And that's it. Today made again some numbers and concluded that fucking around with CEXEs is just not worth it unless you're a scalper and need that centralized reliability to perform very fast trades (which it's not my thing tbh).

So far and for a whole month I have given Bybit [Insert any CEX here] the benefit of the doubt to prove to me that efficient trading with low leverage was possible.

In less than 30 days and with around 1000$ bucks accumulated in ETH I've been proven wrong. Once again.

Some numbers pulled from Bybit.

Until now I had around 1000$ bucks in stETH used as collateral for a loan of 640 USDT on Bybit.

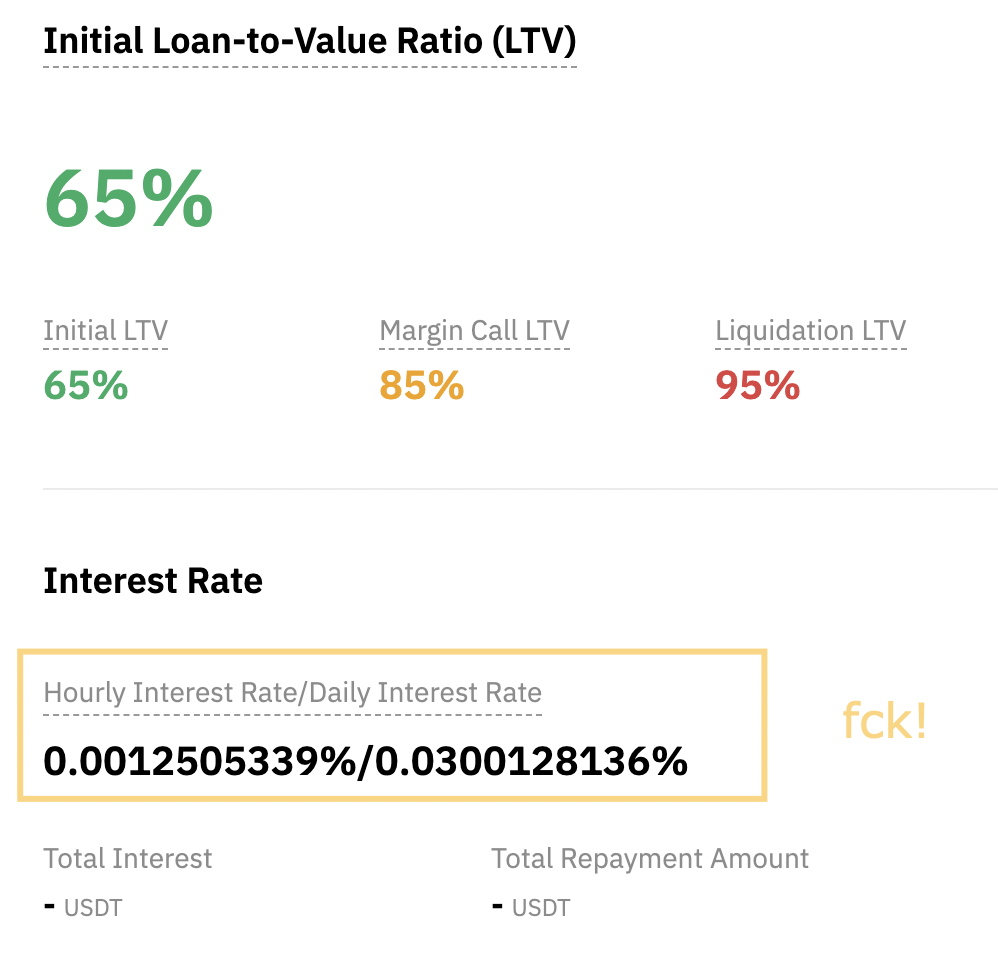

Bybit loans have two special things to take in consideration when borrowing:

- The loan term is fixed. That basically means you can't extend an existing loan; you have to repay it in full and take a new loan with a renewed term.

The maximum term is 180 days. This is not a bad duration by itself but if you're planning about DCA'ing into the collateral (without an urgent need to repay the loan ) then the deadline is somewhat uncomfortable.

- The interest is high asf.

While writing these words, the daily rate ascends up to 0.0300128136 (which *365 = 10,95%. Not bad for a CEX! Even my bank charges me less.

Nah, no way I'm going to hold up this kind of loan for an extended period of time.

Which brings up my next point:

Leaving completely Centralized Exchanges

Why do you even want to use centralized exchanges when all you're getting (at least for the average crypto user) is worse conditions and a centralized point of failure?

Neither short or lazy, I moved funds around (the SPS and the HIVE) to repay the Bybit loan, withdrew stETH into ETH main chain, and swapped stETH for wstETH (Wrapped Staked Ether which is a derivate of stETH ready for use around Defi systems).

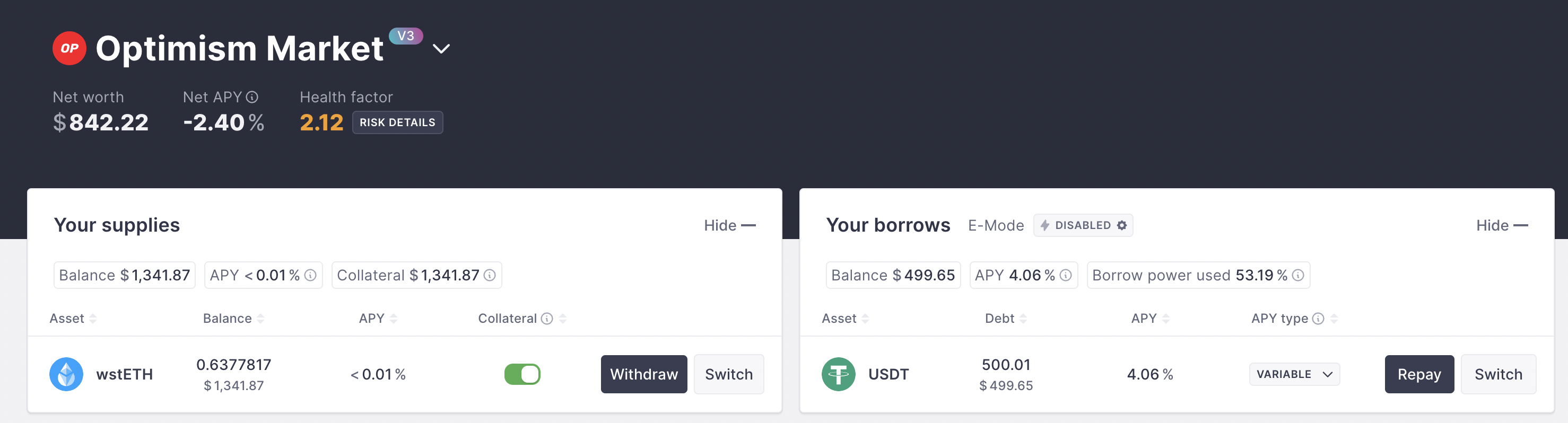

Bridged this wstETH into optimism and now I have a loan through Aave, my old fren.

Loans at Aave have very good conditions:

You don't have a loan term (basically you can let the loan sit there as long as you don't get margin called.

The interest is MUCH more affordable vs Bybit (x2 cheaper) or 4% vs +10%.

Maybe I'm being a bit yolo, but I used the loaned funds to load even more $BASED (instead of SPS/HIVE since I thought I already hold a huge amount of HIVE on my main acc).

I marked my entries, I'm feeling so comfy there with only 650K$ mcap. if it pulled a x10 I would be very very happy and 5M is somewhat realistic. As always, this is a degen gamble into a microcap and there's a huge degree of speculation. Be careful If for whatever reason you decide to step in.

I feel safe since this is still a small part of my portfolio and If for whatever reason I'm rug pulled or whatever fuckery I'll just DCA again into the loan (since my main position is still the wstETH).

And that's all for today's journal. Have a good monday!

Posted Using LeoFinance Alpha

Es algo que he querido intentar por mucho tiempo con AAVE, el poder usarlo para apalancarme y comprar Hive para asi hacer que mis cuentas lleguen minimo a 5000 de HP, el problema es que no tengo suficiente de otras cripto para que mi colateral valga la pena. Asi que por ahora tengo que acumular HP y HBD de forma natural.

Pero el 4% que te cobra AAVE sobre el 10% aprox que recibes de HP y el 20% que se recibe de HBD se me hacen una excelente opcion para intentar apalancarme

Es una muy buena idea de hecho y exactamente lo que yo procuro hacer aquí. También el problema de las gas fees. Pero si trabajas en Optimism/Polygon/Arbitrum deja de ser un problema.