Gold continues to hit new HIGHS on the COMEX.

Once again SILVER is the real star of the Metals Market.

For years the Commercial Bankers have ruled the roost in the Silver Market, but it looks like the scrabble for physical silver is on. The shorts are in trouble!

If you have for years felt that the Silver market has been the place where the Big Boys robbed the Little People perhaps now is the time to get a little physical!

Paybacks can be a B*TCH!

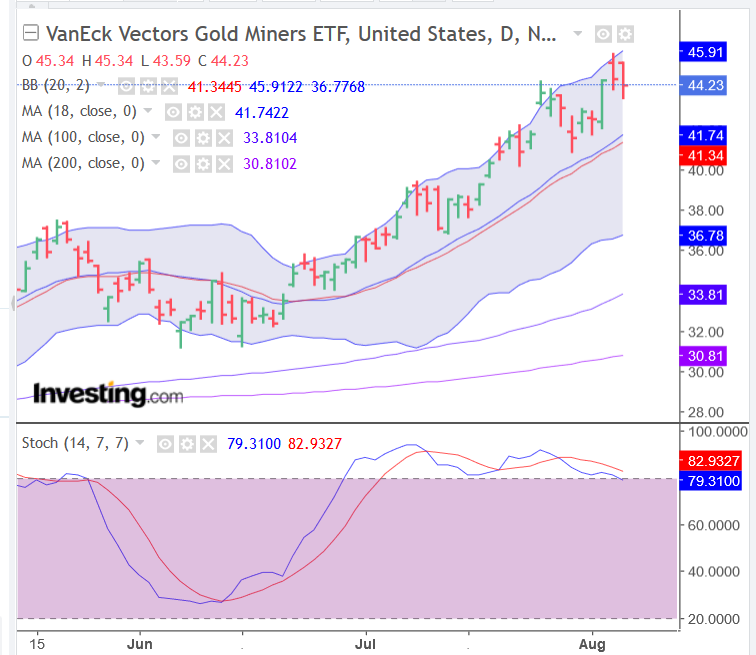

The Miners are showing a sign of weakness.

The Stochastics, which have been embedded since early July, slipped today. Unless the miners regain this tomorrow we could see another pullback.

Although since early June none of the pullbacks have hit the 18 day moving average.

Peace out and stack on!

Hurrah! Stackers rejoice! I feel like I'm making more when I'm sleeping then when I'm going to work :) I love it. With that being said, it's been climbing strait up for a while, do you anticipate a slight pull back in the next few months or are we getting ready for a moon landing?

$21.45 was the break out so it is possible to see a retest of this level in the future. That being said there is a desperate move to get physical silver on the COMEX. Of course there is no where near the amount of physical silver to meet even a fraction of the current futures contracts.

Thanks. Indeed I saw the comex panic and the mint's reduction in production, I was debating of getting some now or waiting for a dip that doesn't come. It's almost $50 CAD /oz with the premiums, gold is almost @ 3k CAD with premiums...ouch. I mean I like it but not to buy! I might sit and wait a bit, see what happens, hopefully the comex doesn't blow up yet. Looks like a market melt up to me tho.