Ethereum has been a proof of stake chain for more almost two years now. As a reminder the start of the transition to proof of stake started back in December 2020. The staking chain was launched then to run in parallel with the proof of work chain. Staking was then enabled, but withdrawals from staking were not. The proof of work chain and the proof of stake merged in September 2022, almost two years after the initial phase. Finaly unstaking was enabled in March 2023, when everyone who had staked on the PoS chain could unstake if they wish so.

How is staking Ethereum going these days? After everything was finished and time has passed. Are more users unstaking or maybe staking now? It’s been a year since the unstaking is live so let’s check it out.

Here we e will be looking at:

- Staked Ethereum by date

- Staked VS Unstaked ETH since the Shanghai update

- Share of staked ETH

- Number of validators

- Top staking pools

The data presented here is mostly gathered from Dune Analytics and Ethscan.

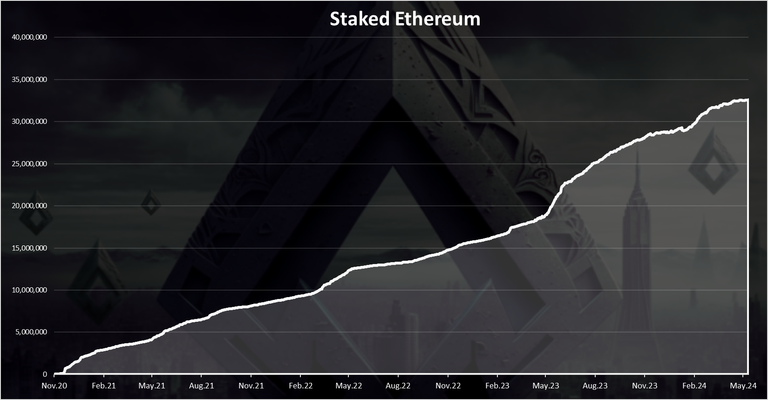

Staked Ethereum by Date

Here is the chart.

This is the amount of staked ETH since the launch of the Beacon chain and the option for staking Ethereum in November 2020.

We can see a constant growth in the amount of ETH staked and, on some occasions, a sharp increase. We can notice that in the last few months there is an uptrend. At the moment of writing this there is 32.5M ETH staked.

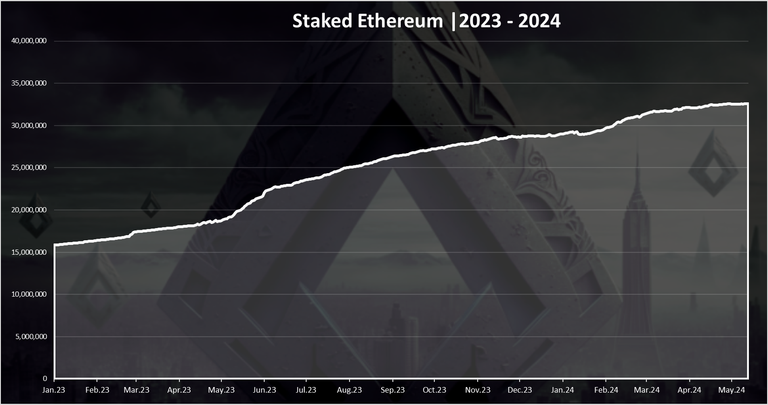

If we zoom in 2023-2024 we get this:

Here we can notice a strong growth in May 2023. The unstaking option has caused more Ethereum to be staked than unstaked. Probably users felt more comfortable staking now knowing that they can unstake at any moment if needed. Then a steadier growth, a small drop in January 2023 and again an increase and almost a constant in the last month.

At the beginning of 2023 there were close to 16M ETH staked while now we are at 32M, basically doubling in year and four months.

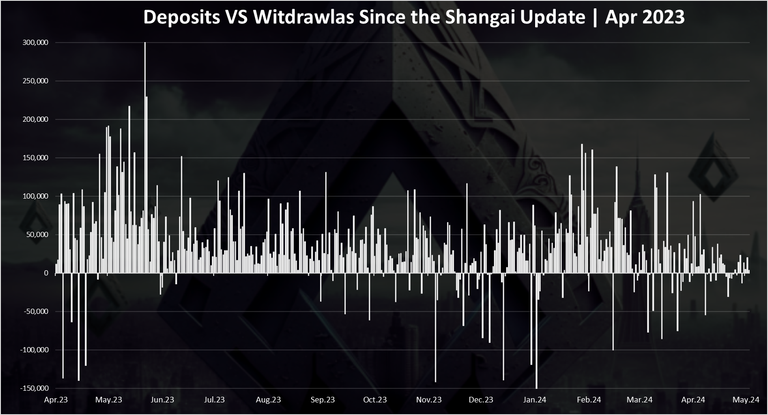

Deposits VS Withdrawals Since the Shanghai Update

If take a look at the daily deposits vs withdrawals since the update we get this:

Most of the days are in positive, meaning that more ETH is being staked in general that ustaked, even with the ustaking option enabled. There are few big unstaking events in April 2023, where more than 100k ETH was unstaked in a day. A few big ones have happened in January 2024 and some smaller one in the last months.

Share of Staked Ethereum

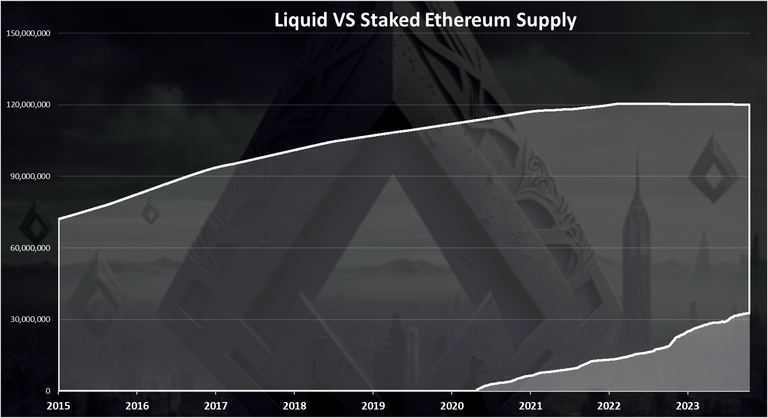

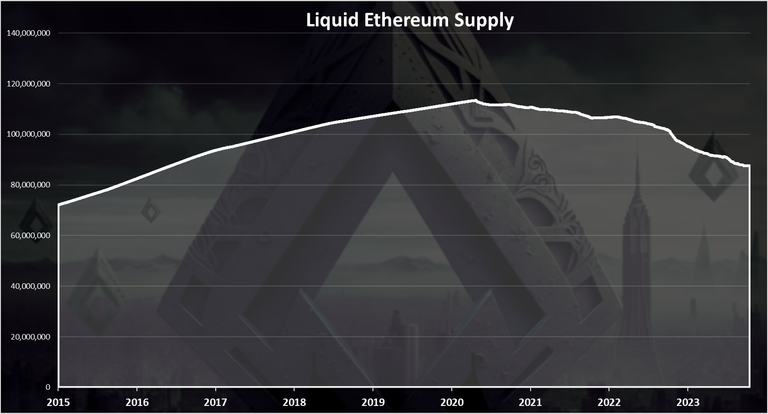

What is the share of staked Ethereum? Here is the historical trend.

We can notice that the staking was activated later in the Ethereum lifecycle and since recently it has started to gather more momentum. It’s worth noting that since last year Ethereum cut their inflation down as well, and is deflationary in the last period. What this means is that the ETH issuance is lowered, and at the same time the staking is locking more ETH, basically lowering the liquid supply from both ends.

The liquid Ethereum supply looks like this:

We can see the drop in the liquid ETH supply, from 113M at the top in 2020 to 87M now. It seems that there is finally some slowdown in the amount of ETH staked. Will see where the balance is found. Staking provides APR, but if more ETH is staked this APR goes down. Also, the APR for staking depends on the network activity and the fees paid by users.

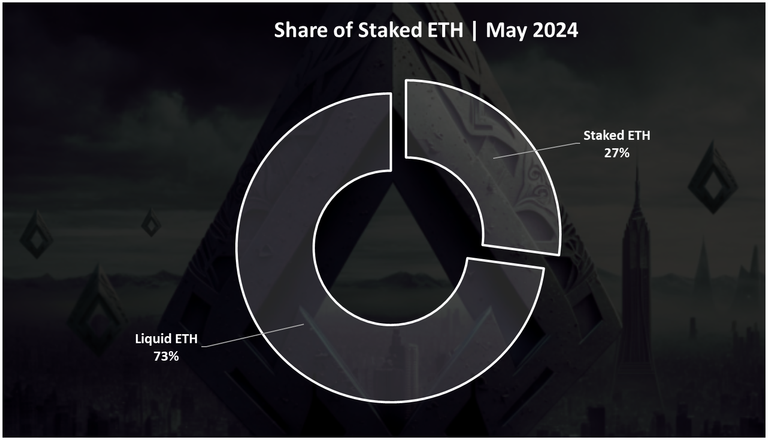

The current share of staked ETH looks like this:

When compared to the total ETH supply that is around 120M now, the 32.5M staked ETH represents a 27% of the supply. This number has kept growing in the last year.

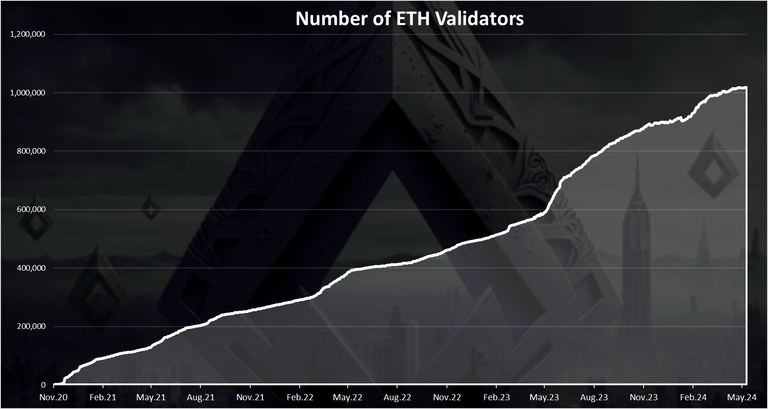

Number of Validators

Here is the chart.

The number of validators has also continued to grow. At the moment there is close to 1M validators, adding 400k more since Shanghai.

Note that these are not unique validators, as most of them are represented by a pool or some type of CEX. There is now even a proposal to increase the upper limit for a validator from 32ETH, so at some point the number of validators might consolidate.

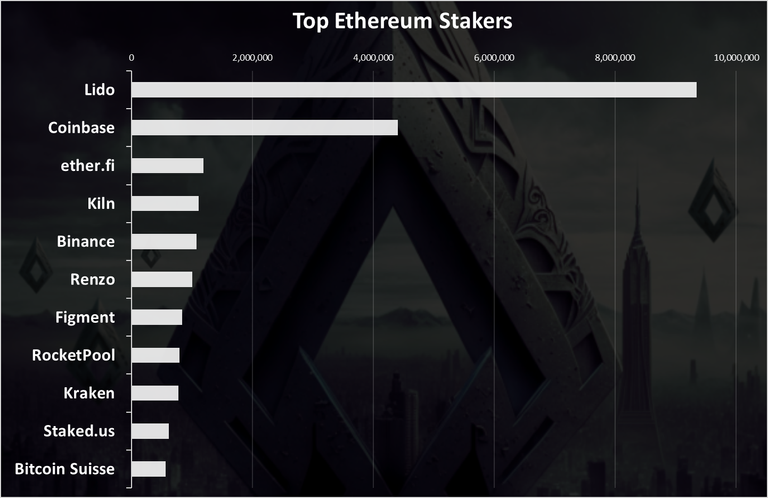

Top Ethereum Stakers

Who is staking the most? Here is the chart.

The Lido pool is on the top with almost 9.3M ETH staked. This pool has even its own token for governance. On the second spot is the Coinbase exchange, followed by the newcomer ether.fi that is a protocol for restaking. Lido has dominated in the past but it seems that it has peaked and now has even lower amount of ETH staked from a few months ago. Probably some of the tokens went to ether.fi.

Overall staking Ethereum has continued in the last period and the amount of ETH staked continues to grow, although might be at a bit of slower rate. The ether.fi and the restaking seem to be the new thing that has moved the needle a bit and has transferred some coins from Lido to the restaking protocol.

All the best

@dalz

I don't think the stakes have found their balance yet. I think Eth will continue to be staked. There is still a lot of room to grow in usage and therefore rates.

It seems to me that Ethereum still has too high transaction fees, it seems to me that it cannot be considered a blockchain that can be used for everyday transactions, I may be wrong but HIVE seems better to me in everyday uses

Zero fee blockchains in general are better for user experience.

Finally my favorite, Dalz comes back with the record books😂🫡🥰 wow ethereum looks really progressive. Do you think it's possible to incorporate proof of brain and proof of stake into one Blockchain though? Are is that a silly question 🙈

The graphics you show look very impressive

The amount of staked ETH is really increasing and I like that

I haven’t staked any though since I just want to stick to Hive…

Ethereum STATS! I am surprised. great skills bro

Seeing ETH's popularity continue to rise really shows its status as number 2. The amount of liquid plateauing and the staked increasing feels like it should be good for the price.

Congratulations @dalz! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 1000 posts.

Your next target is to reach 14000 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

With the chats you shared, it quite looks like every blessed year, the rate at which people stake keep going up and higher

Interesting, contrary to the general perception.

Sir, what is the inflation rate(approx) now in Ethereum?

#hive #posh

Thank you so much for actually giving up this perfect update