Busy options expiry at the end of a down week. Was a good week for adding to uranium positions to replace the largest uranium holding

Portfolio News

In a week where S&P 500 dropped 3.07% and Europe dropped 0.6%, my pension portfolio dropped 2.14%. The drags were commodity stocks and US tech stocks. Quite clear that the portfolio weighting to Europe is a bit low.

Big movers of the week were NeuRizer (NRZ.AX) (100%), Elixir Energy (EXR.AX) (30%), ProShares UltraPro Short QQQ (SQQQ) (17.9%), Panther Metals (PNT.AX) (15.2%), Direxion Daily Real Estate Bear 3X Shares (DRV) (11.6%), 88 Energy (88E.AX) (11.1%), Deep Yellow (DYL.AX) (10.2%)

Only 7 stocks on the big movers of which 2 are shorts on Nasdaq and US real estate. And 2 are oil exploration companies reporting flow test results.

That is the story of the week - US markets traded down every day and were hit with a big tech stocks bust on Friday. Strangely enough Dow Jones had an up day Friday. Now there are a few things that caught my eye

First was a tweet saying that Stanley Druckenmiller was getting out of Nvidia. The importance is he is holding several billion dollars of Nvidia stock. Somebody started unloading Nvidia around 1 pm Friday - that dragged all the chip stocks down

The next was an article in the Wall Street journal about pension funds unloading equity positions in favour of yields. That article was the day after Jerome Powell said rates would stay higher for longer and yields popped. If the pension funds believe rates will not be cut soon, they can afford to load up on yield and prices are not going to fall soon.

https://www.wsj.com/finance/investing/pension-funds-stocks-bonds-679b8536?st=ki3nrsh3x0r85an&reflink=desktopwebshare_permalink - this is a free link - no paywall

That makes a perfect catalyst for the selloff - a big seller on a key stock and pension funds heading to bonds.

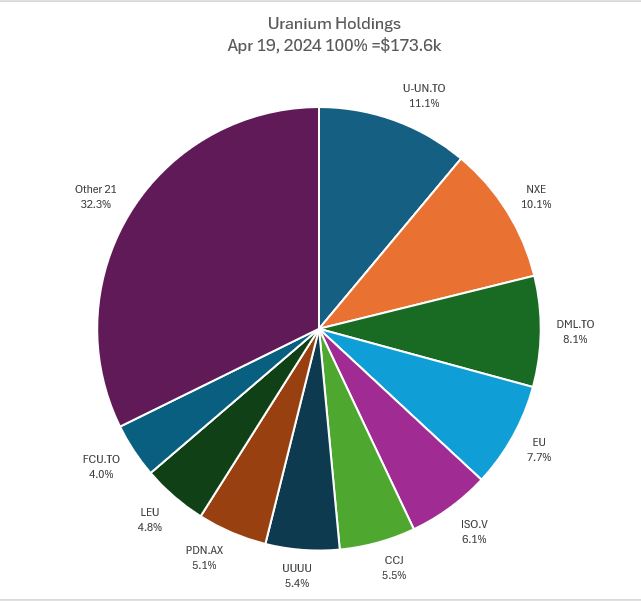

Uranium Holdings

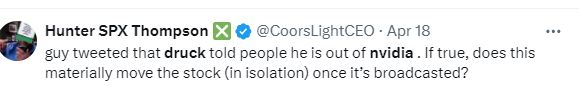

Big change in the uranium holdings with most of the position in Cameco (CCJ) going to assignment on covered calls. First a chart summarising the change in value from April 12 to April 19.

The big change was the sale of large portion of Cameco (CCJ) holdings in all 3 portfolios. Did add some positions in Sprott Physical Uranium Trust (U-UN.TO) to compensate and some Canadian and Australian listed stocks across the pension and managed portfolios. The other big change was drop in value of the holdings of 9.5%. This makes the mix look like this

This is a lot more in line with the way the Uranium Insider Focus list looks with holdings lining up with physical price and producers close to production or with plans for scale production. Also adjusted the portfolio base to include all ASX holdings - uranium is now 8.4% of total portfolio value. Pension and managed portfolios are under-invested.

The coming week will be busy doing relative charts to see what gets added. Will also be doing credit spreads on Cameco to find possible re-entry levels. Plan is to align more with the Uranium Insider ideas as they are doing continusous research

Crypto Diverges with Bitcoin Halving

Bitcoin halving arrived. The pundits are all over the place predicting price to fall and/or to rise. Time will tell but we do know that price has always landed up higher after previous halvings - it is just a question of timing. The fact that the halving coincided with a week of stock exchange losses will muddy the predications somewhat

Bitcoin price fell over ahead of the halving but ended only 2.7% down for the week with a peak to trough range of 11.1%

Ethereum chart looks much the same ending 3.6% lower with a peak to trough range of 12.5%

Beneficiary of the uncertainty was a lot of altcoins popping - sample Litecon (LTC) up 15.8% from the lows of the week.

ShibaInu (SHIB) jumped 36% at one stage giving a third of that away

The key part is many of the altcoins recovered much of the losses from the big falls the week before - sample Cardano (ADA). Shows the value of not panicking when things fall - wait a week for the reversal

Bought

iShares MSCI Emerging Markets ex China ETF (EMXC): Emerging Markets Index. With price opening at $55.54 (Apr 16), pending order on September expiry 58/62 bull call spread was hit. With net premium of $1.20, offers maximum profit potential of 233% for a 11.6% move in price. This pending order was the call spread part of a call spread risk reversal in which the May expiry sold put was set up 2 weeks prior - that ramps the profit potnetial up to 521% with 1% price coverage now (was better on trade day (Apr 1)

Let's look at the chart which shows the bought call (58), as a blue ray and the sold call (62) as a red ray and the sold put (55) as a dotted red ray with the expiry date the dotted green lines on the right margin. At the time the trade idea was set up, price was cycling higher with something of a consolidation above $56. Was looking for another cycle higher. Now that Iran has taken a potshot at Israel, markets are in correction mode. Have drawn in two Fibonacci retracements. In the left hand one price reversed on the 0.786 level and first move was the left hand blue arrow. Price needs to do that again for this trade to succeed. There is a risk though that the turning point will be below the sold put level (55) at its May expiry. Trade management plan was to sell a series of puts to fund the premium - that is still the plan.

88 Energy Limited (88E.AX): US Oil. 88E announced flow test results on the Hickory-1 field making for 2nd successful oil flow. Added to holdings in personal portfolio on a market down day averaging down entry price a little.

Deep Yellow Limited (DYL.AX): Uranium. Tumas project, Namibia expected to be producing in 2026 with full scale from 2028. Received allocation in share purchase plan. As there was a strong chance that allocations would be reduced, had put in double what I would normally do. Received 69% of requested amount which more than doubles holding. Entry price is 22.8% lower than allocation day open (Apr 15) - happy with that - even after the 14% drop in the next 2 days.

Doubled holding in pension portfolio as had not been a holder when SPP was launched.

Azincourt Energy Corp. (AAZ.V): Uranium/Lithium. Explorer - East Preston project, Athabasca Basin. Speculative idea with possibility of being acquired.

Anfield Energy Inc (AEC.V): Uranium. Doubled holding in pension portfolio. Still looking like Cameco (CCJ) will be assigned in this portfolio. Added to managed portfolio. Reopening Shootaring Canyon Mill - Utah with feed from 3 fileds in Utah and Colorado.

F3 Uranium Corp (FUU.V): Uranium. Patterson Lake, Athabasca Basin. Large scale production from 2029

Bannerman Resources (BMN.AX): Uranium. Etango, Namibia - production from 2027 scaled from 2029.

Boss Energy (BOE.AX): Uranium. Honeymoon, South Australia - producing 2023 - at scale from 2026.

Paladin Resources (PDN.AX): Uranium. Langer Heinrich, Namibia. Restarting from 2024 scaling up through 2027.

Sprott Physical Uranium Trust Fund (U-UN.TO): Uranium. Added to holdings in pension portfolio to replace part of holding in Camecia (CCJ) that will be assigned at options expiry.

Averaged down entry prices on a few long held cannabis holdings now that prices have found a bottom.

Aurora Cannabis Inc (ACB.TO): Canadian Marijuana.

Cronos Group Inc (CRON): Canadian Marijuana.

Canopy Growth Corporation (WEED.TO): Canadian Marijuana.

Hercules Silver Corp (BIG.V): Silver Mining. Scaled in holding on rise in silver prices.

Jazz Pharmaceuticals (JAZZ): US Pharmaceuticals. Assigned early on naked put. Breakeven $113.25 - a 3.6% premium to $109.27 close (Apr 18). Options trade idea from TheStreetPro - their model was to set up a September expiry covered call with a net debit around $110. The way to do that would have been to buy the stock and sell a long dated covered call. I chose to set this up as a naked put instead. Now is time to write the covered calls.

3D Systems Corporation (DDD): 3D Printing. Assigned early on naked put and then fully at expiry.

Invesco Ltd (IVZ): Asset Management. TheStreetPro options idea - with a 10 month price target at $23.18 there is 50% upside. The aggressive trade is is to buy stock and sell 17 strike January 2025 expiry calls and puts - i.e., out the money for the sold call and in the money for the sold put. If price reaches $17 at expiry, potential profit is 50% (66% annualised). Downside risk is breakeven on the larger holdings is $14.05 per share which is higher than the lows of 10 of the last 13 years.

Asset managers tend to do better when markets are rising - Invesco is lagging - a good opportunity possibly. My plan is a little different - buy the stock and write covered calls month by month. Will decide once we are past this week's options expiry to sell naked puts below the entry price on the stock. Step one: buy the stock 2.07% 3.5%

NuScale Power Corporation (SMR): Nuclear Power. Watched the monthly Uranium Insiders webinar which covered the growing demand of electricity for AI data centres. The consensus was that there was going to be an explosition in demand for SMR's. Chose this as a signal to add to holdings in this SMR business in anticipiation that they would win some of the business.

Advanced Micro Devices (AMD): US Semiconductors. Assigned on naked put.

Qualcomm Inc (QCOM): US Semiconductors. Assigned on naked put.

Plan for these two holdings plus Nvidia (below) was to use sold put premiums as a way to grab hold of some of the tech stock momentum - seems that this was the month that the momentum reversed. Now is the time to hold the stock and use call premium to get back on the road.

ChargePoint Holdings, Inc (CHPT): Electric Vehicles. Assigned on naked put - time to stop chasing this on the way down. Started out as a AAPlus idea - they liked the potnetial and the fact the business was low in debt. This is no longer the case with debt to equity at 93%. Revenues are growing but gross margin has declined.

Sold

Société Générale S.A (GLE.PA): French Bank. Assigned on covered call for 2.3% profit since December 2023.

Cameco Corporation (CCJ): Uranium. Assigned on covered call for 1.7% profit since January 2024 in pension portfolio. 9.4% blended profit since February/March 2024 in managed portfolio. 7.2% blended profit in personal portfolio since October 2023/February/March 2024.

Coeur Mining, Inc (CDE): Silver Mining. Assigned on covered call at breakeven since February 2024.

Aurora Cannabis Inc (ACB.TO): Canadain Marijuana. Assigned on covered call for 11.9% profit since March 2024. Premium on the covered call was as high as the profit on the sale of stock.

Aurubis AG (NDA.DE): Specialty Chemicals. Assigned on covered call for 3% blended loss since December 2023/March 2024. Averaging down helped. Stock screen idea - stock has almost got back to first entry point.

Glencore plc (GLEN.L): Base Metals. Assigned on covered call for 6% blended profit since December 2023/January 2024. Averaging down helped make the profit.

WPP plc (WPP.L): Advertising. Assigned on covered call for 0.7% loss since December 2023 in both personal and managed portfolios.

Barrick Gold Corporation (GOLD): Gold Mining. Assigned on covered call for 5.9% loss since January 2024.

Barclays Group plc (BARC.L): UK Bank. Assigned on covered call for 6.7% profit since February 2024.

Pan American Silver Corp (PAAS): Silver Mining. Assigned on covered call for 5.6% blended profit in personal portfolio.

Expiring Options

Centrus Energy Corp (LEU): Uranium Enrichment. With price closing at $41.37 (Apr 19), 45/55/40 call spread risk reversal expired out-the-money in pension portfolio. Net profit on the trade was 13.5% of the capital at risk (the short put)

Quick look at the chart. At the time I set the trade up in the pension portfolio, I wrote in TIB698 that the close in expiry was a poor trade setup as there was not enough time for the price scenario to play out - so it proved - see the yellow arrow. Now there is still a chance the trade with the longer expiry has a chance (the blue arrow). The key is price has stayed well above the previous low and above the sold put level for that trade (35). Yes it was a missed opportunity but it did make a profit.

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 35% profit or 25% if 52 week high is lower than 30% advance. New buys are in $400 lots. Scale ins and top ups in $200 lots

Top Ups

Integral Diagnostics Ltd (IDX.AX): Healthcare. Dividend yield 2.50%

Chose to take the 2nd top up signal to improve the averaging down - chart looks like price wants to break higher.

Cryptocurrency

Polymesh (POLYXBTC): Chart shows trade entry on reversal from the prior week sell off - moving averages are stacked the right way with 20 day (blue line) above the 50 day. Polymesh is a blockchain built specifically for security tokens. Node operators must be licensed financial entities

VeChain (VETBTC): Chart shows price forming a few inside bars after the reach down to the late 2023 lows on one of the days. There is a comfortable 50% profit below the previous cycle high - did like the level of support below entry and ignoring the stacking of the moving averages (20 below 50)

Income Trades

56 covered calls went to expiry with 8 going to assignment (in brackets) across 3 portfolios (Aus 1 UK 2 (2) Europe 12 (1) US 40 (4) Canada 1 (1))

Naked Puts

Took action early in the week to roll out naked puts at risk of exercise - was able to roll a few out and down.

- Elevance Health (ELV): US Healthcare. Loss 161.8% Cash positive 27.7% - rolled out

- Sunrun (RUN): Solar Power. Loss 47.4% Cash positive 47.6% - rolled out and down

- Marriott Vacations Worldwide (VAC): Hotels. Loss 293% Cash positive 2.2% - rolled out and down

- Société Générale SA (GLE.PA): French Bank. Profit 90.7% Cash positive 346% - maybe did not need to roll this one. - rolled out

- Coty (COTY): Consumer Products. Loss 267% Cash positive 9.1%. - rolled out only 2 weeks - Norwegian Cruise Line Holdings (NCLH): Cruising. Loss 58% Cash positive 154% - rolled out and down

- Technology Select Sector SPDR Fund (XLK): US Technology. Loss 93% Cash positive 454% - rolled out

- NuScale Power Corporation (SMR): Nuclear Power. Profit 13% Cash positive 6%. - rolled out now to June.

Wrote a few naked puts on stocks likely to go to assignement. Approach is to pick a lower strike if it can be done cash positively

- Cameco Corporation (CCJ): Uranium. Return 3.3% Coverage 6% - same strike

- Aurubis AG (NDA.DE): Specialty Chemicals. Return 1.43% Coverage 6% - same strike

Wrote a few naked puts on stocks comfortable owning at a lower price.

- Advanced Micro Devices (AMD): US Semiconductors. Return 3.3% Coverage 6%

- iShares MSCI India ETF (INDA) Return 0.9% Coverage 1.9%

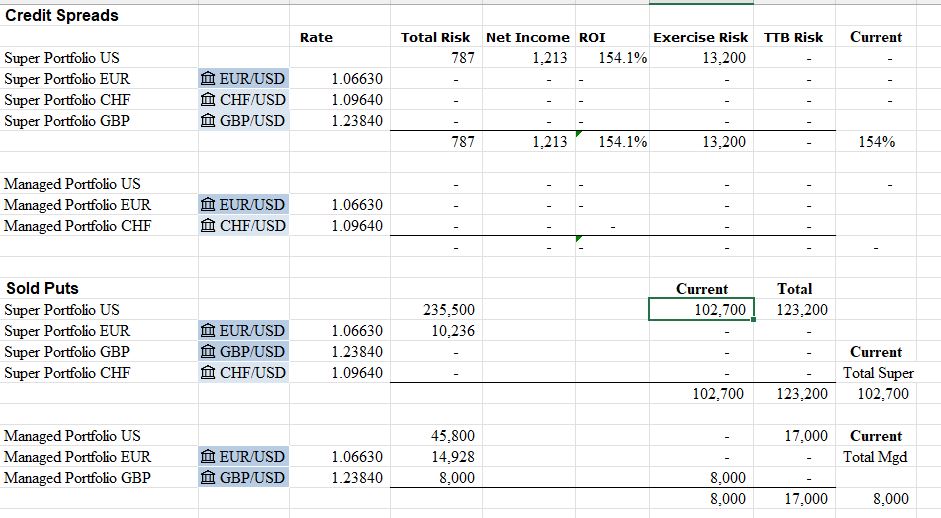

Credit Spreads

NVIDIA Corporation (NVDA): US Semiconductors. With price opening at $831.50 (Apr 19), sold the bought leg of the 800/750 credit spread. Was comfortable that downside protection would not be needed on the last day. Market had other ideas with price dropping 10% during the day which triggered margin violation from the broker buying back the sold put. This realized a capital loss of 77% of the capital at risk and negated the opportunity for a holding to trade back to profit. What really irks me is there was enough cash and long stock positions in the account to go to assignment. I would have sold something else - too bad that the collapse happened at 3.30 am my time. As it happens - in Monday trade price recovered $30 - which was almost as large a move as the loss.

All the other credit spreads (6 in total) expired successfully. The few on Bank of America (BAC) and Morgan Stanley (MS) were a little nervy when JP Morgan (JPM) results came out. Results were all good but guidance was a bit iffy.

Exercise risk has been pushged out but is above the cash margin avalable in the pension portfolio - will be looking to release some cash in the coming week and/or kicking a few of these further down the road. Other portfolios are safe.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

April 15-19, 2024

👏 Keep Up the good work on Hive ♦️ 👏

❤️ @bhattg suggested sagarkothari88 to upvote your post ❤️

🙏 Don't forget to Support Back 🙏

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

Thanks