In my previous post, I went through some of the different airdrop types but in this article, I will focus on staked-based ones and more specifically, TIA staking.

The tricky part with most of the airdrops is that we don't know the criteria beforehand and have to anticipate which projects will likely release tokens through airdrops.

By following similar projects and how they launched we see some recurring patterns and try to repeat the farming process. This may sound like a long shot but this is how it has happened before with staking TIA for example.

In this article, I'm going to share some of the latest airdrop farming strategies with you.

So let's get to it, here are a couple of my $TIA plays:

MilkyWay

When I was first doing my research on Celestia I came across quite a few people suggesting airdrop farming strategies where you stake most of your TIA on Kepler but allocate some to Milky Way which is a platform offering liquid staking solutions for TIA.

This means that when you stake your TIA on there you receive milkTIA, sort of a receipt that you can borrow on different protocols and earn some extra APR on your stake. Also, note that the original APR is reflected on your milkTIA balance and the rewards are received when you unstake.

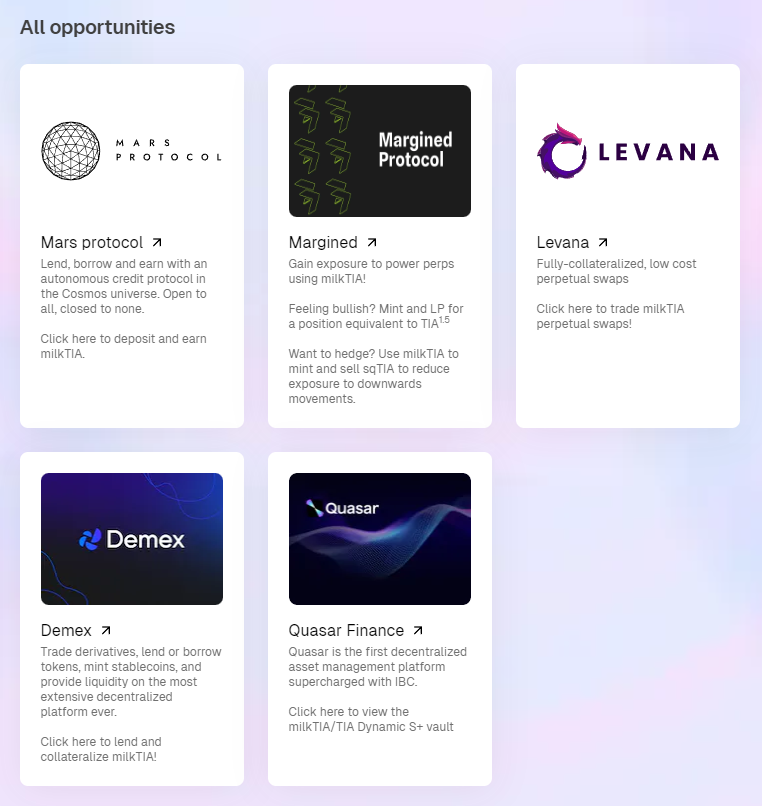

As a degen and an airdrop farmer, my focus is obviously on the potential airdrops. In the picture below you can see the protocols where you can use your milkTIA. Now if these should release a token of their own, portions of the distribution would most likely go to milkTIA holders and to those who interacted with the protocol.

Of course, nothing is guaranteed but these launches seem to follow a pattern where active users of platforms are rewarded. However, in this case, it's very passive as you can potentially take part by just staking and holding.

Here is an example strategy of what you can do with your milkTIA and perhaps take part in two upcoming airdrops.

Farming airdrops is a long play. After we have planted the seed it might take 6 months or a year before we get to reap the harvest. Sometimes it might be in vain but if you are a farmer like me who taking part in multiple airdrops, there are bound to be hits and some of them can be pretty good ones too!

Stride

If my MilkyWay strategy sounded more like a "fingers crossed" plan, this one is easier to plan as you can keep track of how much your future airdrop will be. Stride is similar to Milky Way when it comes to staking and it is also offering a liquid staking for TIA only this time you will receive stTIA tokens.

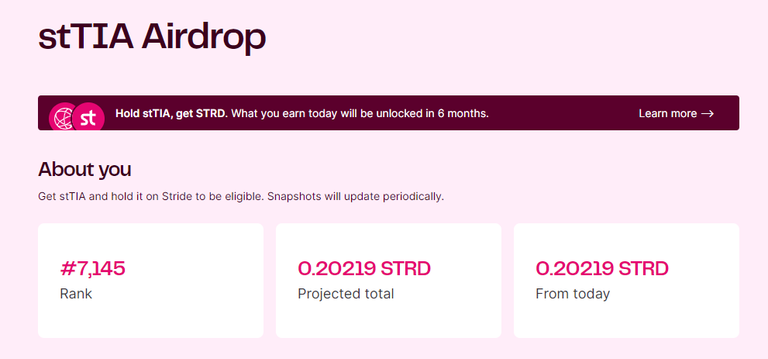

What makes Stride different, is its airdrop system which is not only confirmed but the amount to be received is also visible after the first daily snapshot.

The airdropped asset will be Stride's native token $STRD. Here in the picture above we can see that I received 0.20219 STRD in a day for staking 2.8 TIA. My daily airdrop amount will probably decrease a bit over time as more users discover the platform unless I increase my stake.

The earned STRD will start unlocking after 6 months and it'll happen daily for the next 6 six months while the actual unstaking of TIA will last 21 days.

So is it worth it?

Hard to say yet but there are a couple of things that make me like this play:

- TIA itself is a good long-term investment in my opinion, or longish, as I plan to be staking/holding it for a year and then review the situation.

- APY of 13.45%

- stTIA stakers could very well be eligible for other future airdrops

- It's a LST so it can be used as collateral on borrow & lend platforms

- This is a confirmed airdrop, however...

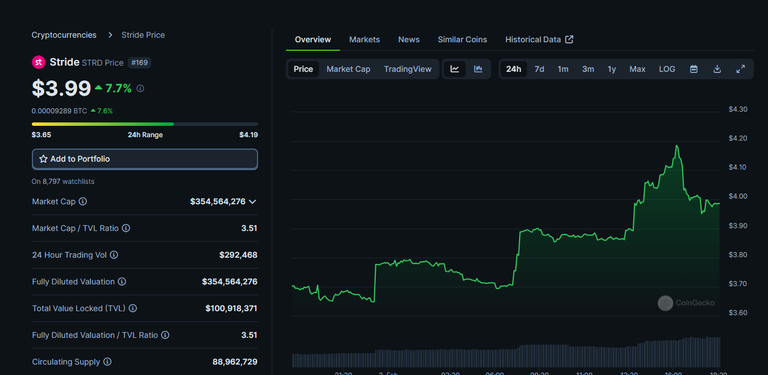

6 months is like forever in the crypto space so it's impossible to predict which way the STRD price will go and where it stands then. So far, so good as its price is near $4 by the time of writing this.

You can see it has experienced an upward movement lately.

I also remember reading that the Stride team is working on a way to include stTIA holders in future airdrops similar to ones who stake TIA on Kepler.

Kepler

This is my main game. In one of my previous posts, DeFi Dives: Staking TIA & SOL, I have written step-by-step instructions on how to stake TIA directly on your Kepler wallet. Staking Celestia native token $TIA has been THE thing for the past six months and it has made the stakers eligible for airdrops such as DYM, SAGA, and ALT.

The tricky thing here is that we don't usually know the exact minimum amount required to stake. For example, for DYM it was only 1 TIA, while for SAGA it was 20, and for ALT 35 TIA.

I remember reading that many users tried the strategy of staking with multiple wallets but that probably didn't go well with SAGA and especially with ALT. Would've worked with DYM though.

Speaking of DYM, I'm currently waiting for the Dymension mainnet to launch but since this post is getting a bit long, I will share my launch experience and DYM strategies in my next post so stay tuned for that!

One thing I like to add:

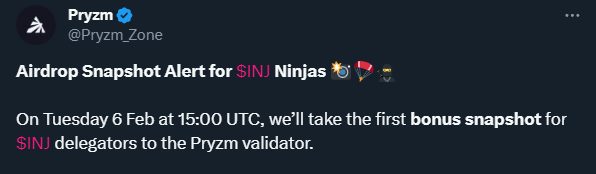

Even though the Kepler TIA staking unlock period is quite long (21 days), the redelegating is instant so you might wanna keep an eye out for some projects offering airdrops for those who delegate with them. 😉

Conclusion

Make your money work for you.

This is something most of us have come across many times and in my opinion, various TIA staking methods are a pretty good example of how to do this.

I've probably said this many times but again, staking for airdrops is a great option to grow your portfolio. Compared to much more degens ways such as using leverage to long or short, staking is a relatively safe way as even if you don't qualify for the airdrop, you still have your initial stake which can be worth a lot in the future.

That being said, I'd invest only in projects that I believe in and have done proper research on.

Thank you for reading and don't forget to follow for more and check out these ongoing airdrops! 👇😊

Ongoing Airdrops:

DOP testnet

GRVT ZkSync Mystery Box - just log in and claim your first mystery box

Ether.fi - stake ETH for Points & EigenLayer points

Thumbnail background image made with Canva

Posted Using InLeo Alpha

Posted Using InLeo Alpha

It is hard keeping up to be honest and I will be not taking profits from DYM but use the half I would normally sell to get more tokens. I believe the minimum for TIA is going to go up and up.

Liquid staking is the flavour of the month and STRD did pump so getting some everyday is cool!

Awesome #airdropalpha indeed.

Need to dig out some testnets and quests as we can't be staking for every airdrop!

Thanks for the comment!

I staked half of my DYM today, crazy APR but will come down as will the price. My approach with DYM is to farm those future airdrops. As you said, TIA will go up but with DYM it might be a fresh start!

It's interesting... I feel I'm getting the hang of this a bit. I think the key in farming airdrops is to be constantly moving, re-allocating profits to new ones, researching and so on.

I'm gonna start some test nets tomorrow, there's one called Niburu that should start tomorrow. I'll share it in the group!

Yay! 🤗

Your content has been boosted with Ecency Points, by @brando28.

Use Ecency daily to boost your growth on platform!

Thank you very much! 😊