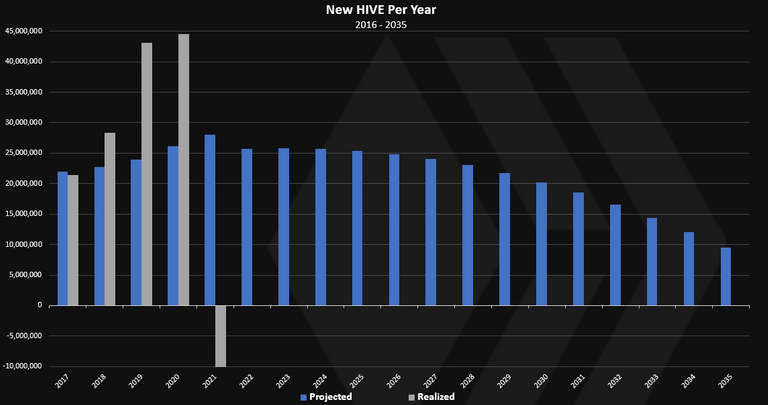

The projected VS realized inflation.

The grey is the realized.

In terms of % the HIVE inflation is constantly going down, from the 9.5% in 2016 to 1.5% in 2035.

But in terms of absolute HIVE created the peak is in 2021 and 2022.

This is because 9.5% out of 250M is less then 7% out of 400M.

Funny how in 2021, when the inflation should been highest it actually has been negative -10M :)

But we can see that in the previous years, especially in 2019 and 2020 the inflation has been much higher then the projected.

All this thanks to the dual tokens and the HIVE <-> HBD conversions.

In the first months of 2022 the realized inflation is close to the projected.

Going forward HIVE will be harder to earn and more scarce.

This is what has me a little concerned when we bump the debt ratio from 10% to 30%. Imagine what happens when the market turns and conversions become profitable again. We could be looking at a tremendous amount of inflation.

We cant predict the market .... what happens if HBD is expanded and a lot of HIVE is converted to HBD?

In the past HBD didn't worked so well ... it didn't maintained the peg, no stabilizer, no DHF, no HIVE to HBD conversions etc ... overall we are in a new territory, and yes increasing the debt limit is a risk, but not that high .... and you know what they say, no risk no gain :)

I'm not trying to predict the market. I'm looking at past experiences of high inflation.

What gamblers never say: high risk, much rekt ;)

We need a tremendous amount of inflation. There is nowhere near enough HBD out there. So conversion will be welcomed.

Posted Using LeoFinance Beta

The kind of conversion I'm talking about is the conversion from HBD to HIVE, thus pushing up HIVE inflation and burning HBD.

With use cases, why would people convert HBD to HIVE? People were thinking that by offering 20% return everyone would power down and start converting all their HIVE to HBD. It didnt happen.

People who are involved in HBD savings, for the most part, are looking at it as a fixed income investment. This is pertaining to yield.

HBD in savings is a lot risk, strong return asset. We see that better returns like what Polycub is offering not pulling much out.

So why does everything think that people who are buying and investing for yield are suddenly going to turn that into speculation?

Posted Using LeoFinance Beta

People will convert when HBD drops below $1. If this situation persists, we will generate a lot of inflation for HIVE.

HBD is fairly save, but I wouldn't call it fixed. It can be changed by witnesses at any time.

For example, what happens when HBD debt reaches 30%? Will witnesses keep that 20% interest on HBD? And the users who are interested in 20% HBD have their coins on chain. Unlike the current situation, where most of HBD is still on exchanges (mostly one ;)).

Why raise the limit preemtively from 10% to 30%, when the only experience we have is around 10% debt limit, and we are currently sitting at 2,5%?

Thank you for your witness vote!

Have a !BEER on me!

To Opt-Out of my witness beer program just comment !STOP below

View or trade

BEER.Hey @bluerobo, here is a little bit of

BEERfrom @isnochys for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.To start, you are talking about different type of investors. Many who are picking up HBD are doing so for the 20% return. They are seeking yield, not a spec play. If they were interested in that, they could just get Hive to begin with.

Secondly, when the 30% level is hit, the blockchain stops producing HBD until the level is regained. That is the reason for the haircut to begin with. No different than it behaves today at 10%.

Because there is the need for a lot more HBD. If it is going to be a serious stablecoin, you cannot have it with only 10 million floating out there. Look at how hard it is to fill the liquidity pool on Polycub. They are barely at 150K HBD.

Posted Using LeoFinance Beta

Thank you for sharing this great content, You have been manually Upvoted by @skylinebuds

Posted Using LeoFinance Beta

This is interesting, the chart is so useful. Now we have a high APR on HBD , surely there's going to be more conversion !