Hi Project.hop community,

I know that you have been saturated of reading articles on the last Bitcoin Halving as many analysts , experts and maybe newbies whipped up a frenzy of estimations about the "holy" Halving in the recent days.

I have been reading many articles on the Halving. However I haven't met a complete one yet !!

Unfortunately, each post I read or video I watched showed a single point of view or biased to another. Some expect that we are shooting for the moon so Buy buy buy..., while others are certain that it is a non-event and disappointing Halving and concerned of a rapidly price declining.

While this natural as everyone is free to express their opinion but at the same time it is important to be realistic and balanced in order not to fall prey to greed or panic.

In this article, I will to cover the Halving event in all its aspects,it might be a bit long but believe me it is interesting and worth 10 minutes of your time.

So, without any further ado, let's begin,

What is Halving?

In a nutshell, transactions within Bitcoin network are executed by "miners" , in order to do so, they utilize brute force computing with specialized mining hardware. In return, they receive "Block Rewards" which is an amount of Bitcoin automatically be added to their wallets.

After a period of time (roughly 4 years) this amount will be cut in half which makes Bitcoin mining more expensive and difficult.

In the simplest terms: Halving makes Bitcoin more scarce and hard to acquire .

This is the crux "the Halving event" .

Bitcoin has undergone three halving events through its history.

- The first was in November 2012 when the block reward was slashed from 50 Bitcoin per block to only 25 Bitcoin

- The second was in July 2016 which reduced the block reward to 12.5 Bitcoin

- And finally the third occurred several days ago on May-11-2020 which reduced the block reward by half again to 6.25 Bitcoin.

Why should I care about the Halving?

I know that the vast majority of Bitcoin users and traders are NOT "miners", so that begs the question What all the hype about Halving? and Why should I care about it?

Well, from a financial perspective, Bitcoin Halving can be considered as a sort of inflation of Bitcoin.

Before the halving, there were about 1800 newly BTC added to the circulating every day. This number has been shrunk to only 900 so, logically, this operation is supposed to make Bitcoin scarcer and and therefore hypothetically more valuable.

What about the past two Halvings?

First of all, I want you to be aware that learning about the history does NOT guarantee what may happen in the future. Hewever, this also doesn't take away the fact that the past and the future often rhyme...

Having looked at the past Halvings you can see that there are things push you to get excited but cautiously

source

In the first halving on November-28th-2012: a year after the halving a massive bull run happened with the price increasing from just above $12 to nearly $1,200. This is almost 100x return during just 368 days !!

In the second Halving on July-16th-2016: After the halving there was another bull run market but this time it took a longer time to take place (525 days) with the price increasing from $650 at the halving date to more than $19000 a the end of bull cycle. This is almost 29x return. So,you see that the return had been cut by roughly a third.

In the third Halving: No one knows how far Bitcoin will reach or when. However, some analysts expect that the return multiple will be cut by a third again from 29x to about 10x .

So if we were at about $9000 at the halving date, then it wouldn't be outrageous if we hit $90000 at the end of the supposed upcoming bull run cycle. Of course you should take all these numbers with a grain of salt as nothing is certain in the crypto world especially when it comes to price predictions .

Another noteworthy thing, if we compare between the past two Halvings, we can clearly notice what so called "extended cycles"

If we identify the cycles that appear after the previous two halvings(the blue rectangles), you will see that first is thin and tall which means that the rise occurred very fast and soared sharply.

The second one is wider and shorter which means that the rise occurred slower, and smoother than the previous one.

As market matures, I thing these cycles will continue to expand.

Why something like that happens after halvings?

Well, this is mostly because miners who spent their hard-eared cash on electricity bills to produce Bitcoins want to receive their rewards in fiat, especially after their Bitcoin rewards have been cut in half, so they start to sell their Bitcoin old stocks creating a sort of sell-side pressure. Depending on supply and demand the price of Bitcoin will continue to swing until miners' old stocks of Bitcoin run out. And then it's the time for another bull run wave.

How long it will take? no one knows. However, according to the past Halvings, I thing it is logical to say that it is somewhere between 2 to 4 years after the Halving date .

So, it is unlikely to see "bull waves" as quickly as the ones we saw in 2013 or 2017...

All in all, given that we have only two Halvings in the past , we don't have enough data to determine which direction Bitcoin price will exactly go. However we can observe that every time we've entered a having, a bull run has been right around the corner...

What does "stock to flow model" say?

Another thing I want to cover in my article is the "stock to flow" model . Before I dive in, let me tell you that Bitcoin price has followed the stock to flow model with %99.6 accuracy since its existence!!get excited?!

Without getting bogged down in the details:

It is a mechanism for calculating the existence of a commodity and the amount of its annual production in an attempt to estimate its future price

"Stock" is the amount of a commodity in existence.

"Flow" is the amount of the commodity being produced per year.

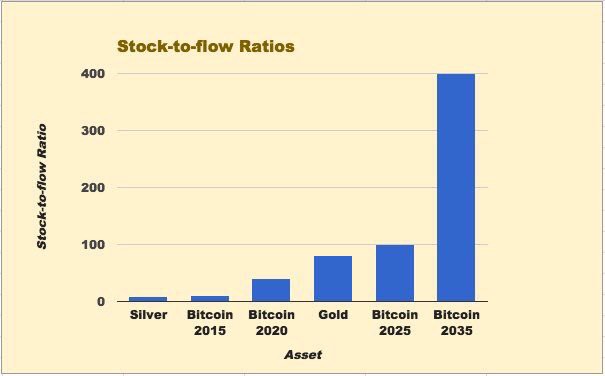

For any product the stock is divided by the flow to calculate "the stock to flow ratio" , and the higher stock to flow ratio, the more scarce this product is.

For example, gold's stock to flow ratio is 62 and this simply means that it would take 62 years of gold production at current annual production rates to reproduce the entire current supply of gold in the world. This is one of reasons that gold has an increasing value over the years and considered the most "safe haven" in the world.

For Bitcoin, according to CoinMarketCap there are about 18,382,106 BTC in Circulating now, and after the halving, there will roughly be 328500 newly BTC produced per year, so Bitcoin's stock to flow ratio is 55.95 which is really close to gold's.

The interesting thing about "stock to flow" model with a commodity like Bitcoin is that we know how much Bitcoin will be produced so,we can exactly calculate the stock to flow ratio in the future something we cannot do with pretty much any other commodity.

And the more interesting thing is that Bitcoin has an increasing stock to flow ratio over years.After each Halving, Bitcoin's stock to flow ratio will dramatically increase, this simply means Bitcoin is scarce and going to be scarcer in the future.

source

As you can see, Bitcoin's stock to flow ratio is currently very close to gold's, and will exceed it in 2024 or 2025 !!

I have to admit that the comparison between Bitcoin and gold is somewhat misleading as the two assets is far so different from each other. Gold has intrinsic material value while Bitcoin derives all its importance from people's confidence in it. However, this confidence has pushed Bitcoin up to the level in which it has been described as "digital gold."

If we want to believe the stock to flow model, then Bitcoin prices could hit around $94000 in May 2021 !

You may be thinking that this number is exaggerated and that the reduction in Bitcoin inflation is not going to have that big an impact. However, you might change your mind if you remember that there are only about 18 million of Bitcoin in the world and according to Credit Suisse Global Wealth Report for 2019 which claims that there are around 47 million millionaires in the world.

If you take a step back and think about it, you will find that literally all the world's millionaires couldn't all own a Bitcoin even if they wanted to!!

If you believe that Bitcoin adoption will continue to grow and spread in the next years then this Halving event certainly means a lot for you.

Some thing special with this last Halving...

If you look around , you will find that public opinion about Bitcoin has fundamentally changed over last few years from just a "bubble" to a " game changer".

From 2009 to 2015, If you walked around in your town and asked 100 random people "What do you think about Bitcoin?" the most answers you would get "Excuse me, what is Bitcoin?"

Now, if you ask 100 random people the same question, you will find that there is more awareness and optimism about the future of Bitcoin than you think.

Even for high-profile companies, many of them started to seriously think to accept Bitcoin and others are trying to mimic the success of Bitcoin by creating their own cryptocurrency, the most prominent example is Facebook with its upcoming cryptocurrency "Libra".

Another special thing with this last Halving is that the wide spread of trading exchanges platforms with various types and characteristics. We've never gone into a Halving with a Bitcoin futures market before, and easily accessible leveraged trading platforms which were not available back in 2016.

Also the giant centralized and decentralized exchanges with decent liquidity (Binanace, Coinbase, OKEx...etc) make Bitcoin trading with all other cryptocurrencies more accessible and easy even for newbies.

This is without doubt a positive point as more cash is flowing to buy Bitcoin

There is also an interesting thing I want mention which is the "inflation rate" .

Before the Halving, Bitcoin had an inflation rate of %3.6 per year which isn't too far off 20 19's global inflation rate of %3.41 however after the Halving, Bitcoin's inflation rate will be will drop to just %1.8. The exciting thing is that this the first time in Bitcoin history that the Bitcoin inflation rate will be lower than the global inflation rate.

source

sourceConclusion:

That being said, there is no guarantee that this last halving will be a positive event for Bitcoin in the medium or short term as many miners will start the sell their stocks to keep their mining farm operational.

It wouldn't be a surprise to me if I saw some price drop in few coming days or even months. However, I'm pretty sure that I will see the price soaring in the long term.

So, I am cautiously optimistic about this last Halving...

It's crucial for me to learn your opinion on the Halving....very interested in reading comments