After I was born in 1971, the world went to shit. Wages stopped growing along with productivity, governments wasted trillions of dollars, saving became pointless and inequality spiraled out of hand. I'm so sorry! But what did I do wrong, exactly?

Look at this devilish child!

"WTF happened in 1971?" is a successful meme. I saw it a dozen times on social media before I googled the phrase and saw where it came from. Even Jack Twitter-Square mentioned it today, 50 years after president Nixon closed 'the gold window' for foreign central banks. (There's a reason for that weird phrase - US citizens couldn't exchange dollars for gold since the 1930s and weren't even allowed to own gold. Nixon didn't end the gold standard, FDR did.)

https://wtfhappenedin1971.com/ is the source of the meme. It was created by two amateur Austrian economists, as they describe themselves, Ben Prentice and Collin Clown. (At least, we only know Collin's first name, while Heavily Armed Clown is his pseudonym on Twitter. It feels weird to cite a source by his first name.)

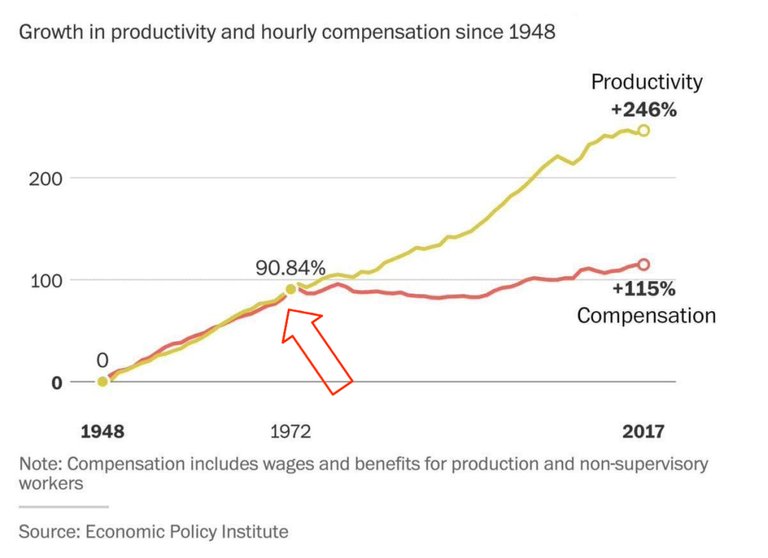

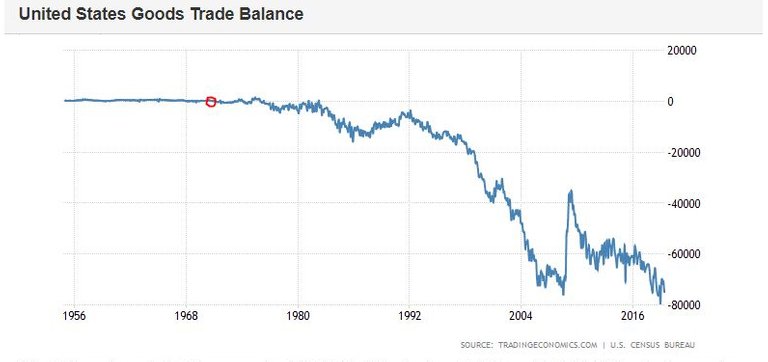

I'm impressed with this website - as someone who studied rhetoric and wrote a book about persuasion. It doesn't make an argument, it only posts a long list of graphs and invites you to do your own research. This way, they don't need to defend a position, while they can attack from every direction. The most prominent graph is this one:

The divergence doesn't even start in 1971, and doesn't become substantial until the late 1970s, but the narrative has been planted. Everything that happens later will be seen as a consequence of this fateful decision. We already know Nixon was a crook, so we don't need to wonder what his reasons were, or what the alternatives were, given the circumstances.

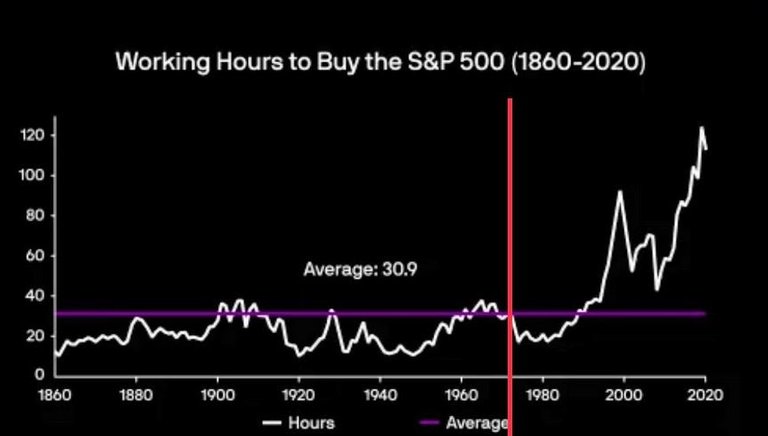

Other graphs show problems that start much later. For example, this interesting metric, the number of hours worked needed to buy the shares in the S&P 500 index or earlier equivalents, remains under the average until around 1990.

One of the downsides of the Just Asking Questions approach is that it won't stop when it reaches absurdities or scapegoats. Even on their own website, Prentice & Clown include far-fetched consequences like the incarceration rate, education spending without results, the number of lawyers in the US, political polarization, the marriage age, the divorce rate, obesity etcetera. Obviously, the growing incarceration rate was the result of another Nixon policy, the War on Drugs. But that doesn't matter for the believers.

If you'd mirror this approach, you could pick and choose graphs that show positive developments, especially when you cover the whole world rather than the US. Cars have become much safer, fewer people are smoking, fewer people are going hungry, more people have a phone, life expectancy is growing, diseases are being eradicated. Progress by Johan Norberg is a book that shows how life has gotten better.

From the top photo, you may have noticed I didn't exactly grow up in luxury. Our pavement consisted of random slabs from construction waste, including the flat part of a kitchen sink. I lived in the house on the right here, a former chicken shed, although it was extended before I was born. The floor wasn't level and instead of stairs, I climbed up to my room using a ladder hand-built by my father. You won't find many houses like this in Western Europe today.

This was a postcard sold in the local bookstore

However, I agree with the WTF site that a few fundamental things have gone wrong in the economy:

- Young people have insecure jobs, can't afford to buy a house and feel like they can't afford to start a family. They're also the first generation in modern times that expects to be poorer than their parents.

- Pension funds have a hard time investing when there's negative interest on bonds. Quantitative Easing failed to boost the real economy, because the money was hoarded by banks and investors. (This doesn't mean that the Cantillon effect is an automatism that explains everything. The Covid stimulus did work, because it mostly went to regular people and companies who spent it. It worked better in Europe than in the US, where it was concentrated in short bursts.)

- Wealth inequality is bad in itself, even when the poor are doing OK. We don't live in a real democracy when the rich can afford to bribe politicians with pocket money. People also lose dignity in their work when sucking up to the rich is the best way to make progress in your career.

Although Prentice & Clown's graphs are based on American data, I'm sure these three points apply to Europe as well as the US.

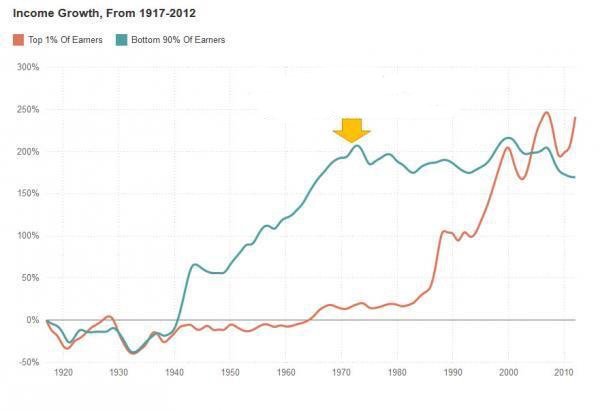

Note that the top 1% don't start getting richer until the late 1980s

Prentice & Clown do give interviews and go on podcasts. This interview is better than I expected from Cointelegraph.

Prentice sighs: “Why did everything get worse after deregulation?” Collin expresses frustration: "You’ve always believed in capitalism, but now you’re seeing this system that they’ve called capitalism is broken."

Yes, it's shocking to realize the system you love isn't working. I know how it feels. But their answer is a fallacy, the mirror image of "Real communism has never been tried".

Collin also notes that my joke isn't original:

The one that we see the most is that someone says ‘I was born that year. This was all my fault’

What happened in 1944?

Bretton Woods was a rickety price-fixing system that gave the reassuring impression of a gold standard without the budgetary limits of an actual gold standard. The goal was to prevent the competitive devaluations and tariffs that led to a negative spiral during the Great Depression. European currencies were pegged to the dollar while allowing a variance of 1%, as well as occasional devaluations in emergency situations. The dollar in turn was pegged to gold at a fixed price of $35 per ounce.

But only central banks participating in the Bretton Woods system were allowed to exchange dollars for gold at this guaranteed rate. The lion's share of the world's gold reserves was held by the United States and the Soviet Union, so it didn't matter much that the Federal Reserve issued more dollars than were backed by its reserves. Central banks could manipulate the gold price, which they did officially in the London Gold Pool since 1961.

Bamboo scaffolding is actually the opposite, sturdier than it looks. Photo of the Space Museum in Hong Kong by Anne Roberts.

As part of the Bretton Woods agreement, the IMF was founded in 1945 as an international lender of last resort, but with a smaller balance sheet than Keynes had proposed. It's still used to discipline small economies, but it could never control or rescue larger economies like France or the UK.

Money Week explains how the system started collapsing shortly after it became fully operational:

The full system actually became operational from 1958. (Up until then, countries had maintained exchange controls).

By 1965 the volume of dollars held by foreign institutions which could conceivably swap them for US gold reserves, outstripped the actual amount of gold the US had.

While America's share of the world economy was declining as Europe recovered from the Second World War, and the US was spending more and more on the Vietnam war, France started exchanging its dollar reserves for gold. The devaluation of the pound sterling in 1967 showed that the system was unstable and needed constant tweaking by governments. Not just with regard to exchange rates - European governments were also setting price and wage levels at times (as did Nixon in 1971).

It's surprising to see libertarians being nostalgic for a statist system where financial markets weren't free - just because money was theoretically pegged to gold. Shouldn't they be happy that US citizens got back the right to own gold in 1974, and that we can freely trade foreign currencies now?

Other explanations

While doing my own research, I found many alternative explanations for what went wrong around 1970, or 1980, or 1990. You can find them in comments on Hacker News and Reddit. I don't want to go into detail here, but some other shocks do play a role:

- The oil crises in 1973 and 1979 created inflation and affected working-class people more, since they spend a larger share of their income on energy and transportation.

- The fact that you can't buy a home in a good location on a single income is a logical consequence of more women doing paid work.

- The epidemic of suicide and drug addiction in industrial towns across the US is the consequence of moving industrial production to China and Mexico, thanks to free trade and containerization. In 1971, Nixon announced his visit to China, which was the first step on this path. In the same year, he also ended the trade embargo on China and kicked Taiwan out of its UN seat.

But the most insightful comment on Hacker News was from tryitnow:

What happened in the early 1970s? I think that's the wrong question because it pinpoints the last 40 years as in some way exceptional. I don't think they are. It's more interesting to ask what happened in the immediate post war era to allow increasing shared prosperity. ... So in the years following WWII, there was about two decades of relatively pro-labor policies (or at least tolerance of labor). This allowed American workers to share in the gains from productivity.

What went right before 1971?

The period after the Second World War was called the Wirtschaftswunder in Germany and Les Trente Glorieuses in France, referring to the years 1946-1975. A remarkable feature of the post-war period was conservative leaders who didn't turn back the clock, but supported the role of the state and trade unions in the economy: Eisenhower (1953-1961), de Gaulle (1959-1969), Audenauer (1949-1963), and even Churchill (1951-1955) who didn't abolish the National Health Service after opposing it ferociously.

The post-war period was unique for several reasons:

- Thomas Piketty describes the period 1950-1970 as 20 years of catching up after low growth from 1913 to 1950. As you know, he wrote a book claiming that by default, capital will grown faster than the general economy (r > g), with the exception of disruptive periods like war or revolution. Despite the title Capital in the Twenty-First Century, it's not a Marxist book. In fact, I'm not going to read it because it it's not theoretical enough to offer an explanation.

- The successful war effort had shown that central planning worked better than expected. This confirmed the experience of the First World War, which ended the viability of classical liberalism as a political movement, although it lived on in economic theory. Despite winning the war, the allies hadn't forgotten that the New Deal had been less effective in fighting unemployment than Hitler's economic stimulus, which involved more aggressive government borrowing and spending. The Soviet Union didn't suffer from the Great Depression, was seen as the nation most responsible for defeating the nazis, and kept its prestige high after the war by hiding a rather understandable famine in 1946 and 1947, winning the space race and gaining new friends in the colonies that gained independence.

- Since communism was a credible threat, capitalists needed to throw the workers a bone. All of Western Europe recognized itself in the comedy Don Camillo and Peppone, where a clever village priest and an energetic Communist mayor competed for the support of the local population.

- Industrial employment created an organized working class in a way that can't be repeated easily in an economy dominated by agriculture or services. At least not without a violent revolution. My father was more conservative than me, but he was a union member and I'm not. I'm on my own, negotiating directly with clients, just like my grandfather who worked as a farmhand.

- Developing countries had their hands full developing agriculture and creating national institutions, wrecked by ethnic and Cold War conflicts, so their industrial production couldn't compete with developed countries.

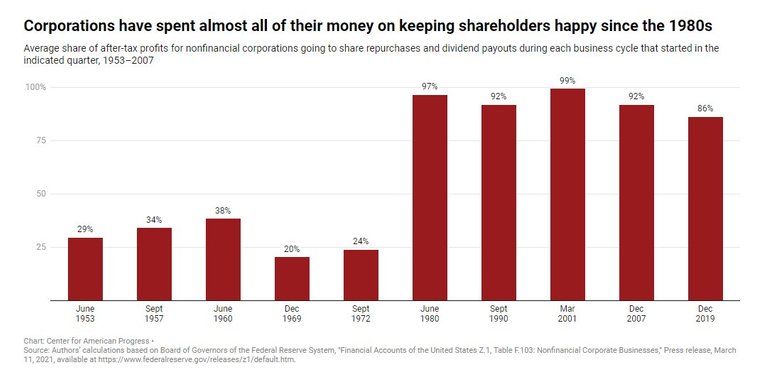

- Corporations, which don't like competition, were allowed to create cartels and conglomerates. Since 1993, this practice is limited in Europe by the EU common market with its rules against cartels and state aid, inspired by Margaret Thatcher. These days, it seems self-evident that lack of competition will make companies lazy, but stability allowed them to invest in capital goods and to train workers who could expect to keep working for the same employer until retirement.

Check out this collection

It wasn't a happy time in every respect. There were race riots in the US, while Western Europe recruited workers from Muslim countries rather than giving women equal access to a career. There was a different attitude towards safety. Both my father and one of our two neighbors had to stop working when they were injured.

Today's Twitter socialists would go mad if they had to wait months for a phone line, which was not unusual in Europe before telecom providers were privatized. At home, we were fashionable because we had a brown phone rather than a beige one, but of course it was the standard model supplied by the state-owned PTT. There was a coin box next to it, for the neighbors who couldn't afford their own phone line. Giving them free calls wasn't feasible.

In the end, the coddled corporations and nationalized industries did become lazy. This doesn't mean that privatization and deregulation are a fundamentally better approach, regardless of historical circumstances. Even the Bretton Woods system, which I disrespected here, wasn't so bad after all, since any monetary system requires believing in illusions.

Do you really want to argue with this guy?

Conclusion

Hard money appeals to nerds because it's a technocratic fantasy: everything will be better once we simply change one basic setting in the configuration file of reality. At the same time, these nerds are dreaming about Satoshi becoming the richest person who ever lived, even about building citadels to protect themselves from the nocoiners. If Bitcoin replaced the dollar, it would create violently disruptive wealth inequality.

Ironically, cheap money is great for the tech sector where many of these gold bugs work. Keeping interest rates artificially low is what you'd do if you wanted to encourage risky innovation.

I think a tragic world view is more realistic: capitalism is the best economic system we have, but it doesn't work well when it's the only system we have.

Look out, he's got a gun!

This is an interesting well considered and very thought provoking post. Thank you for that. I am very new the hive ecosystem, it seems like if I stick around I will learn not just about crypto but economics more broadly. Reading this post it makes me wonder at how everything is connected. As an artist, musician and teacher in the performing arts I really don't spend much time considering how financial and political systems work. I wonder though when we look back we can see its influence culturally as well. Speculating out loud here! Anyway, thanks for the post.