Hey folks, so on 1/27/22 we instituted a small 0.25% trading fee for all transactions in the diesel pools. This has resulted in fees piling up in the pools for liquidity providers.

Fees to date

2022-01-27 => $1898.96111

2022-01-28 => $1458.43986

2022-01-29 => $1203.85103

2022-01-30 => $1264.00858

2022-01-31 => $930.01349 (not complete)

Fees are going down as prices are going down and volume is dropping a little. I imagine it's part of macro cycles where trading volume comes and goes. So, at this point I think we're looking at low end values of how much people can earn. That said, it's only been 4 days so I'm not going to defend this first reaction to the death. As the market picks back up and prices go higher and btc stops trading under 40k I think we'll see a substantially higher volume at higher prices which will make money-made-number go up. But again, it's crypto and my crystal ball isn't precise.

Ballpark Math

Anyway, we're working on a whole lot more tracking at Hive-Engine. The first part is a tax reporting software, but it has other analytical help it can offer too. We haven't spoken about the tax project much, but it's been in development for about a month trying to help people prepare for taxes in April.

In this case we're using data from the tax project to figure out the % return by the pool owners.

We have 4 full days so I'm going to add those up- $5825.

Then I'm gonna turn those 4 days of results into an annual estimate- $531,531

Then I'm gonna say that the top 3 pools contribute about 80% of the volume. So, I'm gonna shrink the value by 20%. $425,225.

At today's rather low value for BTC, low volume for trading, and low price point for the altcoins the people staking in the top 3 pools will earn roughly $425,225.

What does that mean for a return?

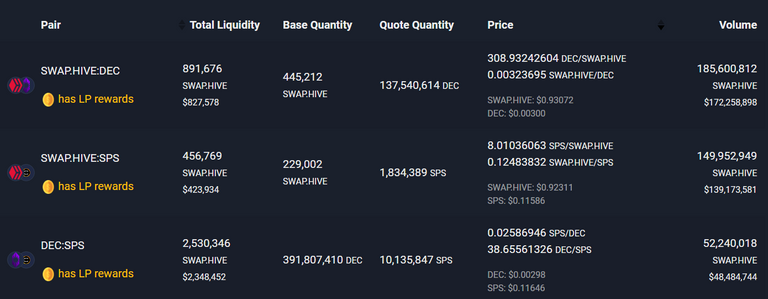

Well, if we look at the top three pools-

You can see the total liquidity in them-

$827,676, $423,934, and $2,348,452- It's almost exactly 3.6M USD.

So, if we earn $425k on a $3.6M pool we get 11.8%.

So, you're telling me what?

At the lowest level you can think of Liquidity pools like a savings account. In that savings account you can earn a return kinda like at a bank. In the bank your return is probably 0.25% per year. Parking money in a diesel pool right now can net you something like 11.8% return if it stays at the current pace.

But there's a couple of caveats.

The rate of return fluctuates every day. So, there isn't just 1 rate. It's more like a rate per day and your annual amount is based on the sum of that daily return. It's my hope that BTC is bottoming out and we're going to see a lot more activity soon. If that happens I expect the numbers go up substantially for the volume of tokens, the USD volume and thus the amount earned in trading fees. If that doesn't happen we may see volume and prices decline still. Crypto is volatile and a big down turn is the main risk (especially if you sell).

You also want to think of the fact that what you're storing doesn't have a stable value typically. First off, if you're storing value in dollar backed anything the dollar seems to be losing more and more value as they print absurd amounts of it and people lose faith in it. So, holding in dollars could be a good move in the super short term, but is likely to get inflated away long term.

The last thing to think about is that the real time to measure your absolute returns is when you're pulling money out. The crypto you have parked there will continue to earn more tokens on both sides of the pool by just sitting there passively growing in an account. The moment of truth is what price are you pulling it out at and selling for something.

Did the dollar value of the token price increase or decrease? Up until that point it's like tracking theoretical returns since you're not cashing your chips out. You sit back and let this thing generate fees for you in various crypto currencies. You don't touch it until the market is what you consider high, and then you take the money out. When you do that, you'll get what I'd consider the actual return on your investment. Same is true if you're forced to sell at a low price due to unforeseen circumstances or lettuce hands.

The way to actually measure success is figure out how much money you made by subtracting the number of tokens and their price when you put them in versus the number of tokens and their price when you took them out.

Example

Let's say you park $10k in the DEC:SPS pool right now. DEC is trading at 0.003. SPS is trading at 0.11506. Let's say amazingly the price stays the exact same for 2 months. During that time you make your 11.8% annual return. So, now your account is closer to $10,200. That's not nothing, but you're probably not changing your life over it. Then finally, the price of these assets move substantially up. Dec doubles to go back to 0.006 and SPS goes on a tear to 68 cents again. At that point your DEC would be something like double the price and now worth $10000+ and your SPS would be be worth like 6x or $30k. LPs are funky and this is a very broad generalization, but at those prices you'd see something like a 4X overall return.

In this case most of your benefit comes from the increase in price, but you're earning along the way. So, when the time comes to pull out you are ahead on amount of tokens and also USD value of tokens. If you have to sell in a down turn hopefully the extra tokens you earned for trading fees keep you in the black.

BUT WAIT! THERE'S MORE!

in particular consider DEC:SPS. In that pool there's a couple of reward types. You're getting airdrop SPS rewards and also BEE rewards. So, how much return you're actually getting requires calculating a couple different income sources.

Those are a little out of the scope of this morning's activity. Overall, I'm trying to help you guys understand that parking cash in liquidity pools has some risks, but can add a ton of value.

What about traders?

Normally you'd think "Hey, these dicks are adding fees! That's gonna make my cost go up!" and in most places that's probably right, but in crypto things are weird so you get unexpected consequences left and right.

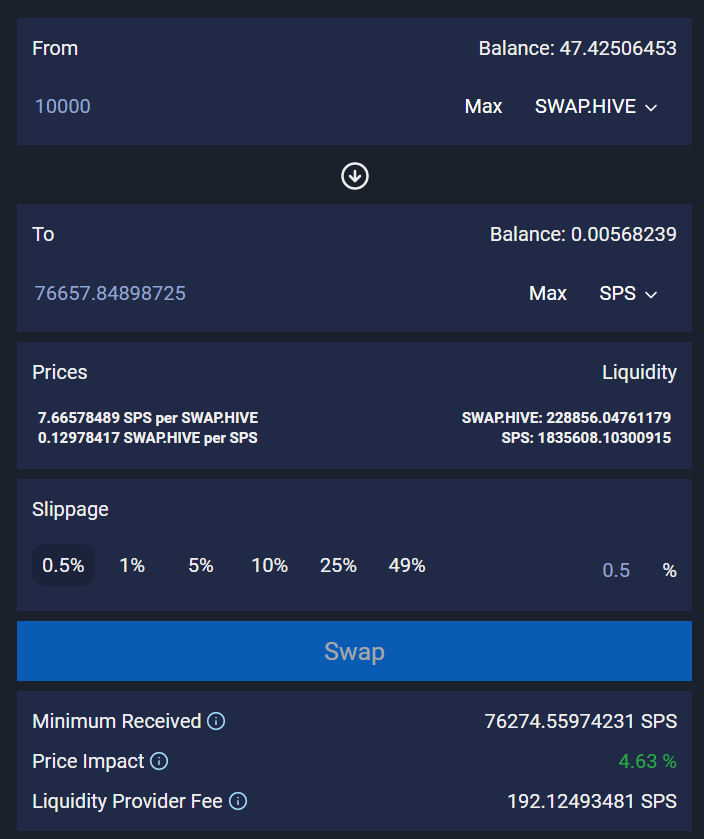

So, here I want to trade 10k hive for SPS. If I do this you can see down at the bottom in green that this will have a 4.63% price impact. What that means is that because this trade represents a sizable portion of the overall liquidity pool the USD value of money I receive on the trade is going to get hit by 4.63%. Now, if the size of the liquidity pool goes up then the price impact will go down. There's only $400k or so in that liquidity pool. So, if the size of the pool increases a lot then that transaction will represent less of it, and price impact can go down. There's more room to go down than just 0.25%, so there's a big opportunity here for us to drive value to traders by increasing the size of liquidity pools.

So, yes, a fee got added, but if this goes right the amount of liquidity on the exchange increases by holders looking to make a 12% return (at the slow times) for holding assets they like anyway in diesel pools, and if the amount of liquidity is higher the price impact is lower. If it's all going according to plan the price impact for your trade is reduced by more than 0.25% to make up for the fee so it's a win-win for the trader and liquidity provider.

TL;DR - My general plan

Stake my tokens

leave them there to appreciate in token number until they hit prices I like

cash them out

bro down

Low end try to get 12% APR just from fees

High end get more by token price go up and other rewards for staking that are provided

Relax math nerds

Anyway, this isn't meant to be financial advice, and it's not even all calculated exactly accurately because liquidity pools are stupid hard to model accurately. So, don't go ape into an LP without any experience, get burned and blame me. Like anything else in crypto, I suggest keeping your moves small until you have experience and understand what you're getting into. Once you have a feel for things then ape in and try not to get rekt.

The benefits appear to me as

- the ability to earn crypto passively

- the ease of use

- the potential of coins to moon

- the multiple revenue streams that are possible

- price impact fees should reduce beyond a 0.25% trading fee as more LPs stake crypto on the platform

the downsides appear to me as

- the potential of coins to increase in number but still decrease in USD value

- asymmetric price movement can leave you with less tokens than you started with because pools can be weird (so, if you really want to make sure you never go below 32 eth so you can stake for eth 2.0 in 2045 then pools won't always provide that certainty of number of tokens on hand)

Thank you @aggroed for explaining it. The fee was something I ask around the last few days and nobody has an idea about it "how it works".

How can i "track" the fee for now? Do I see an increase in shares?

For example, I have 1000 shares in a pool and after some trading in the pool, I see 1000,1 shares, depending on volume?

Would be really cool if you could answer it in some words, so i hammer it under my post with the question, so anyone that search for it, get the info :)

Love these breakdowns. I know I’m going to send this to a few friends that I was trying to explain some of this to…very poorly I might add.

This is perfect and sums up an important cog, that people should absolutely learn about. I wish I gave it the time of day earlier, but I’m here now and mostly due to projects you are involved with, so…a tip of the hat to you good sir.

I pretty much understand things- but how does the daily bonus work? Do we get paired coins added to our position every day?

I just started to dip my toe in the pools (I know I'm late to the party). I put some liquidity in the Swap.Hive/DEC poola week or so back. Your post reminded me to do the same for the DEC/SPS pool.

Wow This is cool. Good decision.

One more thing that will deepen the liquidity will be using a specific token like BEE or HIVE for every pair and drive swaps from one to other token using those pairs.

For now we have 3-4 pools of BTC with different tokens which divide the Liquidity into 4 pools. Instead we can have a single BTC:XX and SPS:XX pools and if someone wants to buy BTC from SPS, it will go from SPS:XX:BTC and vice versa. This will not only help in deepen the liquidity but would provide more trading volume means more revenue means more liquidity and black hole continues. And that XX token will have value based on tokens locked in liquidity. That XX can be BEE or any other token chosen by Engine team. and in order to incentive pool security, you can have miners stake/lock more tokens than whatever in the pool are. This is what is done by THORCHAIN https://app.thorswap.finance/ and looks like a great model. I hope we can implement some of it's parts on Engine.

Looks legit, waiting for some long-term stats to be generated now. Next stop LP Shares as collateral for flash loans? :p

Interesting!!!

So far I only used liquidity pools around Hive - DEC:SPS, swap.Hive:DEC and the like. The main selling point of those is definitely the SPS airdrop inside of Splinterlands. But those thoughts seem intriguing. Have to take a deeper look into those.

Thanks for sharing!

Cheers,

@andy-plays

!gif money

Via Tenor

Great info on the Diesel Pools returns and things are getting more and more hotter on Hive blockchain DeFi. The math is here and working, just need a better interface similar to Top DeFi in the world (I would opt in for somehting alike ThorChain) and that should make a serious contender out of Diesel Pools. Hope there will be more developments this year on it as it simply gets more money to this great ecosystem!

Interesting concept. I want to know more.

So let me get this straight. Put money in box, then magic, then more money inside box without putting?

But how I put?

You missed the first step: rob bank, put money in box...

Who's Rob Bank? How do I get a hold of this man?

You can use https://beeswap.dcity.io/swap?pools or https://tribaldex.com/dieselpools/pools to add liquidity. But do learn that LP can result in impermanent losses if prices of those assets change a lot. That's the risk you take and in return you get pool rewards.

Thanks. Now those hearing about this for the first time might know where to begin.

I have no idea how LPs works, it's black magic and arcane knowledge.

The explanation helped a little in making it look less like unholy science.

!1UP

You have received a 1UP from @trashyomen!

@monster-curator, @pal-curator, @bee-curatorAnd look, they brought !PIZZA 🍕

Delegate your tribe tokens to our Cartel curation accounts and earn daily rewards. Join the family on Discord.

once there is demand we will be creating a $FART TOKEN LP

What's the tax thing? Will we be able to download something that shows how much a trade was, on a specific date, from what to what, etc?

It's been almost impossible for me to figure out my hive engine taxes so I try to almost never use it.

what are taxes ? haha

Unfortunately that excuse won't work if the govt ever decides to go after someone for not paying crypto taxes.

plead insanity !

i just staked my 7 sps and DEC from my daily reward i dont know how much ill put in I'm worried about impermanent loss but the added SPS from the airdrop is nice aswell

Congratulations @aggroed! Your post has been a top performer on the Hive blockchain and you have been rewarded with the following badges:

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!

Love the breakdown and have been dabbling in some of the other pools (not top 3) as well to help provide some liquidity!

Nice one

great work dude, this is looking to be a nice crypto winter stacking before the bull run, making money on the lows.. only in crypto.

Your post is very good and interesting.

This is one of the coolest quotes I've read in a long time 😎

!PIZZA !LUV

@d-zero(1/1) gave you LUV. H-E tools | connect | <><

H-E tools | connect | <><

PIZZA Holders sent $PIZZA tips in this post's comments:

@d-zero(2/5) tipped @aggroed (x1)

Learn more at https://hive.pizza.

Geez, I feel like I've been sleeping on Diesel Pools and I need to wake up and make full use of all the options available on the Blockchain. Thank you for sharing this!

Awesome thanks for chatting about the subject. Anymore detailed info about some of those pools would be amazing and maybe motivate others to jump into those pools as well. Speaking as one of the top contributors to a couple of those pools I'd love to see them get bigger and bigger for sure. Also I would have loved to see a slight competitive advantage where every other swap is doing .25% we could have done something even a tiny bit lower. But anyway the main point is I'd love to have tools to know what Fee money I'm getting as a large LP provider. Even daily or weekly volume on pools would be nice now.

Why don't you add Dash in the pool? I think dash is a good liquid coin.

Emphasis added

It reminds me of a line James Earl Jones had in Coming to America (1989) in his role as the king: "I tried normal once. It's overrated."

One reason people can get into crypto is precisely because things are weird here. Under the normal games played under the normal rules, the people kept getting shafted. Then when people like those in Wall Street Bets use the rules in their favor, they get hammered by both market players and their allies in corporate/legacy media. Let the normal people stick with their normal games: we'll take the weird all the way to the moon!

I really like TribalDex and use it quite often now. Lots of really cool features and especially since it is truely decentralized having block-producers (witnesses). I very seldom use the other internal exchanges anymore with the exception of @blocktrades (which really is not an internal exchange technically I guess).

The fees seem very reasonable to me. I have no complaints and have never really experienced any issues with TribalDex. I really like the withrawal features of different tokens/coins like WAX, ETH and the like. Swapping via the pools (the HIVE Uniswap?) makes things very convenient as well.

As I was a little too late to vote on your post, I am tipping you with some PIMP Tokens (as is often said, every token is a 💩-token, until it is not). Great information about the happenings with Tribaldex.

I guess I will have to stay frosty. As you know, here in the northeastern part of the USA we are back down to the teens. My sister says it is not much better in the part of North Carolina where she is currently. Pennsylvania winters, got to love it!

As a top witness you need to be made aware of some incredible abuse going on here. For the good of the hive community and blockchain please have a look. https://hive.blog/hive/@world-travel-pro/mind-blowing-and-shocking-abuse-revealed-on-the-hive-blockchain