Summary

- The numbers show historical stock market returns are high, ideal to reach a passive income.

- By researches about long-term performance, you could double your money in ten years on average.

- All long-term data shows a positive real stock market return. That means, the purchasing power of your money increases.

- But passive income in the stock market is incalculable in the shorter term, due to the enormous price fluctuations.

Passive Income with Stocks – Is It a Myth?

Don’t worry, this isn’t about a “get-rich-quick-scheme” or other shady investments. Rather, the myth that risky equities can provide higher returns over the long term than low-risk investments. Is this true? Are stocks, indeed, outperforming? Can you build passive income with stocks? (Stocks are also called shares.)

Or is this only a way to lure people into expensive or bad investments? Financial service providers, like banks and wealth managers, are often citing seductive historic data. They try to convince people to invest in high-risk assets. Many sources are claiming the return of the stock market is much higher in the long term than the return of the bond market. Or, the interests of bank accounts, or inflation. For example:

The Federal Reserve Bank of St. Louis has measured the returns of stocks, Treasury bills, and 10-year Treasury bonds. (…) Stocks averaged an annual return of 11.50% in the period from 1928-2013, while T-bills and T-bonds averaged 3.57% and 5.21%, respectively. (…) The S&P 500 clearly posts higher annualized returns, but the extreme fluctuation during market swings can make it a turbulent investment. (Source: The Balance. T-bills and T-bonds are interest-bearing debt issued by the federal government of the USA.)

Twenty Times More Money to Spend

The quote didn’t mention inflation. But let’s dig deeper into the data. The Dow Jones Industrial Average Index is a very old tool. As on the first chart, inflation-adjusted, it surged to 28,256 points from approximately 1419 points in 105 years. That means, its value increased 19.9-fold, which is 2.89 percent p. a. and in real terms.

Chart 1: 105 years of the Dow Jones Industrial Average, monthly, inflation-adjusted (“using the headline CPI”). (Source: Macrotrends)

If somebody invested 100 dollars in February 2015, today, his descendants have almost twenty times as much money, $2,000. Important is that inflation is already discounted here. So we are talking about positive returns over inflation. (That is what “inflation-adjusted” or “real return” means.) The happy heirs can buy twenty times as many products or services than with the original $100. (If you get tired of so much data, you can still look at the graphs and read the conclusion at the end.)

Passive Income in 105 Years?

I found another historical dataset of the S&P 500 index from 1915. (Source) The value of the index was calculated as 7.52 index points on February 20, 1915. Compared with 3,386 points on February 20, 2020, that means a 450-fold increase. (That index didn't exist at that time. So these are values estimated by scientific methods.) But we must adjust it with inflation. By the index of USInflationcalculator, the consumer prices increased from 10.1 to 257.97 in 105 years – 25.5-fold.

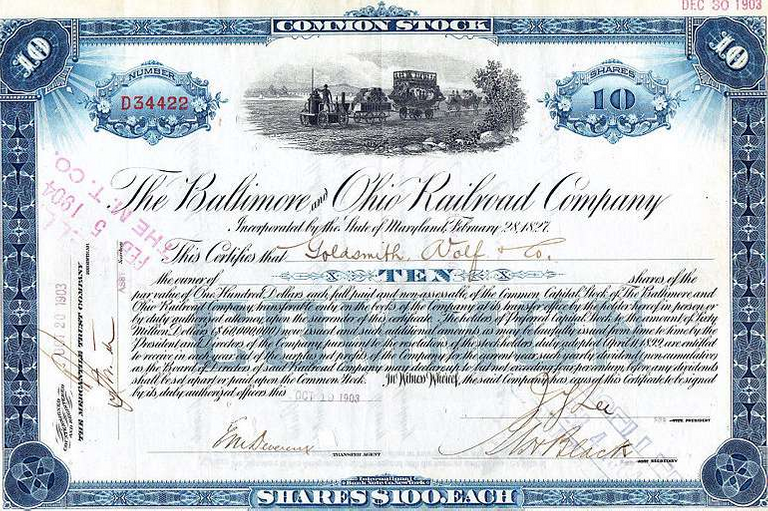

(Photo: Burlington and Missouri River Railroad Company, 1872. Wikimedia, Stocklobster.com)

That means the stock market index increased 5.99 percent, while the inflation reached 3.13 percent p. a. (Per annum, or per year, on a yearly basis.) Accordingly, the real return of the stocks in the index reaches 2.86 percent. It is very like the other 2,89 percent we calculated from the chart of the Dow Jones Industrial Index above.

Old Economy, Young Economy

That sounds good but won’t make you happy as you can’t live for 105 years. But some indices are obsolete in various senses.

Continue Reading on Agelessfinance.com

More Important Readings for You About Your Money

- Looking for a Good Investment Return? Use the Magic Triangle!

- 6 Effective and Proven Ways to Lose Your Money

- How Works Compound Interest? Learn the Secrets of the Dark Side

- Eight Ways How Inflation Threatens Your Income and 13 Ways to Fight It

- Which Is Your Best Source of Money? Investing, Saving or Earning?

- Is It A Myth? – The Genuine Truth About Passive Income

(Historic photos: Wikimedia Commons. Cover: Stock certificate of the Baltimore and Ohio Railroad Company, 1903. Collection of JGHowes)

Disclaimer

I’m not a certified financial advisor nor a certified financial analyst, accountant nor lawyer. The contents on my site and in my posts are for informational and entertainment purposes and reflecting my collection of data, ideas, opinions. Please, make your proper research, or consult your advisors before making any investment or financial or legal decisions.

Wrong approach.

Try looking for dividends on solid companies stocks.

Thank you for reading.

Resteemed and upvoted already @deathcross

Have a great sunday :)

sure?

Can investing in stocks be called a passive income? Well, i believe stock is an investment and security for investors just the way jobs are securities for employees. One thing that devaluate investment earnings is inflation.

2.86% can be a good return but will take about 34 years and 11 months to make a hundred percent off investment if all thing are equal.

1.0286^35=2.683. (+168.3 percent). But that return was without the dividends.

Other calculations (like by Mr. Shiller) are talking about 7-7.5 percent real return p. a. (See the second part of the post on Agelessfinance.com)

1.07^10=1,967 ==>> people needed approximately 10 years to double. In the long term and in average.

It is interesting, certainly, that high-risk investments are promoted by how attractive the ideas of short-term profits are, but low-risk investments (which generate less) are the ones that can be more stable in the long term.

You leave me thinking, to some extent it is not a bad option to build a pension or retirement fund, or for an educational fund to be initiated from the birth of a child, in any case, it seems that it can take decades to that has a return and earnings attractive enough.

Appreciated @deathcross.

These waiting periods in the stock market to take advantage of return look extremely long.

Perhaps this is why many investors prefer bonds.

When Blockchain technology is implemented for the purchase, custody and liquidation of bonds without intermediaries, the results can be surprising.

A well-known Spanish financial group implemented the issuance of a bond which was carried out successfully from beginning to end through the Ethereum blockchain. With an amount of 20M, an early cancellation was made in the first quarter for 99K usd.

Thus the tokenization of bonds in the blockchain has shown that DeFi will be the new scheme used in the global financial system.

I think I got off the subject.

Thank you for sharing this interesting article.

Your friend, Juan.

Thank you. I'm planning to learn much more about "defi". Maybe it will be the future technology in capital markets, maybe not.

"Decentralized" doesn't look so bright today than some days ago...

I understand why you say so... ;-(

Upvoted 👌 (Mana: 10/15 - need recharge?)

Some people are thinking passive income means no work at all. In reality, it can be a state where you invested time or money, effort earlier to work less later. But I think we can never make it to zero attention and effort.