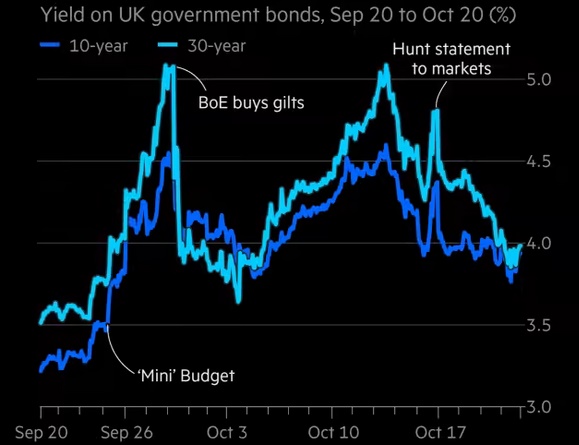

The Tories are in the process of choosing a new leader, but despite Liz Truss resigning, gilt yields haven't recovered from the mini-budget:

I suppose the problem is that the markets arn't sure who will replace Truss. If you look closely at the above graph, yields actually ticked upwards as news broke on Friday that Boris Johnson was going to stand for the leadership again.

The market action on Friday seems to have sobered up some Tory MPs. Though Boris's supporters claim he has 100 nominations (the minimum required to stand as a candidate), they are shy about going public: only 53 have declared for him. The rest may decide not to risk it.

Meanwhile Rishi Sunak has got 130 nominations and Penny Mordaunt 21.

Sunak will try to get 200, for a majority of the 357 Tory MPs. If the other candidates don't manage to hit 100, he'll be declared winner on Monday night and will become Prime Minister by Tuesday.

Sunak being elected might finally calm down the markets enough for yields to return to where they were before the disastrous mini-budget.