(Die deutsche Version des Artikels findet Ihr hier: https://steemit.com/deutsch/@taxguy/besteuerung-der-beim-battle-gewonnenen-steemmonsters-karten-deutsche-version)

Hey Steemians,

Today I'm finally back to continue the series. Unfortunately, my computer's motherboard burned last week, so I had to do a repair first. For cost reasons I had to buy a new one.

As part of the current series, I am involved in taxing Steemmonsters under German tax law.

Disclaimer: As always, I do not provide tax, business or legal advice on this public forum. The facts are usually too complex for this. And the simplifications and generalizations that I have to make, can not take into account your individual situation. In addition, German tax law does not (yet) have any explicit regulations on the taxation of cryptocurrencies. There are also no judgments from the case law that really take us forward to do so. Nor can I rule out the possibility that subsequent legislative changes or jurisprudence contradict my views expressed today. With this in mind, I can only present general information and my opinion on it. So make no decisions based solely on my statements and representations here. Take even appropriate current advice that maps your individual situation or educate yourself accordingly.

Today I would like to deal with the question of how cards won at Battle can be valued according to German tax law.

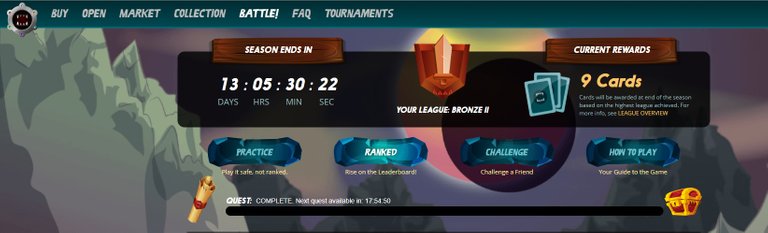

Background: Steemmonsters offers the opportunity to participate in so-called battles.

Source: www.steemmonsters.com

You can first choose how you want to play against another player. If you play in the so-called "Ranked" mode, you can climb up or down in a ranking list.

*Source: www.steemmonsters.com"

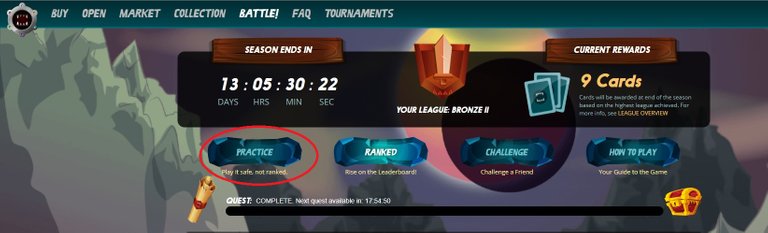

The so-called "practice" mode is for practice, the results are not included in the ranking.

Source: www.steemmonsters.com

After having chosen a style of combat, you are confronted with an opponent whose skills should be as strong as your own. To ensure this, you come with certain points in certain leagues. You then measure your cards with opponents from the same league. In my opinion that works quite well in most cases. However, there are probably times when a small number of players are active, as the team is then sometimes facing opponents from another league.

Source: www.steemmonsters.com

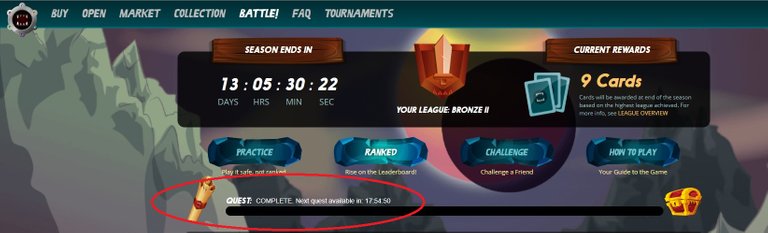

When participating in the Ranked mode, you can complete daily quests.

Source: www.steemmonsters.com

Reward-cards are randomly given as a reward. These can then be retrieved via the "Claim" button.

Source: www.steemmonsters.com

And if you have forgotten how it works, you get the short version of the instructions over the "How To Play" button again.

Source: www.steemmonsters.com

In addition, a "Ranked" season always ends after a certain time (one season lasts about two weeks). At the end of the season you also get "Reward" cards. The number depends on the height of the league, which has been reached during the season. The higher the league reached, the higher the number of reward-cards.

German income tax on the Rewards cards?

The German income tax law knows a total of seven different types of income. Therefore, in this context, we always have to ask ourselves whether the income should be classified under one of these types of income.

You will earn business income if your activity is for profit. There are even more criteria, but I suspect that the profit-making intent of playing Steemmonsters doesn’t usually have priority. It's just a pastime game. But if you are making a living from it, you would have to assume that your income will be covered by it. But I'll cover that in a later chapter of the series.

Income from agriculture and forestry are certainly not present when playing Steemmonsters. This also applies to income from an employee relationship, since you do not play Steemmonsters in the employment relationship for someone else.

There is no income from renting and leasing according to § 23 of the EstG, as you are not leasing any real estate or property rights, nor any rights or rental and lease interest claims.

Income from self-employment could be present. They overlap in the criteria partly with the income from commercial activity. When you are playing Steemmonsters, you do not use knowledge from a degree course and you are not part of a profession particularly mentioned in the Income Tax Act, e.g. as a tax consultant, lawyer, doctor or architect. Income from self-employment is therefore generally not available.

There is no income from capital assets when playing Steemmonsters, since the profits are neither dividends from shares, interest income or the like.

Other sources of income could be the last catch. This is the type of income that is to intervene if the first-mentioned types of income do not lead to taxation, because the income can not be included.

Basically, pension payments, compensation, private sales transactions are recorded here. These are not available here, since this is not about you selling the cards. If you sell cards, I refer to my following post: https://steemit.com/steemmonsters/@taxguy/taxation-of-buying-and-selling-steemmonsters-cards-in-germany-part-1-of-the-series-english-version

There is still one fact which leads to income tax liability: if services are provided which do not belong to other types of income, e.g. from occasional negotiations and rental of movable property. If you rent your Steemmonsters cards regularly or irregularly, there may incur a tax liability. However, it is true that no income tax liability applies if the income amounts to less than € 256 per year. This is a so-called exemption limit, that is, if the amount of 256 € is exceeded, the total amount is taxable, not just the amount that exceeds 256 €. The obtained Steemmonsters cards are usually worth only a few cents, so that this limit should probably not be exceeded.

As a result, the Rewards when participating in Battles are generally not liable to income tax in Germany.

Therefore: Good luck with the Battles!

As a follower of @followforupvotes this post has been randomly selected and upvoted! Enjoy your upvote and have a great day!

Congratulations @taxguy! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Vote for @Steemitboard as a witness to get one more award and increased upvotes!