It’s March of 2020. The United States Government is beginning the process of shutting down the country for everyone except “essential workers”. The stock markets around the world are collapsing out of fear of business activity getting destroyed. The Central Banks and Legislatures around the world unleash a wave of money printing and liquidity unlike at any time in history (even World War II and the Great Depression). Keep in mind that inflation is ALWAYS A MONETARY PHENOMENON. Meaning you increase the supply of cash in the system by too much or too quickly, you get inflation.

Pepper in the fact that the shutdowns throughout the world created the beginning of a giant bullwhip effect.

What is the Bullwhip Effect?

The bullwhip effect refers to a scenario in which small changes in demand at the retail end of the supply chain become amplified when moving up the supply chain from the retail end to the manufacturing end.

This happens when a retailer changes how much of a good it orders from wholesalers based on a small change in real or predicted demand for that good. Due to not having full information on the demand shift, the wholesaler will increase its orders from the manufacturer by an even larger extent, and the manufacturer, being even more removed will change its production by a still larger amount.

The term is derived from a scientific concept in which movements of a whip become similarly amplified from the origin (the hand cracking the whip) to the endpoint (the tail of the whip).

The danger of the bullwhip effect is that it amplifies inefficiencies in a supply chain as each step up the supply chain estimates demand more and more incorrectly. This can lead to excessive investment in inventory, lost revenue, declines in customer service, delayed schedules, and even layoffs or bankruptcies.

-Investopedia

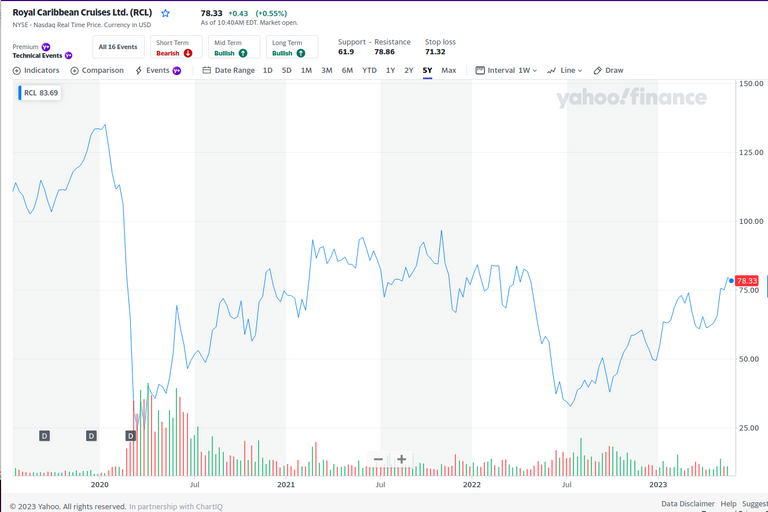

The liquidity increased demand dramatically for certain goods and services while others decreased. Think of the amount of peloton bikes being ordered in 2021 vs. 2019 and then compare that to the amount of cruises being purchased in 2021 vs. 2019. Once the whip starts in one direction, it then swings into the other. Check out these charts of Peloton (PTON) and Royal Caribbean Cruiseline (RCL).

Notice how Peloton skyrockets in 2020/2021 and then collapses after the demand surge is over. The opposite happens to Royal Caribbean as demand falls off a cliff in 2020 and begins to rebuild through 2022/2023. Some good and services see saw back and forth. Like clothing, semi-conductors, and oil.

The excess money in the system amplified this phenomenon and a bullwhip can take years, if not a decade to correct itself because supply chains aren’t very agile. It takes a lot of work to turn up or turn down the production at raw materials producers and factories and then see those increases are decreases work their way through the transportation, logistics, and retail sales portions of the supply chain.

PS - anyone who said supply chain issues are the reason for inflation isn’t wrong, they’re just probably 50% right. If supply chain issues were the only problem, you’d see much less dramatic swings in the bullwhip and inflationary pressures would be much lower than they are now (as well as persistent) because the bullwhip decreases in amplitude (severity) as the supply chain begins to correct.

Has The Federal Reserve Been Able to Fix It?

The Federal Reserve has embarked on one of the fastest interest rate hiking campaigns in its’ history. However, inflation continues to be stubborn. Partly because of the bullwhip. But more importantly, consumers are at the end of the pecking order as far as how quickly higher interest rates affect buying/selling behavior. It takes months or even years before the full effect of Federal Reserve interest rate hikes hit consumers and alter their behavior. It’s part of the reason folks should’ve taken all of that COVID Stimulus money and put it in the bank and sat on it for a couple years. Or thrown it into gold and silver. Instead there is a psychological wealth effect that happens when money gets printed. Consumers feel like they’re wealthier and the money machine will keep printing forever. So they overspend when they should be hoarding assets. This contributes to Aggregate Demand.

What is Aggregate Demand?

Aggregate demand is a measurement of the total amount of demand for all finished goods and services produced in an economy. Aggregate demand is commonly expressed as the total amount of money exchanged for those goods and services at a specific price level and point in time.

-Investopedia

The way this plays out in an increasing interest rate and inflationary environment is that consumers may temporarily delay purchases when prices and rates go up. But when a slight decrease in rates or prices happen, the demand is still there and it results in an increase in demand again. The psychology is that prices will continue to go higher so if something ‘goes on sale’, you had better buy it now before it gets more expensive. It’s a self-fulfilling prophecy as the Aggregate Demand continues to push prices higher until the demand is used up. You can see this in housing currently. Any decrease in mortgage rates instantly increases the number of homes under contract for sale the next month. Prices are declining but the cost to purchase a home continues to remain high because of the higher interest rates.

So What’s the Answer?

This is unfortunate, but the Federal Reserve has to break something. It’s either going to be the labor market (meaning unemployment increases dramatically) or the banking system collapses (removing the biggest driving of spending which is credit/debt issuance). Either way, it’s going to be messy. And beware anyone who thinks interest rates have reached their peak. The Federal Reserve may have a lot more wood to chop. The combination of a rapid increase in money supply and amplified bullwhip effect could mean a decade of higher interest rates, higher unemployment, and very low returns in traditional investment (like the Casino on Wall Street).

How to Get Involved

The main newsletter will be free to all. Follow here on HIVE or sub on substack to get the articles in your email (anarchistinvestor.substack.com). In the coming months, I will begin building a paid offering that will provide a ‘model portfolio’.

Share this with friends and family that could make use of this info.

***Keep in mind that investment and investment results are very much based on you as an individual. Do not rely solely on the discussion here to inform your investment decisions. Always make the investment decisions that are right for you.

The only solution to inflation is crypto. Banks are collapsing.

Don't forget hard currency like gold and silver :)

But they can't be used as mode of payments for overseas transaction.

Agreed. I'm a fan of all of the above. Diversification.