Trading and Investing

Trying to go Trading

It nearly end of 2022. At the time, Indonesian stock markets looks so promising by IDX composite (Indonesia Composite Index) coming up for breaking it's ATH. Even with the global recession issue, Indonesia Market Stock stay strong. Some people tell us to aware of that issue, while some of them thinking Indonesia economics condition is stable enough to resist the global recession. For someone who is newbie at finance and excited to get profit, you know which one would you listen right ? Yeah, young dumb me. I decide to take a brave step by lend some money to the bank and try to trading with it, by calculating i could get more money than the bank interest, after watch some video about how the technical analysis work so well on the market. What I didn't realize is that it is very dangerous when you don't doing it right.

How My Trading Goes and Why I'm Stop Trading and Doing Investing in the Middle of It

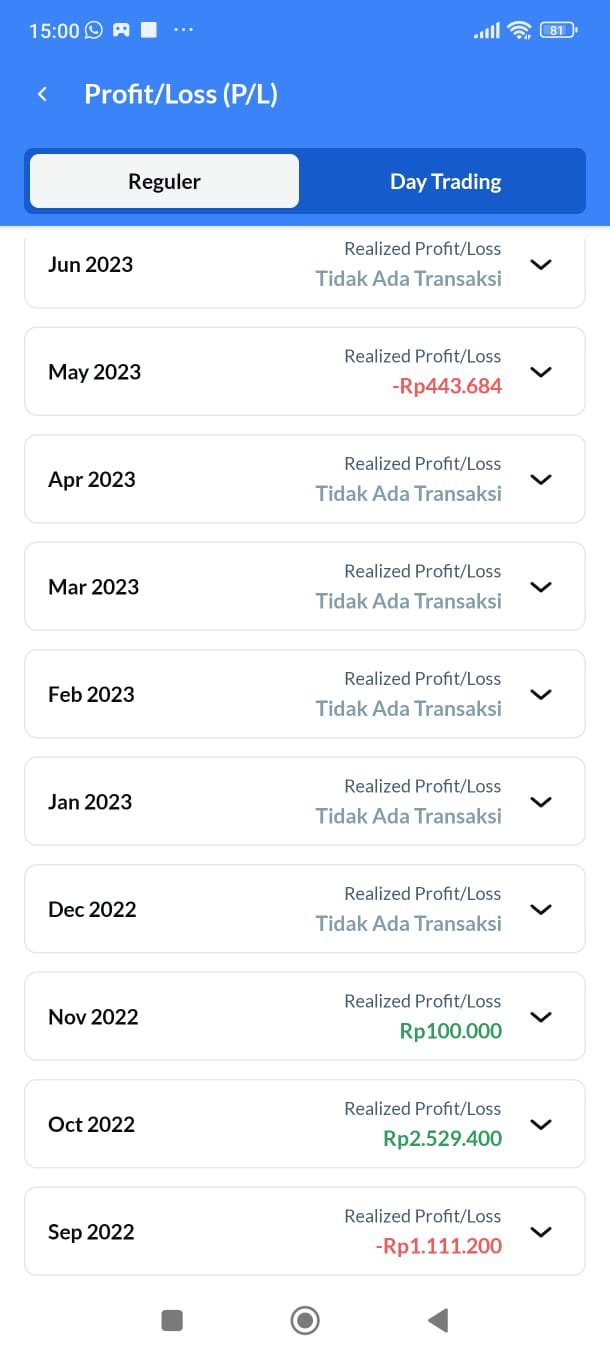

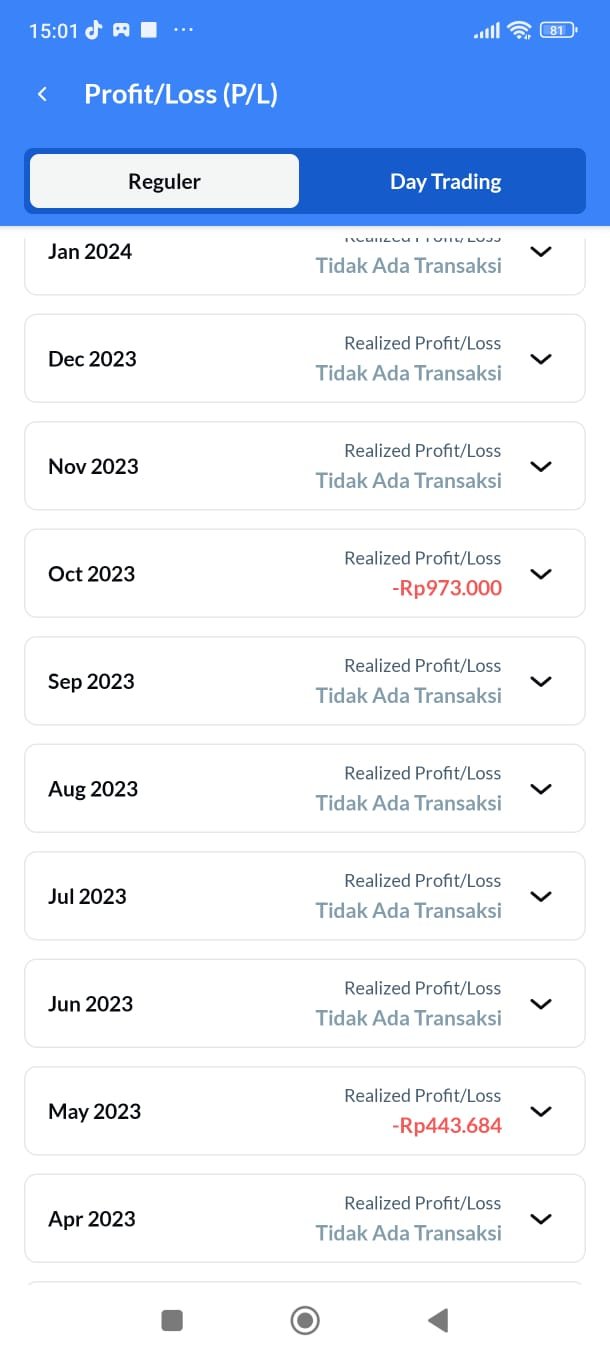

Few first trade was good enough, even after some cut loss, I could gain some profit from it.

I got around Rp 1,5000,000 which is around $100 and it's good enough for the first 2 month. But things were getting turn around, indonesia stock index are dropped, following the world stock market, and I'm not anticipating it. My first mistake is I'm too greedy and being too agresive, while my focus is not full on making the analysis (at the time, I'm excited to investing on hive as well, and spend some of lend money to powering up my hive power at the price around 0.57$). I should know i have to do cut loss at the time, but my mental is not strong enough, and my wife that know about cut loss clearly go against it, said that the price will recover, just like how it usually does. And I just realize it was a big big mistakes. Especially because I realize i don't want to invest on that stock fundamentally, just technically, but I think I forgot about that because I don't want to realize loss for some amount that based on percentage is not so high (around 5-6%), but since It was a borrowed money, with the floating loss value is big enough for us personally, i decide to refuse my logic and go with the feeling. I'm thinking about maybe the price will go up again, even if I have to wait 1 or 2 years.

How It Goes

I'm very happy to see that the Indonesia Composite Index is breaking it's ATH, and wishing my wait could be over, but what comes to me when I see my portofolio is so disappointing.

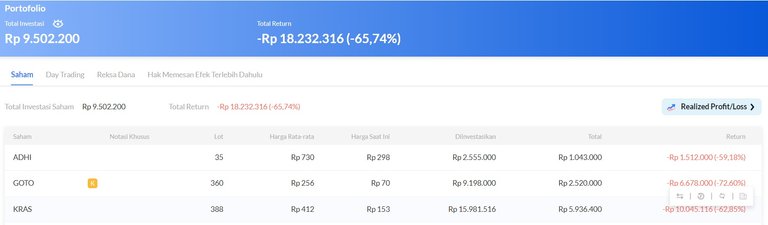

It hurts to know that my money is on floating loss around 65% right now, even after the Indonesia Composite Index is breaking it's ATH right now, my portofolio still crawling around it's ATL (it's reach around 69% floating loss few days ago). And what makes it even sad is that since it is a borrowed money, I need to pay for it along with it's interest, that is pretty high for a long time (15 years). I even had to realize some loss in the middle of it from the stock with lowest loss because I need that money for living.

Conclusion

We should very carefully before deciding to borrow money for investing, because it's not always nice just like what those youtuber tell you. And after you know how to act, and make decision, makes sure you remember the plan and not changing direction in the middle of it for something that you don't analyze well. Those feeling of wanting more, and don't want to lose any, could trapped you on situation where you can't makes decision right, and ended up stuck just like my situation. One positive things is just now I learned about my mistake, but I hope you guys don't need to get the same experience just like me

Final Words

Note : This is Not a Financial Advice and I'm Not an Advisor

Put 3% of benefficiary to @indonesianhiver as my support to fellow Indonesian writer on hive

Meet me on another hive game-verse :

WOO : Visit WOO Website Here

Terracore : Just click this link

Risingstar : Start the journey to become a star here

I also had many active giveaway with each edition of Splinterlands Cards as rewards ! Reach it on my blog !

Mrs. carrieallen for the very useful ULTIMATE Markdown Tutorial

@arcange for keep supporting my post

@oadissin for reblogging my post

Canva and for the free photoshop

All curators and readers that i couldn't mentioned all of your name

~ Thank You ~

Posted Using InLeo Alpha