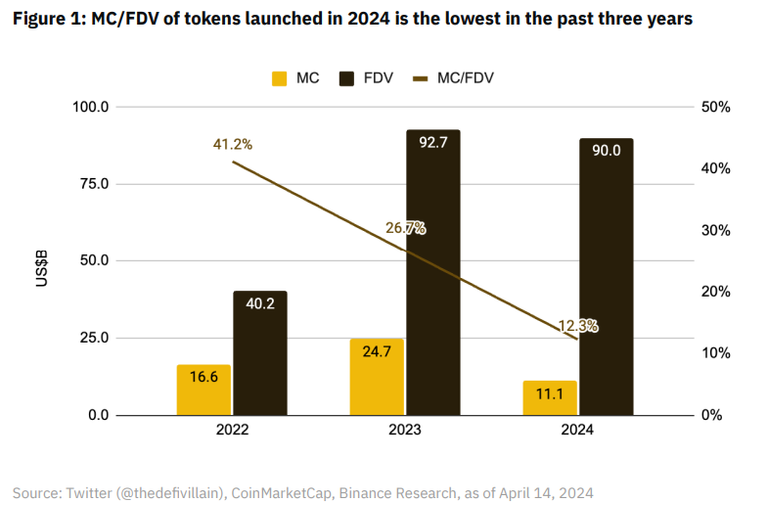

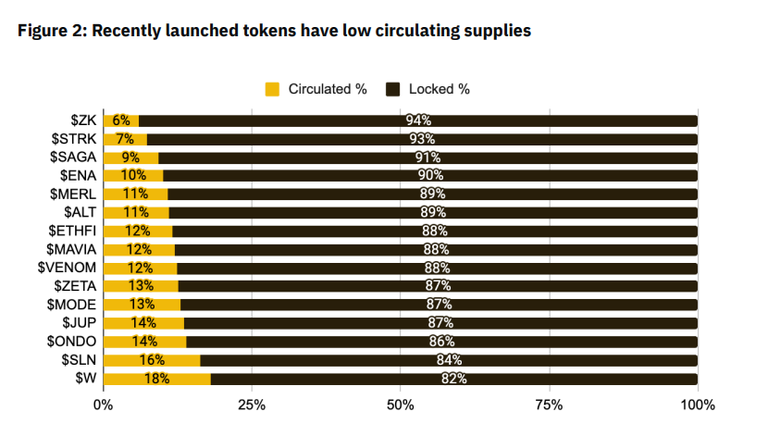

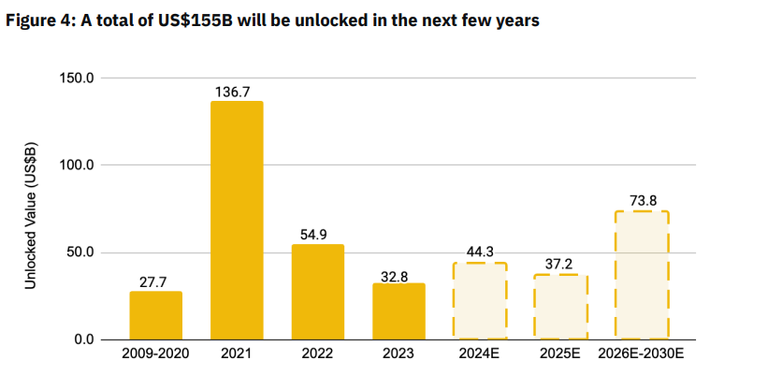

Today Binance released a report about a new phenomenon of new coins launching with tremendous high valuations, coupled with low initial circulating supply and a hefty portion of locked tokens.

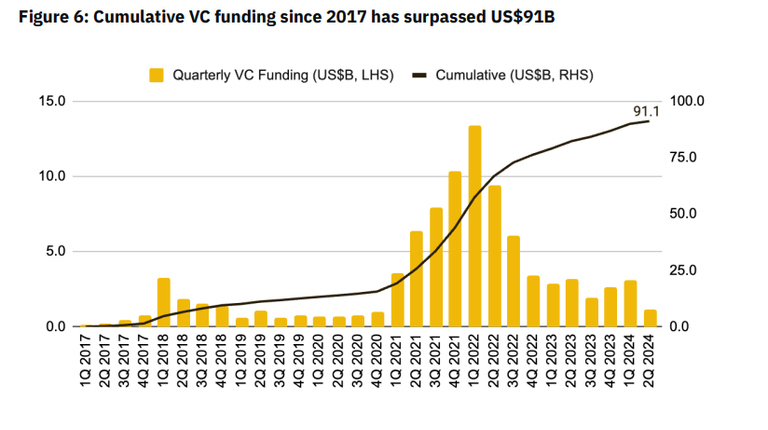

The rise of new coins with low circulating supply and high valuations can be attributed to several factors. First and foremost, the influx of venture capital (VC) funds into the crypto sphere has been substantial. While this injection of capital may seem beneficial on the surface, it has inadvertently led to inflated valuations as VCs bid up prices during private rounds. Consequently, tokens are launched into the public market with eye-watering valuations, setting the stage for potential volatility and price corrections.

The Role of Venture Capital

Venture capital plays a dual role in the crypto ecosystem, with both positive and negative implications. On the positive side, VCs provide essential funding and support to projects, driving innovation and growth. However, the influx of VC capital can also lead to inflated valuations and market distortions, posing risks to retail investors. Therefore, it's imperative for project teams and VCs to collaborate transparently and ensure equitable token distributions and reasonable valuations.

Impact on Investors

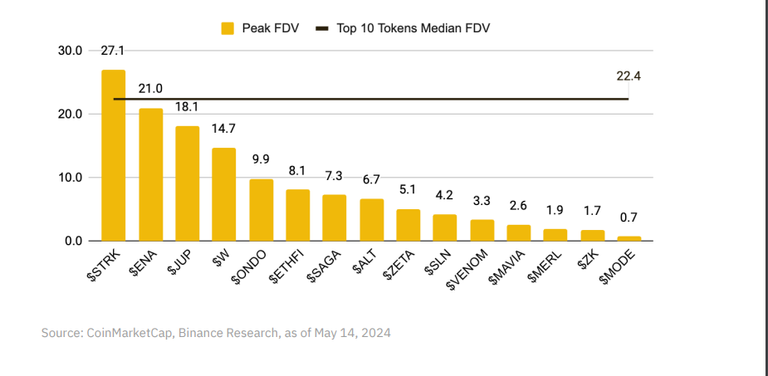

For investors, the allure of investing in tokens with high valuations and low circulating supply is undeniable because everyone wants to buy the next x100. The initial price pumps driven by scarcity can be enticing, but the subsequent unlocking of tokens can unleash a flood of supply, putting downward pressure on prices. This scenario can leave loyal token holders nursing losses and deter new investors from joining the ecosystem. Thus, it's essential to tread cautiously and be cognizant of the long-term implications of investing in such tokens. Remember the VC will probably sell the moment the token launches.

Key Considerations Before Buying

Before diving headfirst into a new token, there are several key factors to evaluate. Firstly, scrutinize tokenomics beyond surface-level metrics. Look for valuation ratios like FDV/Revenue and FDV/Total Value Locked to gain a deeper understanding of the project's true value. Secondly, assess the project's product development stage. Is there a minimum viable product (MVP) with tangible utility?

Look for projects that implement token burning mechanisms and align vesting schedules with key milestones. Additionally, consider the project's product development stage. A viable product with significant user traction can bolster confidence and contribute to long-term token value.Finally, consider the role of venture capital. While VCs can provide crucial funding and support, be wary of projects with excessively high valuations driven by private rounds.

By adopting a cautious approach, conducting thorough due diligence, and staying informed about market dynamics you will probably protect yourself from buying the bags that the Venture Capitals are trying to sell on you and make more money in the process.

Posted Using InLeo Alpha