The good news for the Bulls is that Gold did not fall today!

While a V shaped recovery is always a possibility, it generally is not a probability.

Gold, I believe will be seeking a range, in which to trade for the next few weeks.

Was yesterday's low THE LOW?

Quite frankly, your guess is as good as mine.

Silver is once again showing how much more volatile it is compared to gold.

But still for a long time silver stacker such as myself can I really complain about any price for silver over $20.00 per ounce????

On a longer term scale, silver had a massive breakout to the upside at around $21.50 per ounce. Below is a Monthly Chart illustrating the BREAKOUT.

I also put on the chart the Bollinger Bands and you can see on the Monthly chart how Silver is well above the upper bands.

.png)

On the Weekly Chart, Silver is still way above the upper Bollinger band, but did get within it during the sell off.

What does all of this mean?

Could mean nothing, although it could mean that the metals need to find a range within the Bollinger bands.

Trading these markets is all about probabilities rather than posssibilities.

Is it possible Silver rocket ships to the moon from here? Sure.

Is it probable the Silver rocket ships to the moon from here? Completely different story.

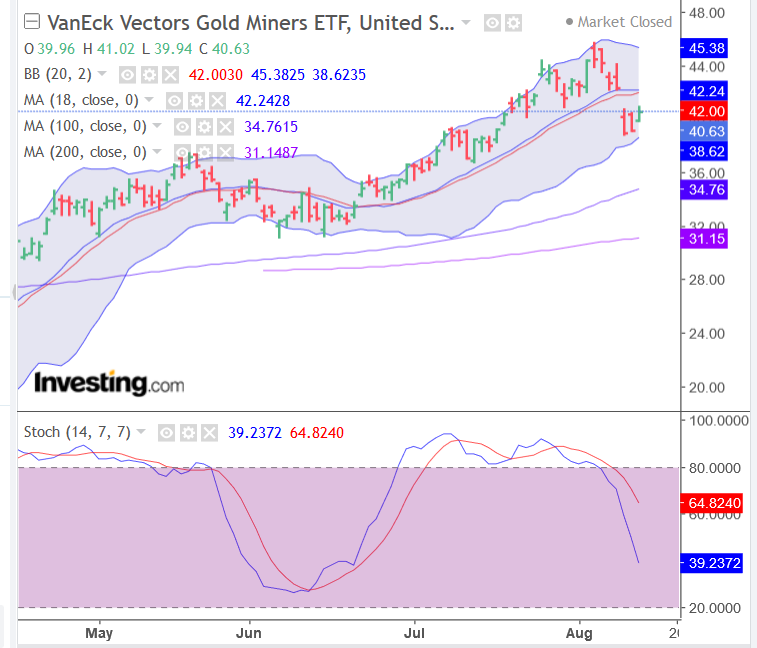

The MINERS had a decent day to the upside But it continues to trade below the 18 day moving average and the stochastics are pointing down. Until those two factors change, the miners are in a down trend.

I suspect that GDX will find a range, just like gold to trade in for the next few weeks before deciding the ultimate question of whether this HUGE upside rally is OVER or just RESTING.

Yesterday I mentioned three things to watch over the next few weeks that could have a serious impact on the metals market.

- The Dollar!

- Interest Rates on Bonds

- Turkey

%20-%20Investing%20com.png)

The dollar is very close to some long term support.

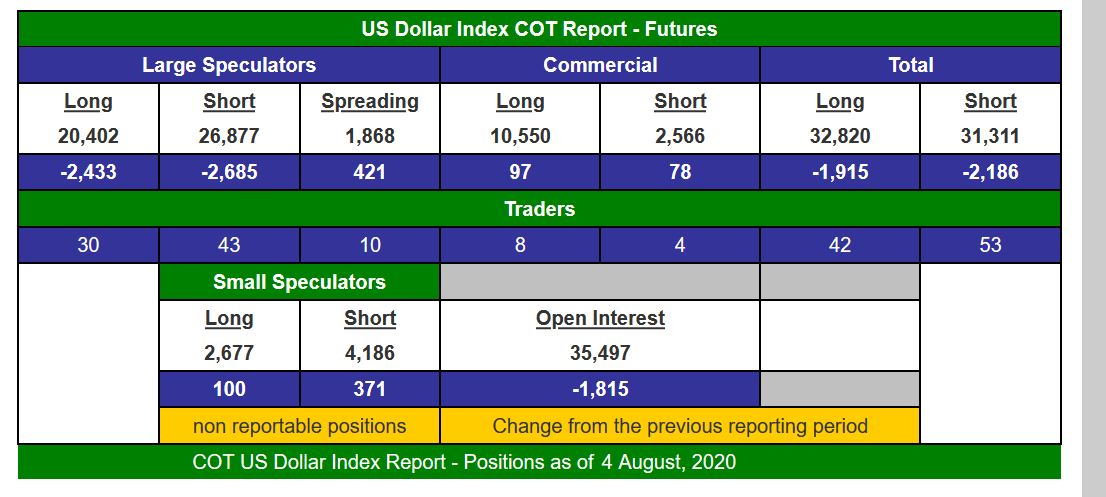

And this on the COT Report from last week:

The Commercials are LONG the US Dollar. Now sometimes Gold and the Dollar do rally together, and when they do GOLD really takes off. With that being said, gold and the dollar usually travel in the opposite direction.

2 Interest Rates

One of the greatest arguments against holding gold is that it does not pay interest. With real interest rates continuing to drop, that argument fades away. However, a spike in interest rates will have an impact on the gold market.

Nice article today on zerohedge about the poor showing of the 30 year Treasury, that caused interest rates to rise, just a bit, but since it is now on my radar I hope it is on yours as well.

https://www.zerohedge.com/markets/treasuries-tumble-after-dismal-30y-auction-shocks-traders

3 TURKEY

President Erdogan, or should I call him Grand Sultan of the New Ottoman Empire, is ratcheting up the rhetoric after a little fun between the Turkish Navy and Greek Warships.

And of course since there is a vacuum in Lebanon (a former French Colony) and the Turks now control Libya (formerly part of the Ottoman Empire), someone has to fill the void, now that we Americans are ending the endless wars.

General Macron sends additional French jets to Cyprus to keep an eye on the Sultan.

We are witnessing the DEATH of Pax Americana - Long Live the Republic and Death to the Empire!

At some point, if the Greeks and the Turks decide to really square off, I ask the question of how long before Russia, the historical DEFENDER of the ORTHODOX CHURCH decides that its Black Sea Fleet, stationed in the Crimea (does anyone remember the great dust up when Russia kicked the Ukrainians out of the Crimea?), might need to pay the Sultan a visit from the North.

Or perhaps it might be a visit from Russian fighter jets from the South in Syria.

The Turks are actually surrounded and don't realize it or just do not care.

Destiny Awaits and The Great Game is a foot!

All of these events play a role in the metals markets, and therefore I am keeping my eye upon them very carefully.

Peace out and Stack On!

Congratulations @handofzara! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board And compare to others on the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Let’s hope for 26.5-27 tomorrow. I’d be happy as my calls are close to break even.

I hope things went well for you today.

Was positive yesterday and we deep red today. fMl...

Hehehe, it can go any which way... and Imma continue to stack!🥰🌺🤙