KEY FACT: Australia is set to approve Bitcoin exchange-traded fund launches, following in the footsteps of the US and Hong Kong. Issuers like Van Eck Associates Corp. and BetaShares Holdings Pty are ready for listings.

Created on Corel Paint

Australia’ set to Approve Spot Bitcoin ETF

Australia has voiced its readiness to join the League of Nations approving the spot Bitcoin ($BTC) exchange-traded funds (ETFs) barely 24 hours to Hong Kong's ETFs launch. There are indications that Australia’s largest stock exchange — the Australian Securities Exchange (ASX) will greenlight several spot Bitcoin exchange-traded funds (ETFs) by the end of 2024. This was communicated through anonymous sources familiar to Bloomberg. ASX Ltd. handles around four-fifths of the country’s equity trading.

With this development, crypto enthusiasts in Australia could soon have a new way to gain exposure to Bitcoin, as the country is poised for a surge of spot Bitcoin ETFs. VanEck Australia and local ETF-focused fund manager BetaShares following the footsteps of fund issuers in the United States and Hong Kong, have sent in their proposals for spot Bitcoin ETF which are set to be approved before the year is through. Meanwhile, DigitalX Ltd. is said to have applied in February.

This is not the first time Australia has attempted to approve Bitcoin ETFs. Monochrome first applied for a spot Bitcoin ETF with the ASX on July 14, 2023, but later switched to Cboe Australia — a much smaller exchange — following a slow approval process at the ASX.

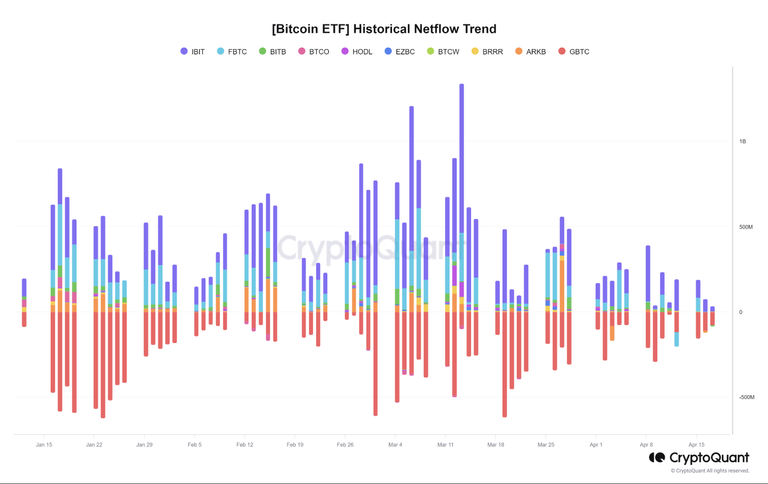

Bitcoin ETF historical netflow. Source: CryptoQuant

Applications for BTC ETFs in Australia are a response to the surge in spot Bitcoin ETF assets under management to about $53b as of April 24 in the US. Justin Arzadon, the head of digital at BetaShares commented that the considerable inflows into U.S.-based ETFs have provided the confidence to launch the products in Australia and “prove digital assets are here to stay,”.

In another remark, Jeff Yew, the CEO of crypto asset management firm Monochrome described Australia as a “very crypto-heavy country” and expects Australian spot Bitcoin ETFs to generate between $3 billion to $4 billion in net inflows within the first three years.

An analysis of the Australian economy shows that fund managers would be the prime drivers for the demand for Bitcoin ETFs.While self-managed super fund (SMSF) investors, also hold direct exposure to Bitcoin on crypto exchanges, there are trust issues as to the possibility of the centralized exchanges collapsing.

Adoption is heavily shaping up in the crypto space, especially with the successful launch of BTC ETF in the US. Many other countries would follow Australia on seeing the success recorded by the U.S. and Hong Kong ETFs which would live tomorrow.

If you found the article interesting or helpful, please hit the upvote button, and share for visibility to other hive friends to see. More importantly, drop a comment below. Thank you!

This post was created via INLEO, What is INLEO?

INLEO's mission is to build a sustainable creator economy that is centered around digital ownership, tokenization, and communities. It's Built on Hive, with linkages to BSC, ETH, and Polygon blockchains. The flagship application: Inleo.io allows users and creators to engage & share micro and long-form content on the Hive blockchain while earning cryptocurrency rewards.

Let's Connect

Hive: inleo.io/profile/uyobong/blog

Twitter: https://twitter.com/Uyobong3

Discord: uyobong#5966

Posted Using InLeo Alpha