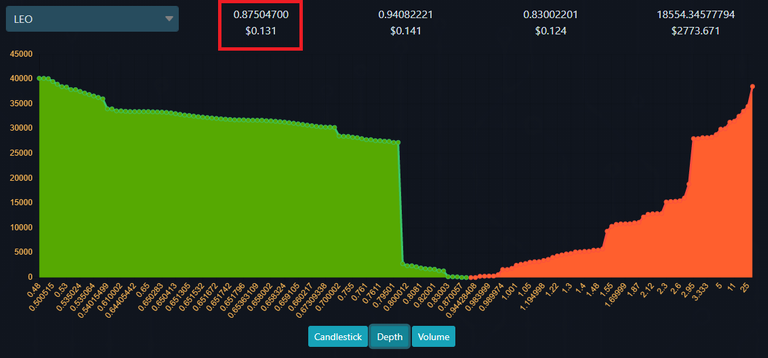

We now see a huge buy wall at 0.8. wLEO is adding so much liquidity to the market this person knows they can buy at 0.8 and just sell back into ETH on Uniswap. 0.8 Hive is 12 cents, so huge buy wall at 12 cents and 15 cents on Uniswap. I still had 1000 Hive.Swap coins on Hive Engine and I'm frontrunning that buy wall. That's just free money on Uniswap if anyone dumps into it.

Value of ETH

There are several considerations here to take note of. The derivative market (UNISWAP) is controlling the main market. A LOT of money would have to get dumped in one direction for the price to move at this point. However, the LEO community is pretty much tapped out at the moment in terms of buying.

This means the ONLY entities that can raise the price of wLEO (and in affect LEO) are people who are putting a lot of ETH into the market. There will also be a few people who put more Hive into it on HiveEngine which will create arbitrage opportunities, but considering the liquidity difference big money can only come from the ETH side of things.

For the price of LEO to crash, hundreds of thousands of coins would have to be sold for Ethereum. LEO is a community of zealot holders. That's probably not going to happen. We all bought up to this moment in anticipation of something happening, unlike with wHIVE.

Of course the same fate that befell wHIVE could also come for wLEO, but we can already see some differences...

The wLEO market has over 30 times the liquidity of wHIVe within the first 48 hours. Hive didn't need Uniswap, wLEO did.

Other considerations

0.3% fees

The fees on Uniswap are actually pretty steep. You know how much Coinbase charges? Half a percent. What about Binance? A tenth of a percent. Uniswap's fees are three times larger than Binance.

In the first day I've farmed 76 cents. It's not much, but it's also not nothing and I wasn't even calculating it into the yield farm bounty. If volume picks up at all and multiple people are entering and exiting the market, fees collected by liquidity providers will be quite high.

Our liquidity is so amazing now with wLEO I could drop my entire stack on the market and not make that big of a splash. Slippage would not be a big deal. There are already half a million LEO in the pool and I have less than 50k.

Like all other LEO whales... I'm not doing that, I'm yield farming this pool, one way or another (upvotes vs Uniswap).

Peg to Ethereum.

The price of LEO is extremely pegged to ETH now. If ETH loses half its value, wLEO loses half its value relative to the dollar. This would allow users to buy wLEO for 7 cents a piece and dump it on the Hive.Swap market. If you're trying to catch arbitrage opportunities like I am something like that can get you burned fast if you don't remove the limit order and ETH is crashing.

However, this is a good peg to have because ETH is a lot more stable than LEO ever could be during the early game. I believe ETH and BTC are at the bottom and ETH will outperform Bitcoin over the next 3 months. Meaning, on top of wLEO just gaining value from ETH being dumped on the pool, a rising price of ETH will also make LEO more valuable. Again this derivative market fully controls us. We are an Ethereum coin now, financially speaking. The 1000x liquidity on Uniswap will overpower anything listed on Hive.Swap instantly.

It almost feels like a small company stock getting listed with the big boys. The interesting thing about wLEO is that it actually does stuff, whereas a ton of other ERC-20 tokens don't do anything yet.

What's going to happen if people on Ethereum start looking at wLEO?

Wait, so it has a website that pays money to bloggers about making money?

Wait, I can take my wLEO, unwrap it, and power it up to yield farm all over again?

We are essentially targeting ETH yield farmers with a coin that yield farms in multiple ways and has a website that pays out coins for organizing financially profitable data. I'm just now realizing none of the ETH yield farmers have ever had access to anything close to that... hm.

Slush fund

When money enters the pool from one side and takes from the other, that changes the ratio of the UNISWAP pool and triggers the 0.3% exchange fee. If a bunch of ETH get dumped into the pool wLEO gets taken out of the pool, and vice versa.

I don't think it's possible for LEO to drop in price right now, we've set the floor on Uniswap using an exchange algorithm that provides x1000 times the liquidity of our on-chain exchange. This means that LEO is fully pegged to the value of its own ETH ratio. Big money has to get shoved now for the price of wLEO to move. I don't know any rich LEO investors... do you? If we get a single one from ETH the price will pump.

How much we talkin?

Looking above we have 240 ETH in the pool. If someone matched that 240 ETH the price of wLEO would quadruple (double ETH pool and cut wLEO pool in half). That's around $82,000 at these prices.

Consider our liquidity on HiveEngine, and it's impossible to pump $82,000 into LEO; the liquidity just isn't there. You wouldn't double the price, you'd x1000 it. This Uniswap pool opens up the gates to people with a lot more money.

Then they realize after they are done yield farming the bounty they can power up the money and dish out inflation and yield farm some more.

We are opening up the gates to a new community and giving them months to figure out how to use the website. This community is already technically literate, because they are farming ETH pools. LEO and Hive aren't any more difficult to use than that.

The only way LEO can lose value is if ETH loses value.

- Relative to the dollar/BTC,

- and assuming LEO is a community of holders.

The only way LEO can gain value is if ETH pumps the pool.

- Hive can no longer pump the pool, it creates too many arbitrage opportunities for the zero-liquid pool.

- Also Eth gaining value adds to LEO, and vice versa.

So who's going to pump more coins into the market?

Is it going to be the LEO whales? That group of zealous holders? Will they be the ones that dump hundreds of thousands of coins on the market? No, they are all yield farming the Uniswap pool. Uniswap allows stake holders to own and fund their own exchange. That's what we are doing, and it's the best option we have for liquidity right now, unlike Hive.

Conclusion:

If anyone dumps into my buy order at 0.83, I can immediately dump it out to ETH for a profit, send it to an exchange, turn it into Hive.Swap and repost the buy order. Free money arbitrage.

The derivative market wLEO is x100 times more liquid than the traditional orderbook market. Yield farming may still be worth it even after the bounty ends from 0.3% fees.

LEO is now targeting a community of new yield farmers with a yield farming token connected to a functional website. Onboarding to Hive may be an issue.

1000x Uniswap liquidity fully pegs LEO to the ETH ratio of wLEO. If ETH crashes, LEO crashes. There is little way around it because the liquidity of the 'main' exchange is too small. ETH spiking gives LEO a spike. I guess we'll see how that plays out going forward.

Having just last night "jumped in" to this liquidity pool, I find your posts to be very helpful @edicted. I agree with this ...

... as before I found your post, I had already begun the process of "reloading" on ETH from all that I needed to put into my stake last night. To do that, I'd converted my BTC "stash" into ETH and went from there ...

I did not understand this ...

... as I thought the only way to get involved was to supply "both sides" when adding to the pool. What am I missing?

What are your thoughts on steadily adding to the liquidity pool? There was a big push on yesterday, for understandable reasons. But ... Going forward, from your perspective and experience, is there any downside to continuing to add to the liquidity pool?

The yield farm has diminishing returns. Only 300k tokens are being airdropped. The bigger the pool is the less coins you get in return. However, a bigger pool points to a higher market cap and token value.

If someone on ETH wants to start yield farming wLEO, they have to buy wLEO first and then provide an equal amount of ETH. So in that situation if the guy was planning to yield farm with that he'd put in another 240 ETH to match. He'd then be yield farming half the current pool. Users can also choose to unwrap and power up without matching ETH to yield farm.

It's not about the ETH that gets matched though and more about the wLEO being bought with ETH. Lot of guys out there just have ETH sitting around and they are wondering what to do with it. Maybe some will yield farm wLEO.

Okay, very good. Thank you @edicted! 👍

Posted Using LeoFinance Beta

I would love to see ETH spiking! 😃

I'm almost expecting a x2 from Bitcoin and a x3 from ETH.

Guess we'll see.

I am ready for it! 👀

I read your post and you mentioned yield farming leo.

Is holding #wLeo in uniswap for opportunity to farm?

Or participation in LP?

Keep writing these posts so I can fully comprehend

the terminology around #defi

!BEER

Posted Using LeoFinance

View or trade

BEER.Hey @edicted, here is a little bit of

BEERfrom @pouchon for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.