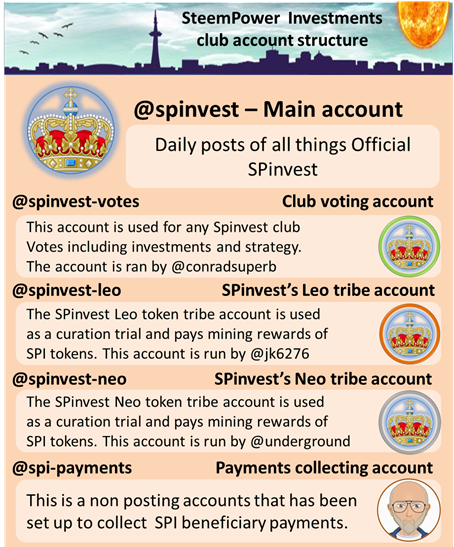

Hello and welcome to this SPinvest post

SPinvest is a tokenized investment fund/club for all users of social blockchains. Everyone is welcome! The concept of SPinvest is to get rich slowly by using time tested methods of earning, saving and compounding long term. This lets SPinvest offer an ROI of 20% per year on SPI tokens. We encourage long term investing on and off the blockchain. We hope someday everyone will HODL some SPI tokens that can be bought directly from @spinvest are through the hive-engine

.

"Get Rich Slowly"

This is the motto of @spinvest. The focus of this project is not to moon overnight. Instead, it sets out to seek outsized returns over the course of a long period of time.

Last year, Tesla was one of the biggest stories in the stock market. The stock was up more than 700% for the year. January saw the market taking a similar approach to the company, pushing it even higher.

Now the craze is all the Tesla millionaires that were created. They are people who have accounts with more than $1 million in Tesla stock. This is similar to the 1990s when everyone was talking about how the average person at Microsoft was a millionaire when their stock holdings were taken into account.

Of course, the main lesson is this did not happen overnight. It took years for these companies to get to that point. In Tesla's case, they had to walk the fine line of bankruptcy in 2018 before pulling their miraculous turnaround.

It is certainly a story of "Get Rich Slowly".

The reason why I bring this up is because we see a lot of impatience in the cryptocurrency world. Even Bitcoin, which did fabulous over the last decade, is still very young. In other words, things are just getting started.

We see the same thing with Tesla. On the earnings call, Elon Musk said that 2020 was the turning point for the company's profitability but it is just the start.

SPInvest had a terrific first couple years. The price of the token mooned. More importantly, the value behind the token is what really took off. With both on and off chain investments, including Bitcoin, the value of the holdings exploded.

After topping 80% growth the first year, we are now seeing an even bigger jump in Year 2. It will be interesting to see what the third year brings.

Everyone wants an overnight success. However, as many companies show, the ultimate success can take more than a decade. With funds, the value of time is the compounding factor. Starting at a very small level, a 30% growth does not move the needle much. That said, as the numbers get bigger, a similar percentage growth is a big numbers.

To compare again, Tesla's growth rate in 2021 with their vehicle deliveries will likely be more cars than they sold in all of 2019.

Compounding is the most natural thing in the world. It reflects the law of nature. There are not shortcuts in nature. Over time, growth is seen which is hard to see at first. However, after a few years, the difference is significant.

Think of an abandoned area. The field stops being tended to yet, for a while, there is little change. Sure some plants start popping up but it is minimal.

As the year pass, the growth becomes more evident, moving from the stage of brush to a fully grown forest. All that from a field that was clear 10 years earlier.

Warren Buffett knows this all too well. He is the epitome of patient when it comes to investing. His fund's success over the last half century is legendary. There is no other way to describe it. No wonder he has over $80 trillion in net worth.

While SPInvest will never be another Berkshire Hathaway, or Tesla for that matter, it can enjoy a tremendous growth rate over the next half decade. We are at the point where the value of the total fund is enough that a 40% growth rate will be significant.

It all takes time. However, the consistent activity along with some well placed investments will lead to outsized returns for a long time.

This is the lesson we can take away from Tesla. Hopefully, SPInvest will create its own millionaires.

.

SPinvest's content is contributed by @silverstackeruk, @no-advice, @metzli & @taskmaster4450

Today's post comes to you from @taskmaster4450

I'm still puzzled how for example the german car manifactures are not able to design a electrical car. All car models of them are like e-tanks. There is the i3. But it is not ecstatic.

I like how Tesla and Bitcoin are slowly increasing their market share, because their concepts clearly out smart the current dominant models.

Keep on your good work - hive on.

Is there a way to take advantage of this or get involved via staking rather than curation? I like the concept but I rarely interact with social media so I’m looking for another way to participate.