The big news across the crypto asset class has been how large Decentralized Finance (DeFi) projects have gone to market with governance tokens which has brought large amounts of interest as many of the popular projects like Compound now have tokens in the Top 100 in market cap list! This is very impressive considering that many of these protocols are very young. However, it signals how much potential is possible with the DeFi space as many investors continue to seek better returns given how traditional markets are now having very low interest rates at the moment.

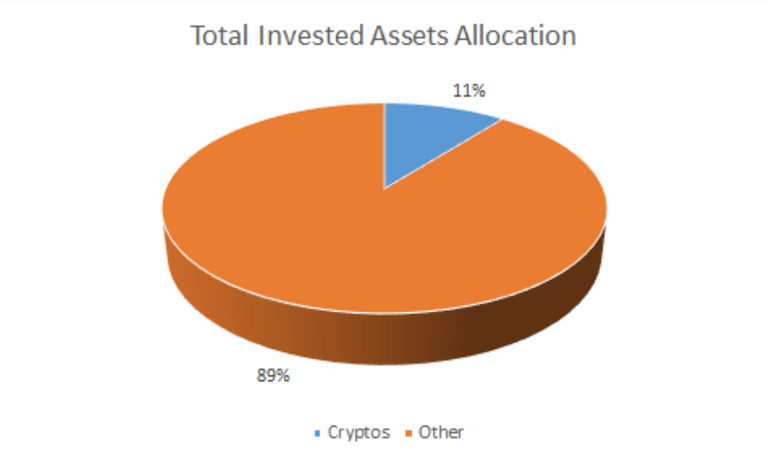

These updates are becoming somewhat boring for me as I have been quite inactive in the markets given my hesitance to really allocate more into any markets at the moment. Considering the risks that the current crisis has for the economy, I continue to believe that most assets will have price pressure given the impacts in the coming year or two. Therefore, I have maintained my invested assets in mostly risk free (sort of) assets like cash and stablecoins. I continue to build my balances in Stablecoins to ultimately facilitate some rotation into some Crypto assets in the medium terms.

However, the move into DeFi interest has continued to get my attention. Although I think that most is due to hype, I do believe that DeFi could be the gateway to adoption over time. While I continue to be concerned on the security of some of these staking efforts across protocols as we have seen some exploits, I have a list of platforms to research and potentially try in the coming months. I continue to be sad when I see the interest rate I am currently getting in my cash accounts at the moment and seeing some staking rates on some DeFi protocols is surely enticing; although rewards come with risk.

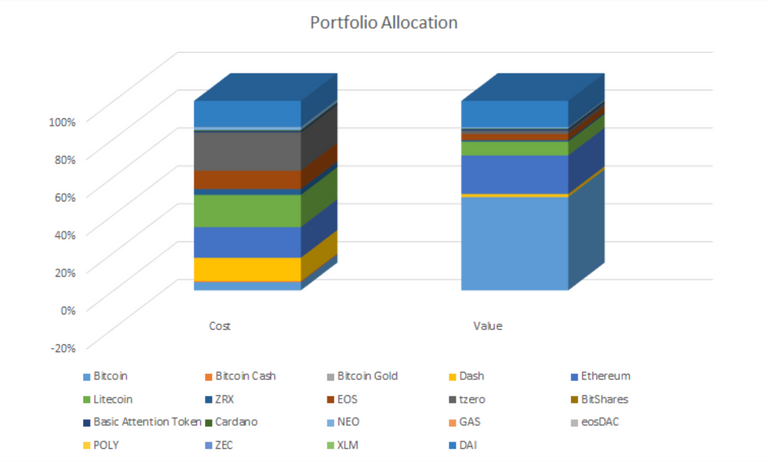

Therefore, other than my monthly addition to DAI, I really did not make many changes. I also saw that some holdings I have like Cardano have performed really well which demonstrates how important it is to chose the right asset allocation in an investor's portfolio. Others have not performed which quickly impacts overall portfolio value. This is probably why I have focused on few assets rather than continuing my diversification. It seems that assets related to DeFi are catching interest now so something to consider in the short term.

Unfortunately, another uneventful month on my portfolio but I think the fact that some volatility of these assets has come downward is a positive. I remember seeing fluxes of over 20% on a monthly basis but it has been much lower this year. It probably signals some maturity for the asset class which is positive for long term growth and adoption. There are certainly many investors looking for places to put assets to work!

Discord: @newageinv#3174

Chat with me on Telegram: @NewAgeInv

Follow me on Twitter: @NAICrypto

The following are Affiliate or Referral links to communities that I am a part of and use often. Signing up through them would reward me for my effort in attracting users to them:

Start your collection of Splinterlands today at my referral link

Expand your blogging and engagement and earn in more cryptocurrencies with Publish0x! Sign up here!

The best new browser to protect your privacy while still being faster and safer. Try the Brave Browser today with my affiliate link here: https://brave.com/wdi876

DISCLAIMER: The information discussed here is intended to enable the community to know my opinions and discuss them. It is not intended as and does not constitute investment advice or legal or tax advice or an offer to sell any asset to any person or a solicitation of any person of any offer to purchase any asset. The information here should not be construed as any endorsement, recommendation or sponsorship of any company or asset by me. There are inherent risks in relying on, using or retrieving any information found here, and I urge you to make sure you understand these risks before relying on, using or retrieving any information here. You should evaluate the information made available here, and you should seek the advice of professionals, as appropriate, to evaluate any opinion, advice, product, service or other information; I do not guarantee the suitability or potential value of any particular investment or information source. I may invest or otherwise hold an interest in these assets that may be discussed here.