Anarchist Investor Weekly

Your weekly review of the Anarchist Investor Newsletter

Don't Leave Your Job

The employment picture is about to get a lot uglier.

THE ANARCHIST INVESTOR

MAY 06, 2024

The Institute of Supply Management (ISM) Non-Manufacturing Purchasing Manager’s Index (PMI) was released on May 3, 2024 and it severely disappointed. In fact, the reading came in at 49.4 when the anticipated number was 52. Why is this so significant and what is in the index that should give you concern about your job and the future of the economy?

What is the Non-Manufacturing PMI?

QuoteThe Institute of Supply Management (ISM) Non-Manufacturing Purchasing Managers' Index (PMI) (also known as the ISM Services PMI) report on Business, a composite index is calculated as an indicator of the overall economic condition for the non-manufacturing sector. The NMI is a composite index based on the diffusion indexes for four of the indicators with equal weights: Business Activity (seasonally adjusted), New Orders (seasonally adjusted), Employment (seasonally adjusted) and Supplier Deliveries.

A reading above 50 percent indicates the non-manufacturing sector economy is generally expanding; below 50 percent indicates the non-manufacturing sector is generally contracting.

Investing.com

In short, this is an index that tracks service sector activity in the US economy as reported in a survey of hundreds of purchasing and supply executives in about 62 different industries.

Because the number came in below 50, it indicates contraction. Keep in mind that the services sector makes up the majority of the US economy in the present day. It’s compliment index (the manufacturing PMI) was reported earlier last week and was also in contraction.

If you notice, the index doesn’t spend much time below 50 over the past 24 years. In fact, the only times we have seen these types of readings have been in big slow downs and/or recessions following the Dot Com bubble bursting, the Great Financial Crisis, and during the COVID lockdowns. The strong and resilient economy politicians and investment media pundits have been boasting about for two years is about to shock a lot of folks back into reality.

Employment Component

The employment diffusion index which is a component of the index tracking hiring/firing was deeply in contraction at 45.9. This also coincides with a disappointing jobs number this past week. Even with seasonal adjustments, the supposedly strong employment market can no longer be masked by the manipulated measures.

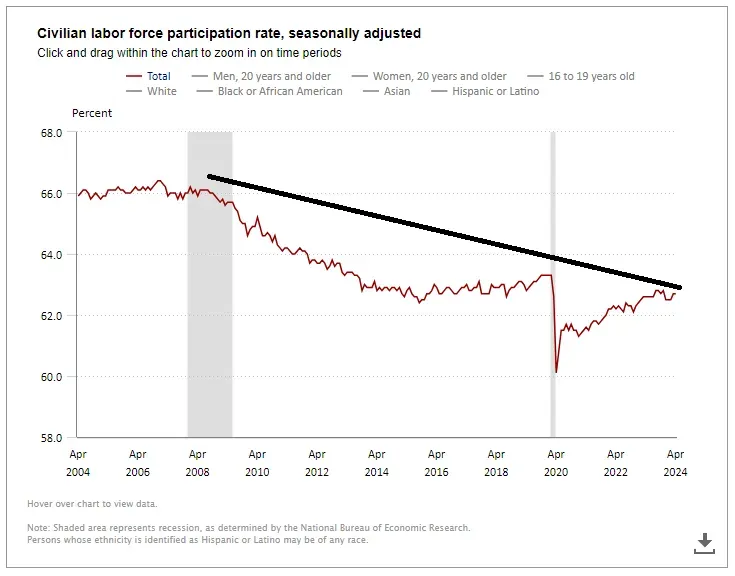

Something even more ominous to note is that labor force participation has been reduced over the past 20 years. This means the low unemployment rates have been masked by not counting individuals that have become disenfranchised by the labor market and no longer get tracked or counted as they aren’t actively engaged in looking for work.

Source: Bureau of Labor Statistics

What this ultimately adds up to is a labor environment that hasn’t been healthy for 20 years and is about to get much worse. It’s also possible that corporate profits have peaked which almost always coincides with deep cost cutting to preserve some amount of profitability. And by cost cutting, I mean head count.

Don’t Quit

In short, stay put if you’re earning a decent salary/wage. It’s possible you won’t lose your current position, but it’s certainly no guarantee you will be able to find another. Many folks retain their employment throughout recession but it can be very difficult to find a new spot if you quit a job during one. Even if your position is on the chopping block, don’t make it cheaper for your employer. Many times they will offer severance which will help you stuff your emergency cash fund if it’s available and provide some options for continuing benefits.

If you are going to leave, make sure you have another position lined up if it’s your intention to continue working. However, be wary. The coming employment environment will be rife with job offers that get rescinded.

Times like these are also why having a side hustle is imperative. It might be time to make it your main gig. It can tide you over during an extended job search or even become your forever income.

Slowly and then All at Once

Economic numbers can snow ball and turn into an avalanche. This means they can weaken slightly over time and then the bottom drops out. Employment and inflation are like that. There are periods of weakness in the face of adversity typically dubbed as ‘resiliency’ that are actually the cracks in the dam forming. That describes the past 12-24 months. If and when the dam finally fails, it will be swift. Don’t be caught by surprise and be prepared.

- Don’t take on new debt

- Get your old debt in line (reduce the bad debt)

- Have a side hustle

- Find ways to make yourself unfireable in your current position

- Have a plan if you lose your main hustle

- Have a safety fund (2-3 months of normal expenses that can be stretched with lower spending)

- Cut expenses now (even if you end up keeping your job, it will help you pay down debt and/or invest when prices are falling)

- Pay attention to your and your family’s health (the past couple years and the future have and will be trying on your physical, mental, and spiritual health)

Public Resources Will Become Popular Again

No I still don't think taxation to provide them is needed.

THE ANARCHIST INVESTOR

MAY 08, 2024

This is going to be a strange article coming from someone who doesn’t approve of government perpetrated theft in the form of taxation to provide public services that could be paid for out of pocket in the marketplace or generated via mutual aid relationships. However, in the coming economic environment, many will flock to and overwhelm (in some areas) these public resources.

The Library Trip

Yesterday my family took a trip to the county library and one thing stood out to me. It was dead quiet. Granted I have unschooled kids and this was 2 pm on a Tuesday, but still. The building is thousands of square feet filled with books, movies, music, computers, meeting rooms, and a whole mess of other resources. They’re just sitting there with the lights on and about 6 staff paid to be there and no one is taking advantage of them. My first thought was, ‘what a waste’. My next thought was, ‘what are people using other than a library to get this information, education, entertainment, etc’? The easiest answer is technology based solutions beamed to their smartphone or home computer/tv. However, many of those solutions have a cost. A cost in addition to the cost that folks already bare that created the library and other such resources where they live.

My final thought was, ‘I bet this place gets much more popular when the economy turns down’.

Public Resources During the Great Depression

The 1920’s and 30’s began a huge push towards the use of public resources during times of economic distress. This caused a huge ground swell of public spending, taxation, public debt, and socialism (yes, things like Social Security and Medicare are socialism).

Build outs of public education, libraries, homeless shelters, etc. boomed in the public sector following the Depression. An oft unmentioned by product being the crowding out of private services such as cultural and religious centers that offered many of the same services. Many folks coming from my perspective would point to the old adage of the government breaking your leg and then stealing your money to provide a crutch. However, that’s a topic for another day.

The average American was looking for help to feed their family, heat their home, educating their kids and even leisure activities like entertainment. The same will happen again.

The Coming Downturn

The live cast yesterday mentioned an article focused on foreign investment in the US. My take on it is this, foreign investors are flocking to the US because of the perception that we can borrow and spend infinitely. As the world slows down or falls into recession, the US is able to keep up a certain level of growth through deficit spending regardless of how inefficient it is or the long-term, negative economic affects. A lot of assumptions about the institutions the average person in the world put their faith into have been destroyed in recent years. This one will too.

The catch is that the money supply in the US is contracting due to Federal Reserve actions and the velocity of money has been slowing for a couple decades (since the late 90’s). This means that despite the desire for unlimited debt issuance, the monetary base in the US and worldwide won’t have an unlimited appetite for US debt. A dollar shortage of all things will result because there will be plenty of them in the system but they will be locked up in places that can’t be accessed by the US Treasury. The inevitable conclusion will be a stronger dollar, a floor on how low interest rates can go due to Federal Reserve intervention, and a prolonged period of economic underperformance. Depending on how quickly or violently this comes about, a possible flash recession or depression could be at the beginning stages of this process.

Under these circumstances, the public will once again return to public services that they have been funding all along. However, due to the inefficiencies of government, the operating costs of those services have increased over time and any “investment” into them has been squandered by the daily operational expenses. This means during times of low usage the facilities were still costing as much as they would have been if they were utilized near capacity. This will cause them to be overrun if the economic downturn is severe enough. This also means there will be no money to build them out further and increase their capacity.

Utilize Them While You Can

The realistic anarchist/agorist understands that tax money has already been spent and will continue to be. If any of your money is taxed, you had better get something out of it. Public resources such as a library, parks, transit, etc. should be utilized now to reduce your household overhead and help you pay down debt and save money to keep as cash or put into gold and silver. A note on cash, some US dollars aren’t a bad thing in the short term. Swiss francs are also an option and can usually be obtained/ordered from your local bank with advanced notice (note there might be a minimum amount you need to exchange and a fee).

You can buy US Treasuries too via the TLT etf but that kind of further incentivizes this insane economic model so don’t feel compelled to if you’re philosophically opposed to it. Need yield? Look to a provider like Monetary Metals. There you can purchase metals that are then leased to industrial users for an interest yield paid in the metals themselves.

The library can be utilized to remove your Netflix/Hulu/Disney+ subscription and also reduce your eBook or physical book buying costs to $0 (or at least no more than is being stolen from you on an annual basis via your property taxes).

Taxes Will Rise

To maintain these services, taxes will be maintained or rise. There will be no tax relief immediately in this economy. Large budget cuts may also be needed at the local, county, and state levels. Federally they may attempt to fill in the gaps but DC too will eventually succumb to the powers of economics. Make certain you’re speaking with a tax professional to reduce your tax liabilities as much as possible. And do this before you incur them!!! You can also look into tax avoidance strategies to help you change how you procure certain items and thus reduce your tax bill. Good examples of these include barter with friends and family, real estate investment or restructuring, and what or how you’re investing and drawing your income.

The Good News

The resources are there for now and can be leveraged in your favor. You just have to be willing to make some changes. A simpler life quite often can be rewarding too. A walk in a park and a library book or a free class for the public are always a good option for an afternoon or evening’s entertainment.

Don’t Miss Your Chance At a Paid Subscription!!!

I’m giving away a yearly paid subscription valued at $99 to 4 free subscribers on June 3, 2024

💌 Get The Anarchist Investor automatically delivered to your inbox and get notified whenever a new post drops for free!

Subscribe: https://anarchistinvestor.substack.com

OR BETTER YET…Become a paid subscriber today and:

📚 Access to the full Anarchist Investor Archive Including Paid Only Posts

💰 My weekly portfolio update newsletter detailing allocations and performance

🎁 Incredible paid subscriber-only giveaways and promotions

Earn Crypto While Driving

With Soarchain Mini

THE ANARCHIST INVESTOR

MAY 09, 2024

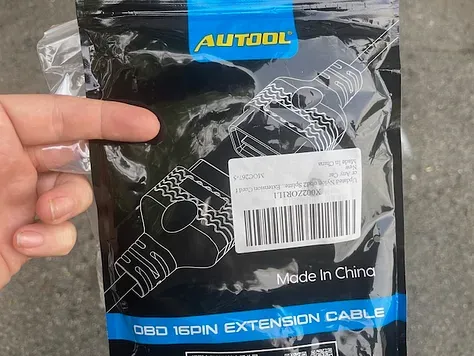

This will be the first of three (3) miners I will be utilizing to turn my personal automotive data into crypto. The SOARchain Mini (formerly MOTUS mini) is a small miner that captures and aggregates driving data on the SOARchain blockchain. That data is then used to decentralize current services as well as develop entirely new ones. For participating in the data aggregation (collection), users get rewarded with SOAR tokens. Here is a short overview of the project as well as my experience so far with installing and using the Soarchain Mini.

What is SOARchain?

This is an excerpt from an interview with Soar Robotics CEO Deniz Kalaslioglu.

Soarchain is a Cosmos SDK-based blockchain that focuses on bringing off-chain data on-chain, particularly in the automotive industry. They have developed a hardware device called Modus, which can securely store and authenticate data using trusted platform modules to ensure data integrity. The Motus device can read various types of data from a vehicle's CAN bus and is compatible with over 95% of the vehicles manufactured after 2000. Soarchain has partnered with multiple automotive companies, including Suzuki and Maruti, to develop applications like road condition monitoring and vehicle-to-vehicle communication. Additionally, they have developed an incentive system using crypto-economic protocols to encourage worldwide participation in achieving common objectives. The core focus of Soarchain is data aggregation and democratizing access to it, with the goal of creating a sustainable economy where the token has value and provides access to applications addressing real problems.

In a recent AMA, Deniz Kalaslıoğlu explained that SOARchain's data is end-to-end encrypted to protect users' sensitive information, and that the Motus device can collect all kinds of data, including those crucial for detecting fraudulent emissions measurements. Soarchain is designed so that new hardware manufacturers can join regardless of the specific hardware used. By using Cosmos SDK, they were able to develop custom modules and reuse modules developed by other chains as public goods. Governance is physically distributed, and token allocation is primarily distributed to vehicle users, with the remaining allocation for early stakeholders and overall network rewards based on individual participation. The team is currently in the incentivized testnet phase and plans to release the mainnet possibly before the third quarter ends.

In short, Soar robotics established SOARchain and the associated devices to make vehicle data publicly available so that applications and offerings could be designed using that data that was typically warehoused at vehicle manufacturing companies or government entities. Ultimately, the project will be one of several that helps develop decentralized vehicle insurance, GPS/directional technology, road monitoring, crash avoidance, fuel efficiency calculations, etc. It is also yet another mechanism for users (drivers) to monetize their own data that used to be hoarded by a few corporations or entities and used exclusively for the profit of others.

Installation

The installation was fairly simple. Mine is slightly more complicated because I have a splitter cable so I can add a DIMO miner in the near future (whenever it ships). The physical connection is pretty much plug and play. There is a little bit of an issue with where it sits on the floor board so I’m going to have to figure out how to tape or wire tie the miners and cable out of the way of my left foot while driving.

The unit does require a tethered connection to your cell phone to collect and send data to the blockchain. There are two applications that are required. The SoarchainConnect app as well as the MotusSecureProvisioning app. The first is your main hub for registering and monitoring your device as well as the SOARchain wallet you will need to create to be rewarded your tokens, stake them, and transfer them as needed. The second is strictly for locating/connecting the device. You will need to keep the box the miner comes in or at least the QR code in the box because that is literally the only way to reconnect if it happens to get reset. I luckily read the instructions and kept the box because I stepped on the reset button for a short period during one of my first trips and completely reset the unit.

The tether connection is slightly fussy but you can get it by having your hotspot, WIFI, and Bluetooth enabled. On my iPhone I needed to open the settings menu to the hotspot for it to disconnect from my home WIFI and then make the match with the miner.

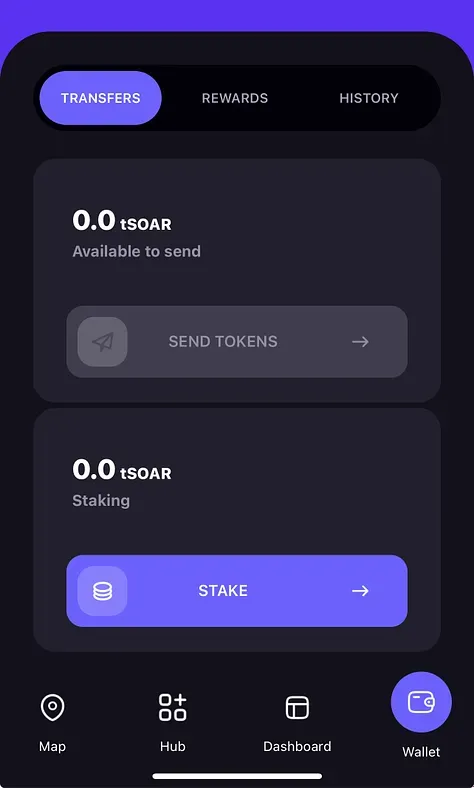

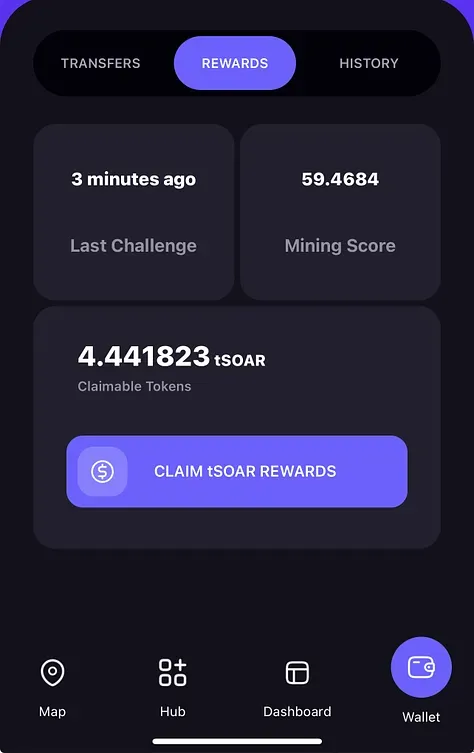

Earning Tokens

Because the project is still in the testnet (beta) phase, the tokens don’t have any assigned value and aren’t listed on any exchanges. However, you are rewarded tSOAR which is the testnet version of the SOAR token. Once the mainnet is launched, the tSOAR will get converted to SOAR and be worth whatever the current value is for the token once it begins trading in the open market.

The daily earnings for me are roughly 5-6 tSOAR but I am just running errands with it now. I will actually be dabbling in some delivery gig type work to stretch out the mileage and see how that affects the rewards. I have also begun staking my tSOAR with some of the validators and there is a small yield for that (kind of like a savings account). I will report back on that too once the project goes live and there is a more mature staking picture.

Overall Experience

It has been pretty easy to get up and running with this project and the earnings started immediately. The entry price also wasn’t that bad. It took about $75 for the miner and another $10 or so for the cable. If you want to get involved in this project, you can use my affiliate code here to get 10% off the device as well as some of the other project devices on the Soarchain shop (if eligible).

https://shop.soarchain.com/discount/MATTHEWSTRUCK?ref=eywjaygt

If you would like to read up more on the project, you can find the main Soarchain page here:

Bitcoin is Digital Art

And that's all that it is.

THE ANARCHIST INVESTOR

MAY 10, 2024

I’ve been battling with this concept of ‘What is Bitcoin’ for some time. It’s creation was intended to be frictionless money that anyone could use to directly transact with anyone else. It was intended to have high liquidity, low fees, fast transaction times, and afford users the ability to have self-custody of their funds without any middleman involved (specifically the government). It was also intended to include anonymity. All of these originally intents for Bitcoin have now become inefficient or non-existent with its’ rise in price. So what is Bitcoin now?

The Attributes Now of Bitcoin

Here are the attributes of Bitcoin that have emerged or remain from the original. It is still a crypto currency based on a primary layer blockchain. It has a high valuation with a market capitalization of over $1 Trillion. It is used as collateral to borrow against and its’ liquidity is relatively low considering most of the float doesn’t trade on a daily basis and HODLers openly advocate for hoarding the currency, not letting it circulate. It retains its’ scarcity as halvings continue and its’ total circulating supply is nearly all minted at 21,000,000 total coins. Its’ block sizes (the amount of data stared in each) have remained the same and relatively small to hard forked Bitcoin alternatives such as Bitcoin Cash, BSV, etc. Transaction times are high with some taking hours or even days. Along with the transaction wait times come higher fees.

Transacting in Bitcoin has also become very centralized and not very anonymous. Government entities and the economies of Bitcoin have consolidated mining operations, strong armed exchanges into KYC (Know Your Customer) practices, and AI can now trace Bitcoin origins back to users’ wallets and match that wallet with an identification.

There is a prestige to holding Bitcoin in much of the community. Just getting to 1 full Bitcoin is a big push. Michael Saylor is on record saying you’ll need at least 0.1 Bitcoin to survive the fall of the fiat system. Whether that fiat system falls tomorrow or in a couple hundred years remains to be determined. There is the ability to also track the origins of the Bitcoin in circulation from the standpoint of when they were minted. So for instance, Satoshi-era Bitcoins can be identified when they come on the grid.

Bitcoin is Fractional Shares in Art

When it’s all said and done, Bitcoin seems more to me like a fractional ownership in a Monet or the whole portfolio of Monet than anything else. The original technology hasn’t been improved upon and the application development off the top of the blockchain has been sparse and very expensive. At the current valuation and efficiency, I’m not sure it’s feasible for Bitcoin to be used as actual money.

However, there may be a long-standing historical significance to owning Bitcoin. It was the first of note. It is the most memorable of crypto currencies to date and probably will remain so into the future. If you own a Bitcoin, you own a piece of history. As such, I don’t expect these coins to be widely transacted unless something major changes (like a price crash or a major technology overhaul).

Bitcoin won’t destroy the fiat system. The powers that be have seen to that. Plus, it’s the destiny of the fiat system to destroy itself (history and economics are undefeated in this regard). Bitcoin also isn’t a lifeboat in the event of a fiat collapse. That’s not how its’ valuation has reacted to market movements. It moves in lockstep with the technology stock market. When conditions are favorable for speculation, it goes up. When the conditions reverse, so too does the trajectory of Bitcoin. However, unlike a technology stock, there is not future iteration of Bitcoin. It will be what it is now. The 21,000,000 pieces of Bitcoin will be what they are into the distant future and no more will be minted. That’s kind of like how no more Monet’s were produced following his death. They are a scarce resource that will be a collector’s item. The HODLers have it kind of right in that this asset will be worth something into the future and trading it away or using it to buy pizza isn’t wise.

In a way, Bitcoin is kind of like the very first NFT. 21,000,000 ownership units in the collective works of Satoshi.

Affiliate Links

Get $10 in free Bitcoin and start stacking today with Swan Bitcoin: https://www.swanbitcoin.com/anarchistinvestor

Get $50 in credit toward Fractional Real Estate investment with Lofty: https://lofty.ai/refer?grsf=afyjpd

Automate your Gold & Silver Purchases with Vaulted:

https://vaulted.blbvux.net/g1EGKX

Save/Make Money on your Cell Phone Plan with Helium MOBILE:

https://my.hellohelium.com/ref/2FN2CHL

Anarchist Investor Links

Anarchist Investor on Substack: https://anarchistinvestor.substack.com

Anarchist Investor on Spotify: ~~~ embed:embed-podcast/show/5bPTSl9UcLuDOlki25iBjU?go=1&sp_cid=195eae3f83bf1083418e06af7cb8af8f&utm_source=embed_player_p&utm_medium=desktop spotify ~~~

Anarchist Investor on Rumble: https://rumble.com/c/c-6154833

Anarchist Investor on YouTube: https://www.youtube.com/channel/UChC2sQ_wL6esPg8e3_NsPDA

Matt_Archy on X: https://twitter.com/Matt_Archy

Matt’s Personal FB: https://www.facebook.com/matthew.struck.37

Matt’s Personal LinkedIn: https://www.linkedin.com/in/matthewstruck/

Matt-Archy on HIVE: https://peakd.com/@matt-archy

Matt-Archy on Vimm.tv: https://www.vimm.tv/c/matt-archy

Keep in mind that investment and investment results are very much based on you as an individual. I am not an investment advisor. I’m a dude with an opinion. Do not rely solely on the discussion here to inform your investment decisions. Always make the investment decisions that are right for you and your situation