As the crypto world continues to evolve and innovate, more and more investors are turning their attention towards cryptocurrency. With the recent bear market, however, it can be difficult to determine if now is the right time to invest in cryptocurrencies, or if it is better to wait for a better opportunity. This blog post will take a closer look at the current bear market and provide insight on how to play the game.

Introduction to the Cryptocurrency Bear Market

It’s been a tough few months for cryptocurrency investors.

The market has seen a continuous decline since January, with no end in sight. This has led to a lot of speculation about what’s causing the bear market, and what will happen next.

In this article, we’ll take a look at the current state of the market and some of the potential reasons behind the bear market. We’ll also provide some tips on how to weather the storm and come out ahead.

So, what exactly is a bear market?

A bear market is defined as a prolonged period of declining prices. It typically refers to stocks, but can also apply to other asset classes like real estate or commodities.

In the case of cryptocurrency, the bear market started around December 2021. Prior to that, the markets had seen an extended period of growth, with prices reaching all-time highs in November 2021.

Since then, prices have fallen significantly and show no signs of stopping. The total value of all cryptocurrencies has declined from over $3 trillion to less than $900 billion during this time period.

What’s causing the bear market?

There are a number of potential factors that could be driving the current bear market in cryptocurrency. Below are some of the most commonly cited reasons:

Reasons for the Bear Market

-Lack of institutional investment

-High level of speculation

-Lack of regulatory clarity

-Volatility

-Theft and hacks

The current bear market in the cryptocurrency space can be attributed to a number of factors. Firstly, there has been a lack of institutional investment. This is because institutional investors are still waiting for greater clarity around regulation before they commit to investing in cryptocurrencies. Secondly, there has been a high level of speculation in the market. This is because many people have been buying cryptocurrencies in the hope of making quick profits. However, this has led to increased volatility and made it difficult for prices to stabilize. Thirdly, there has been a lack of regulatory clarity. This has made it difficult for businesses to operate in the space and has deterred some potential investors. Finally, theft and hacks have also been a problem. This is because hackers have been able to target exchanges and steal large amounts of cryptocurrencies.

Effect of the Bear Market

The bear market for cryptocurrency has been a hot topic of discussion among investors and analysts alike. Many believe that the current slump in prices is simply a natural correction after the massive run-up in 2021. Others, however, believe that this is the beginning of the end for cryptocurrency. So, what's really going on?

There are a few factors that seem to be driving the current bear market. First, there is the issue of regulatory uncertainty. Governments around the world are still trying to figure out how to deal with cryptocurrency, and this has led to a lack of clarity regarding rules and regulations. This has made many institutional investors hesitant to get involved in the space.

Second, there is the problem of scalability. Cryptocurrencies have struggled to scale up as their popularity has increased. This has led to high transaction fees and slow transaction times, which have made many users frustrated.

Third, there is the issue of security. Cryptocurrency exchanges have been hacked numerous times over the past few years, leading to loss of customer funds. This has caused many people to lose faith in cryptocurrencies and has made them more hesitant to invest.

Fourth, there is the problem of price manipulation. Many people believe that some large players in the space are manipulating prices for their own benefit. This makes it difficult for small investors to make money in the space and has led many to lose faith in cryptocurrencies as an investment option.

What Can Be Done to Survive The Bear Market?

The cryptocurrency bear market has been tough on everyone, with prices dropping across the board. But there are things that can be done to survive this market and even come out ahead.

First, it's important to remember that this is a natural market cycle and that there will be a bull market again. So don't give up on your investments just yet.

Second, focus on buying quality coins and holding them for the long term. This is not a time to day trade or speculate on new ICOs. Stick with tried and true investments that have real utility.

Third, stay diversified. Don't put all your eggs in one basket, no matter how good you think that basket is. Invest in a variety of coins and tokens so that you're not wiped out if one crashes.

Fourth, be patient. The bear market may last for months or even longer, but eventually it will turn around. Don't make any rash decisions during this time, just sit tight and ride it out.

By following these tips, you can survive the bear market and even come out ahead when it eventually turns around. So hang in there and don't give up!

Strategies for Investing in a Bear Market

If you're feeling the pinch of the bear market, you're not alone. The cryptocurrency markets have been in a slump for most of 2022, and show no signs of recovery anytime soon.

But does that mean you should give up on your crypto dreams? Absolutely not! In fact, this could be the perfect time to start investing in cryptocurrencies.

The key is to know which strategies to use in a bear market. Below, we've outlined a few investing strategies that can help you profit during these tough times.

1. Buy the Dip

This strategy is all about buying cryptocurrencies when they're down in price. The logic is simple: buy low, sell high. By buying during a dip, you're able to get more bang for your buck. Then, when the market recovers (as it always does), you can sell your coins at a profit.

2. dollar-cost averaging

This strategy involves investing a fixed amount of money into a cryptocurrency at regular intervals. This helps to average out the price you pay for your coins, and ultimately reduces your risk.

3. HODLing

This is perhaps the most popular strategy among crypto investors. HODL stands for "hold on for dear life." In other words, even when prices are crashing, you hold onto your coins and wait for the market to recover. This strategy requires patience and discipline, but can be very profitable in the long run.

Tips for Successfully Playing The Game

In order to be successful in playing the cryptocurrency game, one must first understand what is going on and how the game works. Here are some tips:

Educate yourself about cryptocurrencies and blockchain technology. The more you know about how the system works, the better equipped you will be to make informed decisions.

Stay up-to-date with news and developments in the space. This will help you identify opportunities and avoid potential pitfalls.

Be patient and disciplined. Cryptocurrencies can be volatile, so it is important to have a long-term perspective.

Have a plan and stick to it. Making impulsive decisions is often detrimental to success in investing.

Diversify your portfolio. Don't put all your eggs in one basket – spread your risk across different assets and jurisdictions

Conclusion

Cryptocurrency is a complex and volatile market, but with the right knowledge, it can be an exciting investment opportunity. By understanding what's going on in the markets and how to play the game, you'll have a better chance of success when trading cryptocurrency. We hope this article has given you some insight into the bear market and helped equip you with tips that will help you make smart decisions in your trades. Good luck!

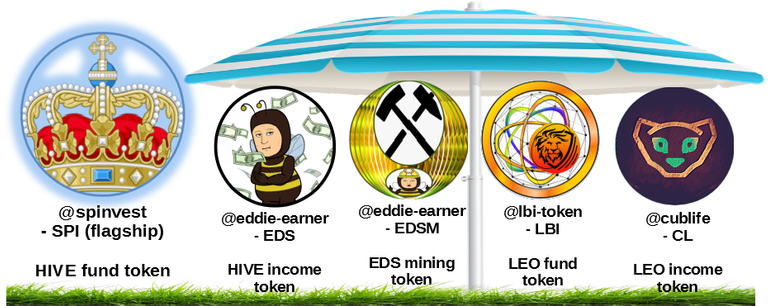

Hi @spinvest

Thank you very much for the very clear explanation of the current situation and the market fundamentals on which all this is based. An understandable analysis for the uninitiated and can also be a good starting point to do what you advise.

I reiterate my thanks. Indeed.

You're very welcome. I would like to start and produce better content, and more informative contact about a plethora of investments, not just crypto for this account. The main objective will be to spread information with a secondary objective of trying to write SEO-friendly posts that have a better chance to get found from a google search.

Thank you for your kind words and have a wonderful weekend.

I am enjoying reading the articles, thank you for the added effort.