7 reasons why the crisis may be much longer and why the Big Tech is ill on the stock exchange. Do you think crude oil is cheap? Think again. Is Big Oil a heaven for contrarian investors, or a sucker’s bet? Few assets are as cheap historically as platinum.

Big Tech is falling these days, pushing main US indices lower. Many people think the vaccine will solve problems and life returns to the normal, but this isn’t so sure.

Many things which happen now happened before. Precious metals were moving in a strong bull market this year, gold reached new all-time highs, silver also jumped. But platinum lags far behind. Is it a buy opportunity?

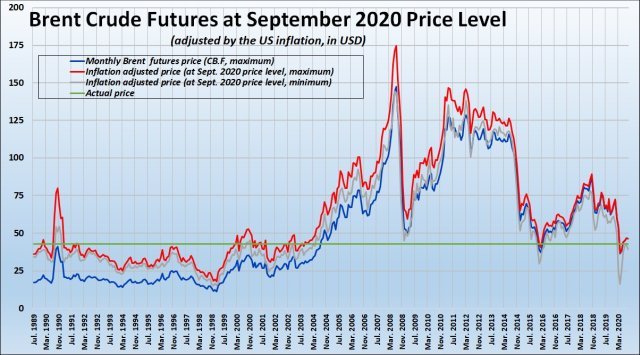

If we adjust the prices with inflation, we see a very different picture by platinum, but also by crude oil. Earlier tops are much higher at actual price levels, also bottoms have a new meaning. Is crude cheap today? Are oil companies a buy after a big fall?

This is my post recommendation for you with a few new publications on my financial web page, Ageless Finance. Shorter and longer, comprehensive articles about investing, and personal finance themes. With many charts and lists. If you are interested in more details, just click on the images.

The Big Tech Winter and the WW(W)-Shaped Recovery

If the stock markets fall after good news, that is a bad sign. The consequences of the epidemic may be more severe than many people think. It may no longer leave technology giants untouched. Winter is coming.

- The poor performance of Big Tech is a warning sign.

- The second and third waves of coronavirus may have serious economic consequences.

- The recovery from the crisis may be much longer, and W or WW-shaped.

- A vaccine can prove much less helpful than people expect.

- But more and more QE and inflationary risks may support the stock market.

Click the picture to view the full post:

Time to Get Greedy in Energy Stocks?

Are traditional energy stocks, oil companies a good buying target?—ask many investors. The energy sector is the most hated investment today.

- Energy stocks almost hit new lows in autumn, in the second coronavirus-wave.

- That’s the most hated industry, near one-year, five-years, many-years lows.

- Heaven for contrarian investors, or a sucker’s bet?

- Comparable with the coal miners and tobacco manufacturers?

Click the picture to view the full post:

Inflation and Crude Oil Price – Will The Fall Never End?

If the vaccine is effective and will be distributed fast next year, the economy may recover in a couple of months. So may crude oil prices. But what is the long-term picture?

- The crude oil price exploded on good news about the vaccine.

- Are crude prices high or low, historically?

- Inflation-adjusted, they are somewhere in the middle.

- But the trend still seems to point downwards.

- Is this the beginning of a beautiful supercycle?

Click the picture to view the full post:

The Real Top of Platinum Price–Rich Man’s Gold, or Poor Man’s Gold?

Platinum investments were much more popular in earlier decades than today. By a slogan, platinum was called “The Rich Man’s Gold”. And today? Where is the old glory?

- Platinum price used to be twice the price of gold, but today it is only less than half of it.

- The real, inflation-adjusted top of platinum price was much higher than the official $2308.8.

- Platinum is historically very cheap. But that doesn’t mean it must jump.

- There are also factors signaling more declines.

Click the picture to view the full post:

Follow me!

You can follow me on Twitter, Telegram, Facebook, Steem, Hive, and Mastodon.

My Previous Post and Chart Recommendations:

My Best Posts: Part-Time Jobs, the Real Price of Gold and Silver, the Longer-Term S&P 500 Sectors Performance

Extreme Crypto Transaction Fees, Natural Gas Price Explosion, Traps in Blogging SEO–Posts of the Week

The Down of Fiat Currencies? Golden Age of Silver and Gold

How to Dictate Your Posts? Which Are the 3 Biggest Challenges in Personal Finance Today?

13 Brilliant Free Apps for Bloggers, Investors and Freelancers, DIY Fake News Generator

Hello @deathcross

Interesting analysis you share with us.

There is a kind of wave of joy around the vaccine, but the reality was that the future is so uncertain, that we do not know what will happen.

Thank you. 😀

the vaccine has created a lot of uncertainty, and it has been big business The price of metals and oil is very interesting and it must be followed closely with attention.

Thanks for sharing your analysis.

👍

People seldom invest in commodities. A lot of opportunities there.