Hello and welcome to this SPinvest post

SPinvest is a tokenized investment fund/club for all users of social blockchains. Everyone is welcome! The concept of SPinvest is to get rich slowly by using time tested methods of earning, saving and compounding long term. This lets SPinvest offer an ROI of 20% per year on SPI tokens. We encourage long term investing on and off the blockchain. We hope someday everyone will HODL some SPI tokens that can be bought directly from @spinvest are through the hive-engine

.

Leo Backed Investments (LBI) is scheduled to go live on December 7th. This is an exciting time for the Leo community.

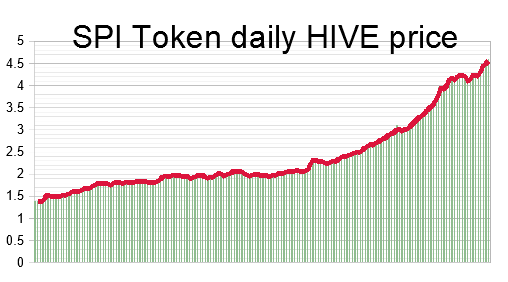

The LBI is based upon the SPInvest model, one that produced outstanding results over the 20 months in operation. To give an idea, the first year saw the token value increase over 80%. In year 2, we will likely see a gain of more than 200%.

Those are numbers that any Wall Street money manager would love to have.

Now we are entering upon another phase where the LBI fund will be based upon LEO. Each LBI token will be sold for 1 LEO. The goal is to get at least 100K LBI out there with a top end of perhaps 250K.

The more tokens that are sold, the more LEO that is staked and put to use for a return.

That said, some have questioned how this works. The easiest way to explain it is to think of a hedge fund. There, people pool money together to make different investments. This is done seeking a return that all the members enjoy. One's return is essentially the total performance of the fund, less any fees, based upon the percentage of holding.

LBI operates on a bit simpler concept. Each token held has a certain value. Each week, there will be a post on Leofinance detailing the value of all the holdings. The total is then divided by the tokens outstanding to give a per token value. Of course, for individual stake, simply multiply that number by what is held.

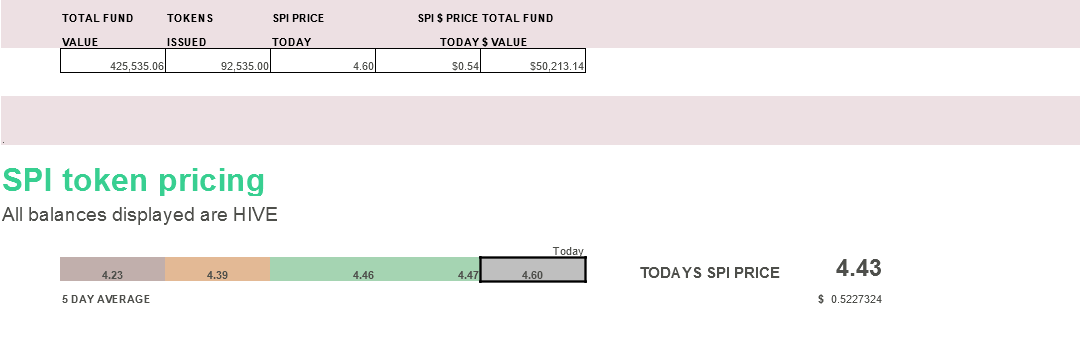

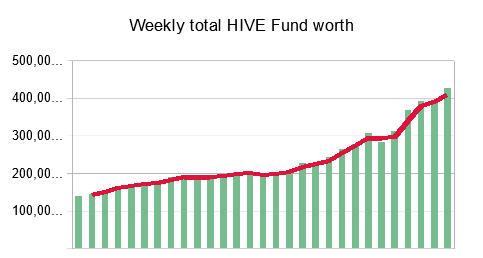

Here is what it looks like from the last @spinvest weekly post.

As you can see, the value of the entire project has increased on a consistent basis. We can see how things started to take off recently as the value of the fund got larger and had more money to play with.

This was reflected in the token value as seen here:

https://peakd.com/leo/@spinvest/spinvest-weekly-earnings-and-holdings-reports-29

It is a model that we seek to reproduce with LBI.

Please note that this all is value of the token, not price. We are not focusing upon what the market is saying. That trades freely on Hive-Engine and Leodex. However, the value is what would happen if all assets were liquidate (at that moment).

This does provide one advantage over hedge funds. Since those are partnership agreements, there are only certain periods where one can exit. LBI has no such restriction. One can simply sell the tokens on the open market.

The goal is to, eventually, have both on and off chain assets. For the immediate future, we will leverage the opportunities tied to Leofinance to try and build the stake even more.

Finally, it should be noted that there is also a weekly divident paid based upon the rewards for the week. The more active the community (token holders) are, the better the payouts to each individual. This is where we can influence the returns that are achieve.

It is a combination of passive as well as active investing.

We hope everyone is getting excited about this project.

.

SPinvest's content is contributed by @silverstackeruk, @no-advice, @metzli & @taskmaster4450

Today's post comes to you from @taskmaster4450

Well, then I need to get some more LEO until the 7th then 😂

T-10 9 8 7 6 5 4 3 2 1! Looking forward to the 7th!

I hope people are taking advantage of the price dip in Leo to get ready for this. It would be neat if this would have a geyser model for the longer-term holders, but then I guess later on people would think they missed the boat.

Posted Using LeoFinance Beta

There is no Geyser model for this since the returns are not based upon staking or providing liquidity.

It is actually a token that is exchanged for LEO, and the LEO is put to use to increase the value of the entire fund.

Two completely different things in that sense. A token purchased on the 7th has the same innate value as one 6 months later. Of course, the price might be higher if the market dictates that as the value will likely be greater.

Posted Using LeoFinance Beta