Silver Price Analysis

Silver prices were weaker during trading on Friday with a loss of $0.19 or -0.73%.

However, there have been good gains this week with silver up 1.82% this week. Silver's next upside price objective is closing prices above technical resistance at $26.50. The next downside price point is closing prices below support at $24.00. First resistance is seen at $26.00 and then at this week’s high of $26.16. Next support is seen at $25.50 and then at Thursday’s low of $25.17.

Silver Chart

Portfolio Update

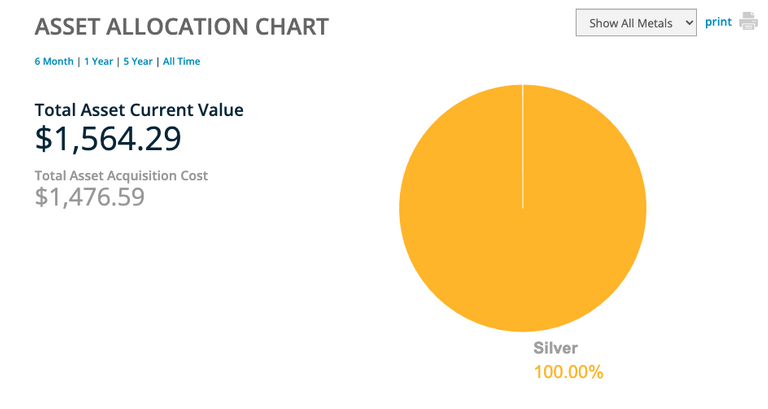

My current assets are valued at $1,564.29 with a total acquisition cost of $1,476.59 representing a 5.93% increase.

Asset Allocation Chart

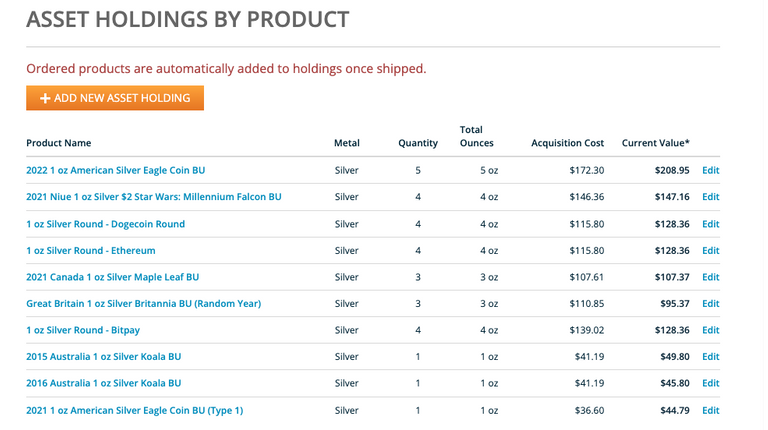

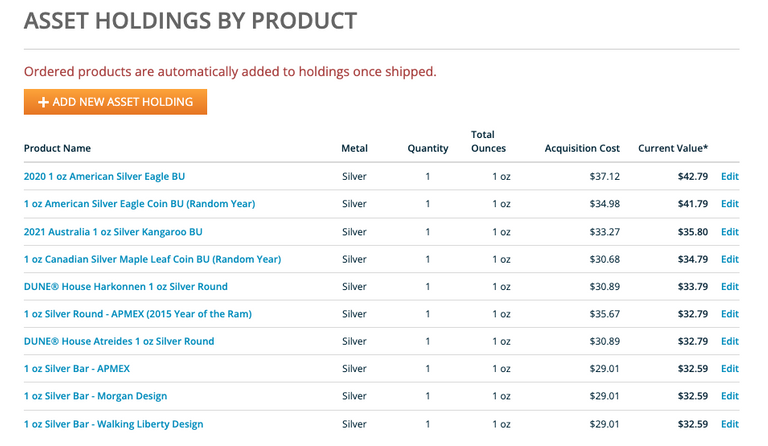

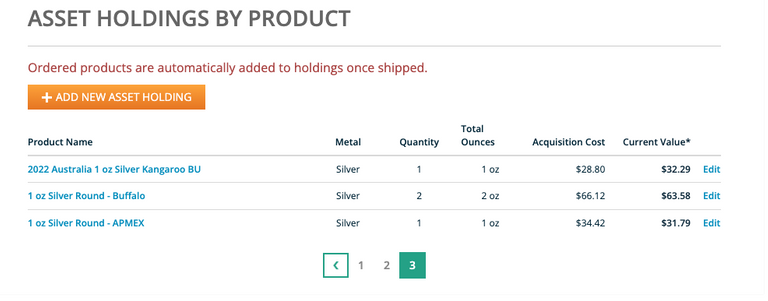

Asset Holding by Product

Silver is steady. There's not too much action with silver. It's $25.50 oz, the market is not open just now. I bought silver at $23.00 last year so I'm sitting on a small profit just now !

It's not too exciting right now. I'm waiting for the JPM paper silver scam to collapse spiking silver prices to $110/oz.

I thought jpm already settled by paying $920 million. Maybe there is other news I not heard. If this is very true, on Monday I going to buy another 100 ounce !

Every couple of years they settle and someone on their PM desk goes to jail. It's the cost of business.

Premiums are stupid high right now. Stash away what you would used to buy for when the premiums come down and make a bigger buy.👍

I'm holding off as you said premiums are stupid right now. I'm thinking about getting some bigger bars when they drop.

Smart move. Ten ounce bars are the stackers choice bar.

how to make that kind of money?

Dollar cost average $200 buys every couple months.