Just a quick glance at a 4-year chart of STEEM and a 3-month chart of HIVE reveal striking similarities:

During hype events token price shoots up easily and after an immediate correction it slowly slides until it stabilizes in the $0.15-$.20 range. Token price also seem to correlate well with the blockchain usage and cannot be simply dismissed as a series of manipulated boom-and-bust cycles.

In order to have a meaningful discussion about the future of Hive social blockchain it is important to understand what Hive is. After all, didn't we have four years to figure this one out?

There is no shortage of Hive definitions:

- a social blogging platform with incentives;

- a censorship-resistant media platform;

- a decentralized social network;

- a platform for social apps;

- a blockchain for web 3.0;

- and so on.

But the problem with these descriptions is that none of them can be used to build a business model for future projections. And without a model (even a simplistic one), it is impossible to do a sensitivity analysis to determine the critical variables that have the most significant impact on the success of the system. These variables are essential for setting priorities and estimating the possible outcomes of development projects.

Hive as a Subscription service

If Hive is defined as a subscription service, then HIVE holders are subscribers and the inflation (currently 8.1%) is an "invisible" subscription fee which is being taken (through a dilution process) from user accounts on a continuous basis and redistributed to four groups of beneficiaries.

Why this definition is important? Because it can be calculated in a spreadsheet and can be used as a “reality check” for future projections.

First, let us start with

Subscribers:

Hive allows subscribers (holders of HIVE) to influence the distribution of subscription fees (inflation). It can be compared to, say, Spotify, where the distribution of subscription fees to artists is determined by the demand for their work. Spotify is a centralized service and can offer better terms to the top talent.

In this respect, the proof-of-brain consensus on the Hive blockchain is much more transparent and a fair system, where equal rules apply to all content creators and curators.

Another very impressive aspect of Hive is that the rewards pool receives a considerable 65% share of all subscription fees.

According to the recent blockchain analysis by @sacrosanct, every day 82,252.8 (2.5 million per month) new HIVE being created and distributed.

Which means that Hive pays over $336,000 per month (1.6 million HIVE at $0.21 exchange rate) to content creators and curators. Not bad for a social network with just 22,000 active monthly accounts according to @dalz.

This impressive result is made possible in large part by

Hive Sponsors:

Oh, you've never heard of them? It's time for you to meet... the liquid HIVE holders.

Sponsors do not earn HIVE and can't even influence the distribution of subscription fees and yet inflation affects them in the same way as everyone else.

What is the extent of this phenomenon? According to the recent Daily Hive Report by @penguinpablo, 62% of the total supply of HIVE is kept in liquid (non-vested) form.

In that sense, major exchanges are Hive sponsors: @binance-hot (35M liquid HIVE), @huobi-withdrawal (35M), @bittrex (20M), @upbitsteem (6M), they all keep funds of their clients in liquid form to ensure instant accessibility.

What about passive

Investors:

Users who powered up their HIVE (Hive Power holders) receive back 15% of total HIVE inflation in recognition for their commitment to hold HIVE for a longer period of time.

Even as the amount of their Hive Power increases, the percentage of their holdings is relation to the total HIVE supply continues to decrease at the rate of about 4.7% per year at the current ratio of non-vested (62%) vs. vested HIVE(38%).

Does this mean that passively investing in HIVE is not a good strategy? Not at all! As long as the overall ecosystem is growing faster than the rate of dilution of your capital, you have a positive return on investment. And the value of a social network is often estimated as a quadratic proportion of the number of active users due to the network effect.

There are many examples in the history, when open and decentralized initiatives toppled established closed systems and completely re-invented entire industries. And with all the app development and experimentation going on Hive, it appears that Hive is approaching the critical mass, when it will offer critical advantages over centralized social networks. You may also want to check out an article by @taskmaster4450 Peak Centralized Social Media.

Back in the day, it was not possible to buy "Internet shares", you could only buy shares of a specific company. This time, investing in Hive Power is like participating in the success of all the projects and initiatives on the world's most advanced social blockchain.

Increasing share of Hive via

Active Curation:

For a Hive user to maintain the share of HIVE, their Hive income must exceed the rate of inflation of HIVE (currently 8.1%). And this is not an easy task.

According to regular reports published by @dalz, the best Hive curators are outperforming inflation, but not by much: @appreciator (12.6%), @upmewhale (11.7%), @rocky1 (12.9%).

To achieve this level of performance, it is essential to use automated voting tools (e.g. hive.vote) and use all available voting mana in a consistent manner.

Decentralization of HIVE

This may not be immediately obvious, but the fact that current HIVE owners cannot easily increase their share of Hive is good news.

First, it ensures that the decentralization of the blockchain will continue in the long term. Today, Hive is already one of the most decentralized blockchains in existence and is a significant step in that direction compared to Steem (https://www.waivio.com/@arcange/is-hive-decentralized-and-who-governs-it). According to @arcange: "the first 31 accounts hold only 35.74% of the Hive Power".

Secondly, it offers better opportunities for new users to join the network, as existing holders are also required to add value to the community to maintain their status. This allows new users to thrive on Hive and establishes a positive atmosphere of fairness.

Beneficiaries:

There are four groups of beneficiaries that receive the newly minted HIVE. Authors and curators together receive 65% of the inflation and it is shared approximately 50/50 between the two groups. Hive Power holders receive 15%, while blockchain witnesses get 10% and another 10% is allocated to the Decentralized Hive Fund (DHF/DAO).

According to @dalz: “A total of 8,697 accounts have earned authors rewards, out of which 7,191 have earned more than 1 HIVE. The top 20 earnings, is around 7% of the total author reward pool.”

At the same time, top 20 witnesses receive 82% of the witness pool, which makes them one of the highest HIVE earners and potentially one of the most significant sellers of HIVE (witnesses need to cover hosting and capital expenses for the network nodes).

Another significant source of liquidity are the recipients of DHF/DAO funding. Currently, only 8 projects receive funding from the fund in support of software development and other initiatives.

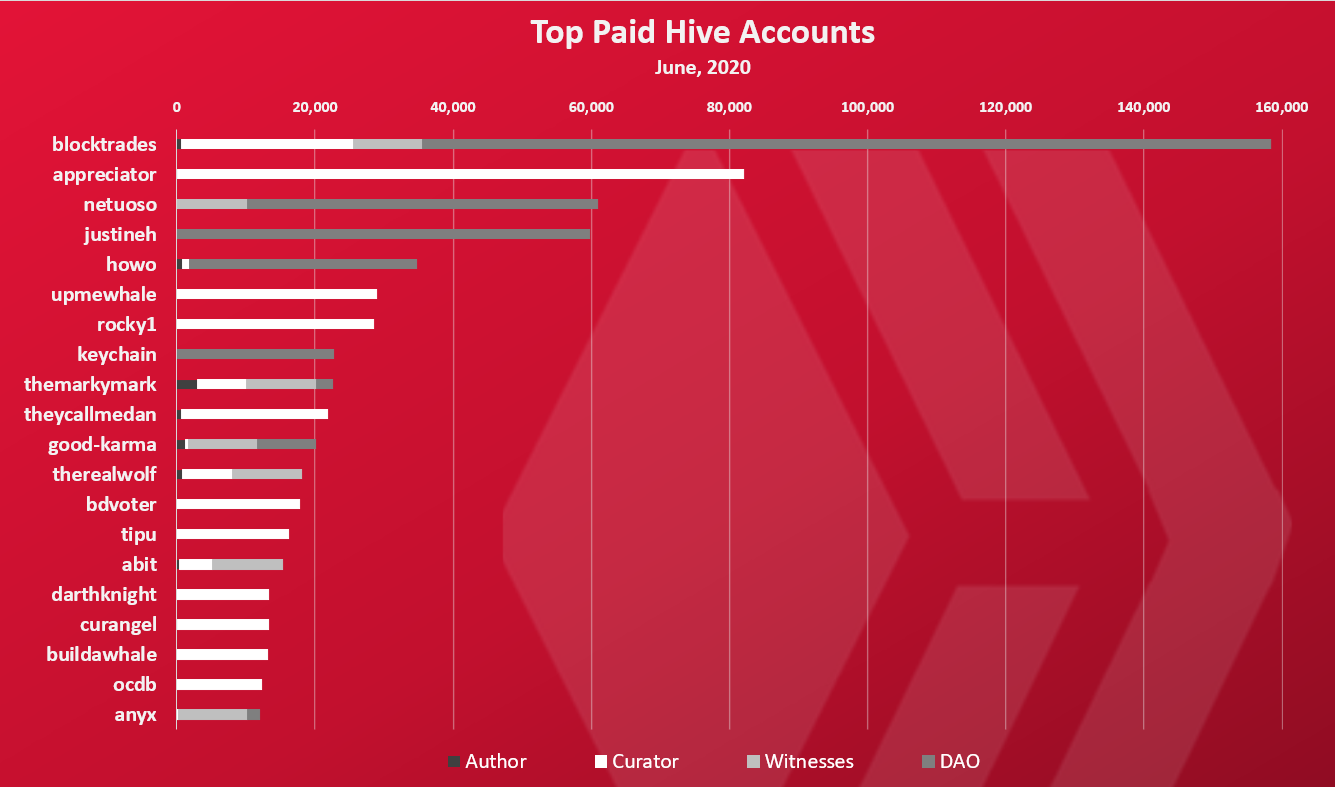

There is an interesting chart published by @dalz featuring top 20 cumulative HIVE earners for June 2020:

What we can see from that chart is that 6 out of 8 DHF project recipients are in the top 20 along with top 11 curators and 7 witnesses. About half of top earners have two or more income streams on Hive.

Quick analysis

If we were to optimize the model for the price of HIVE, it is important to understand the balance of HIVE inflows (buying) and outflows (selling). We can have a model of the re-distribution mechanism, but we also need a deeper understanding of the selling habits of beneficiaries.

Hive been around for just a few months and much of the trading activity was associated with users moving their assets between Steem and Hive, but in the last month we see some level of stabilization.

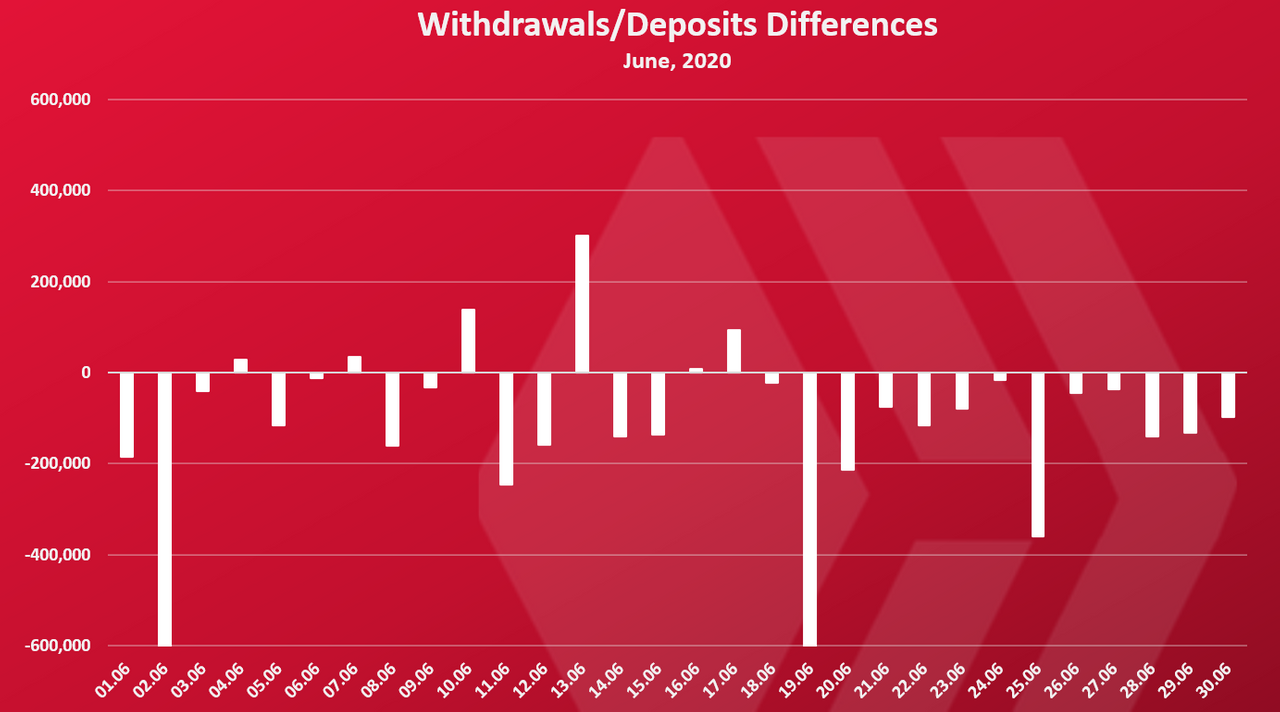

Net deposits/withdrawals chart from the Exchanges Transfer Report by @dalz:

Note: Net outflows to exchanges may drive down the price of HIVE, but the net difference between the HIVE transferred and withdrawn remains in liquid form on exchange accounts, which serve as sponsors for the Hive community, as explained earlier.

What we now know is that beneficiaries continue to sell HIVE until the price approaches $0.20, at which point some of them begin to accumulate more HIVE, while others (for example, users from countries with lower per capita income) continue to sell their Hive revenues. As a result, we see a flattening of the curve, but the slow decline in price continues.

Strategies going forward

There are some ideas and strategies being discussed by the community. For example:

Onboarding new users

There seems to be an almost universal consensus that if it were easier for new users to join Hive, the price of HIVE would rise.

Unfortunately, the subscription model tells us that if these new users were to join Hive without buying a lot of HIVE, then the price of HIVE would not increase. In addition, new users who don't have a lot of HP on their accounts are unlikely to earn a lot of new HIVE, which means that these accounts will not work as a trap for the newly minted HIVE either.

Improving blockchain software

Operators of blockchain nodes could benefit from software that requires fewer resources and is less costly to operate.

This in turn would allow witnesses to sell HIVE cheaper and drive the price down even further.

Card games and non fungible tokens (NFTs)

Since NFTs do not use HIVE as collateral, their success on the Hive blockchain may not have much impact on the price of HIVE. Essentially, they function outside of the Hive subscription model.

Reducing the inflation rate

Reducing the speed of transfer of value (subscription fees) from current holders of HIVE (subscribers) to beneficiaries can reduce the amount of HIVE available for sale. At the same time, however, it may reduce the motivation of authors and curators to engage with Hive.

Throughout Steem's history, the rate of inflation has been reduced, but this has failed to prevent the price of STEEM from falling.

Communities

In line with the subscription model, the introduction of the communities did not increase the price of the token, as the communities do not increase the demand for the token (at least until the introduction of SMTs), nor do they reduce the selling pressure.

Smart Media Tokens (SMTs)

The unique feature of SMTs is the Automatic Market Maker (AMM), which allows instant conversions between HIVE and the smart media token. This process requires certain amount of HIVE to be locked in the AMM. According to the subscription model, these HIVE accounts will operate in a similar way as sponsors (holders of liquid HIVE), offering a considerable advantage to all other participants in the Hive blockchain.

Depending on the extent to which SMTs are adopted (apps, communities), they can have a major impact on the price of HIVE.

Attention trading

Disclaimer: The author is actively involved in the Waivio.com project, which includes attention trading.

This is a form of decentralized, action-based advertising, where companies place offers directly on the Hive blockchain, announcing rewards for certain actions, such as including a link in a post, viewing a video, completing a survey, tracking an account, etc. Offers also include eligibility requirements for users, such as minimum reputation, number (quality) of followers, number of posts, etc. Once an eligible user makes a qualified post / comment / action on Hive, the company makes the payment.

In the process, companies purchase liquid HIVE and distribute it in small quantities to many users on Hive. Some users may choose to cash out their rewards, while others may choose to accumulate them.

The attention trading creates a continued positive demand for HIVE.

Attention bids can also play an important role in onboarding new users, as they will have a clear path to earning HIVE, particularly in the early stages of their experience on Hive.

Conclusion

The Hive blockchain provides a transparent and fair mechanism for the distribution of subscription fees (inflation) to authors, curators, witnesses and developers. But without stable external demand, the price of HIVE is destined to return to the historical resistance level in the $0.10 to $0.20 range, where many beneficiaries prefer to accumulate their HIVE earnings rather than sell them.

Many exciting and promising projects and initiatives are taking place at the same time on Hive. Our quick analysis within the narrow definition of a subscription model revealed that Smart Media Tokens and the attention trading have the greatest potential to establish a long-term positive trend for the price of HIVE.

Please join the discussion in the comments.

'Throughout Steem's history, the rate of inflation has been reduced, but this has failed to prevent the price of STEEM from falling.'

Remember this could be attributed to the fact the CEO was incompetent and was selling Steem relentlessly instead of selling decent amounts at 5 and 6 dollars to provide funds going foward. He failed to plan for the future where as we wont. I always see projects with great tech and then ruined with bad economics. They produce massive token amounts because they plan on some mad adoption in future which never materialises. The only way to maintain value is to keep scarcity. Its the only way and is why XRP and hundreds of coins like it TRX etc etc will never maintain a value because they are just not scarce and never will be. XMR and all POW coins mined into existence with small token caps are the only ones that will maintain value long term IMO. Investors will then look at a coins history and say ok its been going 5 or 10 years and maintained a long term trend, ie its not going away and this then gives them the confidence to invest.

Indeed, Steemit was selling a lot of STEEM to cover development costs. Do you remember the time they laid off more than 70 people? Later, a much smaller team was able to deliver a lot more. And yet, we still don't have SMTs...

yeah i know, as soon as the inevitable bear market took hold it was like uh oh and investor confidence went with it. Utter incompetence he just didn't care one hoot about the project only the money and fame.

What a great analysis! Others would have made 3 posts out of those insights.

First time I hear about waivio.com. Pity it is not in Europe yet. May I ask how you have engaged those restaurants, did you actively went there and told them about the project? There are some restaurants in Europe, like @pizzajohn who might be potential partners.

Both Hive and Waivio are global systems. In fact, Waivio is designed as a multilingual system, where not just the interface, but news feeds can be filtered by language(s). Waivio is using Object Reference Protocol to post data (items, products, companies, lists, pages, etc.) on Hive blockchain and these objects can also exist in different languages. Once the object/item is posted on the chain, anyone can reference and use it.

Once the object is created, it can be referenced in Hive posts (by URL) and such posts will be linked in the Reviews section of the object (restaurant, product, item, place, etc.)

Rewards campaigns are also global. Sponsor can specify eligibility criteria for users and specify requirements for a review. And just post it on Hive.

Waivio is an open source project which is designed to be replicated.

Some guides chose to sponsor rewards campaigns out of their own pocket. And once they collect 20 or so reviews, they will present it to a restaurant and ask if they would like to continue the rebates program at, say, $5-$6 per new customer. There are many business options already available, such as excluding busy days (ex., Fridays & Saturdays), requesting a copy of the bill (with unique number), max monthly budget, registered upvoting accounts and more.

wow, that was a great post. This is one I would point people towards. I dont always understand these sorts of mechanics and projections and technical stuff, but this was made very clear. Communication like this gives me hope that all of the brilliant people who work on this platform can come together and strike at the future with clarity and purpose.

The key advantage of the open and decentralized blockchain (or open projects in general) is that many initiatives can be developed by different groups of people and they all can have different ideas, priorities and strategies.

And yet, we all benefit from successes and failures of each other. If an app can bring more people, engagement or increase demand for HIVE, all other apps would benefit from that as well. And failed experiments teach us what not to do, or very often give us new levels of understanding which can be used to build even greater things.

Im not a developer but I have an idea for a charitable Dapp that I believe would be good for onboarding and increasing demand for HIVE. Im hoping to do a post about it soon, so any feedback or further discussion would be great : ) I just want to see good ideas propagated and some of the immense potential of this blockchain fulfilled!

heres my initial thoughts on a charitable dApp that I think could potentially be powerful for onboarding and increasing demand of HIVE. Your feedback would be massively appreciated : ) https://hive.blog/charity/@basilmarples/hive-charity-dapp-initial-thoughts-discussion-please

I posted a reply on your proposal. Subscription model clearly shows that "demand" for HIVE comes from new users **buying **HIVE, not from selling HIVE. Inflationary rewards (subscription fees) do not come from "thin air". They come from the pockets of existing HIVE holders (subscribers).

There are many people donating money to good causes all over the world. And Hive blockchain offers free payment transactions, which can be used to distribute donations to those in need.

awesome. thanks for your feedback! Ive posted a lengthy reply to your critique which I hope sheds more light on the position I am coming from (as well as conceding to my own lack of technical knowledge!)

Im not sure if this particular comment is in relation to my proposal,but I certainly wasn't suggesting reasons to Sell HIVE. Quite the opposite. My Charitable application concept would be encouragement for common folk to BUY HIVE. Just checking there hasnt been a misunderstanding! :)

really good post, clarifying how the system works! I got a question myself regarding inflation. I made a post some days back in which I looked at the return of investment on Hive through curation. In this I left out inflation which I think makes my analysis incorrect: https://peakd.com/hive-174578/@tobetada/compelling-arguments-for-becoming-a-hive-investor

From what I understand it means that as long as I make ~8% ROI my stake in Hive stays the same, right? Would the calculations then be accurate?

There are couple aspect to it. First, if no delegations are involved and you powered up your own HIVE, then inflation affects you a little less, because 15% of inflation is being distributed to all HP holders (currently 38% of all HIVE is powered up, so instead of 8.1% dilution your are facing only 4.3%).

If through active you will make another 4.3%, then your share of the total HIVE supply will remain steady or even increase.

Make sure you are upvoting quality content though ;-)

thanks for your response! :) and yes, I am trying to upvote good content and help small accounts grow, like everyone should 😅

Brilliant post. Some great points made.

I dont know why SMTs arent being discussed more but they are crucial for the growth of the ecosystem. Im starting to feel like the developers completely gave up on SMTs and will try to push this 2 layer dapp idea.

Id rather they dont, but HIVE so desperately needs a business model and a vision which ive been advocating for so ill take that if we get nothing else.

What is the message wer sharing about hive now?

Well, if you look at what the community has been repeating everywhere is that HIVE is a place where you cant get censored, and that has no CEO, and where you can earn some money.

Awesome.

But what does that say to the investor or a project leader, a dapp developer?

NOTHING.

Its good to spread the word about Hive which the community will do but in the end this is just pointless fluff that might attract idealists but it wont attract a large number of investors.

NFTs are a interesting feature but with HIVE not appealing to larger masses of crypto users NFTs wont be able to attract more buyers and NFTs will mostly act as means to move Hive from the hands of 1 hiver to the hands of another, not doing much for the price.

HIVE needs to rebrand itself. Being a place where you post some stuff, get a few votes, take some inflation from the reward pool doesnt work. Basing your business model on the reward pool has shown to be an atrocious business idea as shown in the case of bots, in the case of Utopian, etc.

do you have any more concrete ideas as how this rebranding could look like?

Read my last post and a few of my last few comments.

Here on Hive we have a very advanced and generally speaking fair distribution system for rewards. But this is only one half of the equation.

If we increase the user base at this stage, the only thing which will happen - the price of HIVE will dive even further.

But there is the second part which is being born as we speak. Allowing companies to bid for attention of users, by posting rewards offers directly on the blockchain. Hive frontends can personalize these deals for users based on their eligibility and receive processing commissions for brokering these transactions.

Hive open blockchain has a lot of user data that can be used for targeting. For example, your profile has an Expertise section (https://www.waivio.com/@lordbutterfly/expertise) which shows how important are different topics for you (based on your history of author and curation rewards). Each offer can have different eligibility parameters listed.

In order for the user to submit a qualifying post/comment/json to the blockchain, they must use their keys, thus providing a confirmation, that particular action was done by that specific user.

This way companies can be certain that it was the targeted user, who actually posted/confirmed an action. But at the same time attention trading process gives users full control over selling their own attention and makes them the main beneficiaries in that process.

It is no longer done through intrusive advertising, but rather through voluntary engagement be the user with direct action-based offers from companies, which are aggregated in the Rewards section of the site. User may chose to browse them at their convenience, follow some sponsors, ignore others, set thresholds for rewards, etc.

Attention trading works well in a distributed environment. And now, growth in user numbers will not longer lead to the drop in the price of HIVE, but instead will create a positive demand for HIVE from companies, which buy tokens in order to reward users.

This way users receive payments besides inflationary rewards. Some users will cash out these rewards. But as long as some users will still keep earned HIVE in the system, the overall balance will be positive. This is a very powerful driver for the price of HIVE.

These two parts of the system will work as a perfect tandem with the price of HIVE balancing inflows and outflows from that system.

The ability to break down such complex material in chunks and making it understandable for the masses is also a skill mister @grampo . Nice going!

I am hoping for a good feature of HIVE and yes there needs to be some bigger step to the masses. One of them I do believe is your dining concept. But indeed, investors needs to want this to putting in the 5 bucks for some reason. But all those 5 bucks from multiple resaturants...is a good inflow on the chain

Hopefully we will get out of this deadlock ( because that is how I see it as well, this phase is good, though we are stuck in it and need to break out to the masses) and make the true potential come out

Onboarding new customers is very important. That is why Waivio offers guest accounts, where new visitors can simply use their Facebook or Google social accounts to post on Hive. Guests can participate in attention bids and receive HIVE rewards (both through upvoting and transfers of liquid HIVE).

We also make it very easy for them to withdraw their earnings through any Bitcoin ATM (transfer HIVE into BTC/LTC/ETH).

For a new visitor it should take just few minutes to register, reserve the reward, post couple photos of the dish and receive tangible rewards.

Thorough and interesting read that I largely agree with. I believe the absolute key is simply growth in the userbase. While I don’t expect most casual users to purchase Hive, and drive price & demand directly; businesses will follow where the people are.

I’ve always found Waivio to be very interesting and the vision presented in your initial proposal was right in line with my own future expectations. I fully believe in influencing behavior and rewarding people through upvotes. The fact that businesses and brands could direct their ad spend into purchasing Hive Power and voting on favorable content is incredibly powerful. Hypothetically a business could increase the visibility of positive mentions of their brand, while simultaneously rewarding their customers and promoters... and feasibly end their “ad campaign” with more capital than they started with... 🤯

We just need the bodies & eyes here to add value to this attention economy.

Today, rewards on Waivio are paid out as a combination of upvotes and liquid HIVE. It seems that companies in general are not willing to make large marketing investments, such as buying Hive Power, but are very open to pay-per-action advertising.

For example, a restaurant is open to the idea of paying, say, $5 for a new visitor. A post with two photos of a specific dish serves as proof-of-sale, which becomes the basis for the user to receive the reward.

Here are some active campaigns on Waivio: https://www.waivio.com/rewards/all (most of them are focused on restaurants in Vancouver, BC, Canada).

The reward is advertised in USD but recalculated into HIVE at the time of reward reservation. The reservation is a formal commitment by the user to write this post according to the terms.

Once the qualifying position is published on the blockchain, the Waivio campaign server calculates the payment obligations between all parties involved (company, user, other beneficiaries of the post, campaign server, index server, referral party).

This is reflected in the section Rewards/Receivables for the user and Rewards/Payables for the sponsor.

There is a special service called Matchbot, which automatically upvotes the qualified posts. Then the sponsor only has to cover the difference between the value of these votes and the reward obligations.

The upvoting accounts must be pre-registered by the sponsor, when the campaign is announced on the blockchain. The value of all other upvotes is not deducted from the reward obligations.

This approach allows for so-called guides to help companies manage their marketing campaigns on Hive.

First of all, guides collect a management fee (say 25%) on the rewards that will be distributed to qualified users, and on top of that, they can also retain the value of positive votes. Waivio supports compensation accounts to collect the difference.

It is assumed that the guides have a much better understanding of Hive dynamics and that they would be motivated to actually buy Hive Power in order to increase the profitability of their marketing business.

What's the plan for Waivio to list restaurants globally ? I know the current situation is not going to allow to expand, but is going global on the to do list ?

Waivio is an open system. Anyone can simply add restaurants, businesses, products in their area and start a guiding business (manage rewards programs for local businesses on Hive). All the tools are there today (billing, reporting, payments, blacklists, admin controls). It does not require any technical knowledge or expertise.

We are currently working on a web hosting solution, where any Hive user will be able to start a specialized social site by selecting related items (e.g. restaurants and dishes in your area), add related news and launch a fully operational site with products, news and even influencers.

I will definitely market it in my area, once everything opens up.

Thanks for the explanation - not many people seem to be able to make this stuff easier to understand

Excellent read and your conclusion is precisely my view.

I had s similar conversation just recently. That rewarding the time spent as an active observer needs reward in order to retain a large userbase. Just rewards for CONTENT (and clicking an upvote button) is a limited system.

I believe that HIVE could implement that now. Without SMT. A simple example would be creating a chat app that rewards the mundane social interactions. Users who don't even interact with the platform can earn incentive rewards, and by that, the Blockchain benefits. Fractions of hive accumulated by simply choosing HIVE for your communications would be a good way to reward people from disadvantaged countries (provided the use of the rewards in real world is also implemented).

You can then build on that model using your examples. A user can then opt to receive ads. That grants them a little better ability for rewards and the brands advertising have actual ability for an ad to be viewed and lead to possible product sale. Rewarding purchasing through this system again, also something that could carry incentives.

All these proposals currently exist as little closed projects that, as you explain, see themselves as mass adoption solutions but really WON'T add the value the platform needs. Without SMTs also, the fundamental backbone is missing in order for these operations to be truly working for that common goal.

Personally I've got some clever ways on how this here (and Blockchain in general) could be coupled with other platforms which would be great benefit to this platform, the talent of content creators, and the future price. The system just isn't there yet though so I won't elaborate on them.

I see this system as a top down solution. Reward the top and convince yourself that you're going to attract masses... simply because you've become indoctrinated into the cultish belief that this is the best Blockchain and everyone in the world will want to be a blogger or a clicker.

Blogging is a solid foundation for a social network, but Hive can be lot more then just a "decentralized blogging platform".

Some people are good at writing long and meaningful posts, but there are many other forms of social interactions, which can also provide deep value, especially, when the knowledge is accumulated over a number of posts made by different people.

For example, a quality in-depth review of a restaurant has value as a separate post. But at the same time, a stream of social posts with photos of the dishes from that restaurant, posted by different people, tags, ratings can offer even greater value.

Waivio makes it easy to create data structures on Hive blockchain. You can create a new restaurant, new business, new product, dish, list, page and more. This new item will have a permanent link on Hive, but the data fields (title, address, hours, social links, avatar, photo gallery, etc.) can be added to that item by other members of the community.

Now, every time you include this item link into your Hive posts, it will be automatically associated with this item. For example, you add a link to a restaurant and to a dish. Now your review will be featured as part of a news stream on both objects.

Another important factor is that all that data is available on the open public blockchain and you can use it to build social sites, apps and services.

For example, a company that sells a product, can put description of that product directly on Hive blockchain and all their resellers can simply index it from the chain.

And when the manufacturer updates that information, it will be immediately updated on all the sites.

When someone would like to build a social site about hiking and integrate related products, they could just select them on the chain and have them listed on their fully social and interactive website in minutes.

Man that's again my view. Collaboration of the network to realize value of the collective, whilst granting elemental value and reward also.

I'm very supportive of the ideas you're expressing. You are the very people needed here to evolve this thing.

That's an idea I hold too that for example on a platform like Instagram, there could be actual reward for each post when it's linked to a business that generates sales and has a cultural connection to the collective.

Similar to your restaurant example, I see for instance, a person wearing a branded outfit as DOING MARKETING in those images they upload wearing brand X. Since they've also (likely) purchased that item, the company has received reward already, so then a return for the marketing done by the wearer is a system which benefits both parties.

As is, people pay for brands AND advertise for free by wearing those brands. Only corporate wins. These systems are what will change when we as that free workforce realize how broken that system is.

To just claim "this is decentralised so bring your content" is nothing. There needs to be new systems excecuted that give the outside a look of something that makes better sense. The flow on effect is what then generates that real world use that Blockchain and reward systems will eventually become.

Years yet imo.

Greetings, @grampo very interesting reading. Although I am not an expert on these topics, I agree with you when you conclude that "without stable external demand, the HIVE price is destined to return to the historical resistance level in the range of $ 0.10 to $ 0.20, where many beneficiaries prefer to accumulate their HIVE profits instead of selling them. " If I'm not mistaken, supply and demand is crucial to boost the value of the Hive.

It is always a challenge to focus on what is strategically important. Too often, we focus on immediate needs and interruptions.

The launch of Smart Media Tokens (SMT) should be the first priority. The long-term success of the Hive depends on it.

This is the best analysis and explanation I've seen so far. As someone before me said, it's not easy to explain these things in a way that many understand.

The top 20 cumulative hive earners list was a surprise for me, I'm not sure everyone deserves to be there but it's not my decision.

I'm looking forward to your next post to learn more about the current state of hive and also for some analysis. Jeep up the good work.

Thank you for your support and attention. It's an exciting time seeing ideas being implemented and getting ready for prime time.

Good break down of ideas.

So the future is SMTs and attention trading. I think SMTs will also improve attention trading.

I think communities can and should be improved.

I've been waiting for SMTs forever now. in the meantime, I hope hive gets cheaper.

After the split fork, it got to the point where I don't even want to hold most of my investment anymore because I have doubts the SMTs will be released, or if it will attract attention at this point. It may take years after they are released for things to get interesting.

Whoever came up with the original concept for SMTs was a genius. Sadly, it takes years for this to come to fruition.

I agree. I am willing to wait about 6 more months for some very clear news. I have my hopes for HF25, but we will see. Now since no one 'official' talks about it, I have my doubts and expect it to come out in about 12 months at the earliest.

For attention trading, which is the only sustainable model in the long-run, to work the user base MUST grow by many orders of magnitude.

This is why our initial focus is on restaurants. Small number of active diners can generate a lot of dish reviews. This way we don't need mass adoption to build a solid business.

Great text!

I hope you write next time about SMT tokens. We need someone like you to explain all its greatness.

Then hopefully SMT will become the reality.

I think circlejerking is one of the big problems we face. Not healthy for new user retention.

It will take months (if not years) for a new user to learn about self-voting and circle-voting.

But one thing any new user will immediately notice - a negative vote. There is a reason, why major social networks do not have downvote options. This is a huge deterrent to the user experience and it turns new users from "promoters" into "demoters" of the network.

If I post something on Facebook, I only need to care about my friends who might see my post. On YouTube, Twitter, Instagram - I have to be mindful of corporate censorship (which goes beyond officially declared rules).

But here on Hive things are much more complicated. We've got a set of "community authorities" which invent their own policies and can cause serious harm to those who dare to trespass these rules.

Communities on Hive can provide a shelter to sub-groups of users from these overreaching policies, but only to a certain degree. The only effective solution - are SMTs, because they would enable sub-communities with a specific distribution of voting rights.

Great job!

Nice post, thanks for sharing

An important and pretty helpful analysis :) Thanks

Truly amazing this blockchain. I only write content and curate, knowing nothing about dev or code or anything like that. All I see is a system that creates money out of nothing, as much money as you want, from an unlimited pool. What magic. And it gets given away to me and other creators who have never bought any Hive. And we just get rich on it - at least here in South Africa where the currency is not worth much, I can live off this free pool of Hive money. I used to think Hive was going to increase n value and that I should just hodl until it rises in BTC value if nothing else, but from what you are saying here, Hive will always stay at $0.20 max. Oh well time to sell.

Yeh, money does not come from thin air, it is always coming from somebody's else's pocket: whether it is an inflation of our paper money (printing national currency) or a fractional reserve banking system (managed to give out 65X more credits than money in existence), government bonds, company IPOs, derivatives and many other creative forms of I-Owe-You (IOUs).

In comparison, cryptos allow us check out from that crazy paper (or digital) fiat money system. Cryptos are not IOUs, cannot be easily printed and all other things you already know.

As for HIVE vs Bitcoin - hard to say. Bitcoin is heavily manipulated via derivatives (futures on CME and more). HIVE is a very inconvenient crypto to manipulate, because much of it is being used in live operations. It is much easier to manipulate assets which are bought mostly for speculation (ex. Bitcoin).

Congratulations @grampo! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board And compare to others on the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Support the HiveBuzz project. Vote for our proposal!

Very important information 👌

One of the best post I've read here in a while. Amazing analysis overall!

Thank you for talking about the AMM, I don't understand why it hadn't been talked about more despite it's one of very few HIVE sink that are proposed on the white paper while the the other ones already proven to have ineffective implementation and failing to remove enough HIVE from circulation.

Indeed, SMTs with AMMs are the greatest HIVE sinks. And these are active sinks, because these tokens are not sitting passively, but are being actively used by the app and the sub-community to create value, attract more HIVE->SMT conversions, bring new users and a lot more.

SMTs must be the top priority for the development of Hive. Instead, we are spending our limited development resources on tactical "nice-to-have" initiatives.