HIVE will pop in relation to BTC.

HIVE, along with all of the alt-coins on HE, probably would pop if the witnesses significantly dropped the interest rate on HBD.

HBD needs a 10% APR just to break even against USD inflation, but I wouldn't mind seeing a drop below 20%. To be fair, I am heavily weighted toward HP vs. HBD. There is some self-interest. Does the charted decline coincide with the HBD APR shift?

Thank you for your witness vote!

Have a !BEER on me!

To Opt-Out of my witness beer program just comment STOP below

Why not convert and power up HIVE? I respect your viewpoint, but I think a lot of the long-termers and true builders are filling their bags with HIVE at Black Friday prices to HODL.

The recent HF26 introduced a RC cost adjustment to transaction execution, You can listen to Blocktrades explain this in The Crypto Maniacs podcast el 168 w/ Blocktrades. As a result of the price adjustment to HIVE's "gas", so to speak, the need to hold Hive Power has increased since resource credits depends on the amount of HP. Accounts that have a large amount of RC now will have the power to execute transactions forever, or... delegate RC for a profit.

have some dapps failed on HIVE? sure.

But dapps that are failing are just iterations towards success. It's just a matter of time until the next Splinterlands is developed. And what happens when one more project like Splinterlands starts competing for block space?

Check out what @khaleelkazi has to say on Chain Chatter #3 at the 1:16:10 mark:

I'm not saying you're wrong. I just have a brighter outlook for HIVE and thought I'd push back on your stance.

Remember: we're in a bear market and even Bitcoin has seen -80%.

My outlook is based on watching a large number of companies implode because they held debt at high interest rates. I believe that HIVE is a good thing. The debt at 20% interest is a bad thing.

The high interest rate does not improve HIVE, but it drives smart investors away.

This last year has proven that the high interest is not improving the HIVE eco-system. There has been a steady decline in monthly active users and a decline in the price of HIVE after this decision.

I know for a fact that smart investors look at the amount of debt and interest on the debt before buying an equity.

If the absurd interest rate is not improving the ecosystem, then we should can it. We have to pay $720,000 a year to maintain the high interest rate.

!WINE

Posted Using LeoFinance Beta

Congratulations, @yintercept You Successfully Shared 0.100 WINEX With @alex-rourke.

You Earned 0.100 WINEX As Curation Reward.

You Utilized 1/1 Successful Calls.

Contact Us : WINEX Token Discord Channel

WINEX Current Market Price : 0.250

Swap Your Hive <=> Swap.Hive With Industry Lowest Fee (0.1%) : Click This Link

Read Latest Updates Or Contact Us

2 trillion usd have been burned in bankruptcies this year.

I'd think the price of alot of investments would be down.

How much of that volume was the stabilizer?

My understanding of the HB stabilizer is weak, but it looks like it isn't converting HBD to HIVE.

As I understand the primary purpose of the HBD stabilizer is buy HIVE when the price of HBD is over $1 ... which doesn't happen all that often.

This is the ausbit page on the HD Stabilizer and this is the HiveBlocks page. Most of the transactions are back to hive.fund but there are some HBD convert requests.

Stabiliser works both ways.

I see you legit care about the platform, so we can always agree to disagree on this one. Just don't forget that entire markets are bleeding though, and the user exit is likely as a result of a dip in Hive value. The proposition can always be reversed so I don't think it will cause nearly as much damage as you imagine

There is a little bit more to this than my dislike of interest.

I had been working on the issue of monetary reform well before HIVE. One of the main complaints that economists had with the Federal Reserve was that the interest structure adopted by the Fed created boom and bust cycles.

World and national economies suffered through a series of economic collapses.

One of the big hopes was that crypto could usher in honest money.

Unfortunately crypto has been dominated by big groups like FTX and Luna. These programs have all built in fixed interest schemes.

The interest HIVE pays for comments is a little bit different from the fixed interest on HBD and the derivatives at the center of FTX.

I've known numerous people who have been hurt financially by debt.

The fact that HIVE made debt the center piece of the platform means that HIVE has broken the ideal of honest money.

There is a huge future for honest money. Funny money has a long history of hurting people.

!PIZZA

I am not entirely convinced that the value of Hive will fall below $0.2 anytime soon. I'm going to keep my eye on the money supply, as we all should. If there isn't enough demand for Hive then the system is in trouble if people keep on converting HBD to Hive and dumping the coin.

I'm not converting any of my HBD to Hive, I'm simply buying and selling as need be for my bills, and holding. Converting too much HBD will keep the HBD market stable in the short term, but the long-term effects of a saturated Hive market will be detrimental.

Personally, I don't think a high HBD interest is a problem. If they are converting their HBD to Hive, they should reinvest in Hive's tokens and not dump them out of the Hive Engine in large quantities.

I gifted $PIZZA slices here:

@yintercept(1/5) tipped @empress-eremmy (x1)

Send $PIZZA tips in Discord via tip.cc!

Congratulations @yintercept! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 3500 comments.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Dear @yintercept,

Your support for the current HiveBuzz proposal (#199) is much appreciated but the proposal will expire soon!

May we ask you to review and support the new proposal so our team can continue its work?

You can support the new proposal (#248) on Peakd, Ecency,

Thank you!

Dear @yintercept,

Your support for the current HiveBuzz proposal (#199) is much appreciated but the proposal will expire soon!

May we ask you to review and support the new proposal so our team can continue its work?

You can support the new proposal (#248) on Peakd, Ecency,

Thank you!