Bottom Line Up Front:

If elected I will absolutely oppose any new tax and any tax increase. Along with that, I will oppose any increase in spending for any piece of Wyoming government.

Taxation is theft. That’s all there really is to it. In the world we live in, we have a state government and that government must be funded by taxes. However we need to be very careful about how public money is spent because at a fundamental level, each dollar the state spends was seized from a private person with the threat of deadly force.

The past century has provided numerous examples and proven beyond a shadow of a doubt that anything that can be done in the private sector will be done better than it will be done in the public sector. We need to look hard at Wyoming government services and decide which ones we really need, understanding that government is AT BEST a necessary evil.

Wyoming Is In Serious Financial Trouble

Wyoming has been having trouble balancing its budget for years despite a handful of recent tax increases on fuel and the introduction of a state lottery, or as I like to call it, “The Stupid Tax.” Then we got hit simultaneously with an oil bust, and a lefty Governor who pushed misguided Covid-19 panic measures that killed our small businesses.

With what may be a billion dollar budget deficit, the 2021 legislative session bandwidth will almost all be consumed by taxing and spending issues. I don’t know even a half a percent as much as I need to know about Wyoming fiscal issues, but win or lose, I’m going to be seeking as much education on these issues as I can get over the next few months.

How We Got Here

Historically Wyoming has been an extremely well run state fiscally speaking. We are a small state, at least in regards to population, and we are a poor state. Our revenues vary wildly year to year based on mineral prices. Wyoming was headed into budget trouble in the late 1990’s and a special panel was appointed to look at ways to increase revenue by then Governor Geringer. Of course the panel’s big recommendation was a state income tax. That idea wasn’t popular at all, and in 2001 when the coal methane boom really got going in Wyoming, statist dreams of a Wyoming income tax went up in flames.

The methane boom followed by the great fracking boom was a two edged sword. On the one hand, Wyoming state coffers were overflowing with cash. But what do politicians do with money? They spend it. I swear that a meteor could crash in Wyoming containing $44 Trillion dollars worth of gold, silver, and platinum, and the RINOs in the Wyoming legislature would have the state broke and needing an income tax within five years of the asteroid impact. Wyoming’s problem is not revenue. Wyoming’s problem is spending. On a per capita basis, Wyoming has a larger state government than The People’s Republic of New York or the California Soviet. We aren’t socialists here in Wyoming? Are we?

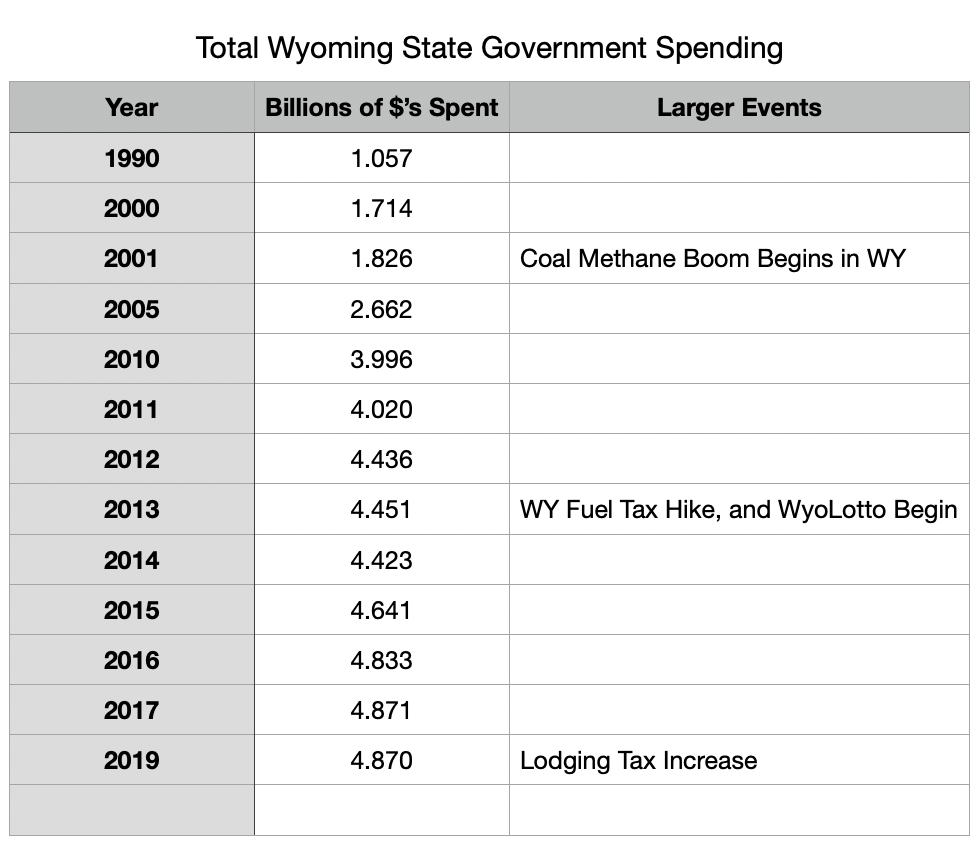

The table below is a broad look at how much the Wyoming state government has increased spending over the past few decades. The data was taken from usgovernmentspending.com

The Deep State RINOs that run the Wyoming Legislature have been crying about the “deep cuts” they’ve had to make recently. But according to this data, the overall Wyoming budget grew by almost a billion dollars the past 10 years, and just last year they managed to cut a measly one million dollars. We should be able to cut a billion dollars from the budget without even breaking a sweat.

Practical Solutions For The Spending Problem

That might not be enough. The financial situation of the sate is desperate. The Alvarez and Marsal Report provides some clues on where we can start saving money. They found that on average, Wyoming supervisors oversee a mere four underlings each. The average nationwide is around 6-8 workers reporting to each supervisor. The golden standard for good government is 12 workers reporting to one supervisor. It looks like Wyoming has an overabundance of supervisors. That looks like a great place to start making cuts to me.

Wyoming’s premiere economist, Mr. Sven Larson has done a lot of thinking and research on how we can make ends meet. I would encourage you to read two of his blog posts on the budget:

The Budget, Part 1: Foresight 2020

The Budget, Part 2: Three Items To Cut

Spoiler alert! The three items Mr. Larson proposes to begin with cutting are:

School Construction

Medicaid

The University of Wyoming

If elected I will push for any cuts I can get, but I will try to target the cuts at the fattest, porkiest portions of our budget first.

Practical Solutions For The Taxing Problem

By their very nature, RINOs are dishonest and sneaky. If they weren’t dishonest and sneaky, they’d be running for office on the Democratic ticket. So for eternity we are going to have to deal with RINOs trying to sneak new taxes through based on some obfuscation or another. It’s not foolproof, but a way to make it harder for new taxes to be snuck in on us is a Taxpayer’s Bill of Rights. The acronym for it is TABOR. Colorado has had one for a while and it’s helped those socialists keep their taxes from ballooning to California levels.

The great Wyoming legislator Chuck Gray and some other good legislators have done outstanding work building a TABOR bill for Wyoming that is even better than Colorado’s. To make a long story short, TABOR makes it much more difficult for taxes to be increased, and raises the bar for new taxes to be passed.

My favorite economist Sven Larson has written about it here. The actual bill is here. If elected I will support this with all my heart.

This Is Not Going To Be Easy

There’s no amount of sugar that will make this medicine go down. Wyoming is going to have to make cuts no matter what. There isn’t enough money in the state to tax our way out of this. We can cut our way out of new taxes though. I’m woefully uneducated on these matters because they are extremely complex. I will work hard to increase my understanding of government budgeting and if you trust me to represent you, I will be ready stop taxes and slash budgets by 2021.

Citizens of Wyoming House District 43 have a clear choice in 2020. My opponent has favored every tax imaginable the past few years. He’s working right now as a committee chair to bring in income taxes, increased sin taxes, and he wants to repeal the grocery sales tax exemption. That last one is really bad. Wyoming has a large number of retired persons living on fixed incomes. It’s hard to cut your grocery budget. Raising taxes on groceries will directly hurt the most vulnerable families in Wyoming.

Taxation is extortion.

Cast your vote for John Harvey and pay less taxes in 2021.

Visit: www.johnharveywy.com

It’s a shame isn’t it, how tax money is stolen then seems to disappear and they cry begging for more? Very frustrating.

Try living in a hardcore blue state like Taxachusetts! We’ve got a lot of industry to offset the costs but they still squeeze out lots of money from the working class.

That's exactly the excuse they give us here for the need to raise taxes, "Wyoming has much lower overall tax rates than any other state!" Well, that's the way we like it and we don't need higher taxes because government always spends as much as they steal, plus a little.

Congratulations @optout! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board And compare to others on the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!