Hey Steemians,

As part of the current series, I am involved in taxing Steemmonsters under German tax law.

Disclaimer: As always, I do not provide tax, business or legal advice on this public forum. The facts are usually too complex for this. And the simplifications and generalizations that I have to make, can not take into account your individual situation. In addition, German tax law does not (yet) have any explicit regulations on the taxation of cryptocurrencies. There are also no judgments from the case law that really take us forward to do so. Nor can I rule out the possibility that subsequent legislative changes or jurisprudence contradict my views expressed today. With this in mind, I can only present general information and my opinion on it. So make no decisions based solely on my statements and representations here. Take even appropriate current advice that maps your individual situation or educate yourself accordingly.

How does it start?

In order to be able to participate in the game at all, you first have to buy a starter pack. This includes a certain number of cards that you can use to participate in the game.

That's why I deal with the income tax treatment of the purchase and later sale of cards in this first part of the series. I'm not going into sales tax here yet. Right now, I'm assuming the earnings tax treatment is regardless of whether the cards are purchased as part of the starter pack, a booster pack or on the market. At least I have not yet come to know any reasons to speak against it.

According to the definition of German tax law, most players’ cards are so-called other assets. I deal with the peculiarity that someone could carry out an independent activity in the form of a freelance or commercial activity in a following part of this series.

The purchase and subsequent sale of so-called other assets are, according to German tax law, income from private divestiture transactions, which are to be found under other income.

This means that the profit from the sale of cards is in principle subject to tax liability in Germany.

The following points need to be taken into account:

1) How is the taxable profit determined?

According to the definition of German tax law, the profit always results as a selling price minus acquisition costs.

An example:

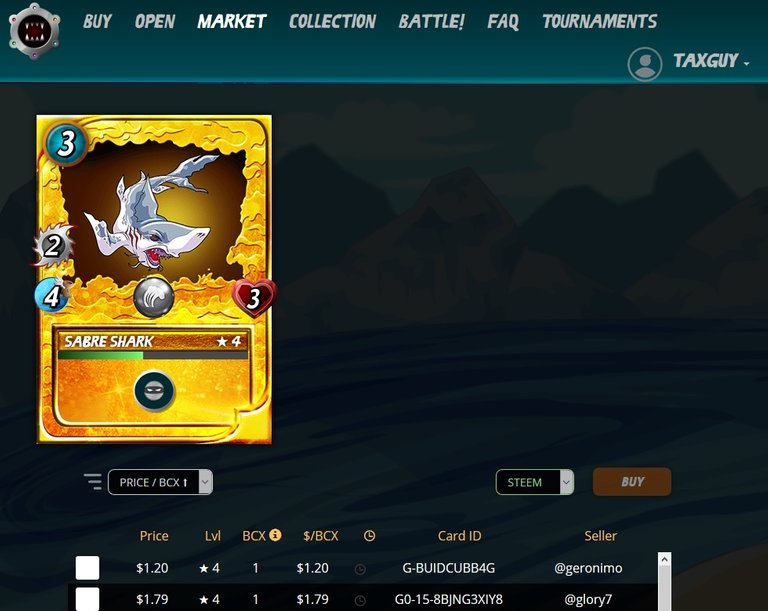

I buy a golden Sabre Shark for $1.20 on the Marketplace. Later, I sell this Sabre Shark for $1.40. In this case, the profit is ($1.40-$1.20 =) $0.20. I would have to subject this amount to income tax under German tax law.

Source: www.steemmonsters.com

Now, of course, there is one point that does not make the whole thing any easier: German tax law only taxes EURO, not USD or STEEM or SBD or other currencies. And for that, I have to convert the amount to EURO both when I buy and later sell. Relevant is the respective price, which was valid at the time of the purchase or at a later sale. So I can't count the sales price for both the purchase and the sale. For later treatment, it is therefore easiest to record in an overview (e.g. spreadsheet) which card I bought and when at what price (including conversion up to EURO) when I bought it. Then I can easily calculate the profit or loss later on the sale. By the way, I am currently preparing such a table. If it works out, I'll make them available to you.

2) Is there an allowance?

However, these profits from private divestiture transactions are subject to an allowance of €600 a year currently. As long as this amount is not exceeded in total, the profit from the sale remains tax-free. Caution: This allowance applies jointly to all private divestiture transactions in a calendar year. This means that if I also act on a stock exchange e.g. Bitcoin or Ethereum or STEEM or SBD, then these amounts are counted in the annual allowance.

3) Handling starter pack and booster packs

*Source: www.steemmonsters.com

For starter and booster packs, I get a certain number of cards for a certain amount. For these cards, of course, I don't know the acquisition costs in detail. In addition, a bit of luck is part of getting me a rare (and therefore more valuable) card. Since there is no more precise way to determine the purchase price of such a card, the simplest and most sensible option is that the purchase price for the pack is evenly distributed between the number of cards received.

4) The annual limit

In the area of so-called private divestment transactions, German tax law knows the 1-year limit. I can sell assets that I held for more than a year since the acquisition date, in accordance with Section 23 of the German Income Tax Act, after the end of the one year. So, from a purely tax point of view, this can be a very interesting way to realize increases in value from the cards without having to tax them.

A first summary

As long as the cards are played or held as an investment on the side, we can summarize that the profits (or losses) from the sale of individual cards under German tax law can be designed in such a way that no Income tax must be paid.

So much first as a rough overview. I will cover other topics relating to the taxation of Steemmonsters in later posts.

I hope that my text help you.

I am happy to read or hear from you.

Best wishes and first of all: may you have a nice day.