- Richard Wyckoff...

Wyckoff, like Livermore, was quite precocious in the stock market world. At the age of fifteen, he was already working for a small brokerage firm on Wall Street, where he went from acting as a "guy for everything", taking stock quotes and other administrative actions, to running and managing the headquarters a few years later. In 1892 he moved to Chicago to establish his own brokerage house. Unfortunately, that first adventure did not turn out as expected and, after some hard months he decided to put an end to it and return to New York. after three years he made negotiations with Price, McCormick & Co. one of the most important brokerage houses in the country. But his relationship with McCormick & Co. did not last long. In 1904, together with his close friend Daniel T. Mallett, he founded the company Mallett & Wyckoff, dedicated to financial advice.

Wyckoff was also a prolific writer. In 1908 he wrote his first book "Studies in Tape Reading " under the pseudonym of Rollo Tape. It was followed by "How to Trade and Invest in Stocks and Bonds ", published in 1924. Then "Ventures and Adventures Through forty Years ", in 1930. And finally his course "The Richard D. Wyckoff Method of Trading and Investing in Stocks ".

***Today, hundreds of thousands of speculators and investors use Wyckoff's ideas as the pillars of their investment strategies.

Wyckooff Method

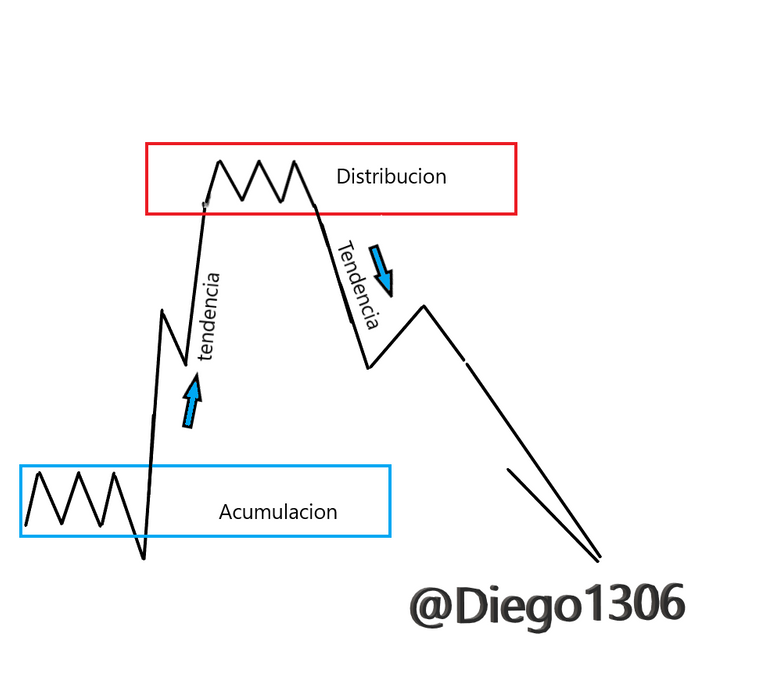

The Wyckoff method is an investment method or system that attempts, through the interpretation of market phases, to predict the future price movements of a financial asset. The ultimate goal of this method is to generate long-term profits by investing in the stock market.

Richard Wyckoff coined an investment method or system that allowed, a priori, to predict market movements with the analysis of past and current information, based on price and volume of a financial asset.

- Market phases according to Wyckoff :

[Image created in Pain 3D]

[Image created in Pain 3D]

It is a soil phase. It is common to see the price move in range, i.e. sideways, without a defined trend. In addition, there are usually volume peaks.

This analysis is based on Wyckoff's methodology which in my opinion is quite effective at the time of making decisions, you can share your ideas and opinions regarding the analysis since it would serve me as a guide since I am entering the world of cryptomonies .

Bat/USD 3 hour timeframe

GUIDE TO UNDERSTANDING THE GRAPHICS

@Tipu curate

Excellent explanation, about Wyckoff's method is one of the most used for my operation.

@lenonmc21

Financial Markets Analyst

Upvoted 👌 (Mana: 0/5)

Congratulations @diego1306! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board And compare to others on the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz: