So if you pay attention to any financial news you've heard that the Fed raised interest rates again.

Most people don't actually know what this means other than higher rates = bad. To be fair, that's not wrong exactly.

As of the last meeting, the fed funds rate is the range of 4.25 - 4.50%. Most people use the lower bound and just call it 4.25%.

The Federal Reserve's decision to change the interest rate it pays on reserves held by banks (known as the interest rate on excess reserves, or IOER) can have significant effects on the wider economy. The IOER is one of the primary tools the Federal Reserve uses to influence the overall level of interest rates in the economy and control the money supply.

When the Federal Reserve increases the IOER, it becomes more attractive for banks to hold their excess reserves at the Fed rather than lend them out to borrowers. This can reduce the supply of loanable funds in the economy, leading to higher interest rates and slowing down borrowing and spending. Conversely, when the Federal Reserve lowers the IOER, banks are more likely to lend out their excess reserves, increasing the supply of loanable funds and lowering interest rates, which can stimulate borrowing and spending.

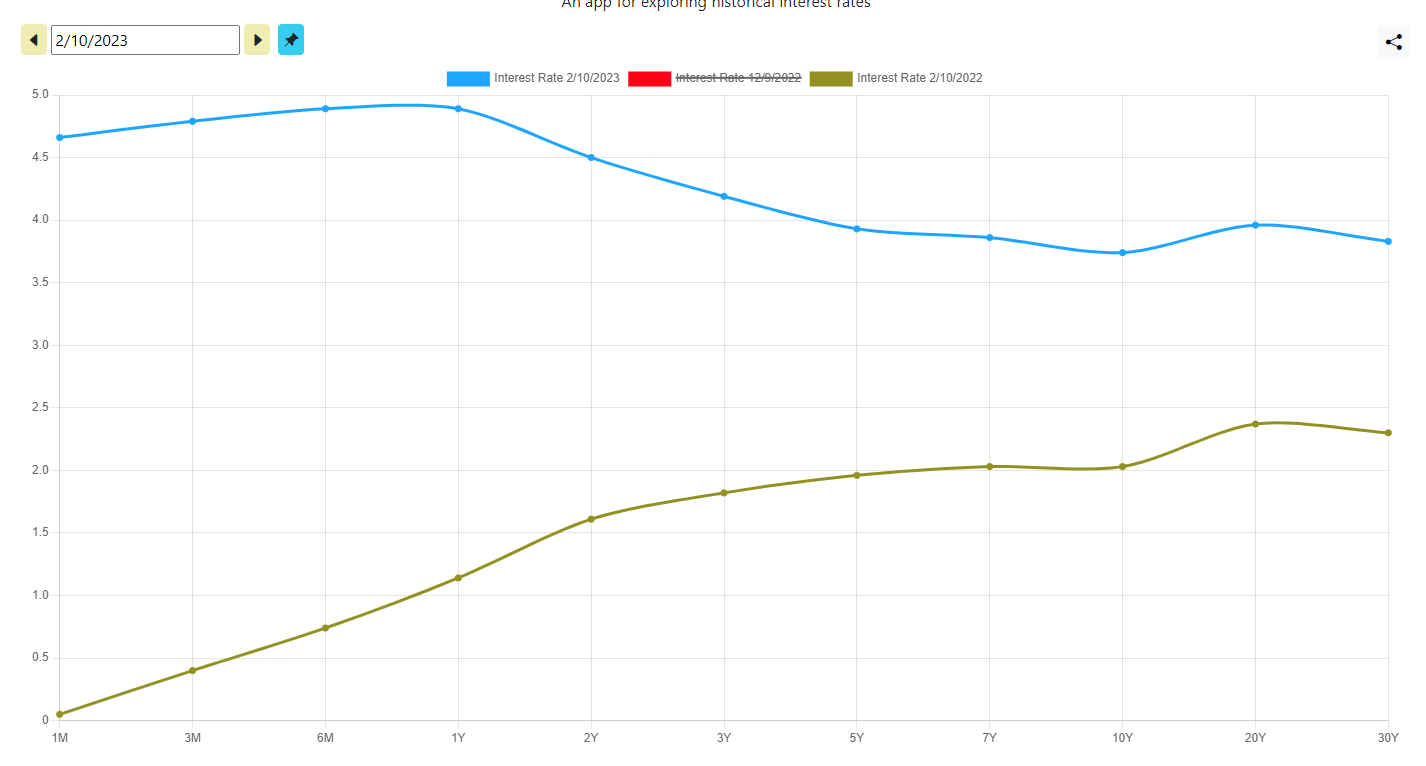

Changes in the IOER can also affect the yield curve, which shows interest rates for bonds of different maturities. A steeper yield curve can signal that economic growth is expected to pick up in the future, while a flatter yield curve can indicate a more cautious outlook for economic growth. And an inverted curve can indicate that market participants are expecting recession in the short term.

Notice we have gone from a normal sloping yield curve a year ago (red line) to an inverted curve today (blue line).

In addition to affecting borrowing and spending, changes in the IOER can also have a direct impact on the financial markets. For example, a change in the IOER can influence the prices of bonds and other fixed-income securities, as well as the value of the currency.

Bottom line, the Federal Reserve is setting the opportunity cost to the banking system. If a bank can make a guaranteed 4.25% then the only way it would make a loan is to charge a higher rate after factoring in defaults and administration costs. This is why 30-year fixed mortgage rates are 6.55% today. The higher the opportunity cost (fed funds rate) the lower the incentive for banks to finance economic activity. The less economic that gets financed, the worse off the economy is.

On the retail side, the yield curve sets the baseline opportunity cost. If I can get 4.75% on a 6-month treasury note, any speculation I want to do needs to be compared against that. In crypto terms, my opportunity cost is based on 20% HBD.

Posted Using LeoFinance Beta

It's not surprising to me at all that they're cutting the money supply lines today. It's all so tiresome. Insofar as crypto prevents funds from being completely at the whim of the legacy financial system now, we can also expect them to undertake to eradicate that market for money, so that their CBDCs are the only game in town when they try to force them on us.

I predict the lack of decentralized and KYC free exchanges to be one of the most limiting factors in the utility of crypto soon. Anyone that expects centralized and PII affected exchanges to be available without limitations is going to terribly impacted when they're not.

Thanks!

The key will be operating completely in crypto when the fiat ramps are restricted.

Posted Using LeoFinance Beta

I really wish Rune had swaps with Hive.

That is because people only look at the supply of money and ignore demand.

Rising interest rates in an expanding economy is a good thing. That means demand is there and investment is active. People seem to think only in terms of a morgage or something like that. They completely overlook the investing side.

A CFO is not going to sign a 1% loan on a factory if the ROI is flat to negative. If there is going to be a 35% return, the same CFP will sing a 10% mortage.

Friedman talked about the interest rate fallacy. The reason the Fed has to monkey with the interest rates is there is not enough money in the economy.

This is not a surprise considering the impact of technology on the overall economy. The amount of money required to sustain growth is enormous and bank lending is basically flat since the GFC.

Posted Using LeoFinance Beta

Well we are a long ways from rising rates in an expanding economy environment.

Ideally we would have a free market in money and real world market participants would come together to create an interest rate that reflects actual supply of money and actual demand for money.

But that's just not how the broad monetary system works.

It is how defi lending protocols work though. We can see when utilization rates for BNB or whatever get high interest rates skyrocket.

Posted Using LeoFinance Beta