Dear trading community,

Here is a look at my sample portfolio for Friday December 6th 2019.

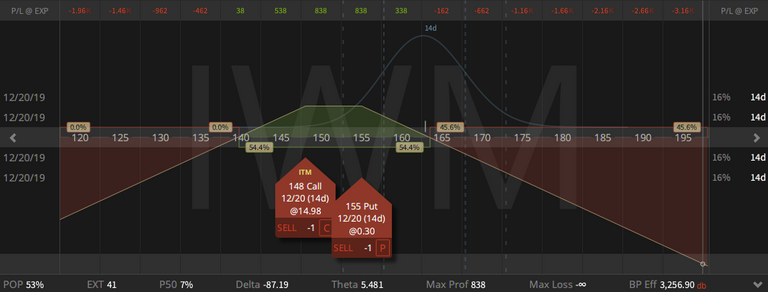

Inverted IWM Short Strangle

On Friday, August 23rd, 2019, I sold this call for a credit of $4.53.

On Thursday, September 26th, 2019, I rolled it up to the 147 strike and out to November for a credit of 69 cents.

On Friday, October 25th, 2019, I rolled it up to the 148 strike and out to December expiration and also added a short 148 put to reduce my short deltas.

On Friday, November 8th, 2019, my deltas got too short, so I rolled up my put into an inverted strangle for a credit of $1.22

My overall credit for this position is now $8.47.

No specific profit target, since this is all in defense mode.

At the moment this position is down $6.91 ($691 per one lot).

I didn’t close this position at 21 DTE since it is only a one lot, so this is kind of a gamble, we’ll see if we get a little sell off next week, so that I’m able to scratch this trade.

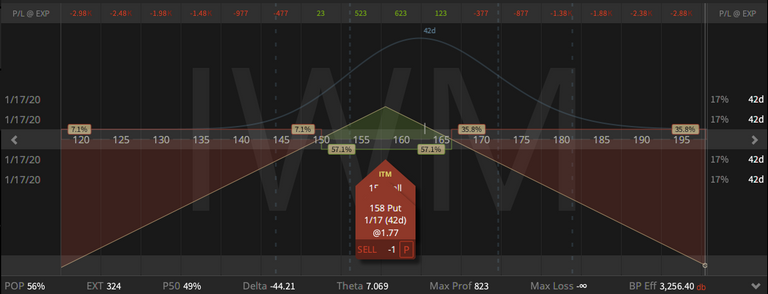

New IWM January Short Straddle

On Tuesday, December 3rd 2019, I sold this position for a credit of $8.12.

My profit target for this position is $1.79, so I'm going to close it, when it trades for $6.33 or at 21 DTE.

At the moment this position is down 11 cents ($11 per one lot).

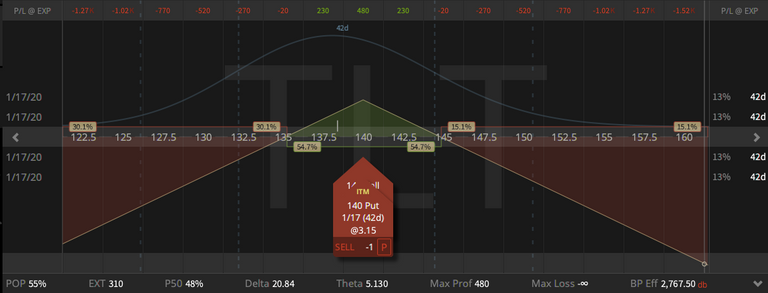

New TLT January Short Straddle

On Tuesday, December 3rd 2019, I sold this position for a credit of $4.85.

My profit target for this position is $1.10, so I'm going to close it, when it trades for $3.75 or at 21 DTE.

At the moment this position is unchanged.

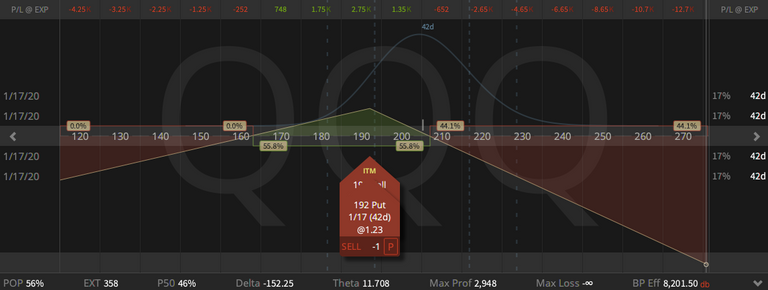

Rolling QQQ December Synthetic Covered Put out and up to January

On Monday, December 2nd 2019, I rolled this position up and out for a credit of $0.49.

My synthetic basis on the covered put is now $184.98, I have collected enough in credit in this position to have the chance to be profitable.

We'll see how and if this will work out.

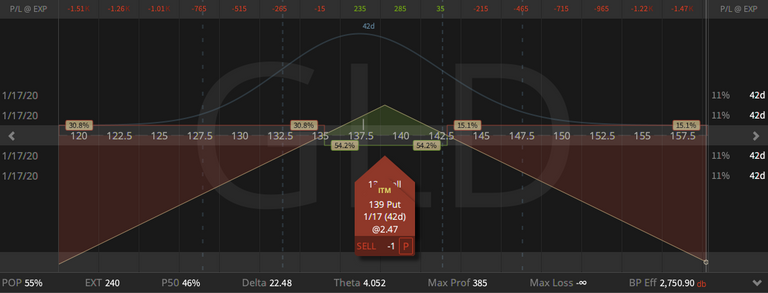

New GLD January Short Straddle

On Tuesday, December 3rd 2019, I sold this position for a credit of $4.25.

My profit target for this position is $95 cents, so I'm going to close it, when it trades for $3.30 or at 21 DTE.

At the moment this position is up 40 cents ($40 per one lot).

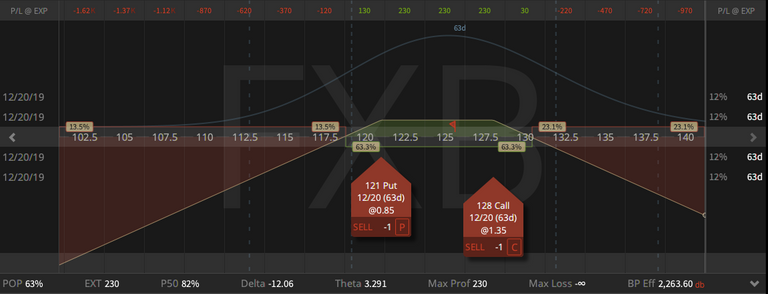

FXB January 30 Delta Short Strangle

On Monday, November 18th 2019, I sold this position for a credit of $2.02.

My profit target for this position is 85 cents, so I'm going to close it, when it trades for $1.17 or at 21 DTE.

At the moment this position is down 1 cent ($1 per one lot).

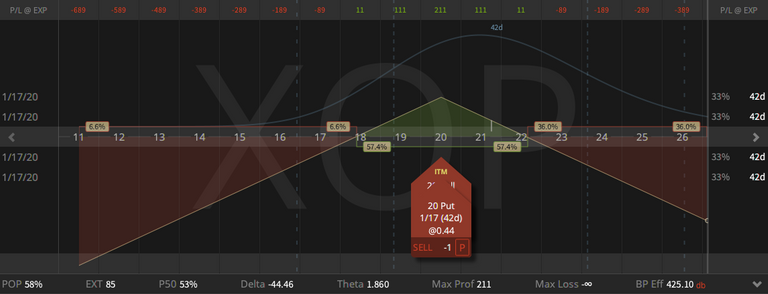

New XOP January Short Straddle

On Tuesday, December 3rd 2019, I sold this position for a credit of $2.15.

My profit target for this position is 40 cents, so I'm going to close it, when it trades for $1.75 or at 21 DTE.

At the moment this position is up 4 cents ($4 per one lot).

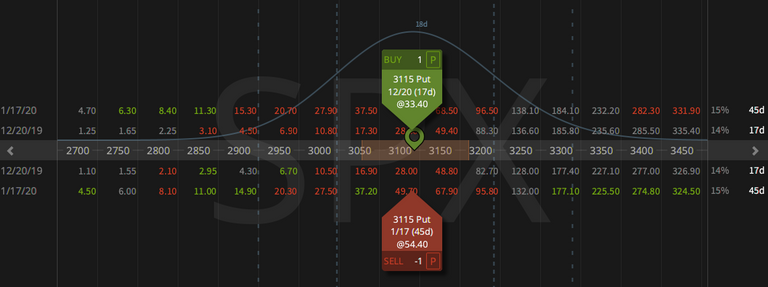

Closing SPX Put Calendar Spread

On Wednesday, November 25th, 2019, I opened this position for a debit of $19.90.

On Monday, December 2nd 2019, I closed it at a profit of $1.70 ($170 per one lot).

Books Update

With the completion of my latest book, I have now a trilogy.

The first book is still available for a huge discount on Google Play, so buy as long as it is still cheap.

You can also buy it for $19.99 on iTunes, Amazon or Barnes and Nobel.

Thanks to all my readers for buying it.

If you like it, you would do me a great favor by writing a short review on amazon.

My second book is available for $5.99 on Amazon, Google and on Apple.

Thanks to all my readers for buying it.

If you like it, you would do me a great favor by writing a short review on amazon.

My third book is available on Amazon, Google and iTunes.

Have a great weekend,

Stephan Haller

Legal disclaimer: These are not trade recommendations. Options involve risk and are not suitable for all investors. The trades shown above are for educational purpose only.

think risky. you need to wait for starting tend up or down. After tend start you can tread.