A proof-of-work (PoW) blockchain requires mining which consumes high electric energy. A proof-of-stake (PoS) blockchain’s consensus mechanism is very different. Instead of miners, there are validators. In PoW, the cryptographic puzzles are solved by staking cryptocurrency. PoS is a more energy-efficient method to secure the network. Vitalik Buterin cited three key reasons why PoS is a superior blockchain security mechanism compared to PoW in this recent post. To summarise, the reasons are - PoS offers more security for the same cost, attacks are much easier to recover from in proof of stake and Proof of stake is more decentralized than ASICs. Ethereum 2.0 is finally set to go live. Ethereum will move from PoW to PoS with Ethereum 2.0. Migrating an entire operational blockchain from PoW to PoS is always an uphill task. Numerous issues were faced by the developers while working on the project.

Launch of ETH 2.0 deposit contract

As per this blog post of Ethereum Foundation, Ethereum 2.0 will now go live on December 1, 2020, 12 pm UTC. Originally, they planned to go live on January 3 2021. Ethereum 2.0 mainnet deposit contract was also launched a few days back and it is the first physical implementation of Ethereum 2.0.

“To trigger genesis at this time, there must be at least 16384 32-ETH validator deposits 7 days prior to December 1. If not, genesis will be triggered 7 days after this threshold has been met (whenever that may be).” – Ethereum Foundation

If the deposit contract reaches the magic figure, the launch of the Beacon Chain will be triggered. Beacon chain is the infrastructure that will facilitate the historical switch of Ethereum and create Ethereum 2.0 genesis event. This Beacon chain will be the first step, although Ethereum 2.0 will be launched phase-wise along with time.

One-way contract

You can send Ether to Ethereum 2.0 deposit contract and earn inflation rewards after the genesis event. Your Ether is placed as collateral to earn staking rewards. You need to stake 32 Ether to run a node to strengthen the blockchain’s security. The staking APY should be 8-15% now and it is decent enough. It is important to note that the deposit contract is one way. That means you can’t extract Ether from it now. Most probably it’ll take almost 18 months if you want to withdraw Ether. At present, the stakers aren’t expected to maintain 100% uptime. 60-70% uptime is good enough to be profitable. Running a node with 32 Ether and maintaining minimum downtime isn’t everyone’s cup of tea obviously. Ethereum devotees are still jumping into the staking game. Let’s analyse what’s really going on with Ethereum 2.0 deposit contract.

The signals

Almost 0.12% of Ethereum supply is staked now. The staking amount is growing really exponentially after the deposit contract launch. Price also has a correlation with staking. It is clear that price was pumped by the deposit contract launch event.

Source - Ethereum: ETH 2.0 Staking Rate (%) - The balance of the ETH 2.0 deposit contract divided by the total supply

To reach the magic figure, 524,288 ETH is needed. 16,384 node validators are needed with 32 ETH (16,384 x 32 = 524,288). Phase zero has reached 8% success rate within a few days.

Source - Phase 0 Success Rate (%) - The valid balance of the deposit contract divided by 524,288 ETH

Phase 0 unique validators have reached 200+ now. Whales are more interested in this game for obvious reasons.

Source - Phase 0 Unique Validators - The number of accounts who deposited over 32 ETH to the deposit contract (ETH 2.0 requires 16,384 validators)

The valid ETH balance of the deposit contract is already 45K ETH now. Growth is really exciting.

Source - Ethereum: Total Value Staked

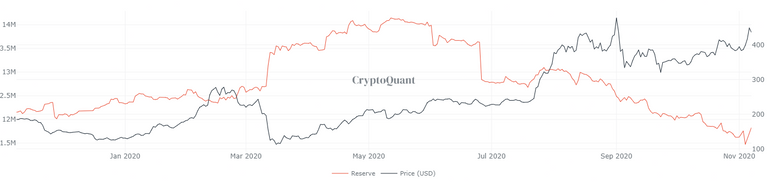

Who is depositing ETH to the deposit contract? Exchange ETH balance is decreasing exponentially.

Source - All Exchanges Reserve - The amount of ETH held in all exchange wallets.

Exciting developments are happening on Ethereum blockchain. DeFi or decentralized finance is happening mainly on Ethereum. DeFi yields are often very high in comparison to Ethereum staking APY. But soon we may observe tokenized derivatives being issued against staked Ether. Every opportunity is a trading opportunity in crypto and imagination of the Ethereum community is boundless. Ethereum 2.0 can act as a black hole for Ethereum. Ether will enter into it but it won’t come out. The ‘world computer’ is ambitious. Very ambitious!

Cheers!

[paragism]

Your current Rank (129) in the battle Arena of Holybread has granted you an Upvote of 13%

I will not lock 32 Ether but is a steady income stream.

I am waiting for pool staking

Where you can invest a small portion of the 32 ETH required?

@tipu curate

Upvoted 👌 (Mana: 0/10) Liquid rewards.